EURUSD Technical Analysis 2016, 18.09 - 25.09: ranging correction to the possible daily bearish reversal

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.17 10:38

Weekly Outlook: 2016, September 18 - September 25 (based on the article)

The US dollar had a positive week, resisting unconvincing data. Now comes the biggest test: the Fed decision. In addition, we have US Building Permits, rate decisions in Japan and in New Zealand, as well as other events. These are the main events for this week.

- US Building Permits: Tuesday, 12:30. The number of new residential permits is expected to rise to 1.17 million in August.

- Stephen Poloz speaks: Tuesday, 17:45. BOC Governor Stephen Poloz will speak in Quebec.

- Japan rate decision: Wednesday.

- US Crude Oil Inventories: Wednesday, 14:30.

- US Fed Decision: Wednesday: statement and projections at 18:00, Yellen’s press conference at 18:30.

- NZ rate decision: Wednesday, 21:00. Governor Graeme announced new lending restrictions for property investors to cool the housing market and enable further rate cuts in the coming months.

- US Unemployment Claims: Thursday, 12:30. Economists expect the number of claims will reach 261,000 this week.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.19 18:30

EURUSD Price Action Outlook: Breaking Lower (based on the article)

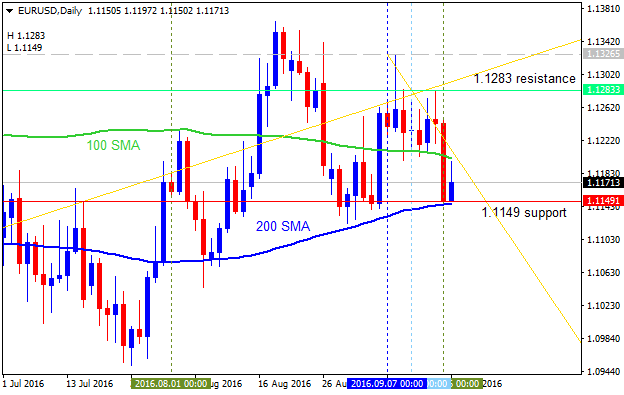

Daily price is on testing 1.1149 support level to below for the reversal to the primary bearish market condition.

- "The EURUSD outlook unchanged as it ended the previous week on its knees, closing Friday around 1.1150 area. While this may not seem like a big deal, one should consider the range the pair was holding for the whole week: less than one hundred pips."

- "For the Forex market, a market dominated by wild moves and unpredictable reactions, one hundred pips on the most liquid currency pair out of them all is quite nothing. And this range held until Friday, even though important economic events like the US retail sales and the Producer’s Price Index (PPI) were released on Thursday."

- "Despite those events and the EURUSD outlook, nothing moved the pair. That is, until Friday, when a cold shower saw bulls capitulating: the CPI or inflation in the United States printed higher."

The price is located within 100 SMA/200 SMA for the breaking the 200-day SMA together with descending triangle pattern to below for the bearish condition. Alternative, if the price breaks 1.1283 resistance to above so the bullish trend will be resumed.

- If the price will break 1.1283 resistance level so the primary bullish trend will be resumed.

- If price will break 1.1149 support so the bearish reversal will be started.

- If not so the price will be ranging within the levels.

| Resistance | Support |

|---|---|

| 1.1283 | 1.1149 |

| 1.1326 | N/A |

- Recommendation to go short: watch the price to break 1.1149 support level for possible sell trade

- Recommendation to go long: watch the price to break 1.1283 resistance level for possible buy trade

- Trading Summary: bearish reversal

SUMMARY : correction to the possible bearish reversal

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.20 10:23

Technical Targets for EUR/USD by United Overseas Bank (based on the article)

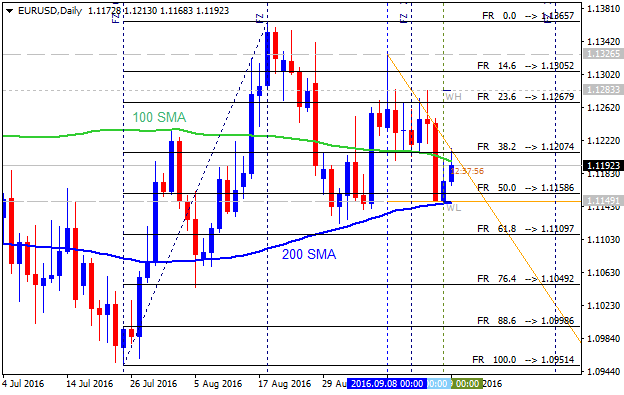

H4 price

is near and below 100 SMA/200 SMA for 1.1197 resistance level to be tested for the bullish reversal. The price is located within

the following support/resistance

levels:

- 1.1197 resistance level located near 100 SMA/200 SMA in the beginning of the bullish trend to be started, and

- 1.1150 support level located below 100 SMA/200 SMA in the beginning of the bearish trend to be resumed.

Daily

price. United Overseas Bank is expecting for EUR/USD to be on bearish condition with the strong support level to be around 1.1100 for example:

"We turned bearish EUR yesterday but indicated that any decline is expected to encounter solid support at 1.1100. In other words, the downside potential appears to be limited. That said, the outlook for EUR is deemed as bearish until there is a break above 1.1240."

- If daily price breaks 1.1207 resistance level

on close bar so the bullish trend will be resumed.

- If daily price breaks 1.1109 support level on close bar so the reversal of the price movement to the primary bearish market condition will be started.

- If not so the price will be on ranging within the levels.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.20 15:14

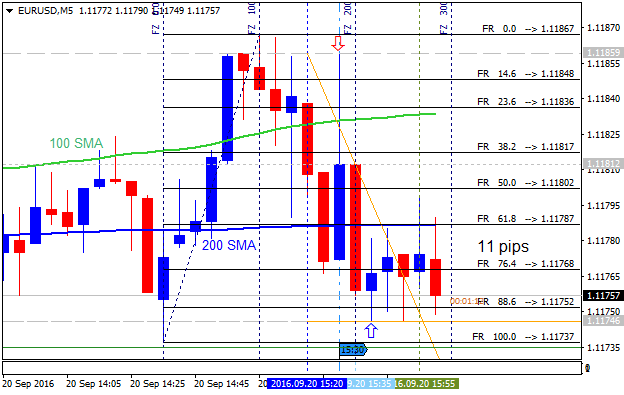

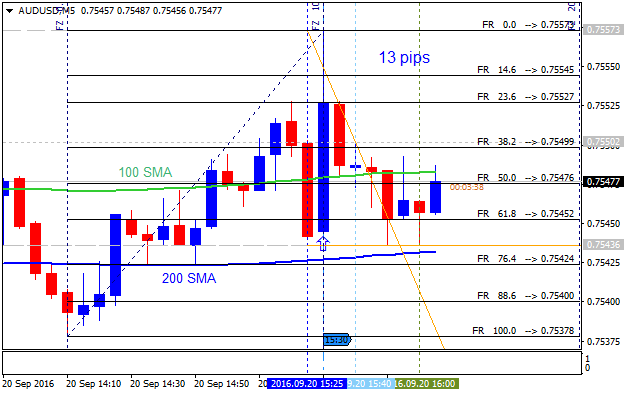

Intra-Day Fundamentals - EUR/USD, USD/CAD and AUD/USD: U.S. Residential Building Permits

2016-09-20 12:30 GMT | [USD - Building Permits]

- past data is 1.14M

- forecast data is 1.17M

- actual data is 1.14M according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Building Permits] = Annualized number of new residential building permits issued during the previous month.

==========

From Business Insider article:

U.S. housing starts fell more than expected in August as building activity declined broadly after two straight months of solid increases, but a rebound in permits for single-family dwellings suggested demand for housing remained intact.

Groundbreaking decreased 5.8 percent to a seasonally adjusted

annual pace of 1.14 million units, the Commerce Department said

on Tuesday. July's starts were unrevised at a 1.21 million-unit

pace.

Permits for future construction slipped 0.4 percent to a 1.14 million-unit rate last month as approvals for the volatile multi-family homes segment tumbled 7.2 percent to a 402,000 unit-rate. Permits for single-family homes, the largest segment of the market, surged 3.7 percent to a 737,000-unit pace.

Economists polled by Reuters had forecast housing starts falling to a 1.19 million-unit pace last month and building permits rising to a 1.17 million-unit rate.

==========

EUR/USD M5: 11 pips range price movement by U.S. Building Permits news events

==========

USD/CAD M5: 20 pips price movement by U.S. Building Permits news events

==========

AUD/USD M5: 13 pips price movement by U.S. Building Permits news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.21 09:38

Technical Targets for EUR/USD by United Overseas Bank (based on the article)

H4 price

broke 1.1150 support level to below for the primary bearish trend to be continuing: the price is on ranging within

the following narrow support/resistance

levels:

- 1.1213 resistance level located near 100 SMA/200 SMA in the beginning of the bullish trend to be started, and

- 1.1124 support level located below 100 SMA/200 SMA in the beginning of the bearish trend to be resumed.

Daily

price. United Overseas Bank is expecting for the bearish condition to be continuing with 1.1100 strong support level:

"There is not much to add as EUR spiked to a high of 1.1213 yesterday but eased off quickly to end near the day’s low. The outlook is still bearish but as highlighted in recent updates, any decline is expected to encounter solid support at 1.1100."

- If daily price breaks 1.1244 resistance level

on close bar so the bullish trend will be resumed.

- If daily price breaks 1.1149 support level on close bar so the reversal of the price movement to the primary bearish market condition will be started with 1.1122 target to re-enter.

- If not so the price will be on ranging within the levels.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.21 20:48

Intra-Day Fundamentals - EUR/USD, USD/CAD and AUD/USD: FOMC Statement and Federal Funds Rate

2016-09-21 18:00 GMT | [USD - Federal Funds Rate]

- past data is 0.50%

- forecast data is 0.50%

- actual data is 0.50% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Federal Funds Rate] = Interest rate at which depository institutions lend balances held at the Federal Reserve to other depository institutions overnight.

==========

From ft article: Fed fund futures see 60% chance of 2016 rate hike"Fed fund futures, contracts that investors use to bet on interest rate movements, imply that there is a 60 per cent chance of a hike at the December meeting, up slightly from 59 per cent ahead of today’s decision, reports Robin Wigglesworth in New York."

==========

EUR/USD M5: 61 pips range price movement by Federal Funds Rate news events

==========

AUD/USD M5: 67 pips range price movement by Federal Funds Rate news events

==========

USD/CAD M5: 93 pips range price movement by Federal Funds Rate news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.22 14:51

Intra-Day Fundamentals - EUR/USD, USD/CAD and AUD/USD: U.S. Jobless Claims

2016-09-22 12:30 GMT | [USD - Unemployment Claims]

- past data is 260K

- forecast data is 261K

- actual data is 252K according to the latest press release

if actual < forecast (or previous one) = good for currency (for USD in our case)

[USD - Unemployment Claims] = The number of individuals who filed for unemployment insurance for the first time during the past week.

==========

From MarketWatch article: Jobless claims fall to lowest level since July- "Initial claims for U.S. unemployment-insurance benefits fell to the lowest tally since July, signaling a strong labor market, according to government data released Thursday."

- "The number of people who applied for U.S. unemployment-insurance benefits fell by 8,000 to 252,000 in the week that ended Sept. 17, the Labor Department reported."

- "That is the lowest level since mid-July and only modestly above the four-decade low of 248,000 hit in April."

- "The government said there were no special factors in the report. This marks 81 weeks that initial claims are below the key 300,000 level, the longest streak since 1970."

- "Economists polled by MarketWatch had expected the government to report that initial claims for regular state unemployment-insurance benefits would be just about unchanged in the week that ended Sept. 17, from the 260,000 in the prior week."

- "Longer-run trends also showed improvement, with the four-week average of new claims falling 2,250 to 258,500."

- "Economists say few layoffs alongside steady hiring rates implies that solid payroll employment growth lies ahead."

- "Fed Chairwoman Janet Yellen said Wednesday at her quarterly press conference that data suggests the labor market still has more room to improve without overheating the economy. That gives the Fed the ability to hold interest rates steady, she said."

==========

EUR/USD M5: 7 pips range price movement by U.S. Jobless Claims news events

==========

AUD/USD M5: 8 pips price movement by U.S. Jobless Claims news events

==========

USD/CAD M5: 11 pips range price movement by U.S. Jobless Claims news events

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price is on secondary correction within the primary bullish market condition: the price is started with the breakdown on open daily bar for now with 1.1140 support level to be tested to below for the bearish reversal to be started.

Absolute Strength indicator is estimating the bearish trend to be started on the future, and Trend Strength indicator is evaluating the future possible trend as a secondary correction to be continuing.

If D1 price breaks 1.1140 support level on close bar so the reversal of the daily price movement from the ranging bullish to the primary bearish market condition will be started with 1.1070 level as a target.If D1 price breaks 1.1326 resistance level on close bar from below to above so the bullish trend will be resumed with 1.1366 nearest bullish target to re-enter.

If not so the price will be on bullish ranging within the levels.

SUMMARY : bullish

TREND : correction