Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.30 11:26

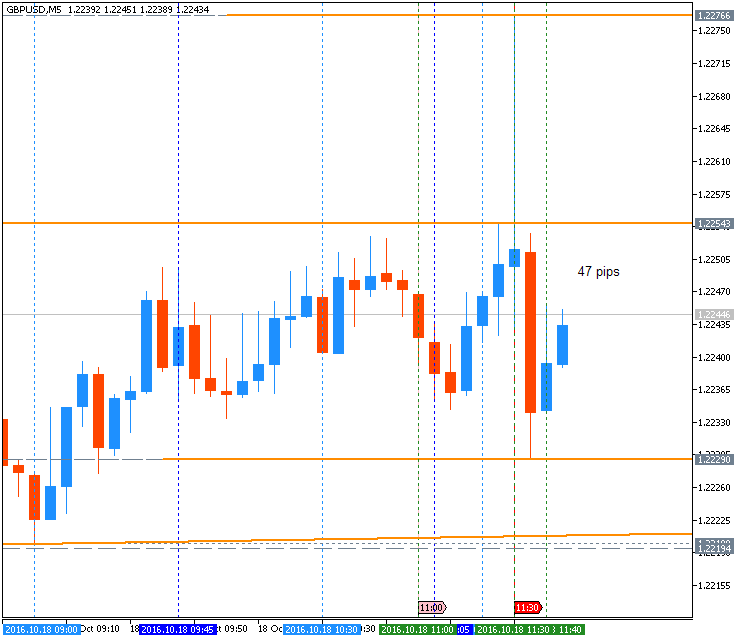

GBP/USD Intra-Day Fundamentals: U.K. Current Account and 47 pips price movement

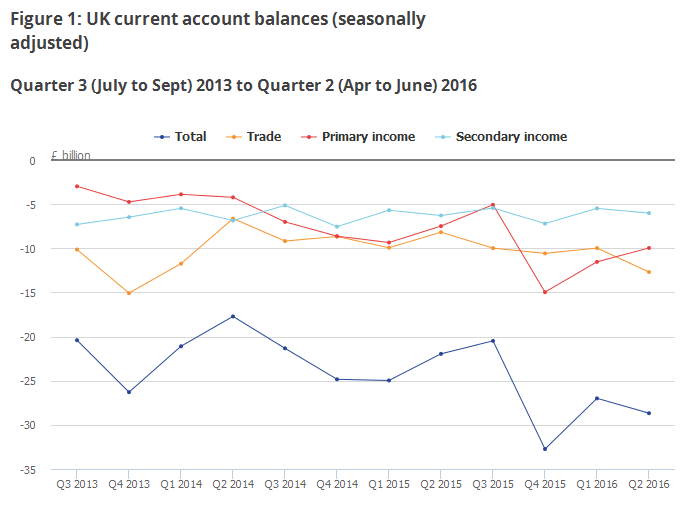

2016-09-30 08:30 GMT | [GBP - Current Account]

- past data is -32.6B

- forecast data is -30.5B

- actual data is -28.7B according to the latest press release

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Current Account] = Difference in value between imported and exported goods, services, income flows, and unilateral transfers during the previous quarter.

=========="The UK’s current account deficit was £28.7 billion in Quarter 2 (April to June) 2016, up from a revised deficit of £27.0 billion in Quarter 1 (January to March) 2016. The deficit in Quarter 2 2016 equated to 5.9% of gross domestic product (GDP) at current market prices, up from 5.7% in Quarter 1 2016."

==========

GBP/USD M5: 47 pips range price movement by U.K. Current Account news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.02 13:24

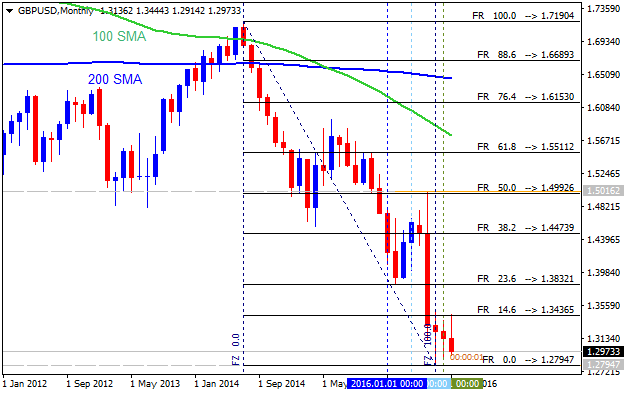

Fundamental Q4'16 Forecasts for GBP/USD (based on the article)

GBP/USD - "The first set of crucial technical levels

carved out through the previous quarter are 1.3500 resistance and 1.2800

support. These boundaries were set early and were not retested through

the subsequent months – in other words the market was contracting.

Dwindling consolidation was the primary feature of the Dollar-based

majors and for the broader financial markets through the inordinately

quiet third quarter. In turn, GBP/USD will likely succumb to changing

winds that force major breakouts and trend development. A break below

1.2800 would likely be met with chop and struggle for progress. In

contrast, an earnest break above 1.3500 will more readily find momentum

towards 1.4750 and perhaps as high as the 1.5000 pre-Brexit spike."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.04 11:08

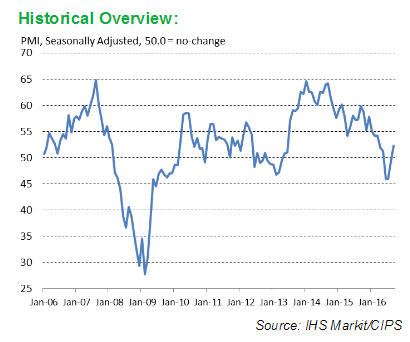

GBP/USD Intra-Day Fundamentals: U.K. Construction PMI and 22 pips price movement

2016-10-04 08:30 GMT | [GBP - Construction PMI]

- past data is 49.2

- forecast data is 49.1

- actual data is 52.3 according to the latest press release

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Construction PMI] = Level of a diffusion index based on surveyed purchasing managers in the construction industry.

==========

==========

GBPD/USD M5: 22 pips range price movement by U.K. Construction PMI news event

Forum on trading, automated trading systems and testing trading strategies

Flash Events

Christian Deforth, 2016.10.10 12:33

Dramatic price movements in the forexmarket seems to be periodic events and includes a higher risk potential when trading currency pairs.

e.g.

http://www.economist.com/blogs/economist-explains/2015/02/economist-explains-2

What can a trader do to avoid bigger losses?

...& could unknown future events like these profitable tradable?

Christian

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.15 18:17

Weekly Fundamental Forecast for GBP/USD (based on the article)

GBP/USD - "Signs of stronger U.K. inflation accompanied by a pickup in retail spending by may curb the bearish sentiment surrounding the sterling as BoE officials continue to drop their dovish tone and see a greater risk of above-target price growth. Even though BoE Governor Mark Carney argues the central bank is willing to tolerate ‘some inflation overshoot,’ it seems as though the marked depreciation in the British Pound is becoming a growing concern within the Monetary Policy Committee (MPC) as Deputy Governor Jon Cunliffe warns the next quarterly inflation due out on November 3 will reflect the sharp decline in the exchange rate. As a result, the central bank may have little choice but to stay on the sidelines throughout the remainder of the year in an effort to combat the risk for stagflation. A series of positive U.K. data prints may fuel a near-term recovery in the British Pound as market participants push out bets for the next BoE rate-cut, but the broader outlook for GBP/USD remains tilted to the downside as the growing threat of a ‘hard Brexit’ undermines the better-than-expected developments coming out of the real economy."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.18 09:28

Trading News Events: U.K. Consumer Price Index (CPI) (adapted from the article)

- "A material pickup in both the headline and core U.K. Consumer Price Index (CPI) may sap the bearish sentiment surrounding the British Pound and spark a larger recovery in GBP/USD especially as a growing number of Bank of England (BoE) officials see a greater threat of overshooting the 2% target for inflation."

- "Even though the BoE argues ‘a majority of members expect to support a further cut in Bank Rate to its effective lower bound,’ heightening price pressures may keep the Monetary Policy Committee (MPC) on the sidelines throughout the remainder of the yearas Deputy Governor Jon Cunliffe warns the next quarterly inflation due out on November 3 will reflect the sharp decline in the exchange rate. In turn, GBP/USD may face a more meaningful correction as the BoE looks poised to endorse a wait-and-see approach ahead of 2017, but the broader outlook for the sterling remains tilted to the downside as the risk of a ‘hard Brexit’ clouds the outlook for growth and inflation."

Bullish GBP Trade: Headline & Core CPI Pick Up in September

- "Need green, five-minute candle following the print to consider a long GBP/USD trade."

- "If market reaction favors long sterling, buy GBP/USD with two separate position."

- "Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward."

- "Move stop to entry on remaining position once initial target is hit, set reasonable limit."

- "Need red, five-minute candle to favor a short GBP/USD trade."

- "Implement same setup as the bullish British Pound trade, just in reverse."

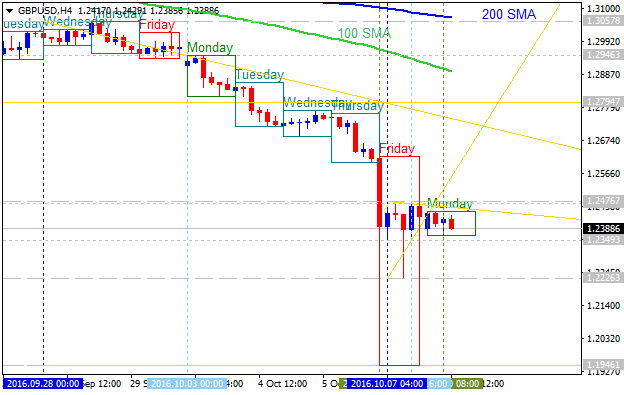

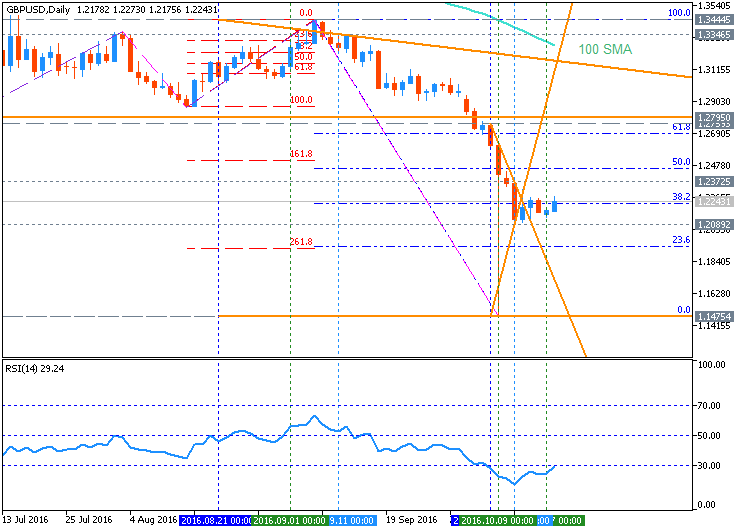

Daily

price

is located below 200-day SMA (200 SMA) and 100-day SMA (100

SMA) for the primary bearish market condition with the ranging within the narrow support/resistance levels.

- If D1 price breaks 1.2478

resistance level to above on

close daily bar so the local uptrend as the bear market rally will be started.

- If price breaks 1.1940

support to below on close daily bar so the primary bearish trend will be resumed.

- If not so the price will be on bearish ranging within the levels.

GBP/USD M5: 47 pips price movement by U.K. Consumer Price Index news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.19 11:25

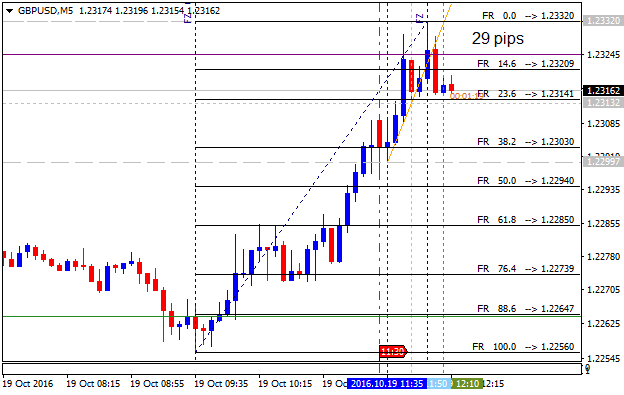

GBP/USD Intra-Day Fundamentals: U.K. Jobless Claims and 29 pips price movement

2016-10-19 08:30 GMT | [GBP - Claimant Count Change]

- past data is 7.1K

- forecast data is 3.4K

- actual data is 0.7K according to the latest press release

if actual < forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Claimant Count Change] = Change in the number of people claiming unemployment-related benefits during the previous month.

==========From The Telegraph article: FTSE 100 falters and pound rises above $1.23 as UK unemployment rate holds steady at 4.9pc despite Brexit vote

- "The three-month average level of employment rose by a solid 106K, or 0.3pc, between May and August, but 66K of these new positions are part-time roles. Total hours worked held steady between May and August, indicating employees’ demand for labour has stagnated. Meanwhile, employment growth no longer is keeping pace with the expanding size of the workforce; the three-month average level of unemployment edged up by 10K between May and August."

- "This increase was not large enough to push the unemployment rate up from 4.9pc, but the steady upward trend in the claimant count, which rose 0.7K month-to-month in September after an upward-revised increase of 7.1K in August, suggests the main rate will edge up over the coming months. In addition, the stagnation of the number of job vacancies and the deterioration in surveys of employment intentions point to slower employment growth ahead."

==========

GBP/USD M5: 29 pips price movement by U.K. Jobless Claims news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.20 10:49

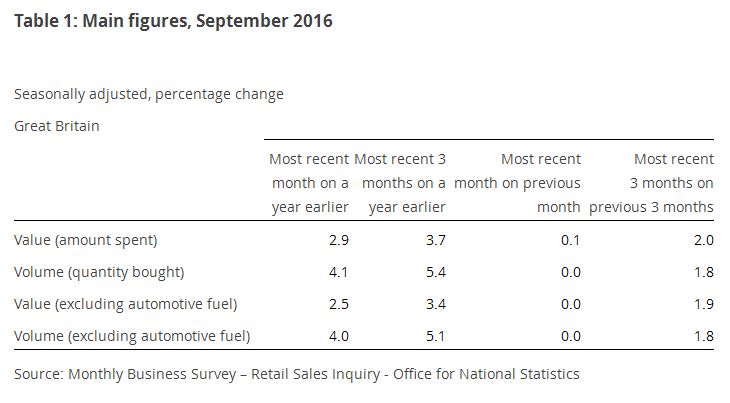

GBP/USD Intra-Day Fundamentals: U.K. Retail Sales and 17 pips range price movement

2016-10-20 08:30 GMT | [GBP - Retail Sales]

- past data is 0.0%

- forecast data is 0.3%

- actual data is 0.0% according to the latest press release

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Retail Sales] = Change in the total value of inflation-adjusted sales at the retail level.

==========

From official report:

==========

GBP/USD M5: 17 pips range price movement by U.K. Retail Sales news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.24 17:18

GBP/USD Intra-Day Fundamentals: Bank of England Bond-Buying Operation Results and 36 pips price movement

2016-10-24 13:50 GMT | [GBP - Bank of England Bond-Buying Operation Results]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

==========

GBP/USD M5: 36 pips price movement by Bank of England Bond-Buying Operation Results news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

GBP/USD October-December 2016 Forecast: ranging below Ichimoku cloud near key support level for the bearish trend to be resumed

W1 price is located below Ichimoku cloud in the bearish area of the chart. The price is on ranging since end of June this year within the narrow support resistance levels: 1.3444 resistance for the bear market rally to be started and 1.2794 support level for the bearish trend to be resumed. Ascending triangle pattern was formed by the price to be crossed to above for the local rally to be started, but the price is on testing with 1.2914 support level to below for 1.2794 bearish target to re-enter for the bearish trend to be continuing.

Chinkou Span line is below the price indicating the ranging condition, Tenkan-sen line is below Kijun-sen line for the bearish trend to be resumed, and Absolute Strength indicator is estimating the trend to be ranging bearish in the near future for example.

Trend:

W1 - ranging bearish