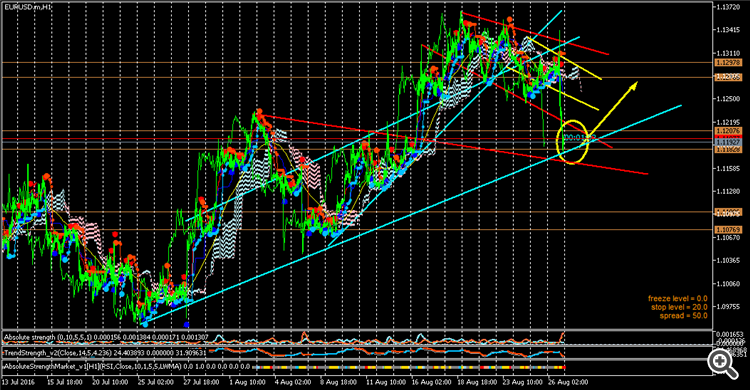

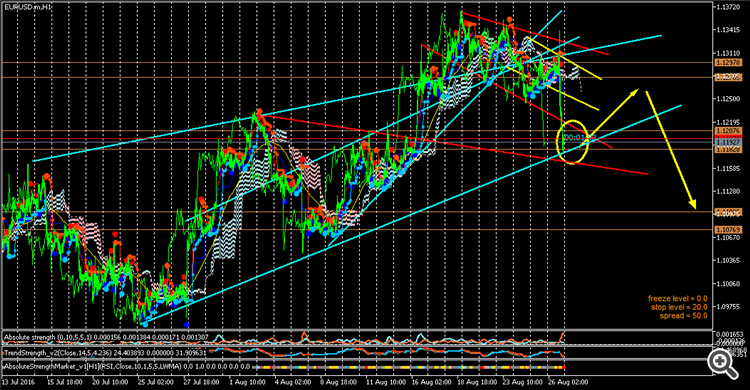

Just about intra-day price movement ...

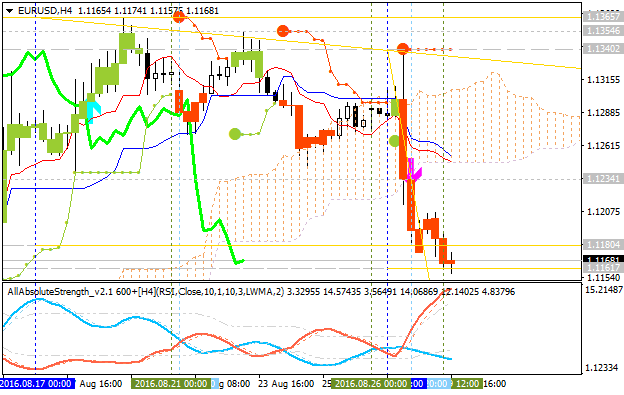

H4 price is already on the bearish breakdown: the price broke support level to below to be reversed to the primary bearish market condition with 1.1170 level to be tested for the bearish trend to be continuing, otherwise - ranging bearish.

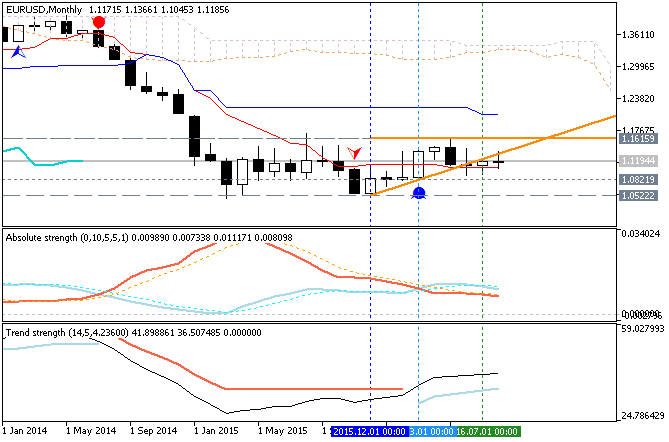

Weekly price is on ranging within the following key reversal support/resistance levels:

- 1.1366 resistance level located above Ichimoku cloud in the bullish area of the chart, and

- 1.0931 support level located near and below Ichimoku cloud in the beginning of the bearish trend.

Monthly price is already on the bearish condition within the narrow support/resistance levels: 1.1615 and 1.0821.

Thus, the bearish trend for daily timeframe for this pair is very likely for for example.

Just about intra-day price movement ...

H4 price is already on the bearish breakdown: the price broke support level to below to be reversed to the primary bearish market condition with 1.1170 level to be tested for the bearish trend to be continuing, otherwise - ranging bearish.

So, the bearish breakdown is continuing.

By the way, the daily bearish reversal level according to the price action strategy (not Ichimoku) is 61.8% Fibo support at 1.1109 for now, and if the price breaks this level to below so the bearish reversal may be started.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.08.30 16:22

Intra-Day Fundamentals - EUR/USD, GBP/USD and AUD/USD: The Conference Board Consumer Confidence

2016-08-30 14:00 GMT | [USD - Consumer Confidence]

- past data is 96.7

- forecast data is 97.0

- actual data is 101.1 according to the latest press release

[USD - Consumer Confidence] = Level of a composite index based on surveyed households. Survey of about 5,000 households which asks respondents to rate the relative level of current and future economic conditions including labor availability, business conditions, and overall economic situation.

==========

The Conference Board Consumer Confidence Index®, which had decreased slightly in July, increased in August. The Index now stands at 101.1 (1985=100), compared to 96.7 in July. The Present Situation Index rose from 118.8 to 123.0, while the Expectations Index improved from 82.0 last month to 86.4.

The monthly Consumer Confidence Survey®, based on a probability-design random sample, is conducted for The Conference Board by Nielsen, a leading global provider of information and analytics around what consumers buy and watch. The cutoff date for the preliminary results was August 18.

“Consumer confidence improved in August to its highest level in nearly a year, after a marginal decline in July,” said Lynn Franco, Director of Economic Indicators at The Conference Board. “Consumers’ assessment of both current business and labor market conditions was considerably more favorable than last month. Short-term expectations regarding business and employment conditions, as well as personal income prospects, also improved, suggesting the possibility of a moderate pick-up in growth in the coming months.”

==========

EUR/USD M5: 11 pips price movement by The Conference Board Consumer Confidence news event

==========

GBP/USD M5: 18 pips price movement by The Conference Board Consumer Confidence news event

==========

AUD/USD M5: 16 pips price movement by The Conference Board Consumer Confidence news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.08.31 08:30

EUR/USD Intra-Day Fundamentals: German Retail Sales and 9 pips range price movement

2016-08-30 08:30 GMT | [EUR - German Retail Sales]

- past data is -0.6%

- forecast data is 0.5%

- actual data is 1.7% according to the latest press release

if actual > forecast (or previous one) = good for currency (for EUR in our case)

[EUR - German Retail Sales] = Change in the total value of inflation-adjusted sales at the retail level, excluding automobiles and gas stations.

==========

Compared with the previous year, turnover in retail trade was in the

first seven months 2016 in real terms 1.7% and in nominal terms 1.9%

larger than in in the corresponding period of the previous year.

==========

EUR/USD M5: 9 pips range price movement by BoE Mortgage Approvals news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.08.31 14:31

Intra-Day Fundamentals - EUR/USD, GBP/USD and AUD/USD: ADP Non-Farm Employment Change

2016-08-31 12:15 GMT | [USD - ADP Non-Farm Employment Change]

- past data is 194K

- forecast data is 175K

- actual data is 177K according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - ADP Non-Farm Employment Change] = Estimated change in the number of employed people during the previous month, excluding the farming industry and government.

==========

==========

EUR/USD M5: 6 pips range price movement by ADP Non-Farm Employment Change news event

==========

GBP/USD M5: 17 pips range price movement by ADP Non-Farm Employment Change news event

==========

AUD/USD M5: 12 pips range price movement by ADP Non-Farm Employment Change news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.09.01 16:19

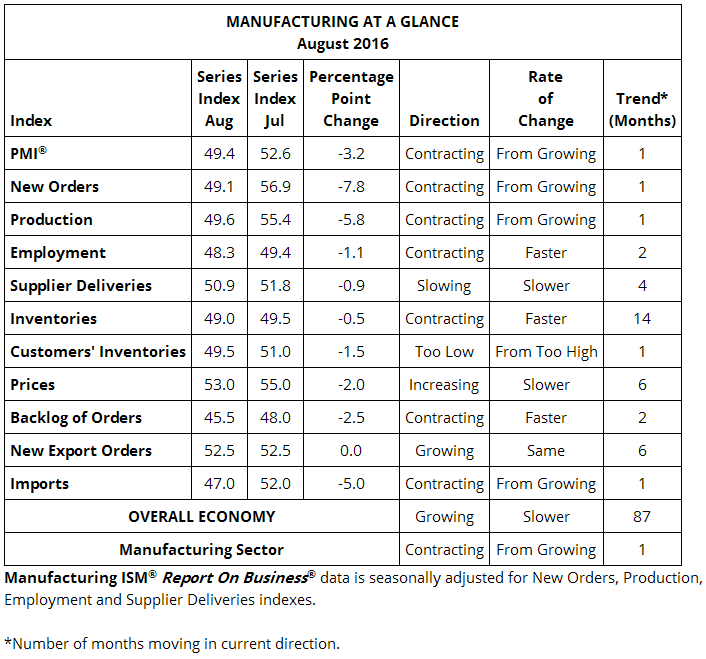

EUR/USD Intra-Day Fundamentals: ISM Manufacturing PMI and 43 pips range price movement

2016-09-01 14:00 GMT | [USD - ISM Manufacturing PMI]

- past data is 52.6

- forecast data is 52.0

- actual data is 49.4 according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - ISM Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry.

==========

==========

EUR/USD M5: 43 pips range price movement by ISM Manufacturing PMI news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

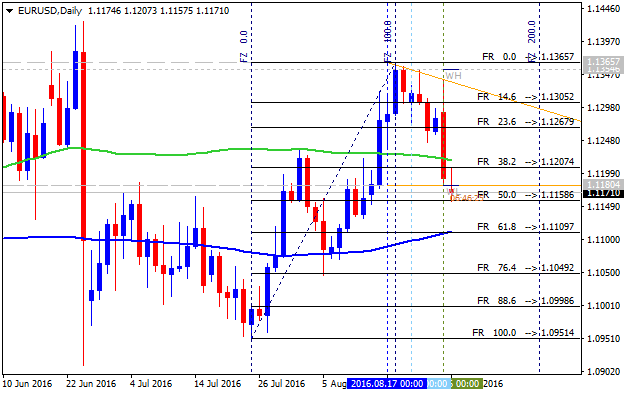

Daily price is continuing with the correction to be started in the beginning of the week: the price is located above Ichimoku cloud in the bullish area of the chart for 1.1177 support level to be tested for the secondary correction to be continuing.

- The price is breaking 1.1177 support level to below for the continuing with the secondary correction.

- Chinkou

Span line of Ichimoku indicator is located above Ichimoku cloud

indicating the future possible breakdown to be started in the near

future.

- Trend Strength indicator is estimating the ranging condition, and Absolute Strength indicator are estimating the correctionla trend to be continuing.

- The daily bearish reversal level is Kijun-sen value at 1.1148, and if the price breaks this level to below so the daily bearish reversal will be started.

If D1 price breaks 1.1177 support level on close bar so the local downtrend as the secondary correction will be continuing.If D1 price breaks 1.1148 support level on close bar so the reversal of the daily price movement from the ranging bullish to the primary bearish market condition will be started.

If D1 price breaks 1.1366 resistance level on close bar from below to above so the bullish trend will be resumed.

If not so the price will be on bullish ranging within the levels.

SUMMARY : bullish

TREND : correction