Forum on trading, automated trading systems and testing trading strategies

Discussion of article "The Implementation of Automatic Analysis of the Elliott Waves in MQL5"

Sergey Golubev, 2014.03.13 09:39

Keys to Investor Success - Elliott Wave Theory (based on thetechnicaltraders article)

Elliott Wave Theory - Plenty of people will freely offer you

advice on how to spend or invest your money. “Buy low and sell high,”

they’ll tell you, “that’s really all there is to it!” And while there is

a core truth to the statement, the real secret is in knowing how to

spot the highs and lows, and thus, when to do your buying and selling.

Sadly, that’s the part of the equation that most of the advice givers

you’ll run across are content to leave you in the dark about.

The reality is that no matter how many times you are told differently,

there is no ‘magic bullet.’ There is no plan, no series of steps you can

follow that will, with absolute certainty, bring you wealth. If you

happen across anyone who says otherwise, you can rely on the fact that

he or she has an agenda, and that at least part of that agenda involves

convincing you to open your wallet.

In the place of a surefire way to make profits, what is there? Where can

you turn, and what kinds of things should you be looking for?

The answers to those questions aren’t as glamorous sounding as the

promises made by those who just want to take your money, but they are

much more effective. Things like careful, meticulous research. Market

trend analysis. Paying close attention to extrinsic factors that could

impact whatever industry you’re planning to invest in, and of course,

Elliott wave theory. If you’ve never heard of the Elliott wave, you owe

it to yourself to learn more about it.

Postulated by Ralph Nelson Elliott in the late 1930’s, it is essentially

a psychological approach to investing that identifies specific stimuli

that large groups tend to respond to in the same way. By identifying

these stimuli, it then becomes possible to predict which direction the

market will likely move, and as he outlined in his book “The Wave

Principle,” market prices tend to unfold in specific patterns or

‘waves.’

The fact that many of the most successful Wall Street investors and portfolio managers use this type of trend analysis in their own decision making process should be compelling evidence that you should consider doing the same. No, it’s not perfect, and it is certainly not a guarantee, but it provides a strong framework of probability that, when combined with other research and analysis, can lead to consistently good decisions, and at the end of the day, that’s what investing is all about. Consistently good decision making.

We can use Elliott Wave Theory in real time by looking at the larger patterns of the SP 500 index for example. We can deploy Fibonacci math analysis to prior up and down legs in the markets to determine where we are in an Elliott Wave pattern. This will help us decide if to be aggressive when the markets correct, go short the market, or to do nothing for example. It also prevents from making panic type decisions, whether that be in chasing a hot stock too higher or selling something too low before a reversal. We also can use Elliott Wave Theory to determine when to be aggressive in selling or buying, on either side of a trade.

For many, its not practical to employ Elliott Wave analysis with

individual stocks and trading, but it can be done with experience.

Knowing when to enter and exit a position whether your time frame is

short, intermediate, or longer… can often be identified with good

Elliott Wave Theory practices. Your results and your portfolio will

appreciate it

Forum on trading, automated trading systems and testing trading strategies

Something Interesting to Read March 2014

Sergey Golubev, 2014.03.13 09:30

The Wave Principleby Ralph Nelson Elliott

The Elliott Wave Principle is a form of technical analysis that some

traders use to analyze financial market cycles and forecast market

trends by identifying extremes in investor psychology, highs and lows in

prices, and other collective factors. Ralph Nelson Elliott, a

professional accountant, discovered the underlying social principles and

developed the analytical tools. He proposed that market prices unfold

in specific patterns, which practitioners today call Elliott waves, or

simply waves. Elliott published his theory of market behavior in this

book "The Wave Principle". Elliott stated that "because man is subject

to rhythmical procedure, calculations having to do with his activities

can be projected far into the future with a justification and certainty

heretofore unattainable."

Forum on trading, automated trading systems and testing trading strategies

Expert Advisors: ElliottWaveMaker 3.0

Sergey Golubev, 2013.10.19 12:21

How to Understand the Three Building Blocks for Trading Elliott Wave

Talking Points

- How To Understand the Basic Pattern

- How To Understand Corrections vs. Impulses In Markets

- How To Understand Fibonacci In Relation To Wave Development

-Paul Tudor Jones, Tudor Jones Capital

Elliott Wave is a great trading tool for trading trends. However, it’s not as confusing as a lot people make it out to be when you consider the primary objective of the tool. Elliott Wave is meant to put the current move of the market in context for you, the trader.

Putting the market in context for you is of great help. For starters, if you know a market that has recently been in a strong trend is correcting, you can look for a resumption of the prior trend to enter at a favorable price. Also, you can look to see if the pattern is starting to break down to see if the prior trend has exhausted itself, and look to either take profits or enter a new trade in the direction of the new trend.

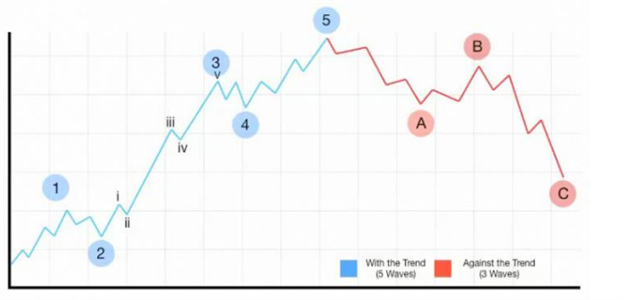

Understand the Basic Pattern

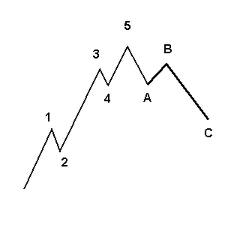

The picture above is a mock-up that shows the progression of markets as

seen in Elliott Wave. As you can see, the market is often broken up by

strong trends and minor moves against the trend. The with-trend moves

are known as impulse or motive waves and the counter trend moves are

known as correction.

Another key aspect of Elliott Wave is that trends are fractal. Simply

put, that means that each impulsive wave can be broken down into 5

smaller waves and each correction can be broken into 3 smaller segments

of a counter-trend move. However, it’s often not overly necessary to

label every single aspect of the wave.

How to Understand Corrections vs. Impulses in Markets

As illustrated above, the trend or impulse unfolds in 5-waves whereas

corrections unfold often in a 3-wave pattern. You’ll often hear Elliott

wave fans discussing trading based on 5-s & 3-s and that is because

they identify the trend and countertrend moves based on the unfolding of

a move in 5 & 3-wave patterns.

Furthermore, in understanding the basic 5-wave impulse or trend, you can

be on the lookout for a 3-wave correction or developing correction. The

purpose of looking for a correction is that as the trend resumes, you

can look for the correction to be losing steam so that you can enter at a

good price. What many traders who are unfamiliar with Elliott wave

often end up doing is chasing the price or enter on the extension of the

trend right before the correction begins. This causes them to get

stopped out because they did not understand the context of the market

and current trend when they entered the trade.

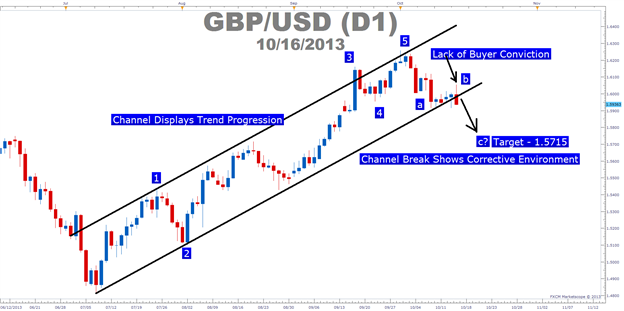

When looking at the 5-wave pattern and 3-wave correction to get context,

you can see how the breaking down of GBPUSD has us looking for a

correction to continue. Therefore, I’m taking the context as provided by

Elliott Wave to get a better feel for GBPUSD. Once this corrective move

to the downside completes, then I can look for a buy on a resumption of

the overall trend to higher prices.

If you’re not trading GBPUSD, you can take a look at the chart you’re

trading and see if you can identify any 5-wave or 3-wave structures.

That will help you grab a context of the current market so that you can

look for the maturity of the current trend or ideally the exhaustion of

the correction. After you’ve identified a current market as ready to

resume the trend, you can then look to Fibonacci numbers in order to see

where the market is likely go to go as according to Elliott Wave.

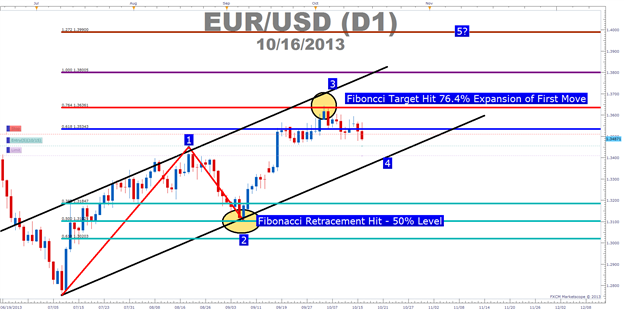

How to Understand Fibonacci In Relation To Wave Development

“When R.N. Elliott wrote Nature’s Law, he explained that the Fibonacci

sequence provides the mathematical basis of the Wave Principle”

-Elliott Wave Principle, Frost & Prechter pg. 91

Once you’ve been able to get context for the current trend, you can then look to Fibonacci numbers in order to find price objectives within Elliott Wave. In other words, the reason why Elliott Wave traders often utilize Elliott Wave is because you can have definitive levels as to where the correction may end with Fibonacci Retracements. Furthermore, you can have price objectives by utilizing the Fibonacci Expansion tool.

One key thing to note when utilizing Fibonacci retracements within

Elliott Wave is that there are levels to watch out for but rarely a

level that the market must hit. Therefore, you want to focus on price

action near levels like the 61.8% on a wave 2 and a 38.2% on wave 4. If

you see a lack of conviction past these levels then you can look to a

resumption of the overall trend off of these levels.

In terms of price objectives, you can use the Fibonacci expansion tool.

The expansion tool takes three points on the chart to project the

exhaustion of the next impulse. The most-commonly used targets are the

61.8%, 100% & 161.8% expansion. This simply means that this impulse

is either 61.8%, 100% or 161.8% of the prior wave and simply shows you

the progression and strength of the current trend.

Closing thoughts

Elliott can be a headache if you worry about labeling every wave and

every correction. Instead, I’d recommend focusing on the big picture. In

other words, are we in an impulse or a correction? More importantly, if

we’re in a correction that’s about to be exhausted, where can we enter

on the resumption of the trend?

Forum on trading, automated trading systems and testing trading strategies

Expert Advisors: ElliottWaveMaker 3.0

Sergey Golubev, 2013.12.15 14:24

Elliott Wave (based on thetechnicaltraders article)

Every investor has seen the odd phenomena of stocks going down when

there is good news about the stock or conversely stocks going up when

there is bad news about the stock. Is there a system that can be used

to help analyze these trends and to be able to then predict stock

trends? The answer is yes, and one possibility is Elliot Wave Theory.

Elliot Wave Theory examines how groups of individuals react en

masses to things in their environment and the psychological reasons for

such reactions. Elliot Wave Theory then groups those reactions into

predictable patterns or ‘waves. Once you have identified a particular

trigger, you can then predict the coming waves and how groups will

behave in accordance to those waves.

Elliot Waves: mini waves make up bigger waves

The key component of Elliot Wave Theory are the Elliot Waves

themselves. Several mini Elliot Waves will make up one bigger wave. The

bigger wave is known as a fractal. Fractals can then be grouped together

to create an even larger wave showing a complete trend based one

trigger.

Elliot Wave Predictions

The stock market is an excellent vehicle to use Elliot Wave Theory to

analyze potential market trends. Once a potential trigger has been

identified, the potential movement of the stock can be predicted by the

applying the Elliot Wave principles. Opportunities for solid Elliot Wave Predictions exist whether the stock is moving in an upwards or downwards trend as Elliot Wave Theory accounts for upwards and downwards movement.

Elliot Wave Gold

Elliot Wave Theory can be applied to anything that is traded,

including gold. Elliot Wave Gold systems can provide an opportunity for

excellent growth. The key of course is being able to identify a trigger,

understand that triggers implications, and then predict how groups of

investors will react. That’s where solid, proven Elliot Wave Theory

application can give you an edge in your invested strategies.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use