The Disciplined Trader : Developing Winning Attitudes : Mark Douglas

One of the first books to address the psychological nature of how

successful traders think ~ The Disciplined Trader™ is now an industry

classic. In this groundbreaking work published in 1990 ~ Douglas

examines the causes as to why most traders cannot raise and keep their

equity on a consistent basis ~ and brings the reader to practical and

unique conclusions as to how to go about changing any limiting mindset.

The trader is taken through a step-by-step process to break through

those queries ~ and begin to understand that their very thoughts may be

limiting their ability to accumulate and succeed at trading.

==============

Interview with Dr. Alexander Elder: "I want to be a psychiatrist in the market" :

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2013.09.03 11:03

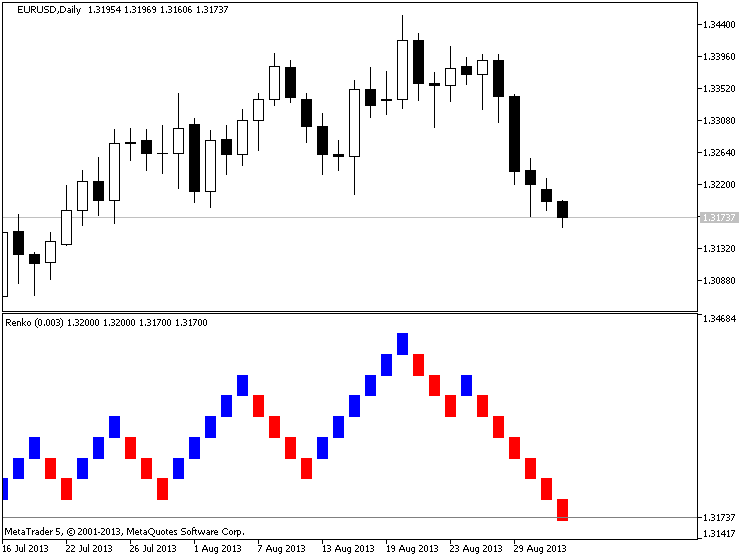

Renko (extraction from Achelis - Technical Analysis from A to Z)

============

Overview

The Renko charting method is thought to have acquired its name from "renga" which is the Japanese word for bricks. Renko charts are similar to Three Line Break charts except that in a Renko chart, a line (or "brick" as they're called) is drawn in the direction of the prior move only if prices move by a minimum amount (i.e., the box size). The bricks are always equal in size. For example, in a 5-unit Renko chart, a 20-point rally is displayed as four, 5-unit tall Renko bricks.

Kagi charts were first brought to the United States by Steven Nison when he published the book, Beyond Candlesticks.

Interpretation

Basic trend reversals are signaled with the emergence of a new white or black brick. A new white brick indicates the beginning of a new up-trend. A new black brick indicates the beginning of a new down-trend. Since the Renko chart is a trend following technique, there are times when Renko charts produce whipsaws, giving signals near the end of short-lived trends. However, the expectation with a trend following technique is that it allows you to ride the major portion of significant trends.

Since a Renko chart isolates the underlying price trend by filtering out the minor price changes, Renko charts can also be very helpful when determining support and resistance levels.

Calculation

Renko charts are always based on closing prices. You specify a "box size" which determines the minimum price change to display.

To draw Renko bricks, today's close is compared with the high and low of the previous brick (white or black):

-

If the closing price rises above the top of the previous brick by at least the box size, one or more white bricks are drawn in new columns. The height of the bricks is always equal to the box size.

-

If the closing price falls below the bottom of the previous brick by at least the box size, one or more black bricks are drawn in new columns. Again, the height of the bricks is always equal to the box size.

If prices move more than the box size, but not enough to create two bricks, only one brick is drawn. For example, in a two-unit Renko chart, if the prices move from 100 to 103, only one white brick is drawn from 100 to 102. The rest of the move, from 102 to 103, is not shown on the Renko chart.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting to Read February 2014

Sergey Golubev, 2014.02.14 18:06

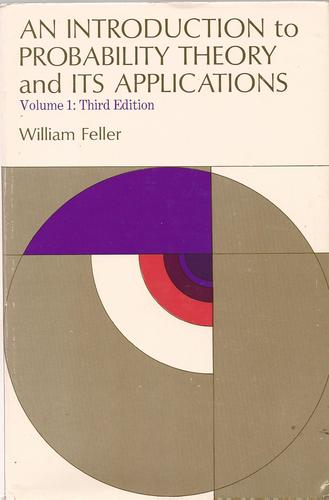

An Introduction to Probability Theory and Its Applications, Vol. 1, 3rd Edition

by William Feller

"If you could only ever buy one book on probability, this would be the one!

Feller's elegant and lateral approach to the essential elements of

probability theory and their application to many diverse and apparently

unrelated contexts is head-noddingly inspiring.

Working your way through all the exercises in the book would be an

excellent retirment diversion sure to stave off the onset of dementia."

Dr. Robert Crossman

============

MT5 Article about it related to trading :

Random Walk and the Trend IndicatorForum on trading, automated trading systems and testing trading strategies

Something Interesting to Read May 2016

Muhammad Syamil Bin Abdullah, 2016.05.27 09:45

Forex Price Action Scalping: an in-depth look into the field of professional scalping

Forex Price Action Scalping provides a unique look into the field of professional scalping. Packed with countless charts, this extensive guide on intraday tactics takes the reader straight into the heart of short-term speculation. The book is written to accommodate all aspiring traders who aim to go professional and who want to prepare themselves as thoroughly as possible for the task ahead. Few books have been published, if any, that take the matter of scalping to such a fine and detailed level as does Forex Price Action Scalping. Hundreds of setups, entries and exits (all to the pip) and price action principles are discussed in full detail, along with the notorious issues on the psychological side of the job, as well as the highly important but often overlooked aspects of clever accounting. The book, counting 358 pages, opens up a wealth of information and shares insights and techniques that are simply invaluable to any scalper who is serious about his trading.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

This is the thread about books related for stocks, forex, financial market and economics. Please make a post about books with possible cover image, short description and official link to buy (amazon for example).

Posts without books' presentation, without official link to buy and with refferal links will be deleted.Posts with links to unofficial resellers will be deleted