Forum on trading, automated trading systems and testing trading strategies

EURUSD - News & Analysis

Mahdi Vaseghmanesh, 2016.10.08 19:48

EURUSD - News & Analysis

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.08 09:07

Weekly Outlook: 2016, October 09 - October 16 (based on the article)

German ZEW Economic Sentiment, US FOMC Meeting Minutes, UK Rate decision, US Unemployment Claims, US Crude Oil Inventories, US Consumer Sentiment and Janet Yellen’s speech; These are the main events on forex calendar.

- German ZEW Economic Sentiment: Tuesday, 9:00. Economic sentiment is expected to improve to 4.2.

- US FOMC Meeting Minutes: Wednesday, 18:00.

- UK Rate decision: Thursday, 11:00. The MPC expect a boost in growth during 2017 if the present economic momentum continues.

- US Unemployment Claims: Thursday, 12:30. The number of new claims is expected to reach 252,000 this week.

- US Crude Oil Inventories: Thursday, 15:00.

- US Retail sales: Friday, 12:30. Retail sales is expected to gain 0.6%, while core sakes are predicted to rise 0.4%.

- US Prelim UoM Consumer Sentiment: Friday, 14:00. U.S. consumer confidence is expected to climb to 92.1 this

- Janet Yellen speaks: Friday, 17:30. Federal Reserve Chair Janet Yellen will give a talk in Boston’s Annual Research Conference. She will talk about the US economic recovery and may give further clues regarding the expected rate hike timetable. Market volatility is expected.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.11 14:36

Intra-Day Fundamentals - EUR/USD and USD/CAD: NFIB Small Business Index

2016-10-11 10:00 GMT | [USD - NFIB Small Business Index]

- past data is 94.4

- forecast data is 95.2

- actual data is 94.1 according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - NFIB Small Business Index] = Level of a composite index based on surveyed small businesses.

==========

From 247 wallst article: Small Business Optimism Slips Again in September

"Clearly the stock market loves the Fed, but bloated stock values are not

real productive wealth which is created by real investment in plant,

equipment, research and infrastructure, weak in this recovery. Even

housing with low mortgage rates has not performed up to expectation

based on demographics. It has not occurred to the Fed that what meager

growth we have had has occurred in spite of government policy, not

because of it. The private sector continues to perform poorly in light

of the barriers that governments at all levels throw up in its path."

==========

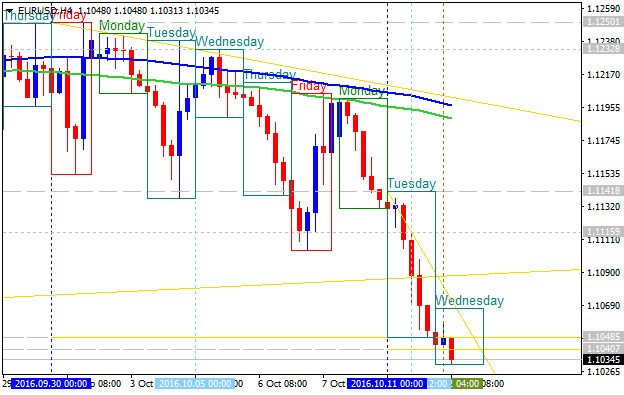

EUR/USD M5: 37 pips price movement by NFIB Small Business Index news events

==========

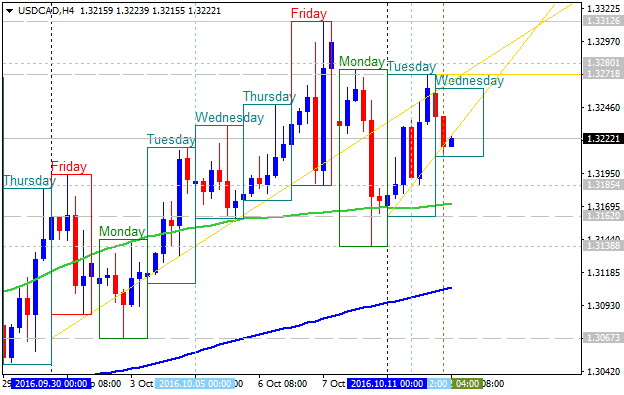

USD/CAD M5: 29 pips price movement by NFIB Small Business Index news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.12 07:28

Fed Dudley Speaks, Fed George Speaks , Sep FOMC Minutes - Barclays (based on the article)

2016-10-12 12:00 GMT | [USD - FOMC Member Dudley Speaks]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[USD - FOMC Member Dudley Speaks] = Speech at the Fireside Chat with the Business Council of New York, in Albany.

==========

New York Fed President Dudley (FOMC voter) speaks: "Dudley speaks on the economy. Based on his recent speeches, we think he is now of the view that, from a risk-management perspective, accommodation should be removed cautiously given the lack of scope to lower rates in the event of an economic downturn."

==========

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.12 07:41

Fed Dudley Speaks, Fed George Speaks , Sep FOMC Minutes - Barclays (based on the article)

2016-10-12 13:40 GMT | [USD - FOMC Member George Speaks]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[USD - FOMC Member George Speaks] = Speech at the Federal Reserve Bank of Chicago's Annual Payments Symposium.

==========

Kansas City Fed President George (FOMC voter) speaks: "George speaks on the economic outlook. She has dissented several times this year. We expect her to maintain her call for a rate hike."

==========

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.12 07:54

Fed Dudley Speaks, Fed George Speaks , Sep FOMC Minutes - Barclays (based on the article)

2016-10-12 18:00 GMT | [USD - FOMC Meeting Minutes]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[USD - FOMC Meeting Minutes] = It's a detailed record of the FOMC's most recent meeting, providing in-depth insights into the economic and financial conditions that influenced their vote on where to set interest rates.

==========

FOMC minutes: "Given the three dissents in favor of a rate hike at the FOMC’s September meeting, we expect the minutes to reveal widening divisions within the committee over the appropriate stance of policy. On one side are those who believe a rate hike in September would have been warranted given that the economy is operating near mandate-consistent levels and mediumterm risks are rising. These concerns were expressed by regional Fed presidents Rosengren, Mester, and George in remarks leading up to, and following, the meeting. On the other side are those FOMC members, primarily within the Board, who point to a slower removal of labor market slack, via trends in participation and other variables, and a lack of evidence that inflation or financial instability are rising, as supporting a further delay in policy normalization."

==========

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.14 11:11

EUR/USD Rebounds From Weekly Lows (based on the article)

Daily price was on the breakdown with the bearish reversal: the price was bounced from one week low at 1.0985 to above for the ranging bearish condition to be started:

"The EUR/USD is beginning to pair losses after closing lower for 3

consecutive sessions and declining as much as 219 pips for the week. The

current daily low for the EUR/SUD resides at 1.0985, but technical

traders will continue to monitor the psychological 1.1000 level going

into tomorrow’s University of Michigan’s Confidence figures and Janet

Yellen’s speech at the Boston Fed conference. Both of these events are

marked as high importance events, with both having the ability to shift

the direction of the EUR/USD."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.14 15:27

Intra-Day Fundamentals - EUR/USD, USD/CAD and NZD/USD: U.S. Advance Retail Sales

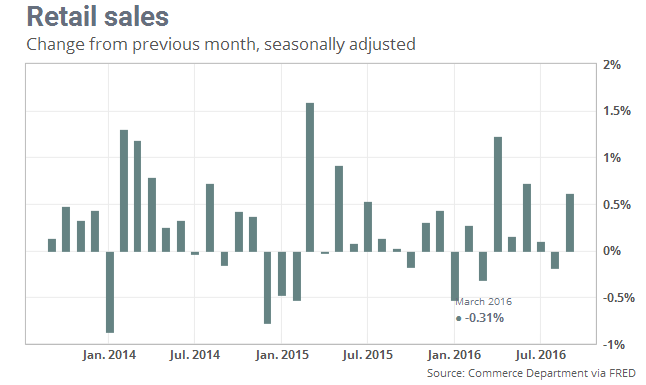

2016-10-14 12:30 GMT | [USD - Retail Sales]

- past data is -0.2%

- forecast data is 0.7%

- actual data is 0.6% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Retail Sales] = Change in the total value of sales at the retail level.

==========

From MarketWatch article: U.S. retail sales snap back in September

"Sales at U.S. retail stores rebounded in September, with auto dealers

and gas stations racking up the biggest gains, in a sign consumers are

still spending fast enough to keep the economy on solid ground. Retail

sales rose 0.6% last month to snap back from a small decline in August

that was the first in five months. Economists surveyed by MarketWatch

had forecast a 0.7% increase."

==========

EUR/USD M5: 25 pips range price movement by U.S. Advance Retail Sales news events

==========

USD/CAD M5: 23 pips range price movement by U.S. Advance Retail Sales news events

==========

NZD/USD M5: 24 pips price movement by U.S. Advance Retail Sales news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.14 20:20

Intra-Day Fundamentals - EUR/USD and DAX Index: Fed Chair Yellen Speaks at the Federal Reserve Bank

2016-10-14 17:30 GMT | [USD - Fed Chair Yellen Speaks]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[USD - Fed Chair Yellen Speaks] = Speech named "Macroeconomic Research After the Crisis" at the Federal Reserve Bank of Boston’s Annual Research Conference.

==========

From Bloomberg article: Yellen Sees ‘Plausible Ways’ Hot Economy Could Heal Growth

- "Federal Reserve Chair Janet Yellen said there are “plausible ways” that running the U.S. economy hot for a while could fix some of the damage caused to growth trends by the Great Recession."

- "Increased business sales would almost certainly raise the productive capacity of the economy by encouraging additional capital spending,” Yellen said Friday in the text of a speech to a Boston Fed conference on the elusive economic recovery. “A tight labor market might draw in potential workers who would otherwise sit on the sidelines."

- "Yellen pondered whether a “high-pressure economy” could reverse some of

the damage done in the recession, including declines in research

spending and labor force participation. In effect, that has been the

Federal Open Market Committee’s bet this year, though Yellen cautioned

that running a low-rate policy for too long “could have costs that

exceed the benefits” by increasing financial risk or inflation."

==========

EUR/USD M5: 24 pips price movement by Fed Chair Yellen Speaks news events

==========

DAX Index M5 price movement by Fed Chair Yellen Speaks news events

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

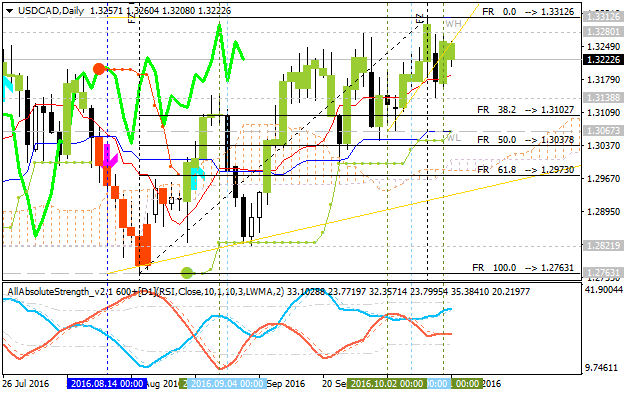

Daily price is on ranging around the lower bound of the Ichimoku cloud on the border between the ranging bullish and the primary bearish market condition within the following key support/resistance levels:

Chinkou Span line is located above the price for the ranging condition, Absolute Strength indicator is estimating the bearish reversal, and Trend Strength indicator is evaluating the trend as a primary bearish market condition in the near future.

If D1 price breaks 1.1137 support level on close bar so the reversal of the daily price movement from the ranging bullish to the primary bearish market condition will be started with 1.1122 level as a daily bearish target.If D1 price breaks 1.1258 resistance level on close bar from below to above so the bullish trend will be resumed with 1.1326 nearest bullish target to re-enter.

If not so the price will be on ranging within the levels.

SUMMARY : bullish

TREND : ranging