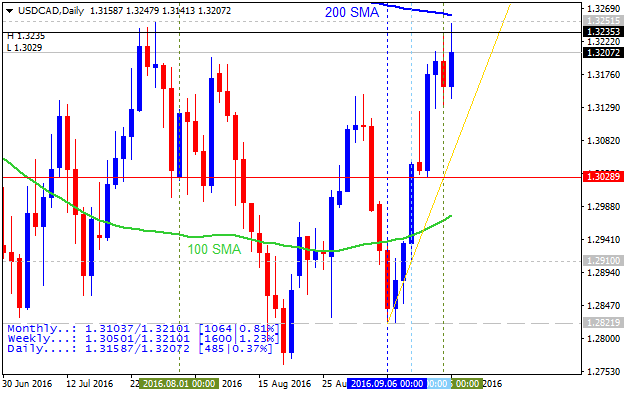

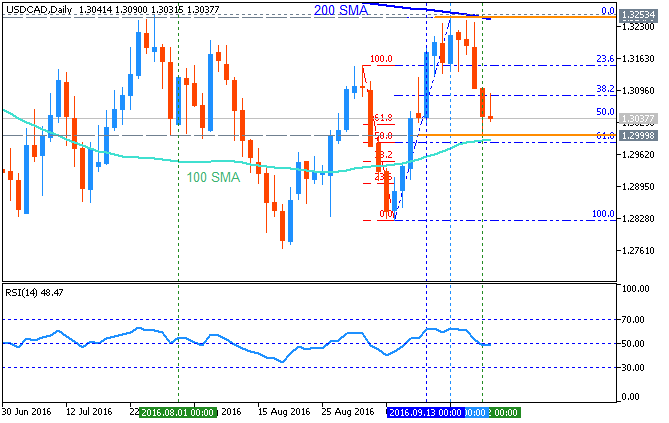

USDCAD Technical Analysis 2016, 18.09 - 25.09: daily breakout with triangle pattern to be tested to above for the breakout to be continuing

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.17 11:59

Fundamental Weekly Forecasts for Dollar Index, GBP/USD, AUD/USD, NZD/USD, USD/CAD, USD/CNH and GOLD (based on the article)

USD/CAD - "The heavy economic data points this week will take place on Friday, which will be after the dust settles from the international development such as the Central Bank triple-header on September 21. On Tuesday, Bank of Canada Governor Stephen Poloz will be speaking in Quebec City, which will be followed by a press conference. Friday will provide the Canadian Dollar an opportunity to reverse its trend of negative economic surprises with Retail Sales (exp. -0.1 MoM), and the Consumer Price Index (exp. 1.3% YoY.) Because this is the key gauge for inflation in Canada, a disappointment here coupled with positive developments south of the Canadian Border could put further selling pressure on the Loonie."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.20 15:14

Intra-Day Fundamentals - EUR/USD, USD/CAD and AUD/USD: U.S. Residential Building Permits

2016-09-20 12:30 GMT | [USD - Building Permits]

- past data is 1.14M

- forecast data is 1.17M

- actual data is 1.14M according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Building Permits] = Annualized number of new residential building permits issued during the previous month.

==========

From Business Insider article:

U.S. housing starts fell more than expected in August as building activity declined broadly after two straight months of solid increases, but a rebound in permits for single-family dwellings suggested demand for housing remained intact.

Groundbreaking decreased 5.8 percent to a seasonally adjusted

annual pace of 1.14 million units, the Commerce Department said

on Tuesday. July's starts were unrevised at a 1.21 million-unit

pace.

Permits for future construction slipped 0.4 percent to a 1.14 million-unit rate last month as approvals for the volatile multi-family homes segment tumbled 7.2 percent to a 402,000 unit-rate. Permits for single-family homes, the largest segment of the market, surged 3.7 percent to a 737,000-unit pace.

Economists polled by Reuters had forecast housing starts falling to a 1.19 million-unit pace last month and building permits rising to a 1.17 million-unit rate.

==========

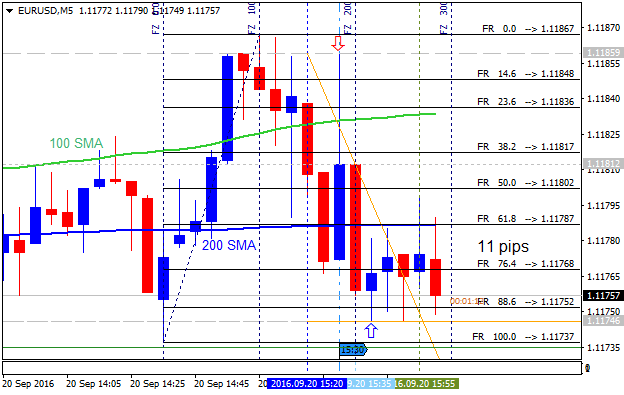

EUR/USD M5: 11 pips range price movement by U.S. Building Permits news events

==========

USD/CAD M5: 20 pips price movement by U.S. Building Permits news events

==========

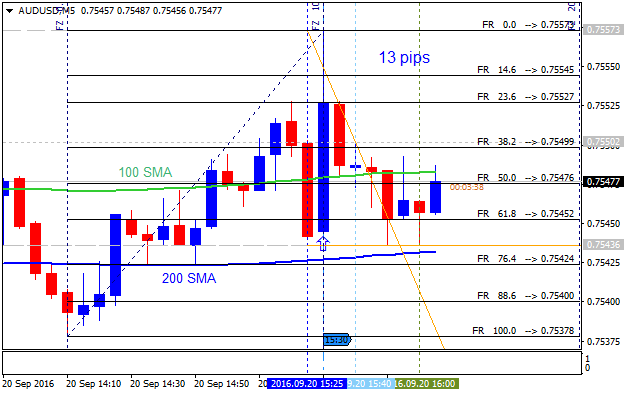

AUD/USD M5: 13 pips price movement by U.S. Building Permits news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.20 19:12

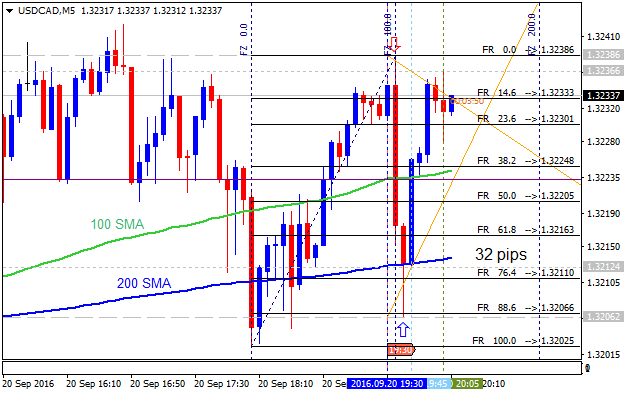

USD/CAD Intra-Day Fundamentals: Bank of Canada Gov Poloz Speaks and 32 pips range price movement

2016-09-20 16:50 GMT | [CAD - BoC Gov Poloz Speaks]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[CAD - BoC Gov Poloz Speaks] = Speech at the Chartered Financial Analysts Society, Quebec.

==========

"It’s time to conclude. What I’ve tried to do today is be clear about the forces that have brought about this period of ultra-low interest rates and help identify the implications. While monetary policy actions played a role in the decline of interest rates, the Bank sets its policy rate to meet its primary mission: returning inflation sustainably to target, thus helping to get the economy back to full output. In this sense, ultra-low interest rates are a symptom of the conditions we face, conditions that we believe are improving over time."

"But some of the forces leading to low interest rates will persist for a long time, so we need to prepare for lower for longer. Individuals need to plan for retirement with different assumptions about longevity, interest rates and growth. Businesses need to make sure their expectations about investment returns reflect the current and likely future reality and reconfigure their investment plans accordingly. And policy-makers need to make sure they are working to increase the economy’s potential output and reduce uncertainty—whether economic, political or regulatory—that may be holding back investment."

"What the Bank can, and will, continue to do is to provide certainty about the future value of money through inflation control. Together, we can make the necessary adjustments and boost confidence that will foster the economic growth we all want to see."

==========

USD/CAD M5: 32 pips range price movement by Bank of Canada Gov Poloz Speaks news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.21 20:48

Intra-Day Fundamentals - EUR/USD, USD/CAD and AUD/USD: FOMC Statement and Federal Funds Rate

2016-09-21 18:00 GMT | [USD - Federal Funds Rate]

- past data is 0.50%

- forecast data is 0.50%

- actual data is 0.50% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Federal Funds Rate] = Interest rate at which depository institutions lend balances held at the Federal Reserve to other depository institutions overnight.

==========

From ft article: Fed fund futures see 60% chance of 2016 rate hike"Fed fund futures, contracts that investors use to bet on interest rate movements, imply that there is a 60 per cent chance of a hike at the December meeting, up slightly from 59 per cent ahead of today’s decision, reports Robin Wigglesworth in New York."

==========

EUR/USD M5: 61 pips range price movement by Federal Funds Rate news events

==========

AUD/USD M5: 67 pips range price movement by Federal Funds Rate news events

==========

USD/CAD M5: 93 pips range price movement by Federal Funds Rate news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.22 14:51

Intra-Day Fundamentals - EUR/USD, USD/CAD and AUD/USD: U.S. Jobless Claims

2016-09-22 12:30 GMT | [USD - Unemployment Claims]

- past data is 260K

- forecast data is 261K

- actual data is 252K according to the latest press release

if actual < forecast (or previous one) = good for currency (for USD in our case)

[USD - Unemployment Claims] = The number of individuals who filed for unemployment insurance for the first time during the past week.

==========

From MarketWatch article: Jobless claims fall to lowest level since July- "Initial claims for U.S. unemployment-insurance benefits fell to the lowest tally since July, signaling a strong labor market, according to government data released Thursday."

- "The number of people who applied for U.S. unemployment-insurance benefits fell by 8,000 to 252,000 in the week that ended Sept. 17, the Labor Department reported."

- "That is the lowest level since mid-July and only modestly above the four-decade low of 248,000 hit in April."

- "The government said there were no special factors in the report. This marks 81 weeks that initial claims are below the key 300,000 level, the longest streak since 1970."

- "Economists polled by MarketWatch had expected the government to report that initial claims for regular state unemployment-insurance benefits would be just about unchanged in the week that ended Sept. 17, from the 260,000 in the prior week."

- "Longer-run trends also showed improvement, with the four-week average of new claims falling 2,250 to 258,500."

- "Economists say few layoffs alongside steady hiring rates implies that solid payroll employment growth lies ahead."

- "Fed Chairwoman Janet Yellen said Wednesday at her quarterly press conference that data suggests the labor market still has more room to improve without overheating the economy. That gives the Fed the ability to hold interest rates steady, she said."

==========

EUR/USD M5: 7 pips range price movement by U.S. Jobless Claims news events

==========

AUD/USD M5: 8 pips price movement by U.S. Jobless Claims news events

==========

USD/CAD M5: 11 pips range price movement by U.S. Jobless Claims news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.23 13:08

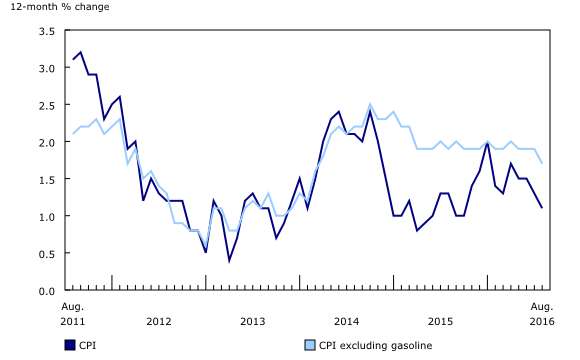

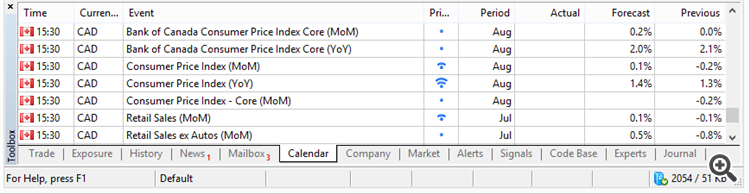

Trading News Events: Canada Consumer Price Index (adapted from the article)

- "Despite forecasts for a uptick in Canada’s Consumer Price Index (CPI), a marked slowdown in the core rate of inflation may drag on the loonie and spur a near-term rebound in USD/CAD as it puts pressure on the Bank of Canada (BoC) to further support the real economy."

- "Easing price pressures may push the BoC to adopt a dovish outlook for monetary policy as the central bank warns ‘risks to the profile for inflation have tilted somewhat to the downside since July,’ and Governor Stephen Poloz may prepare Canadian households and businesses for lower borrowing-costs as global growth in the first half of 2016 was slower than the Bank had projected'."

Bullish CAD Trade: Headline & Core CPI Beat Market Expectations

- "Need to see red, five-minute candle following the release to consider a short trade on USD/CAD."

- "If market reaction favors a bullish loonie trade, sell USD/CAD with two separate position."

- "Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward."

- "Move stop to entry on remaining position once initial target is hit; set reasonable limit."

- "Need green, five-minute candle to favor a long USD/CAD trade."

- "Implement same setup as the bullish Canadian dollar trade, just in reverse."

Daily

price

is located within 200-day SMA (200 SMA) and 100-day SMA (100 SMA) in the

ranging bearish area

of the chart waiting for the direction of the trend: the price was bounced from 200 SMA level and 1.3253 resistance level to below for the 100 SMA with 1.2999 to be tested to below for the primary bearish trend to be resumed. RSI

indicator is estimating the ranging condition to be continuing in the near future.

- If D1 price breaks 1.3253

resistance level to above on

close daily bar so the reversal of the price movement from the ranging bearish to the primary bullish market condition will be started.

- If price breaks 1.2999

support to below on close daily bar so the primary bearish trend will be resumed with 1.2821 nearest daily target.

- If not so the price will be ranging within the levels.

(all images/charts were made using Metatrader 5 software and free indicators from MQL5 CodeBase)

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.23 16:06

USD/CAD Intra-Day Fundamentals: Canada's Consumer Price Index and 123 pips range price movement

2016-09-23 12:30 GMT | [CAD - CPI]

- past data is 1.3%

- forecast data is 1.4%

- actual data is 1.1% according to the latest press release

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - CPI] = Change in the price of goods and services purchased by consumers.

==========From official Statistics Canada source: The 12-month change in the Consumer Price Index (CPI) and the CPI excluding gasoline

==========

USD/CAD M5: 123 pips range price movement by Canada's Consumer Price Index news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price is located above Ichimoku cloud in the bullish area of the chart.

If D1 price breaks 1.2909 support level on close bar so the reversal of the price movement from the primary bullish to the primary bearish market condition will be started with 1.2763 nearest daily bearish target to re-enter.

If D1 price breaks 1.3235 resistance level on close bar from below to above so the bullish trend will be continuing with 1.3253 level as a target.

If not so the price will be on bullish ranging within the levels.

SUMMARY : breakout

TREND : bullish