Market Condition Evaluation based on standard indicators in Metatrader 5 - page 119

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.07.30 14:10

Bank of America Merrill Lynch - preview for today's US 2Q GDP (based on efxnews article)

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.07.31 09:37

Where To Sell EUR/USD (based on efxnews article)

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.07.31 15:04

2015-07-31 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Employment Cost Index]if actual > forecast (or previous data) = good for currency (for USD in our case)

[USD - Employment Cost Index] = Change in the price businesses and the government pay for civilian labor. It's a leading indicator of consumer inflation - when businesses pay more for labor the higher costs are usually passed on to the consumer.

==========

"Compensation costs for civilian workers was little changed at 0.2 percent, seasonally adjusted, for the 3-month period ending June 2015, the U.S. Bureau of Labor Statistics reported today. Wages and salaries (which make up about 70 percent of compensation costs) was also little changed at 0.2 percent, and benefits (which make up the remaining 30 percent of compensation) was little changed at 0.1 percent."

==========

EURUSD M5: 112 pips price movement by USD - Employment Cost Index news event:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.08.02 10:21

NFPs, BoE and RBA Will Stir Volatility Even If Risk Trends Hold Steady (based on dailyfx article)

"The most high-profile indicator on the list is the NFPs, but labor data's wage component and Monday's PCE inflation report speak more directly to rate forecasting. High level event risk for the UK and Australia should also have traders keeping tabs on Pound and Aussie sets going forward. We look at the event risk and market potential ahead in the weekend Trading Video."

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.08.03 11:19

Skandinaviska Enskilda Banken: Outlooks For EUR/USD, USD/JPY, AUD/USD, SP500 (based on efxnews article)

EURUSD: rejection from the 55-day MA

'The up and down move on Friday became the third consecutive rejection from the 55d ma band (since the return below it a month ago). The behavior is showing that bearish forces are at play and increasingly so given the return to a negative slope. We are thus looking for additional selling.'

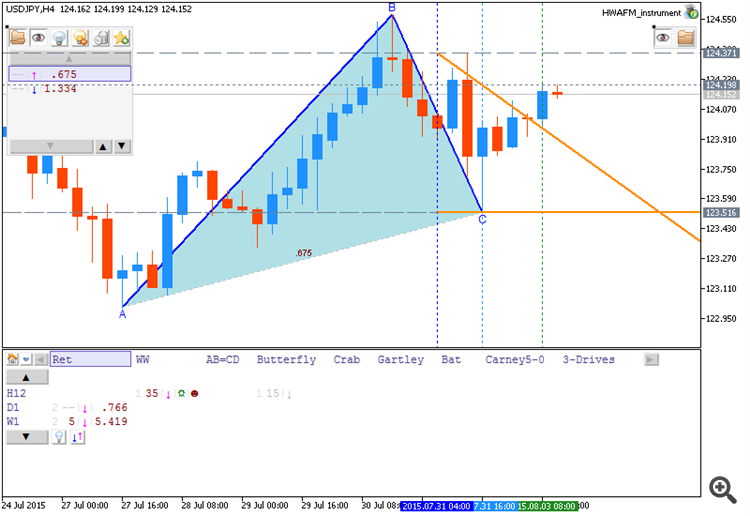

USDJPY: new attempt to be above the key level

'Given the violation of the B-wave high (and a three wave setback from Thursday’s peak) there’s a high probability of a soon more successful break higher (targeting a new trend high). For today we see 124.37 as the trigger point for the next step higher.'

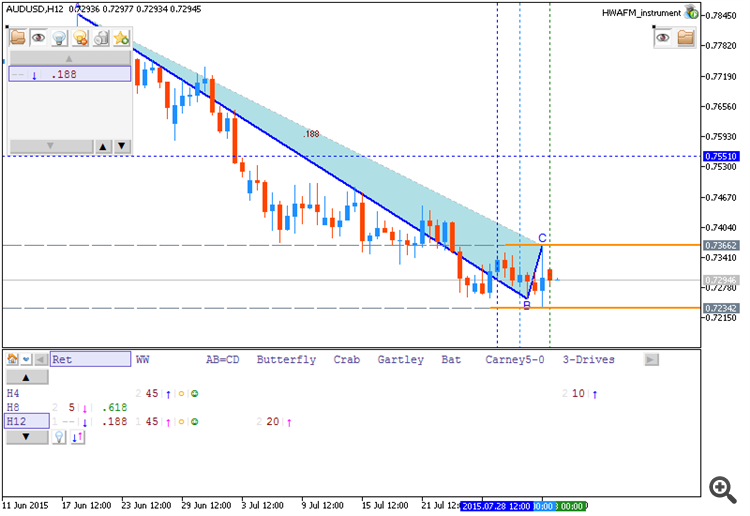

AUDUSD: Signs for sellers

'The spinning candle (small net move and big spikes to both sides) and the spring bottom are both signs of exhaustive sellers. There’s clearly a potential for the pair to bounce back to retest the 2001 trend line (or even back up to the 0.75- area) during the coming week.'

S&P 500: Higher again

'As long as the recent correction low remains unbroken a positive view should be kept in place (the July candle also developed into a mildly bullish piercing pattern). The entire structure since May can also be seen as an inverted head and shoulders formation, here seen as an upside continuation pattern.'

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.08.03 12:30

Societe Generale: EURUSD and Non-Farm Payrolls (based on efxnews article)

Societe Generale made some review for Non-Farm Employment Change report (Change in the number of employed people during the previous month, excluding the farming industry) which will be on Friday:

- "There’s a risk that we see edgy markets in the meantime...At the risk of sounding like a broken record, the case for raising rates to less unusually low levels does not rest on wage growth or inflation returning in earnest first. Rates are too low, and capital is misallocated as a result."

- "More than the wage data however, we’d focus on the unemployment rate. We look for a solid 240k increase in non-farm payrolls, a 2.2% increase in hourly earnings and a drop to 5.2% from 5.3% in the unemployment rate."

- "Anything that gets the front end of the curve higher in the US should be negative for EUR/USD. A meander back above 1.10 is possible in the early part of the week, but we’d like to sell against 1.11 and look for a break lower in August."

Just to remind that previous NFP data was 223K, and forecasting for this Friday is aroud 224K for example (from 222K to 225K), so if Societe Generale is looking for 240K as anactual data for this Friday - it merans to be more bearish for EURUSD. Because in case of NPF: actual > forecast = good for currency (for US Dollar in our case). So, it means: more bearish for EURUSD with some key support levels to be broken. And Unemployment Rate is forecadting to be 5.2% from 5.3% by SG.Thus, I think - it may be good bearish breakdown during this high impacted news event.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.08.04 07:40

Bank of Tokyo-Mitsubishi - 'we target EUR/USD at parity by year-end and at 0.96 by Q1'16-end' (based on efxnews article)

Bank of Tokyo-Mitsubishi (BTMU) made their fundamental forecasts for EURUSD based on some fundamental factors:

Bank of Tokyo-Mitsubishi (BTMU) forecasts for EURUSD to be at parity by year-end and at 0.96 by Q1'16-end.

By the way, the price is located to be below yearly Central Pivot at 1.2729 for the primary ranguing between S1 Pivot at 1.1466 and S2 Pivot at 1.0834, and the next target in the case the bearish trend will be continuing is S3 Pivot at 0.9571. So, the Bank of Tokyo-Mitsubishi (BTMU) is right with their forecast.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.08.04 09:54

2015-08-04 05:30 GMT (or 07:30 MQ MT5 time) | [AUD - Cash Rate and RBA Rate Statement]if hawkish > expected = good for currency (for AUD in our case)

More hawkish than expected = Good for currency

[AUD - Cash Rate and RBA Rate Statement] = Interest rate charged on overnight loans between financial intermediaries. Short term interest rates are the paramount factor in currency valuation - traders look at most other indicators merely to predict how rates will change in the future. RBA Rate Statement is among the primary tools the RBA Reserve Bank Board uses to communicate with investors about monetary policy. It contains the outcome of their decision on interest rates and commentary about the economic conditions that influenced their decision. Most importantly, it discusses the economic outlook and offers clues on the outcome of future decisions.

==========

"The Federal Reserve is expected to start increasing its policy rate later this year, but some other major central banks are continuing to ease policy. Hence, global financial conditions remain very accommodative. Despite fluctuations in markets associated with the respective developments in China and Greece, long-term borrowing rates for most sovereigns and creditworthy private borrowers remain remarkably low."

"The Board today judged that leaving the cash rate unchanged was appropriate at this meeting. Further information on economic and financial conditions to be received over the period ahead will inform the Board's ongoing assessment of the outlook and hence whether the current stance of policy will most effectively foster sustainable growth and inflation consistent with the target."

==========

AUDUSD M5: 94 pips price movement by AUD - Cash Rate news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.08.04 17:13

EURUSD Breakout Fails (based on dailyfx article)

After traversing its daily 30 pip range, the EURUSD has opened the US trading session with a false breakout. Prices attempted a move above today’s R4 Camarilla pivot at 1.0979, but this bullish breakout quickly reversed. Prices are currently tradingback inside of today’s pivot range. As seen below, the EURUSD’s trading range begins at resistance found at the R3 pivot, at a price of 1.0964. If price continues to decline through values of support, traders will begin to look for price to target the S3 pivot found at a price of 1.0934.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.08.05 07:40

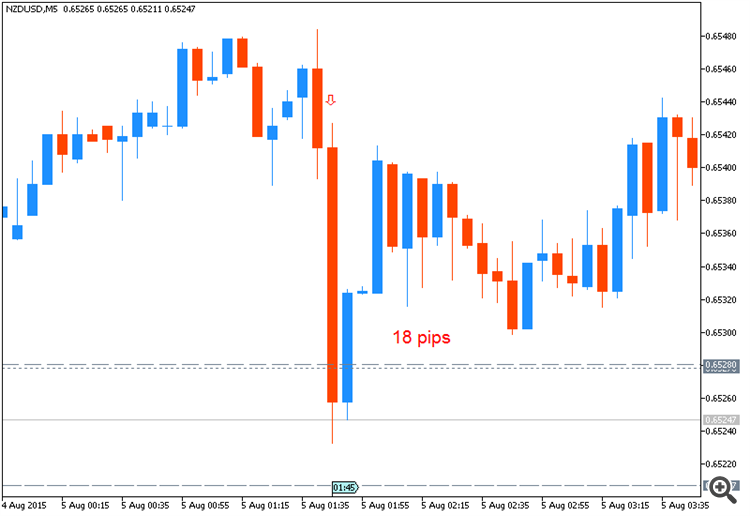

2015-08-04 23:45 GMT (or 01:45 MQ MT5 time) | [NZD - Employment Change]if actual > forecast (or previous data) = good for currency (for USD in our case)

[NZD - Employment Change] = Change in the number of employed people. Job creation is an important leading indicator of consumer spending, which accounts for a majority of overall economic activity.

==========

==========

NZDUSD M5: 18 pips price movement by NZD - Employment Change and Unemployment Rate news event: