Market Condition Evaluation based on standard indicators in Metatrader 5 - page 134

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.11.27 11:52

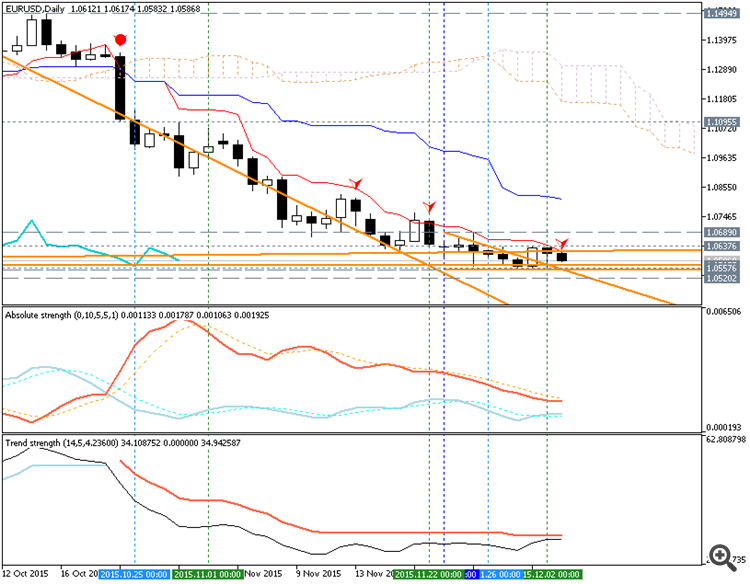

Outlooks For EUR/USD (adapted from the article)Skandinaviska Enskilda Banken (SEB) made a forecast related to EUR/USD with the stated that the pairs will be in more ups and downs: the price will break 1.05 and 1.04 support level before go up to 1.0830. It means the following: the price will be in ranging market condition with the following steps:

As we see from the chart above - the price is on bearish market condition for the breaking 1.0616 support level from above to below for the bearish trend to be contining with 1.0461 level as the next bearish target. Thus, SEB nmade a forecast that the price may touch this 1.0461 level from above and bounce from it to 1.0818 resistance area on the 'downs and ups' way.

The Strategy: watch the price to go to be near 1.0461 level to open buy trade.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.11.29 09:14

EUR weakness: rate cuts and more easing (adapted from the article)

Morgan Stanley estimated for EUR to be in more bearish condition because of some expectation related to some main high impatected news events which will be happened in this week:

For example, the EUR/USD price will be in 'more bearish' market condition with the around 1.04 level as the real target for this week.

Morgan Stanley is expected for above mentioned news events to be a key driver for the currency with further rate cuts from the ECB and increase in QE. Anyway, it will make EUR to be a more attractive for traders for this week for example.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.12.03 08:38

Trading News Events: European Central Bank (ECB) Interest Rate Decision (based on the article)

The European Central Bank (ECB) interest rate decision may fuel a further decline in EUR/USD amid speculation for additional monetary support but, heavy expectations for a meaningful announcement may ultimately trigger a short-squeeze in the exchange rate should the central bank disappoint.

What’s Expected:

Beyond bets for a meaningful adjust to the ECB’s quantitative easing (QE) program, market participants are looking for a further reduction in the central bank’s deposit-rate as the Governing Council struggles to achieve its one and only mandate for price stability. Efforts to further insulate the monetary union may push EUR/USD to give back the advance from the March low (1.0461) amid the deviating paths for monetary policy.

How To Trade This Event Risk

Bearish EUR Trade: ECB Expands/Extends QE & Cuts Deposit-Rate

- Need red, five-minute candle following the policy announcement to consider a short EUR/USD trade.

- If market reaction favors a bearish Euro trade, sell EUR/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from cost; need at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is met, set reasonable limit.

Bullish EUR Trade: Central Bank President Draghi Attempts to Buy More Time- Need green, five-minute candle to favor a long EUR/USD trade.

- Implement same strategy as the bearish euro trade, just in the opposite direction.

Potential Price Targets For The ReleaseEURUSD Daily

Even though the European Central Bank (ECB) stuck to its current policy in October, the Governing Council showed a greater willingness to further embark on its easing cycle as the central bank opened the door for a further reduction in deposit-rate. As the ECB pledges to re-examine its non-standard measures, the central bank may continue to push monetary policy into uncharted territory in an efforts to further insulate the monetary union . The Euro sold off as the ECB removed the floor on interest rates, with EUR/USD breaking below the 1.1200 handle following the interest rate decision to close the day at 1.1107.Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.12.03 14:34

2014-12-03 12:45 GMT | [EUR - Minimum Bid Rate][EUR - Minimum Bid Rate]= Interest rate on the main refinancing operations that provide the bulk of liquidity to the banking system.

Short term interest rates are the paramount factor in currency valuation - traders look at most other indicators merely to predict how rates will change in the future.

==========

==========

EURUSD M5: 150 pips price movement by EUR - Minimum Bid Rate

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.12.04 12:14

Intra-Day Fundamentals - Non-Farm Payrolls: scenarios and trading ideas (adapted from the article)

As we are going to have USD - Non-Farm Employment Change news event today so The Royal Bank of Scotland made fundamental forecast related to this news event with the connection with the most attractive pairs to trade in any situation concerning the actual data for NFP for example. And just to remind: if actual data for NFP > forecast (200K for now) so it will be good for currency (US dollar will become more stronger).

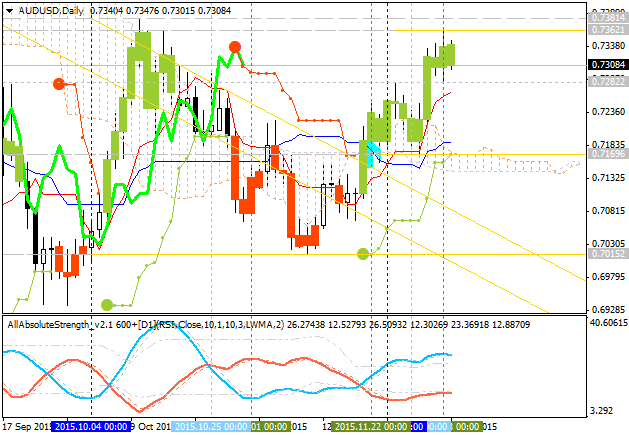

The are 3 main scenarios for NFP:

1. Actual data is 225k and above (with 200K forecasting ones): The most attractive pair to trade in this case is AUD/USD: the strong case with Australian dollar will be finsihed and we can consider for this pair to be in more bearish market condition.

Sell AUD/USD.

2. Actual data is 150-225k. This data is something to be around 200K forecasting so we should consider the ranging market condition for most of the pairs. The only pair may be attractive to trade is GBP/USD which will be stapped with secondary ranging in intra-day for good breakdown possibilities.

Sell GBP/USD.

3. 150k and below. As we know - the long-term projections for EUR/USd is the bearish market condition. But this is the opposite short- term situation when actual data for NFP is less than forecasting 200K: EUR/USd price will be going to be more bullish in intraday basis.

Short-term: Buy EUR/USD.

Long-term: Sell EUR/USD.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.12.04 15:10

2014-12-04 13:30 GMT | [USD - Non-Farm Employment Change][USD - Non-Farm Employment Change]= Change in the number of employed people during the previous month, excluding the farming industry.

Job creation is an important leading indicator of consumer spending, which accounts for a majority of overall economic activity.

==========

==========

EURUSD M5: 60 pips range price movement by Non-Farm Employment Change news event:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.12.08 11:42

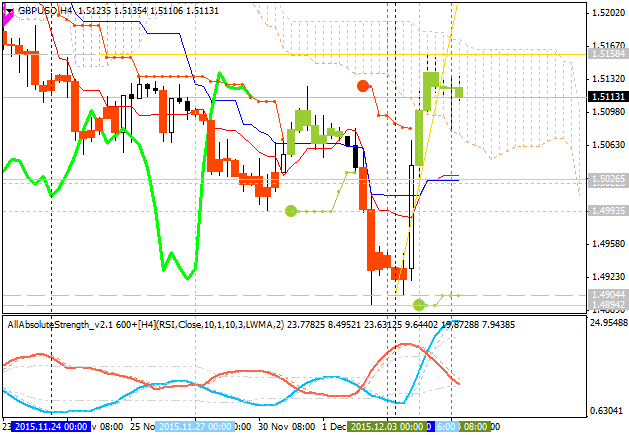

We like short GBP/USD more than short EUR/USD in Q1'16 - Societe Generale (adapted from the article)

Societe Generale made a forecast for EUR/USD compare with GBP/USD telling that both the pairs will be on bearish condition for Q1'16. And GBP/USD will be in more bearish related to EUR/USD. Let's review this forecast with technical point of view.

As we see from the charts above - both pairs are located below 100 period SMA and 200 period SMA in the primary bearish area of the chart ranging within key support/resistance levels:

The price for GBP/USD is having more signs to be bearish in Q1/16 than EUR/USD, and that is why Societe Generale is expecting more bearish for GBP/USD compare with EUR/USD for example.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.12.09 07:37

EURUSD long-term forecasts updated: more ranging than bearish - Goldman Sachs (based on article)

Goldman Sachs updated their long-term forecast for EUR/USD with more bullish than in previous one: the price will be droped to 1.07 for 3 months instead of 1.02 as the previously forecasted, half a year forecast is 1.05 instead of 1.000, and one year fiorecast is 1.0000 instead of 0.9500 previous one.

According to Goldman Sachs - the price will reach second pivot support level at 1.0672 for 3 months only, and the price will be in the bearish market condition for the ranging within S2 Pivot at 1.0672 and 1.0520 support level. And the bearish trend will be re-started in the second half of 2016 only: price will reach 1.0000 psy level by the end of 2016 for example.

Thus, we will see the ranging bearish market condition since January till June 2016, and the primary bearish condition will be continuing with good breakdown possibility without ranging since July till December 2016.Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.12.10 13:06

Setups For EUR/USD by Barclays (based on efxnews article)

Barclays Capital made a forecast for EUR/USD for today and tomorrow:

Let's evaluate this forecast with the technical point of view.

M5 timeframe. Ranging bearish. The price is located below 100 period SMA (100 SMA) and 200 period SMA (200 SMA) for the primary bearish market condition with the secondary ranging within the following support/resistance levels:

If the price will break 1.0932 support level on close bar so the bearish trend will be continuing.

If the price will break 1.1042 resistance level on close bar so we may see the reversal of the intra-day price movement to the primary bullish market condition.

If not so the price will be on ranging within the levels.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.12.11 10:11

Trading News Events: U.S. Retail Sales (adapted from the article)

Another 0.2% expansion in U.S. Retail Sales may fuel speculation for a December Fed rate-hike and spur a near-term pullback in EUR/USD as central bank officials largely endorse an upbeat outlook for the world’s largest economy.

What’s Expected:

Why Is This Event Important:

Signs of stronger consumption may encourage the Federal Open Market Committee (FOMC) to remove the zero-interest rate policy (ZIRP) at the next meeting as it remains one of the leading drivers of growth and inflation but, a weak sales report may drag on rate expectations as Chair Janet Yellen appears to be in no rush to normalize monetary policy.

However, subdued wages accompanied by the slowdown in private credit may drag on sales, and a dismal outcome may prompt the FOMC to lower its interest-rate forecast at the December meeting as it undermines the central bank’s scope to achieve the 2% inflation target over the policy horizon.

How To Trade This Event Risk

Bullish USD Trade: Retail Sales Expands 0.2% or Greater in November

- Need red, five-minute candle following a positive print to consider a short EUR/USD trade.

- If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

Bearish USD Trade: U.S. Household Consumption Falls Short of Market Forecast- Need green, five-minute candle to favor a long EUR/USD trade.

- Implement same setup as the bullish dollar trade, just in reverse.

Potential Price Targets For The ReleaseEUR/USD Daily