Market Condition Evaluation based on standard indicators in Metatrader 5 - page 129

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.10.02 13:07

What To Expecе From US NFP - review (based on efxnews article)

==========

2015-10-02 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Non-Farm Employment Change]

if actual > forecast (or previous data) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry. Job creation is an important leading indicator of consumer spending, which accounts for a majority of overall economic activity.

==========

EURUSD M5: 100 pips ranging price movement by USD - Non-Farm Employment Change news event:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.10.02 14:44

2015-10-02 13:30 GMT | [USD - Non-Farm Employment Change]- past data is 173K

- forecast data is 201K

- actual data is 142K according to the latest press release

if actual > forecast (or previous data) = good for currency (for USD in our case)[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

==========

EURUSD M5: 161 pips price movement by USD - Non-Farm Employment Change news event:

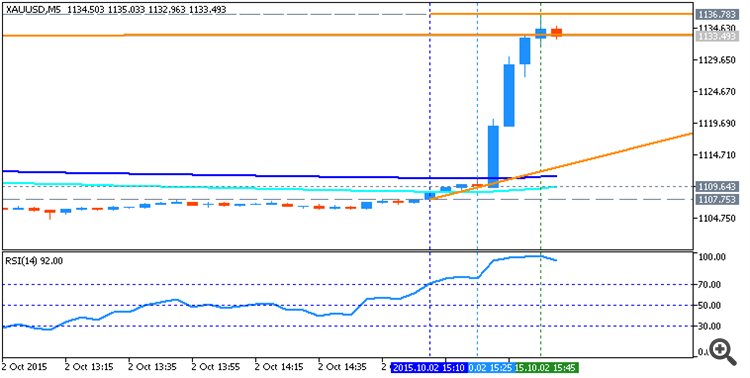

Gold (XAU/USD) went to the bullish market condition - on close bar for M5 timeframe, and on open bar on H4 chart:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.10.04 18:33

EUR: Outlooks For The Coming Week - Morgan Stanley (based on efxnews article)

"EUR: EUR Still Driven by Risk. Neutral.

As risk sees some relief, we would expect EUR to see some pressure, given the inverse relationship between EUR and equities. We like tactically trading short EUR/EM crosses, though we would be selective on EM currencies. EURUSD could also weaken in this environment. Over the medium term, we also expect EUR to head lower, on the back of divergence in monetary policy between Europe and the rest of the world."

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.10.05 09:02

EUR/USD: Levels & Targets by UOB (based on efxnews article)

UOB expects for EUR/USD the ranging within 1.1160 and 1.1275.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.10.06 13:39

Intraday Outlooks for EUR/USD by SEB (based on efxnews article)

EUR/USD: "Sellers keep responding. Thinned dynamic resistance keeps attracting responsive selling, but bears' initiative below 1.1150/05 is needed to confirm the ongoing bearish "Flag". Current intraday stretches are located at 1.1115 & 1.1285."

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.10.07 09:32

EUR and the global risk picture - Morgan Stanley (based on efxnews article)

Morgan Stanley is expecting for EUR/USd to be in breakdown below 1.1120/1.1100 level with 1.0850 as a next target with the possibility to break resistance levels in spike way in short-term situation for example:

As we see from the chart above - the price is on bearish with the ranging within the following support/resistance levels:

Thus, the most expected scenario is the following: the price will go down for breaking 1.0924 with 1.0807 as the next bearish target. As we are talking about the ranging market condition for this pair so we should expect some local downtrend as a bear market rally up to 1.1459 resistance in short-term basis for example.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.10.08 09:16

FOMC Minutes expectations by Barclays Capital (based on efxnews article)

Barclays Capital made some expectation and forecasting concerning upcoming Federal Open Market Committee Minutes:

Just to remind one trading rules for high impacted news event such as FOMC Minutes: more hawkish than expected = good for currency (for USD in our case).

From the technical points of view, the EUR/USD is moved on the border between the primary bearish and the primary bullish in intra-day H4 chart and on daily chart, and any good high impacted news event can move the price to any direction for example. Key support/resistance levels for EUR/USD H4 are the following: 1.1317 bullish resistance and 1.1134 bearish support. On the daily chart we may see 1.1579 key resistance and 1.0878 key support levels.

Once the price breaks key support/resistance levels at least in intra-day basis so it may be the good sign for the direction to be chosen by the price for the next week for example.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.10.08 12:08

Intraday Outlooks for EUR/USD and Gold - SEB (based on efxnews article)

EUR/USD: "Another 1.13+test underway. Even though most factors speaks in favor of a bear flag being under construction since Sept 22 the short term charts speaks of more near term upside risk. The move above 1.1273 triggers an hourly buy signal calling for a test of the flag’s upper boundary, 1.1340-ish (and then turning for a downside test). To avoid the above scenario prices must fall back below 1.1211."

Gold: "Small setback likely before sharply up. Trendline sellers mark a "Triangle" wave point “D” and it should ideally be followed by a short & shallow “E-wave low, somewhere around 1,131/26 before moving up for the BIGbreak out of the formation to challenge resistance at 1169\70, 1,184 to reach the extension objective at 1,192."

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.10.09 11:45

Intraday Outlooks for EUR/USD by SEB (based on efxnews article)

EUR/USD: "Flag ceiling basically met. The pair did the anticipated up and down move. The rejection from the upper boundary does now indicate that a new attempt to exit the flag to the downside should be seen next week."

Forum on trading, automated trading systems and testing trading strategies

How to Start with Metatrader 5

Sergey Golubev, 2015.02.03 18:48

Market condition setup (indicators and template) is here