Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.13 07:42

AUD/USD Intra-Day Fundamentals: Westpac-Melbourne Institute Consumer Sentiment and 17 pips price movement

2016-07-13 00:30 GMT | [AUD - Westpac Consumer Sentiment]

- past data is -1.0%

- forecast data is n/a

- actual data is -3.0% according to the latest press release

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Westpac Consumer Sentiment] = Change in the level of a diffusion index based on surveyed consumers.

==========

- "With the major events of ‘Brexit’ and prolonged election uncertainty it is not surprising to see a fall in the Index. In fact, given these developments, this fall appears to be surprisingly modest."

- "The survey was conducted over the period July 4 to July 7. By the time of the survey market volatility associated with ‘Brexit’ had largely settled down and media commentary was, correctly in my view, concentrating on the implications for the UK economy rather than the initial reaction which speculated on some disastrous contagion for the whole of Europe. However concerns would have lingered for many respondents given the blanket publicity which the ‘Brexit’ development received."

==========

AUD/USD M5: 17 pips price movement by Westpac-Melbourne Institute Consumer Sentiment news event :

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.14 08:57

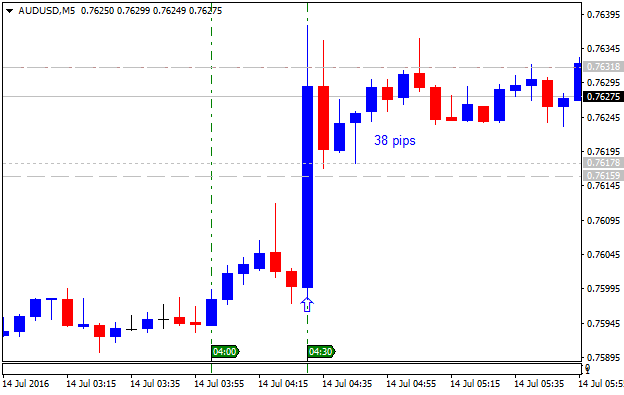

AUD/USD Intra-Day Fundamentals: Australian Employment Change and 38 pips price movement

2016-07-14 01:30 GMT | [AUD - Employment Change]

- past data is 19.2K

- forecast data is 10.1K

- actual data is 7.9K according to the latest press release

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Employment Change] = Change in the number of employed people during the previous month.

==========

TREND ESTIMATES (MONTHLY CHANGE)

- Employment increased 8,300 to 11,933,400.

- Unemployment decreased 200 to 725,900.

- Unemployment rate remained steady at 5.7%.

- Participation rate remained steady at 64.8%.

- Monthly hours worked in all jobs decreased 0.7 million hours to 1,635.1 million hours.

- Employment increased 7,900 to 11,939,600. Full-time employment increased 38,400 to 8,198,900 and part-time employment decreased 30,600 to 3,740,700.

- Unemployment increased 9,900 to 734,200. The number of unemployed persons looking for full-time work decreased 9,200 to 496,700 and the number of unemployed persons only looking for part-time work increased 19,000 to 237,500.

- Unemployment rate increased by 0.1 pts to 5.8%.

- Participation rate increased by less than 0.1 pts to 64.9%.

- Monthly hours worked in all jobs decreased 4.3 million hours to 1,640.0 million hours.

==========

AUD/USD M5: 38 pips price movement by Australian Employment Change news event :

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.16 11:34

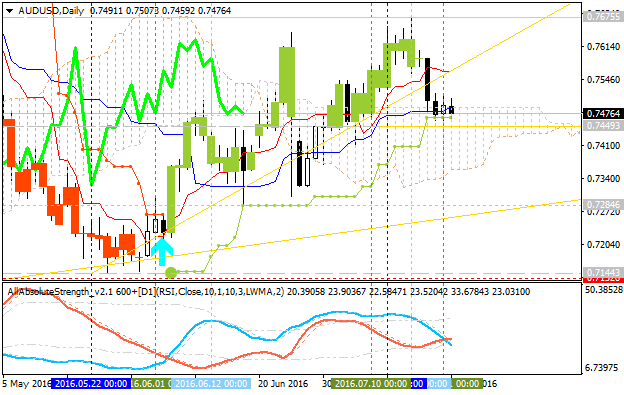

Fundamental Weekly Forecasts for Dollar Index, GBP/USD, USD/CAD, USD/JPY, NZD/USD, AUD/USD, USD/CNH and GOLD (based on the article)

AUD/USD - "On the geopolitical front, an attempted military coup in Turkey late Friday complicates the landscape further. The country’s proximity to and significant economic linkages with Western Europe may fuel fears that turmoil there will amplify existing post-Brexit vulnerabilities, catalyzing a broader unraveling."

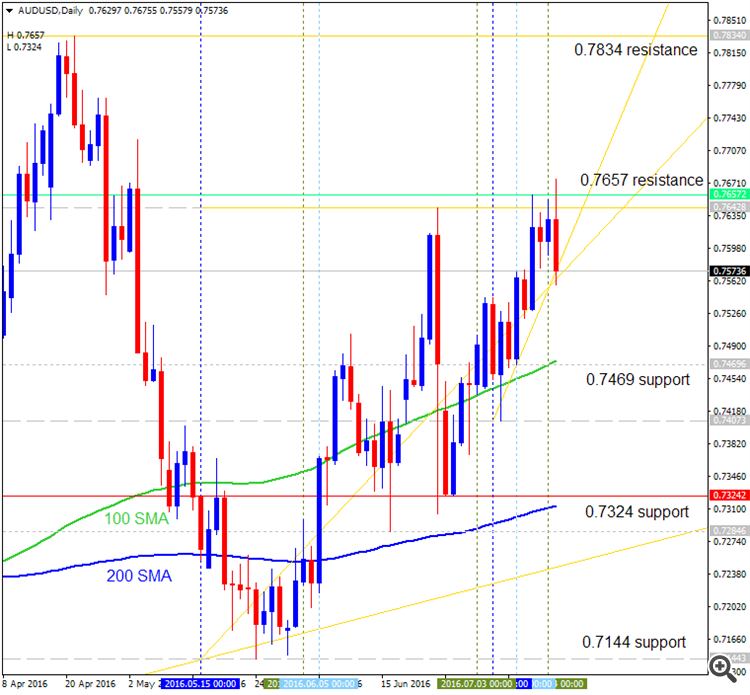

D1 price is located above 200 SMA for the bullish condition on ranging within the following support/resistance levels:

- 0.7657 resistance located on the bullish area of the chart, and

- 0.7324 support level located near 200 SMA on the border between the primary bearish and the primary bullish trend.

If the price will break 0.7657 resistance level so the primary bullish trend will be continuing with 0.7834 bullish target.

If price will break 0.7324 support so the reversal of the daily price movement from the primary bullish to the primary bearish market condition will be started with 0.7144 nearest bearish daily target.

If not so the price will be ranging within the levels.

| Resistance | Support |

|---|---|

| 0.7657 | 0.7324 |

| 0.7834 | 0.7144 |

- Recommendation to go short: watch the price to break 0.7324 support level for possible sell trade

- Recommendation to go long: watch the price to break 0.7657 resistance level for possible buy trade

- Trading Summary: bullish ranging

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.19 06:54

AUD/USD Intra-Day Fundamentals: Reserve Bank of Australia Monetary Policy Meeting Minutes and and 41 pips price movement

2016-07-19 01:30 GMT | [AUD - Monetary Policy Meeting Minutes]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

if actual > forecast (or previous one) = good for currency (for NZD in our case)

[AUD - Monetary Policy Meeting Minutes] = It's a detailed record of the RBA Reserve Bank Board's most recent meeting, providing in-depth insights into the economic conditions that influenced their decision on where to set interest rates.

==========

From Economic Calendar article:

Officials at the Reserve Bank of Australia (RBA) are awaiting further information on growth and inflation before deciding whether to adjust monetary policy, the minutes of the July 5 meetings revealed Tuesday.

“The Board noted that further information on inflationary pressures, the labour market and housing market activity would be available over the following month and that the staff would provide an update of their forecasts ahead of the August Statement on Monetary Policy,” the official July 5 minutes said. “This information would allow the Board to refine its assessment of the outlook for growth and inflation and to make any adjustment to the stance of policy that may be appropriate.”

The RBA voted to keep its benchmark interest rate at 1.75% earlier this month. That was the second consecutive month interest rates have remained on hold. Policymakers voted to cut the benchmark rate by 25 basis points to 1.75% in May, a new all-time low.

==========

AUD/USD M5: 41 pips price movement by RBA Monetary Policy Meeting Minutes news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.22 07:50

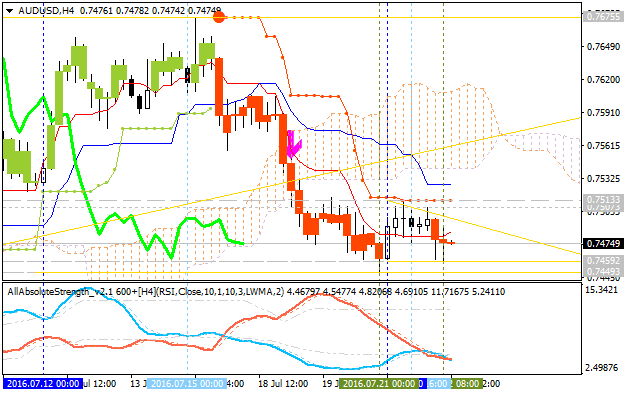

AUD/USD Intra-Day Technical Analysis - bearish ranging within narrow levels (adapted from the article)

H1 price

is located below 100 SMA/200 SMA reversal in the primary bearish area of the chart. The price is on ranging within key support/resistance levels waiting for direction.

- "The AUD/USD continues to consolidate today, after moving to new weekly lows late in Wednesdays trading. The weekly low for the AUD/USD currently resides at .7452, and this value comprises a key point of support for an ongoing trading range. Resistance has been noted in the graph below as the last swing high for July 19, found at a price of .757. As prices continue to range traders should continue to track short-term momentum, coupled with support and resistance, to pinpoint any future breakouts in price."

- "Alternatively, traders may look for a retracement in price if price begin to turn back towards range support. The Grid Sight Index found prices declined 9 pips in 48% of the reviewed historical matches. A move through the first bearish distribution, found at .7496, would open the pair for further declines. It should be noted that prices only fell 33 pips, in only 3% of historical instances. This places today’s final bearish distribution at a price of .7472."

- The resistance levels for the price are 0.7507 and 0.7606.

- The support levels are the following: 0.7461 and 0.7449.

- If H1 price breaks 0.7507 resistance level to above on close bar so the local uptrend as the bear market rally will be started with 0.7606 possible target.

- If H1 price breaks 0.7461 support so the bearish trend will be continuing with 0.7449 target to re-enter.

- If not so the price will be ranging within the levels.

| Resistance | Support |

|---|---|

| 0.7507 | 0.7461 |

| 0.7606 | 0.7449 |

- Recommendation to go short: watch the price to break 0.7461 support level for possible sell trade

- Recommendation to go long: watch the price to break 0.7507 resistance level for possible buy trade

- Trading Summary: ranging

SUMMARY : ranging

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.22 11:11

Technical Targets for AUD/USD by United Overseas Bank (based on the article)

H4 price

is below Ichimoku for the bearish market condition with the ranging within the following key narrow s/r levels:

- 0.7513 resistance level located below Ichimoku cloud in the beginning of the bear market rally to be started, and

- 0.7449 support level located far below Ichimoku cloud in the bearish area of the chart.

Absolute Strength indicator is estimating the ranging market condition in the near future.

Daily

price. United Overseas Bank is expecting for this pair to be more bearish:

"The price action is line with our expectation but the down-move has been more rapid than expected and a clear break below 0.7445 would greatly increase the odds for further decline to 0.7400, possibly to 0.7330. Overall, this pair is expected to stay under pressure unless it can reclaim 0.7560. On a shorter-term note, 0.7530 is already a strong resistance."

- If daily price breaks 0.7675 resistance level

on close bar so the bullish trend will be continuing.

- If daily price breaks 0.7449 support level on close bar so the reversal of the daily price movement from the ranging bullish to the primary bearish market condition will be started.

- If not so the price will be ranging within the levels.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.26 13:10

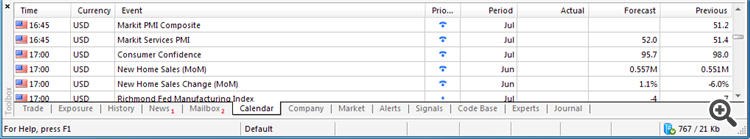

Trading News Events: The Conference Board Consumer Confidence

2016-07-26 14:00 GMT | [USD - CB Consumer Confidence]

- past data is 98.0

- forecast data is 95.5

- actual data is n/a according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - CB Consumer Confidence] = Level of a composite index based on surveyed households.

==========

What’s Expected:

From the article:

==========

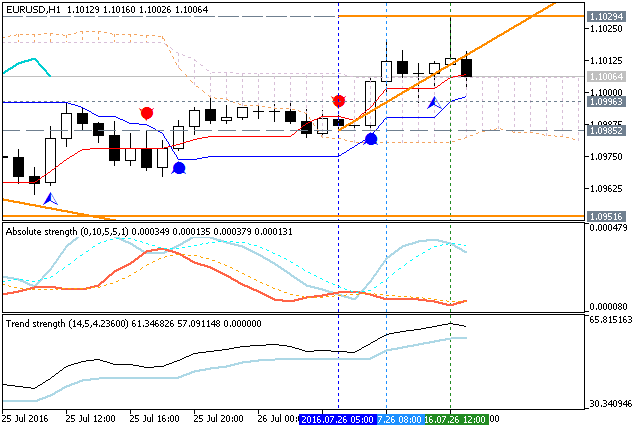

EUR/USD H1: bullish ranging near bearish reversal. The price is on ranging near and above Ichimoku cloud within the following key reversal support/resistance levels:

- 1.0985 support level located below Ichimoku cloud and near Senkou Span line in the beginning of the bearish trend to be resumed, and

- 1.1029 resistance level located above Ichimoku cloud in the bullish area of the chart.

If the price breaks 1.1029 resistance to above on close H1 bar so the bullish reversal will be continuing.

If not so the price will be continuing with the ranging within the levels.

| Resistance | Support |

|---|---|

| 1.1029 | 1.0985 |

| N/A | 1.0951 |

=========

AUD/USD H1: ranging for the bullish continuation or for the bearish reversal. The price is located above Ichimoku cloud in the bullish area of the chart for the ranging within the following key reversal support/resistance levels:

- 0.7582 support level located near and below Ichimoku cloud in the beginning of the bearish trend to be started, and

- 0.7537 resistance level located above Ichimoku cloud in the bullish area of the chart.

If the price breaks 0.7537 resistance to above on close H1 bar so the bullish reversal will be continuing.

If not so the price will be continuing with the ranging within the levels.

| Resistance | Support |

|---|---|

| 0.7537 | 0.7582 |

| N/A | 0.7582 |

AUD/USD M5: 10 pips price movement by CB Consumer Confidence news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.27 07:22

AUD/USD Intra-Day Fundamentals: Australian Consumer Price Index and 108 pips range price movement

2016-07-27 01:30 GMT | [AUD - CPI]

- past data is -0.2%

- forecast data is 0.4%

- actual data is 0.4% according to the latest press release

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - CPI] = Change in the price of goods and services purchased by consumers.

==========

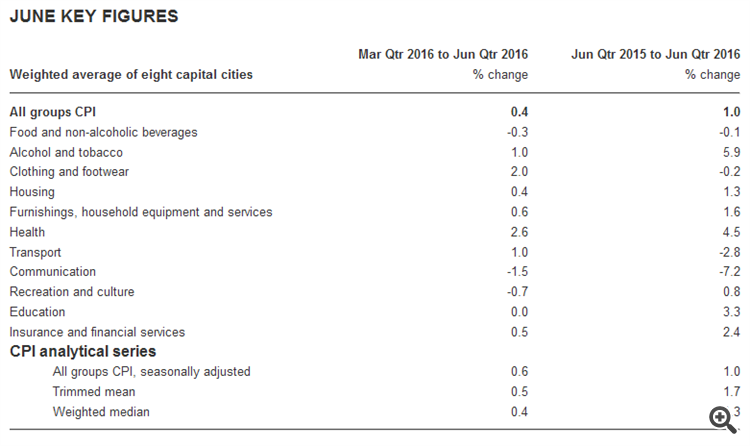

- rose 0.4% this quarter, compared with a fall of 0.2% in the March quarter 2016.

- rose 1.0% over the twelve months to the June quarter 2016, compared with a rise of 1.3% over the twelve months to the March quarter 2016.

==========

AUD/USD M5: 108 pips range price movement by Australian Consumer Price Index news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.08.03 15:31

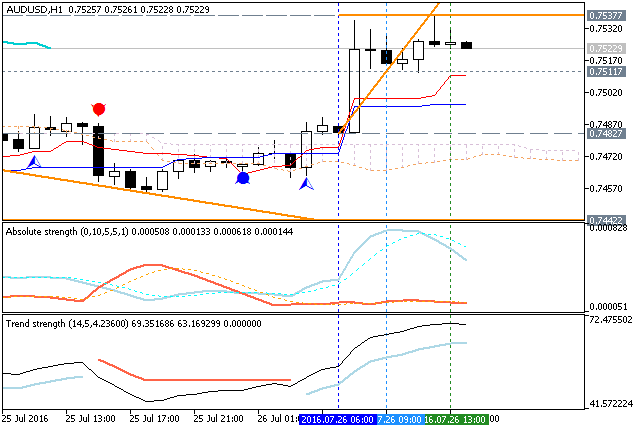

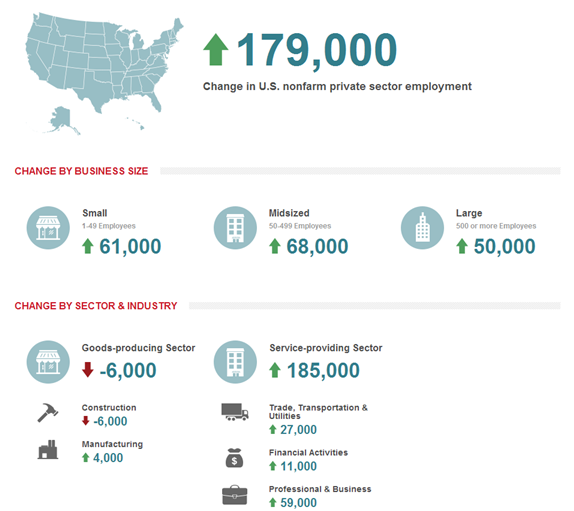

Intra-Day Fundamentals - EUR/USD, AUD/USD, NZD/USD and USD/CNH: ADP Non-Farm Employment Change

2016-08-03 12:15 GMT | [USD - ADP Non-Farm Employment Change]

- past data is 176K

- forecast data is 171K

- actual data is 179K according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - ADP Non-Farm Employment Change] = Estimated change in the number of employed people during the previous month, excluding the farming industry and government.

==========

AUD/USD M5: 18 pips price movement by ADP Non-Farm Employment Change news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.08.04 07:03

AUD/USD Intra-Day Fundamentals: Australian Retail Sales and 29 pips range price movement

2016-08-04 01:30 GMT | [AUD - Retail Sales]

- past data is 0.2%

- forecast data is 0.3%

- actual data is 0.1% according to the latest press release

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Retail Sales] = Change in the total value of sales at the retail level.

==========

- The trend estimate rose 0.2% in June 2016. This follows a rise of 0.2% in May 2016 and a rise of 0.2% in April 2016.

- The seasonally adjusted estimate rose 0.1% in June 2016. This follows a rise of 0.2% in May 2016 and a rise of 0.1% in April 2016.

- In trend terms, Australian turnover rose 3.1% in June 2016 compared with June 2015.

==========

AUD/USD M5: 29 pips range price movement by Australian Retail Sales news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.07.12 07:00

AUD/USD Intra-Day Fundamentals: National Australia Bank Business Confidence and 44 pips price movement

2016-07-12 01:30 GMT | [AUD - NAB Business Confidence]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - NAB Business Confidence] = Level of a diffusion index based on surveyed businesses, excluding the farming industry.

==========

Business confidence rises despite Brexit, election campaign :==========

AUD/USD M5: 44 pips price movement by National Australia Bank Business Confidence news event :