Market Condition Evaluation based on standard indicators in Metatrader 5 - page 121

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.08.11 06:56

JP Morgan for EUR/USD: ranging within daily triangle support/resistance (based on efxnews article)JP Morgan estimated the false breakout by bouncing back starting to range between very strong support/resistance levels. Market refused to make necessary breaks to established good stable trend, says JP Morgan.

Thus, JP Morgan descovered 2 very strong s/r levels:

- daily ascending triangle with 1.1071 resistance;

- daily descending triangle with 1.0772/44 support.

It means that the market is on the border waiting for direction.Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.08.11 12:26

Skandinaviska Enskilda Banken - Intraday For EUR/USD and USD/CNH (based on efxnews article)

Skandinaviska Enskilda Banken (SEB - Swedish financial group with headquarters in Stockholm/Sweden) is continuing intra-day forecast. For now - we are having some analysis for EUR/USD and USD/CNH:

EUR/USD

"The pair moved a tad higher (1.1042) than expected before turning around and falling back lower. A close at current levels (or lower) will create yet another 55d ma band rejection indicating that the sellers still are in control. A sustained break below 1.0926 will sharply up a bearish outlook calling for a swift continuation down to the recent low area."

USD/CNH

"Today’s extremely impulsive move higher has cancelled out the idea that the move up from the 2014 low point was a three wave upside corrective move. Today’s break above 6.3014 makes such a wave count obsolete and instead warns of creating either a more complex upside correction pattern (theoretically targeting the 6.48-area) OR a having entered a third of a third wave (allowing for considerably higher levels over the medium term horizon)."

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.08.12 08:09

EUR/USD - bulls in control (based on forexlive article)

EURUSD was up and down again for ranging on the back of the China surprise and the news that Greek creditors reached a deal. The price reached the border between bearishand bullish trend and stopped near some key resistance levels such as 1.1113/1.1215/1.1466.

The bulls market is under control as there are few strong resistance levels on the way for the price to be reversed. For example, 200-SMA value is located at 1.25 on weekly chart and at 1.1466 on daily chart so the price should go quite a long way through many levels on the way to possible reversal. Any fundamental news events may move the pair to be down or increase the choppy situation for the downtrend to come later for this pair.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.08.13 08:18

BofA Merrill about doubts concerning the ability of the USD to rally further (based on efxnews article)

Bank of America Merrill Lynch is dispalling the doubts about the ability of the USD to rally further and about the EURUSD to resume the bearish market condition. Strong USD skeptics are providing some arguments that USD can not be more stronger than now:

Yes, positive Eurozone data surprises, and negative US data surprises, but skeptics are missing 2 additional main arguments:

Thus, according to BofA Merrill, the USD will become more stronger compare with EUR and we will see the price as 1.04/1.05 by the end of this year anyway.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.08.13 14:20

UBS AG: short-term strategies for EUR/USD, USD/JPY, AUD/USD (based on efxnews article)

UBS AG is a Swiss global financial companymaking currency forecasts and some prediction for EUR/USd and some other pairs. They are often publishing some trade ideas and reviews concerning technicals and fundamentals.

For example, this is their well-known prediction for USDCNY immediate after first CNY devaluation: "We now expect USDCNY trading at about 6.5 by end 2015E instead of 6.3 as previously envisaged, and 6.6 at end 2016E."

So, please find below very short ideas from UBS concerning EUR/USD, USD/JPY and AUD/USD. Those idea can be valid for tomorrow and for coming week as well:

New setup is coming - support/resistance/trend lines indicators for MT5 (converted by Igorad from Job project).

I will make the entry to CodeBase.

This is great indicator for market condition and for trading too.

Just for information.

hmm...

thanks for your sharing this info. i was searching for good indicator and you have make easeness for me :)

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.08.14 07:46

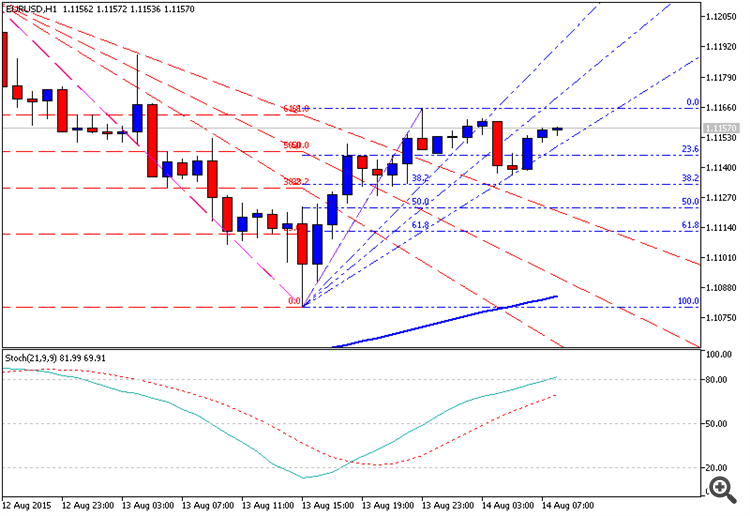

EUR/USD key levels for the bulls from JP Morgan (based on forexlive article)

JP Morgan publish the next technical analysis for EURUSD, and for now - about the key levels for the bullish trend to be continuing in intra-day and day trading:

As we see from intra-day H1 chart - the EUR/USD is traded between Fibo resistance at 1.1160 and 23.6% Fibo support at 1.1145 for possible breakout of the price movement of the key resistance levels. Thus, forecast made by JP Morgan may be the rrue in this case.Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.08.14 11:28

EUR/USD, USD/JPY, EUR/GBP, AUD/USD - Intraday by SEB (based on efxnews article)

Skandinaviska Enskilda Banken (SEB) made some intra-day analysis for few pairs whch may be used for the next week for example. Those pairs are the following: EUR/USD, USD/JPY, EUR/GBP and AUD/USD. This is very short technical analysis for good s/r levels and for the direction to be followed:

EUR/USD: "The failed move below 1.1126 (and the created downside spike) keeps the short term wave pattern unclear. As long as 1.1190 remains unbroken there’s still a possibility that an upward correction ended the other day but if making way above the resistance new highs should be penciled in."

USD/JPY: "With the pair still below the mid body resistance downside risks are increasing. If also today manages to stay below 124.68 then downside risks will be even further enhanced going into next week. A move below 124.07 will likely lead to a loss of the 123.79 key support."

EUR/GBP: "The ongoing correction has still room to move a bit further north. The primary target for the move is 0.7176 with a possible extension towards the trend line at 0.7200. Once there look for offers to be returning."

AUD/USD: "After the latest rejection from the 2001 trend line the pair fell down but only to a marginally new low. Price action with no follow through selling together with a bullish divergence hints of an overly oversold market and therefore also an increasing reaction risk. Shorts should be very cautious should we break above 0.7440 (if such a move takes place today it will also create a bullish key week reversal)."

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.08.16 19:09

Weekly Outlook for USD, EUR, JPY, GBP, AUD by Morgan Stanley (based on efxnews article)

Morgan Stanley is continuing to make a weekly forecast for the currency pairs making on technical analsysi, fundamental analysis and for some Morgan Stanley's expectation about what they want for us to do for example sorry.

As we see - the expectation for EUR is bearish and for AUD is bearish too (USD is for bullish condition).

USD: "We believe USD strength will be focused against EM and commodity currencies going forwards, with AxJ particularly underperforming. This is largely a result of the CNY move, but also reflects growth differentials and structurally lower commodity prices. However, we would expect the path against other G10 currencies to be driven more by data into September, as the market watches the Fed closely."

EUR: "We believe EUR could benefit from the latest developments in China. CNY moves could spill over into general asset market volatility. This would support currencies with current account surpluses that have been used to fund risky holdings, as investors unwind their risky positions. EUR is such a currency. In addition, many investors have hedged their European equity holdings, and as these positions are unwound, this will lead to buying back of hedges, supporting EUR."

JPY: "We believe JPY is likely to face conflicting forces following the developments in China. On the one hand, this increases deflationary risks for Japan, as a weaker CNY could lead to disinflationary pressure in Japan. It also challenges Japanese competitiveness, given the impact on the REER. On the other hand, uncertainty on CNY is likely to de-stabilize risk appetite, leading to repatriation and supporting JPY. Overall, we expect the latter effect to win out in impact, but recognize the risks."

GBP: "The dovish inflation report and risk appetite getting hit has provided some headwinds for GBP. However with China developments still playing on markets’ minds and the Fed coming back into play, we believe GBPUSD is going to be driven more by the USD side of the pair. The BoE is still one of the central banks heading towards a hike next year so GBP should gain some relative strength. Here we like to buy against the more vulnerable commodity currencies (CAD, NOK and AUD)."

AUD: "We believe AUD is likely to be an underperformer following the developments in China this week, though stabilization in the near term could provide some relief for the currency. However, given China’s close trade relations with China, any CNY weakness will lead to de facto AUD REER appreciation, which may be countered by AUDUSD weakness in order to maintain competitiveness."