Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.04 09:47

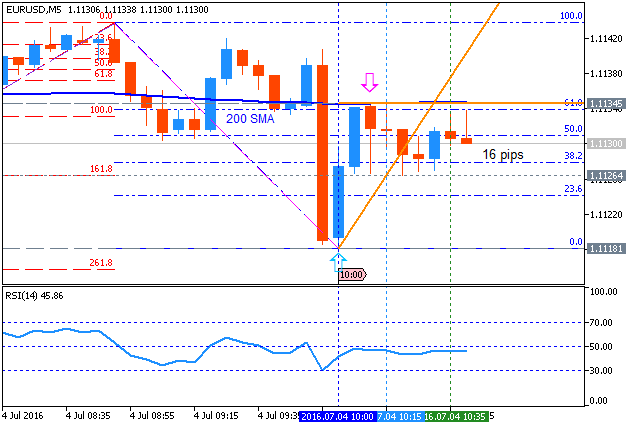

EUR/USD Intra-Day Fundamentals: Spanish Unemployment Change and 16 pips range price movement

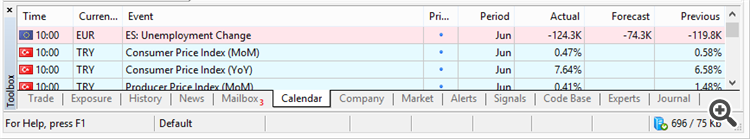

2016-07-04 07:00 GMT | [EUR - Spanish Unemployment Change]

- past data is -119.8K

- forecast data is -74.3K

- actual data is -124.3K according to the latest press release

if actual < forecast (or previous one) = good for currency (for EUR in our case)

[EUR - Spanish Unemployment Change] = Change in the number of unemployed people during the previous month.

==========

==========

EUR/USD M5: 16 pips range price movement by Spanish Unemployment Change news event :

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.04 18:47

EUR/USD Weekly Outlook: 2016, July 03 - July 10 (based on the article)

EUR/USD wobbled in the post-Brexit week, but basically did not go too far. More PMIs as well as the postponed ECB meeting minutes are eyed. Will EUR/USD choose a new direction? Here is an outlook for the highlights of this week.

- Services PMIs: Tuesday: Markit releases the data for Spain at 7:!5, Italy at 7:45, the final French figure at 7:50, final German number at 7:55 and final euro-zone number at 8:00. Spain saw robust growth in its services sector in May with 55.4 points, above the 50 point threshold separating expansion and contraction. A score of 55.2 is expected for June. On the other hand, Italy suffered from slight contraction with 49.8 points. 50.3 is predicted now. The initial read for France for June showed a weak 49.9 points. Germany contrasted that with 53.2 and the whole euro-zone with 52.4. These 3 numbers will likely be confirmed in the final read.

- Retail Sales: Tuesday, 9:00.

- German Factory Orders: Wednesday, 6:00.

- Retail PMI: Wednesday, 8:10.

- German Industrial Production: Thursday, 6:00.

- French Trade Balance: Thursday, 6:45.

- ECB Meeting Minutes: Postponed from last week. Thursday, 11:30. The ECB releases minutes from its June meeting, when the ECB did not announce new measures but described the implementation of corporate bond buying and the new TLTROs. In that meeting, they also provided new forecasts which were not too optimistic. The minutes can show how worried members really are regarding their inflation mandate. It can also expose the internal debate. What could be more interesting is if we get details about the members’ view on the potential of Brexit.

- German Trade Balance: Friday, 6:00.

- French Industrial Production: Friday, 6:45.

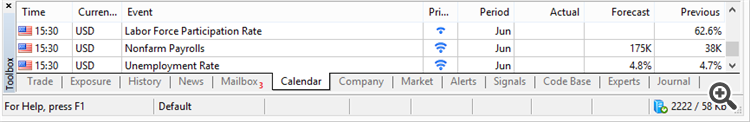

- US Non-Farm Payrolls: Friday, 12:30. US monthly jobs report for June is forecast to show a 181,000 jobs gain, while the unemployment rate is estimated to rise to 4.8%.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.05 09:31

Technical Targets for EUR/USD by United Overseas Bank (based on the article)H4 price

is located near and below 200

period SMA (200 SMA) for the bearish ranging near bullish reversal. The price is on ranging within the following key s/r levels:

- 1.1426 resistance level located above 200 SMA in the bullish area of the chart, and

- 1.0911 support level located below 100 SMA/200 SMA reversal on the bearish area.

Bullish reversal level for H4 timeframe is 1.1168, and if the price breaks this level to above so the reversal of the price movement from the ranging bearish to the primary bullish trend will be started

Daily price. United Overseas Bank is considering for EUR/USD to be on the bearish market condition with 1.0813 key support level:

"The current short-term consolidation/correction phase is taking longer

than expected as EUR continues to hold above the 1.1095/00 support.

Downward momentum is beginning to show signs of slowing but as long as

1.1210 is intact, we are not giving up on our bearish view just yet.

That said, the prospect for a sustained down-move has clearly dimmed and

EUR has to move and stay below 1.1095 within these couple of days or

the risk of an interim low would continue to increase."

- If daily price breaks 1.1168 resistance level

on close bar so the bullish reversal will be started.

- If daily price breaks 1.0911 support level on close bar so the primary bearish trend will be continuing with 1.0813 level as a possible bearish target.

- If not so the price will be ranging within the levels.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.05 16:47

EUR/USD Intra-Day Fundamentals: U.S. Factory Orders and 25 pips price movement

2016-07-05 14:00 GMT | [USD - Factory Orders]

- past data is 1.9%

- forecast data is -0.8%

- actual data is -1.0% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Factory Orders] = Change in the total value of new purchase orders placed with manufacturers.

==========

U.S. factory orders fall, but unfilled orders increase :

- "New orders for U.S. factory goods fell in May on weak demand for transportation and defense capital goods, but growing order backlogs and lean inventories suggested the worst of the manufacturing downturn was probably over."

- "The Commerce Department said on Tuesday new orders for manufactured goods declined 1.0 percent after two straight months of increases."

- "April's orders were revised slightly down to show a 1.8 percent increase instead of the previously reported 1.9 percent jump. Economists polled by Reuters had forecast factory orders falling 0.9 percent in May."

- "The department also said orders for non-defense capital goods excluding aircraft fell 0.4 percent in May instead of the 0.7 percent drop reported last month. These so-called core capital goods are seen as a measure of business confidence and spending plans on equipment."

==========

EUR/USD M5: 25 pips price movement by U.S. Factory Orders news event :

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.06 12:00

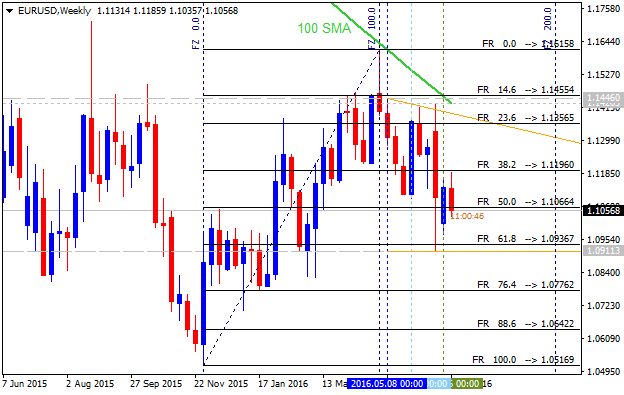

Bank of America Merrill Lynch - "We now expect EUR/USD to end 2016 at 1.05" (adapted from the article)

Bank of America Merrill Lynch predicted for EUR/USD price to be around 1.05 by 2016 year end, and at 1.10 by by the end of 2017:

"We revised our projections following the UK referendum. We now expect EUR/USD to end 2016 at 1.05, from

1.08 before, appreciating to 1.10 by the end of 2017, from 1.15 before.

These projections will still keep the Euro undervalued, but not

substantially, compared with our equilibrium EUR/USD estimate of 1.16.

In our view, a much weaker Euro would affect the Fed’s policy reaction

function, as the US data remains mixed, recently losing momentum."

If we look at the weekly chart so the price is located on the bearish market condition with the ranging within 1.1455 resistance level and 1.0936 support level. Breaking the resistance at 1.1455 will lead to the ranging bearish condition by the bear market rally up to the possible weekly bullish reversal. Alternative, if the price breaks 1.0936 support to below on close weekly bar so the primary bearish trend will be continuing up to 1.0516 support level as a the end-year bearish target.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.06 15:27

EUR/USD Intra-Day Fundamentals: U.S. Trade Balance and 17 pips price movement

2016-07-06 12:30 GMT | [USD - Trade Balance]

- past data is -37.4B

- forecast data is -40.0B

- actual data is -41.1B according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Trade Balance] = Difference in value between imported and exported goods and services during the reported month.

==========

- "The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $41.1 billion in May, up $3.8 billion from $37.4 billion in April, revised. May exports were $182.4 billion, $0.3 billion less than April exports. May imports were $223.5 billion, $3.4 billion more than April imports."

- "The May increase in the goods and services deficit reflected an increase in the goods deficit of $3.7 billion to $62.2 billion and a decrease in the services surplus of $0.1 billion to $21.1 billion."

==========

EUR/USD M5: 17 pips price movement by U.S. Trade Balance news event :

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.06 20:03

EUR/USD Intra-Day Fundamentals: ISM Non-Manufacturing PMI and 35 pips price movement

2016-07-06 14:00 GMT | [USD - ISM Non-Manufacturing PMI]

- past data is 52.9

- forecast data is 53.3

- actual data is 56.5 according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - ISM Non-Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers, excluding the manufacturing industry.

==========

"The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 56.5 percent in June, 3.6 percentage points higher than the May reading of 52.9 percent. This represents continued growth in the non-manufacturing sector at a faster rate. The Non-Manufacturing Business Activity Index increased to 59.5 percent, 4.4 percentage points higher than the May reading of 55.1 percent, reflecting growth for the 83rd consecutive month, at a faster rate in June. The New Orders Index registered 59.9 percent, 5.7 percentage points higher than the reading of 54.2 percent in May. The Employment Index grew 3 percentage points in June after one month of contraction to 52.7 percent from the May reading of 49.7 percent. The Prices Index decreased 0.1 percentage point from the May reading of 55.6 percent to 55.5 percent, indicating prices increased in June for the third consecutive month. According to the NMI®, 15 non-manufacturing industries reported growth in June."

==========

EUR/USD M5: 35 pips price movement by ISM Non-Manufacturing PMI news event :

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.08 09:23

Trading News Events: U.S. Non-Farm Payrolls by Barclays, TD, Goldman (adapted from the article)

Barclays: "For the June US employment report, we expect nonfarm payrolls to rise by 175k,

private payrolls to increase by 170k, and government payrolls to rise

by 5k. A number in line with our expectation would represent a modest

rebound in hiring relative to the May employment report after adjusting

for the effects of the Verizon strike. Telecommunications employment

fell 37k in May, about in line with the estimate of the strike-related

effects as estimated by the BLS, and we look for this employment to

return in June given the conclusion of the strike prior to the survey

week. Elsewhere in the report, we expect the unemployment rate to remain unchanged at 4.7%. Finally, we expect average hourly earnings to rise 0.2% m/m (2.7% y/y) and average weekly hours to hold steady at 34.4."

TD: "We expect the sharp downdraft in employment to partially reverse in June, with a forecasted increase of 175k jobs. This print will be supported by the return of 34k Verizon workers who were on strike in May. In addition to the rebound in the telecom sector, a bounce back in the wholesale, manufacturing and construction sectors should also bolster the headline print. The unemployment rate is forecast to increase to 4.8% from the cycle-low of 4.7% on account of an expected rebound in the labor force (following the outsized 820K decline over the prior two months), which should more than offset the gains in household employment. On the wage growth front, average hourly earnings are expected to rise modestly, posting a 0.2% m/m gain, resulting in the pace of wage growth accelerating from 2.5% to 2.7% y/y due in large part to favorable base effects."

Goldman: "We forecast that nonfarm payroll growth rebounded to +210k in June from

just +38k in May. In part the pickup reflects the conclusion of a strike

at Verizon Communications—this alone accounts for 70k of the

month-over-month swing. However, we also see scope for improvement

beyond Verizon, as other labor market data have generally looked

encouraging. We expect a small increase in the unemployment rate to 4.8% after

its three month decline in May. Data from the household survey have

been volatile in recent months, but the broad trends—participation

stabilizing and job growth remaining strong enough to reduce slack over

time—still look intact. We see a low month-over-month gain in average

hourly earnings due to calendar quirks, but the year-over-year rate

should edge higher."

-----

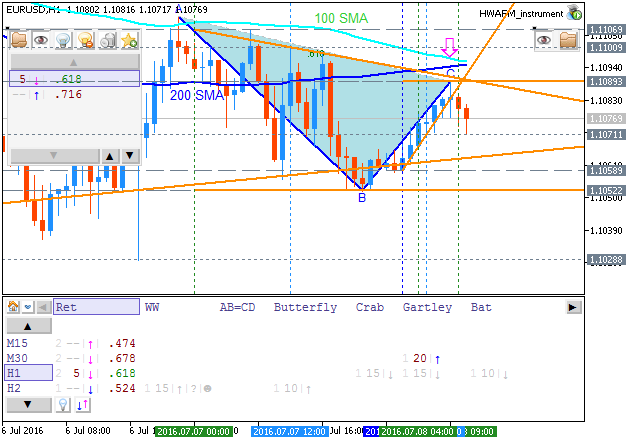

EUR/USD Quick Technical Overview: intra-day bearish trend to be resumed. H1 price was bounced from 200 SMA to below for the bearish market condition to be resumed in the near future: the price is testing 1.1071 support level to below for the bearish trend to be continuing with 1.1052 bearish breakdown target.

If the price breaks 1.1106 resistance level on close H1 bar so the reversal of the price movement to the bullish market condition will be started.

If the price breaks 1.1052 support level to below so the bearish trend will be continuing with the good breakdown possibilities.

If not so the price will be on ranging condition for direction.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.08 14:43

EUR/USD Intra-Day Fundamentals: Non-Farm Payrolls and 66 pips price movement

2016-07-08 12:30 GMT | [USD - Non-Farm Employment Change]

- past data is 11K

- forecast data is 180K

- actual data is 287K according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

"Total nonfarm payroll employment increased by 287,000 in June, and the unemployment rate rose to 4.9 percent, the U.S. Bureau of Labor Statistics reported today. Job growth occurred in leisure and hospitality, health care and social assistance, and financial activities. Employment also increased in information, mostly reflecting the return of workers from a strike."

==========

EUR/USD M5: 66 pips price movement by Non-Farm Payrolls news event :

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price was started to be ranging after Brexit breakdown located below Ichimoku cloud in the primary bearish area of the chart, and within the following key support/resistance levels:

Chinkou Span line is below the price indicating the ranging bearish market condition for the week, Trend Strength indicator is estimating the bearish trend, and Absolute Strength indicator is for the possible secondary rally to be started within the primary bearish market condition.

If D1 price break 1.0911 support level on close bar so the bearish trend will be continuing.

If D1 price break 1.1427 resistance level on close bar from below to above so the reversal of the price movement from the ranging bearish to the primary bullish condition will be started.

If not so the price will be on ranging within the levels.

SUMMARY : bearish

TREND : ranging