Market Condition Evaluation based on standard indicators in Metatrader 5 - page 131

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.10.23 07:32

Post ECB rate decision event review - BNP Paribas (based on efxnews article)

The ECB left policy unchanged and Mario Draghi delivered the maximum level of dovishness at the press conference.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.10.24 17:44

EUR/USD: levels and targets by Societe Generale (based on efxnews article)

Societe Generale made a weekly technical forecast concerning the EUR/USD:

As we see from the chart above - the nearest support level is 1.1086, and it is going to be crossed on the weekly open bar. The next support levels as the next bearish taregts are 1.0807 and 1.0607. And the 'final' taregt si 1.0461.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.10.26 10:37

EURUSD Intra-Day Technical Analysis - stop near key support for the bearish breakdown to be continuing (based on efxnews article)

Skandinaviska Enskilda Banken made intraday technical forecast for EUR/USD pair estimated new support level around 1.08 with stop loss at about 1.15:

"With additional selling on Friday prices broke and closed below the March support line, the floor of the large bear flag. The break now suggests that we have left the seven months long correction having resumed the longer term underlying bear trend. The next key support is 1.0869- 1.0808. Short term there is however a growing risk for at least a minor reaction higher. Lower the stop from 1.1510 to 1.1306."

From the technical point of view - the intra-day price was stopped by 1.0996 support level on the way to the bearish breakout to be continuing, and reversal resistance level is 1.1339.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.10.26 14:26

Trading ideas for EUR/USD by UBS Group (based on efxnews article)

UBS Group made a weekly technical forecast making the trading recommendations for the EUR/USD pair related for the trading.

EURUSD:

The price is trading to be below Ichimoku cloud for the crossing 23.6% Fibo support level at 1.1021 from above to below for the bearish trend to be continuing. The nearest bearish target is Fibo support level at 1.0811, and if the price crosses this target so we may see the good bearish breakdown up to 1.04/1.05.

If the price will break 1.1021 support level on close W1 bar so the primary bearish will be continuing up to 1.0811 as the next target.

If the price will break 1.0811 support level on close W1 bar so we may see good breakdown within the primary bearish market condition.

If not so the price will be ranging within the levels.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.10.28 07:58

EUR/USD: Levels & Targets - UOB (based on efxnews article)

EURUSD traded sideways as expected, notes UOB Grou:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.10.29 11:00

Technical Ideas for EUR/USD by SEB (based on efxnews article)

Skandinaviska Enskilda Banken made intraday technical forecast for EUR/USD pair estimated new support level at 1.0896:

"The rejection from the recently broken flag floor and the break below the support was exactly what was needed to trigger the next part of the decline. Selling will likely take short pause arriving at 1.0896 but probably not for long. The current wave three should stretch out for the 1.05-area before any more profound reaction likely to occur."

From the technical point of view - the intra-day price is on bearish ranging within 1.1095 resistance and 1.0896 support levels. If support level will be broken from above to below so the bearish trend will be continuing, otherwise - ranging.Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.11.01 05:50

Fundamental Analysis by Credit Agricole: what we’re watching (based on efxnews article)

Credit Agricole made a fundamental forecasts related to the price of some pairs movement during some high impacted news events for the week.

Fundmental analysis:

Technical analysis:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.11.02 07:25

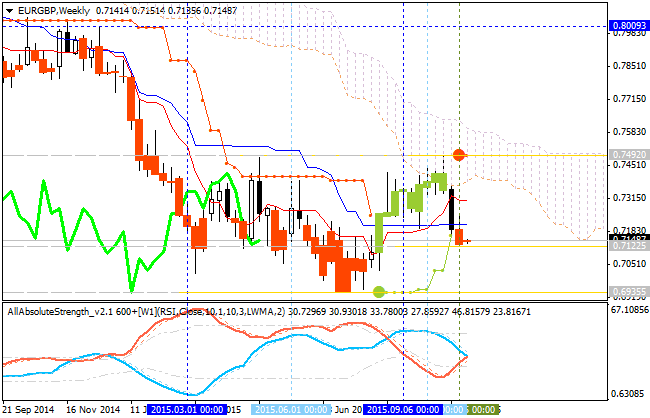

Trading Weekly Review - Sell EUR/GBP (based on efxnews article)

Deutsche Bank adviced to sell EUR/GBP this week based on some fundamental weekly forecast:

From the technical point of view - the EUR/GBP pair is on bearish market condition for crossing the key support level at 0.7122 with 0.6935 as a next bearish target. Ichimoku cloud together with Sinkou Span lines are located below the price for the bearish condition, and absolute strength indicator is signaling for the bearish breakdown to be started. If the price crosses 0.7122 support level on close bar so we may see the good price movement up to 0.6935 support level for example.Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.11.02 13:59

Trading Ideas for EUR/USD - bearish key month reversal (based on efxnews article)

Skandinaviska Enskilda Banken made some technical analysis for EUR/USD:

EUR/USD: secondary correction is started "Mr. Market did chose to follow the alternate correction path and prices accordingly moved up in close proximity to the recent correction high, 1.1098. With the rejection lower there’s a relatively high probability that the minor correction now is over and done hence lower levels waiting around the corner. The monthly close below 1.1087 also created a bearish key month reversal (here seen as a bearish continuation pattern given that it didn’t come from a correction high)."

H4 price is on bearish market condition with the ranging within 1.1072 resistance and 1.0896 Fibo support level. Ascending triangle pattern is formed by the price to be crossed from below to above, but the price broke trendline to above for the secondary correction to be started.

If H4 price will break 1.0896 support level on close H4 bar so the primary bearish will be continuing.

If H4 price will break 1.1072 resistance level so the bear market rally will be started with the good possibility to the reversal of the price movement from the primary bearish to the primary bullish market condition.

If not so we may see the ranging within the levels.

SUMMARY : bearish

TREND : rangingForum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.11.03 08:02

Trading Weekly Review - Sell EUR/USD (based on efxnews article)

Credit Suisse adviced to sell EUR/USD this week based on the following some fundamental factors:

From the technical point of view - the price for the pair broke 100 day SMA and 200 day SMA from above to below for the primary bearish market condition: the price was bounced off Fibo support level at 1.0896 to start ranging around 23.6% Fibo level. By the way, descending triangle pattern was formed by the price to be crossed to below, and RSI indicator is estimating the bearish trend to be continuing, so the mist likely scenario for this pair for the week is to continuing with bearish trend with the possible breakdown possibility.