Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.01 11:58

Weekly Outlook: 2016, October 02 - October 09 (based on the article)

The third quarter ended with mixed moves in currencies. A full buildup to the US Non-Farm Payrolls, a rate decision in Australia and other figures fill the first week of the last quarter. These are the main events on forex calendar.

- US ISM Manufacturing PMI: Monday, 14:00. Manufacturing PMI is expected to reach 52.1 in September.

- Australian rate decision: Tuesday, 3:30. No change in rates is expected this time. This is the first rate decision made by the new governor Philip Lowe.

- US ADP Non-Farm Employment Change: Wednesday, 12:15. The ADP report is expected to show a 166,000 jobs gain in September.

- US ISM Non-Manufacturing PMI: Wednesday, 14:00. Non-manufacturing activity is expected to reach 53.1 in September.

- US Crude Oil Inventories: Wednesday, 14:30.

- US Unemployment Claims: Thursday, 12:30. The number of new claims is expected to register 255,000 jobs gain this week.

- Canadian employment data: Friday, 12:30. Economists expected a smaller gain of 16,000 jobs and the unemployment rate to remain steady at 6.9%.

- US Non-Farm Payrolls: Friday, 12:30. The number of new jobs in September is expected to be 171,000 while the unemployment rate is forecasted to remain at 4.9%. Wages are projected to rise by 0.2% m/m.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.02 13:18

Fundamental Q4'16 Forecasts for EUR/USD (based on the article)

EUR/USD - "Put simply, if there is a seismic shift in

the US political environment, the Fed will be forced to go back to the

drawing board and dramatically alter its growth and inflation forecasts.

Doing so will likely come at the expense of a rate hike this year -

which means one less reason to like the greenback. There are thus two

periods to watch for on the US Dollar side: the run-up to the election

on November 8; then the fallout and lead-in to the December 14 FOMC meeting. Even though EUR/USD is coiling now, there are plenty of reasons to look for increased volatility."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.05 13:02

Trading News Events: U.S. ISM Non-Manufacturing (adapted from the article)

- "A rebound in the U.S ISM Non-Manufacturing survey may fuel the near-term strength in the greenback and spark a selloff in EUR/USD should the report boost expectations for a 2016 Fed rate-hike."

- "It seems as the Federal Open Market Committee (FOMC) is taking a similar path to 2015 as a growing number of officials endorse higher borrowing-costs, and the central bank may continue to take a more collective approach to prepare U.S. households and businesses for a December rate-hike as ‘the Committee judges that the case for an increase in the federal funds rate has strengthened.’ However, market participants may pay increased attention to the 2017-rotation as the three dissenting members from the September interest-rate decision (Esther George, Loretta Mester, and Eric Rosengren) give up their votes, and the decline in the long-run forecast for the federal funds rate may become a key theme in the year ahead as Chair Janet Yellen continues to endorse a ‘gradual’ path in normalizing monetary policy."

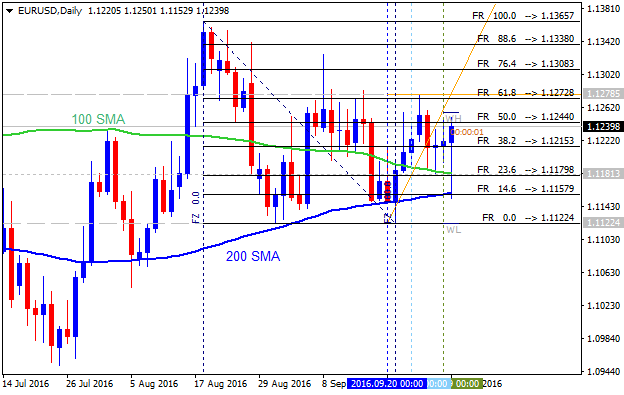

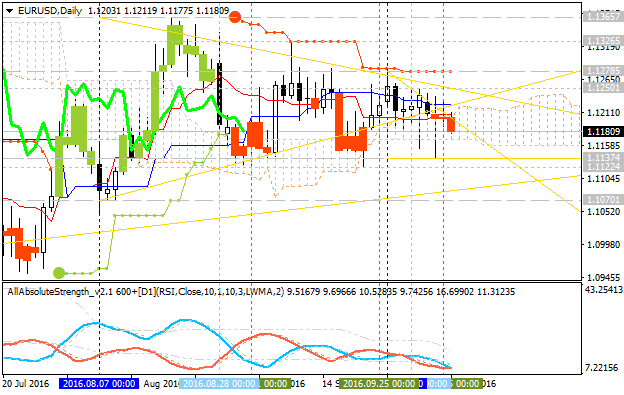

Daily

price

is on bullish ranging above 200-day SMA (200 SMA) and 100-day SMA (100 SMA) for the primary bullish trend to be resumed or for the bearish reversal to be started.

- If D1 price breaks 1.1278

resistance level to above on

close daily bar so the primary bullish market condition will be ressumed.

- If price breaks 1.1137

support to below on close daily bar so the reversal of ther daily price movement from the ranging bulliush to the primary bearish market condition will be started.

- If not so the price will be on bullish ranging within the levels.

(all images/charts were made using Metatrader 5 software and free indicators from MQL5 CodeBase)

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.05 17:09

Intra-Day Fundamentals - EUR/USD and USD/CAD: U.S. ISM Non-Manufacturing PMI

2016-10-05 13:45 GMT | [USD - ISM Non-Manufacturing PMI]

- past data is 51.4

- forecast data is 53.1

- actual data is 57.1 according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - ISM Non-Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers, excluding the manufacturing industry.

==========

==========

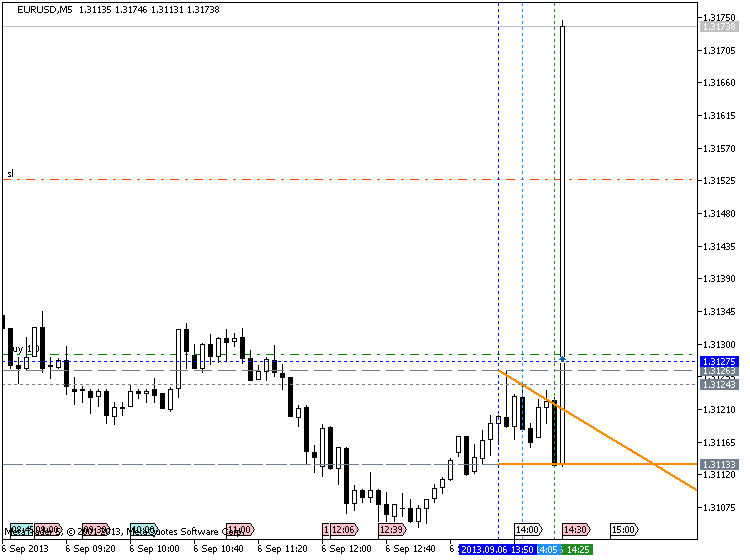

EUR/USD M5: 27 pips price movement by ISM Non-Manufacturing PMI news events

==========

USD/CAD M5: 43 pips range price movement by ISM Non-Manufacturing PMI news events

Daily price is continuing to be ranging inside Ichimoku cloud for direction with 1.1278 resistance for the bullish trend to be resumed and 1.1137 support for the bearish reversal to be started:

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.06 14:31

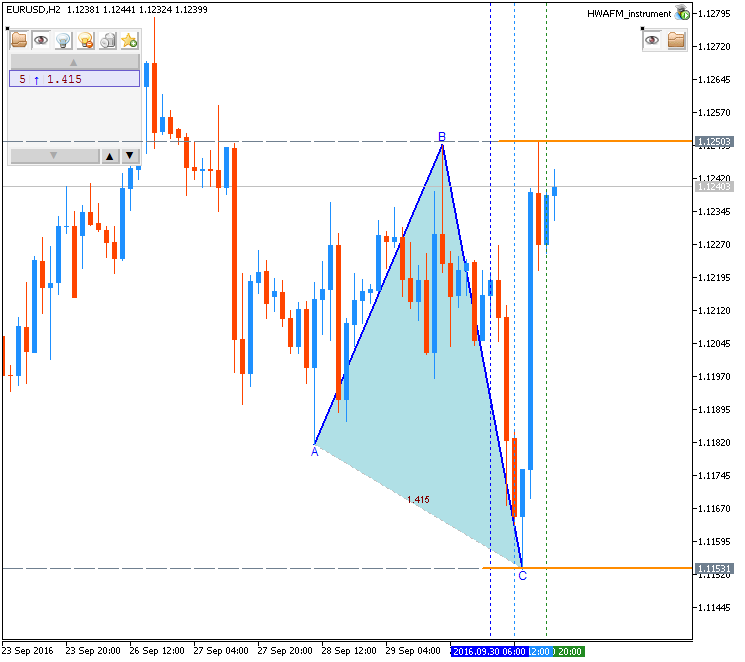

Technical Targets for EUR/USD by United Overseas Bank (based on the article)

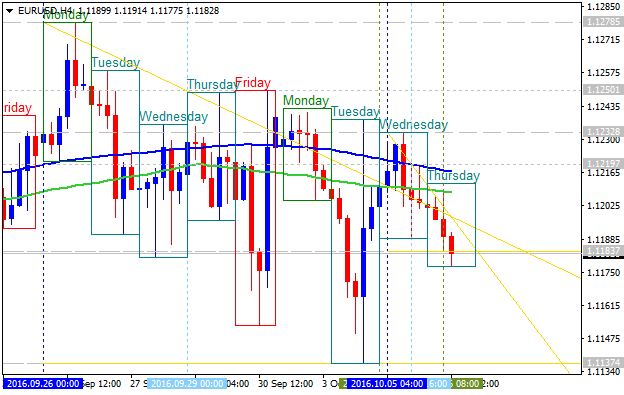

H4 price is on bearish breakdown located below 100 SMA/200 SMA area. The price is breaking 1.1183 support level to below for the primary bearish trend to be continuing.

Daily

price. United Overseas Bank is expecting for this pair the ranging trend to be continuing:

"EUR spent another day going nowhere and at this stage, there is no pre-indication that the current neutral phase is about to end soon. In other words, the expected sideway trading range of 1.1120/1.1290 that was first highlighted about 2 weeks ago is still intact."

- If daily price breaks 1.1278 resistance level

on close bar so the bullish trend will be resumed.

- If daily price breaks 1.1122 support level on close bar so the reversal of the price movement from the ranging bullish to the primary bearish market condition will be started.

- If not so the price will be on ranging within the levels.

This is the 1st video in a series on economic reports created for all markets, or for those who simply have an interest in economics. In this and the next lesson, we cover the Employment Situation Report, also known as Non Farm Payroll.

============

Non-farm Payrolls (metatrader5.com)Non-farm Payrolls is the assessment of the total number of employees recorded in payrolls.

This is a very strong indicator that shows the change in employment in the country. The growth of this indicator characterizes the increase in employment and leads to the growth of the dollar. It is considered an indicator tending to move the market. There is a rule of thumb that an increase in its value by 200,000 per month equates to an increase in GDP by 3.0%.

- Release Frequency: monthly.

- Release Schedule: 08:30 EST, the first Friday of the month.

- Source: Bureau of Labor Statistics, U.S. Department of Labor.

============

FF forum economic calendar :

- Source : Bureau of Labor Statistics

- Measures : Change in the number of employed people during the previous month, excluding the farming industry

- Usual Effect : Actual > Forecast = Good for currency

- Frequency : Released monthly, usually on the first Friday after the month ends

- Why Traders Care : Job creation is an important leading indicator of consumer spending, which accounts for a majority of overall economic activity

- Also Called : Non-Farm Payrolls, NFP, Employment Change

============

mql5 forum thread : Non-Farm Employment Strategy

============

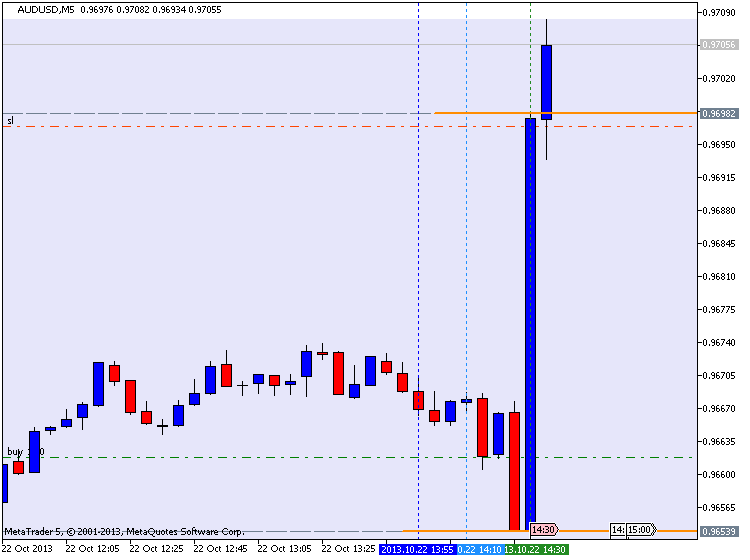

AUDUSD M5 with 45 pips in profit (by equity) for NFP :

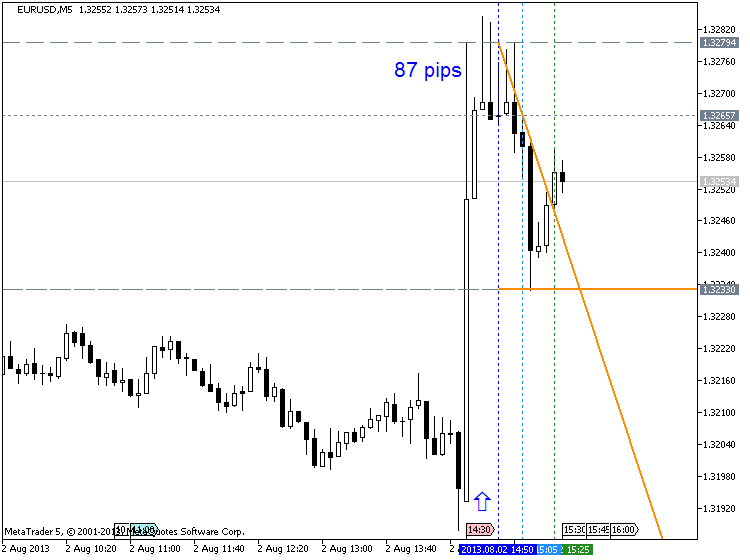

EURUSD M5 : 87 pips price movement by NFP news event :

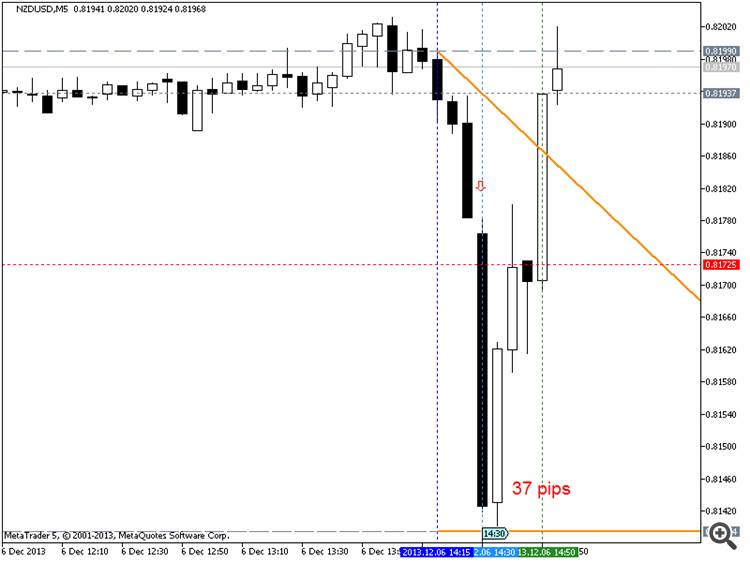

NZDUSD M5 : 37 pips price movement by USD - Non-Farm Employment Change :

Trading EURUSD during NFP :

==================

02: NON FARM PAYROLL (Part 2): ECONOMIC REPORTS FOR ALL MARKETS

This is the second part of video lesson about nfp.

============

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.07 14:52

Intra-Day Fundamentals - EUR/USD and USD/CAD: Non-Farm Payrolls

2016-10-07 12:30 GMT | [USD - Non-Farm Employment Change]

- past data is 151K

- forecast data is 171K

- actual data is 156K according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

==========

EUR/USD M5: 52 pips range price movement by Non-Farm Employment Change news events

==========

USD/CAD M5: 103 pips price movement by Non-Farm Employment Change news events

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price is located near and above Ichimoku cloud for the ranging on the border between the primary bullish trend to be resumed and the ranging bullish market condition tio be started within the following key support/resistance levels:

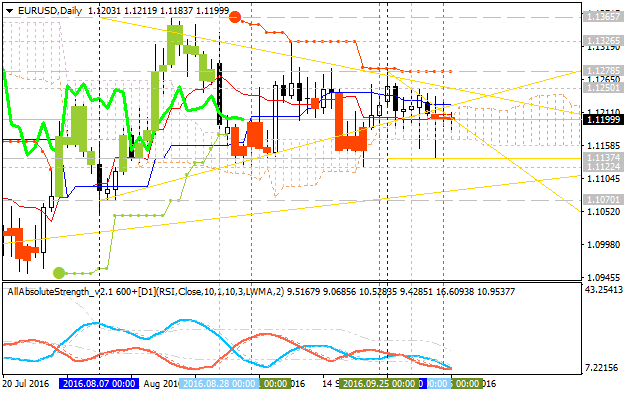

Ascending triangle pattern was formed by the price to be crossed to above for the possible bullish trend, Absolute Strength indicator is estimating the ranging condition to be continuing, and Trend Strength indicator is evaluating the trend as a primary bearish market condition.

If D1 price breaks 1.1181 support level on close bar so the reversal of the daily price movement from the ranging bullish to the primary bearish market condition will be started with 1.1122 level as a daily bearish target.If D1 price breaks 1.1278 resistance level on close bar from below to above so the bullish trend will be resumed with 1.1366 nearest bullish target to re-enter.

If not so the price will be on bullish ranging within the levels.

SUMMARY : bullish

TREND : ranging