Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.09 12:22

Credit Agricole with Week Ahead: Relative Value Trades With Degrees of Separation From The Brexit Trade (adapted from the article)

Credit Agricole was analysiing the Brexit situation onto the forex price movement with the taking into account the pairs with the good degrees of the separation from the Brexit trade for example:

- "Our preference still is for relative value trades like long AUD/NZD."

- "We stick with our long USD/CAD call as we maintain our constructive view on USD overall especially against G10 commodity currencies."

- "The outcome of the Upper House elections in Japan may increase the chances of structural reforms and add to investors bets on further BoJ easing. At the margin, this could help weaken the JPY."

Let's describe the situation with the technical points of view.

USD/JPY - Next Week Forecast. Credit Agricole indicated the local uptrend as the bear market rally for the price to be started in the coming week - the daily price is located below Ichimoku cloud in the primary bearish area of the chart with the ranging within the narrow support/resistance levels. So, the secondary rally may be started by 103.39 resistance level to be broken by the price to above and with 107.86 possible bullish reversal target, alternative - if the price breaks 100.19 support ot below on daily close bar so the ranging bearish market condition will be continuing with 98.93 bearish target to re-enter.

Most likely scenario for the daily price is the following: bearish ranging within the levels.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.13 08:00

USD./JPY Intra-Day Fundamentals: Japan Indices of Industrial Production and 29 pips price movement

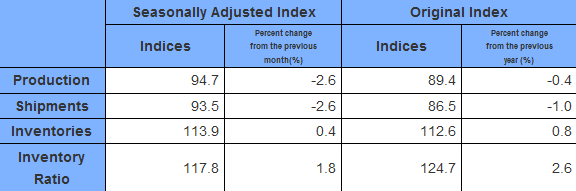

2016-07-13 04:30 GMT | [JPY - Industrial Production]

- past data is -2.3%

- forecast data is -2.2%

- actual data is -2.6% according to the latest press release

if actual > forecast (or previous one) = good for currency (for JPY in our case)

[JPY - Industrial Production] = Change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities.

==========

==========

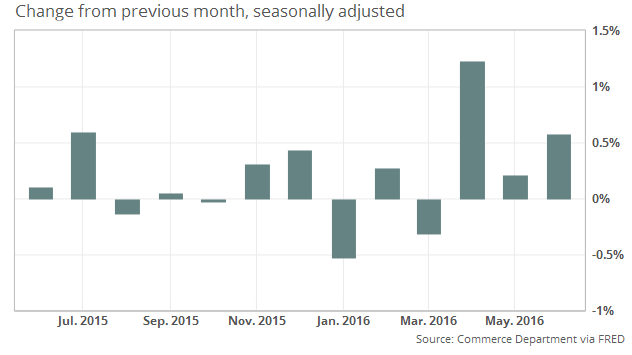

USD./JPY M5: 29 pips price movement by Japan Indices of Industrial Production news event :

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.15 15:13

Intra-Day Fundamentals: U.S. Consumer Price Index and Advance Retail Sales

2016-07-15 12:30 GMT | [USD - CPI]

- past data is 0.2%

- forecast data is 0.2%

- actual data is 0.2% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - CPI] = Change in the price of goods and services purchased by consumers.

==========

- "The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent in June on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index rose 1.0 percent before seasonal adjustment."

- "For the second consecutive month, increases in the indexes for energy and all items less food and energy more than offset a decline in the food index to result in the seasonally adjusted all items increase. The food index fell 0.1 percent, with the food at home index declining 0.3 percent. The energy index rose 1.3 percent, due mainly to a 3.3-percent increase in the gasoline index; the indexes for natural gas and electricity declined."

==========

2016-07-15 12:30 GMT | [USD - Retail Sales]

- past data is 0.2%

- forecast data is 0.1%

- actual data is 0.6% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Retail Sales] = Change in the total value of sales at the retail level.

==========

"Sales at U.S. retailers rose 0.6% in June, led by a surge in spending at home-and-garden centers and online stores, the government said Friday. Economists surveyed by MarketWatch had forecast a 0.1% increase. Stronger retail sales in June adds to evidence of a sharp rebound in U.S. growth in the recently ended second quarter."

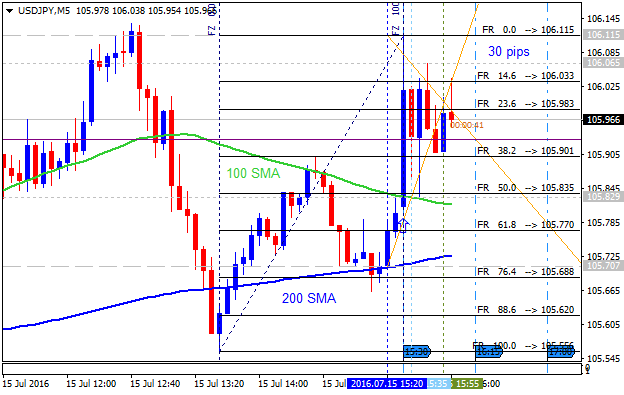

USD/JPY M5: 30 pips price movement by U.S. Consumer Price Index and Advance Retail Sales news event

:

H4 price broke 200 SMA to be reversed to the primary bullish market condition: the price is testing 106.31 resistance level for the bullish trend to be continuing. Alternative, if the price breaks 104.81 support level to below so the bearish trend will be resumed.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.16 11:34

Fundamental Weekly Forecasts for Dollar Index, GBP/USD, USD/CAD, USD/JPY, NZD/USD, AUD/USD, USD/CNH and GOLD (based on the article)

USD/JPY - "For next week the forecast for the Japanese Yen will be set to bearish under the premise of continued anticipation of eventual stimulus from Japan, whether that’s in July or September."

Daily price is located below 100 SMA/200 SMA reversal zone on the bearish area of the chart for the ranging within the following support/resistance levels:

- 105.93 resistance located in the beginning of the bear market rally to be started, and

- 99.98 support level located far below 200 SMA in the primary bearish area of the chart.

If the price will break 105.93 resistance level so the local uptrend as the bear market rally will be started with 107.89 level to re-enter.

If the price will break 114.25 resistance level so we may see the reversal of the price movement from the ranging bearish to the primary bullish market condition.

If price will break 99.98 support so the bearish trend will be continuing with 98.97 target to re-enter.

If not so the price will be ranging within the levels.

| Resistance | Support |

|---|---|

| 105.93 | 99.98 |

| 114.25 | 98.97 |

- Recommendation to go short: watch the price to break 99.98 support level for possible sell trade

- Recommendation to go long: watch the price to break 105.93 resistance level for possible buy trade

- Trading Summary: ranging

SUMMARY : ranging

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.23 08:45

Weekly Outlook: 2016, July 24 - July 31 (based on the article)

A busy week saw plenty of action in the yen and the pound, and a stronger dollar in general. A jey German survey, GDP data from the UK Canada and the US and rate decisions in the US and in Japan stand out. These are the major events on forex calendar.

- G20 Meetings: Sat-Sun. The UK and Japan are expected to lead the discussion towards co-ordination in fiscal spending with monetary policy.

- German Ifo Business Climate: Monday, 8:00. German business moral is expected to decline moderately to 107.7 in July. The ZEW indicator already turned negative.

- US CB Consumer Confidence: Tuesday, 14:00. Us consumer confidence is expected to decline to 95.6 this time.

- UK GDP data: Wednesday, 8:30. The second quarter growth rate is expected to be 0.5%.

- US Durable Goods Orders: Wednesday, 12:30. Durable Orders are expected to drop 1.1%, while core orders are predicted to gain 0.3%in June.

- US Crude Oil Inventories: Wednesday, 14:30.

- Fed decision: Wednesday, 18:00. It seems that Yellen will wait for at least after the elections. A hint about a hike earlier than that could send the dollar higher, while a dovish Fed, which is more likely, could weigh on the greenback.

- US Unemployment Claims: Thursday, 12:30. The number of new claims is expected to reach 261,000.

- Japan Rate decision: Friday.

- Canadian GDP: Friday, 12:30. The 0.1% growth rate was in line with market forecast.

- US GDP: Friday, 12:30.

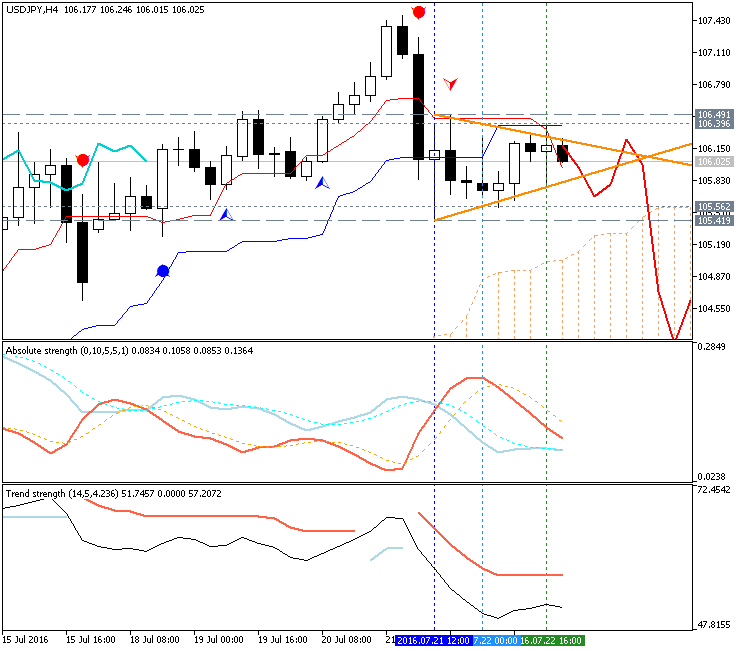

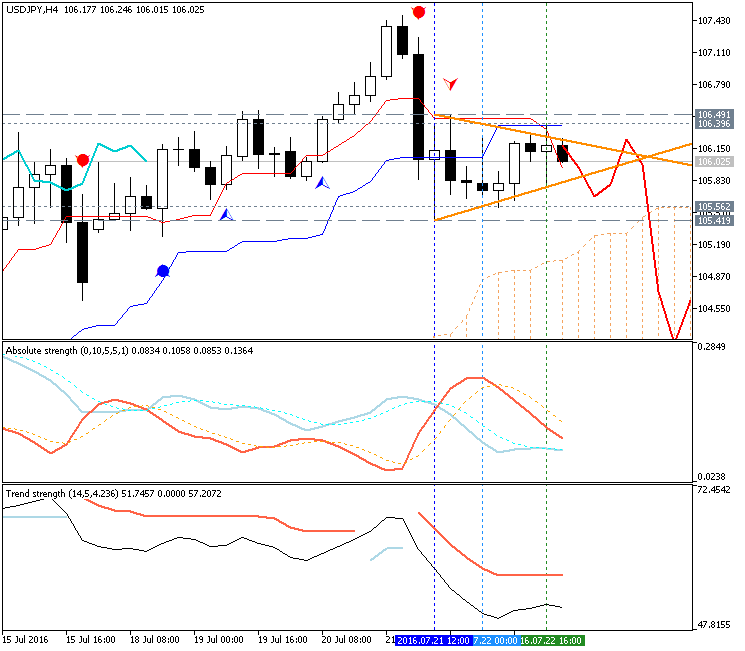

H4 price is located above Ichimoku cloud for the bullish ranging within the following support/resistance levels:

- 106.49 resistance level located above Ichimoku cloud in the bullish area of the chart, and

- 105.41 support level located in the beginning of the bearish trend to be started.

Chinkou Span indicator is estimating the possible bearish reversal, and Absolute Strength indicator is evaluating the trend as a ranging condition.

If H4 price breaks 106.49 resistance level on close bar from below to above so the bullish trend will be continuing.

If not so the price will be on ranging within the levels.

- Recommendation for long: watch close D1 price to break 106.49 for possible buy trade

- Recommendation

to go short: watch D1 price to break 105.41 support level for possible sell trade

- Trading Summary: ranging bullish

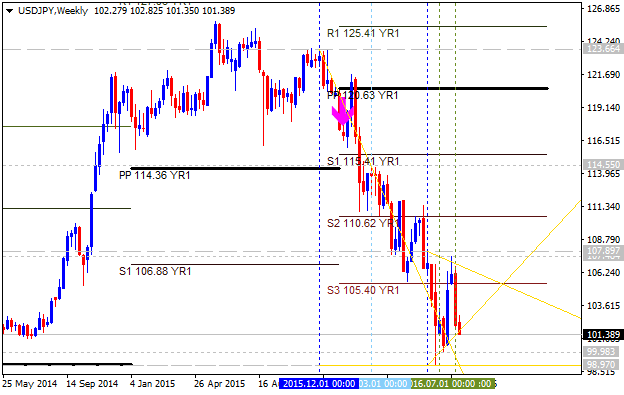

USDJPY Pivot Points Analysis - weekly oversold to be below S3 Pivot level

W1 price is located to be below S3 Pivot at 105.40:

- The price is on bearish ranging between S2 Pivot level at 110.62 and support level at 98.97.

- Price is breaking symmetric triangle pattern to below for the bearish trend to be continuing;

- If weekly price will break S3 Pivot at 105.40

so the primary bearish market condition will be continuing, otherwise the price will

be ranging bearish condition.

| Instrument | S1 Pivot | S2 Pivot | S3 Pivot | Yearly PP | R1 Pivot |

|---|---|---|---|---|---|

| USD/JPY | 115.41 | 110.62 | 105.40 | 120.63 |

125.41 |

Trend:

- D1 - ranging bearish

- W1 - ranging bearish

- MN1 - bearish

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.08.06 15:44

Fundamental Weekly Forecasts for Dollar Index, GBP/USD, USD/JPY, AUD/USD, USD/CNH and GOLD (based on the article)

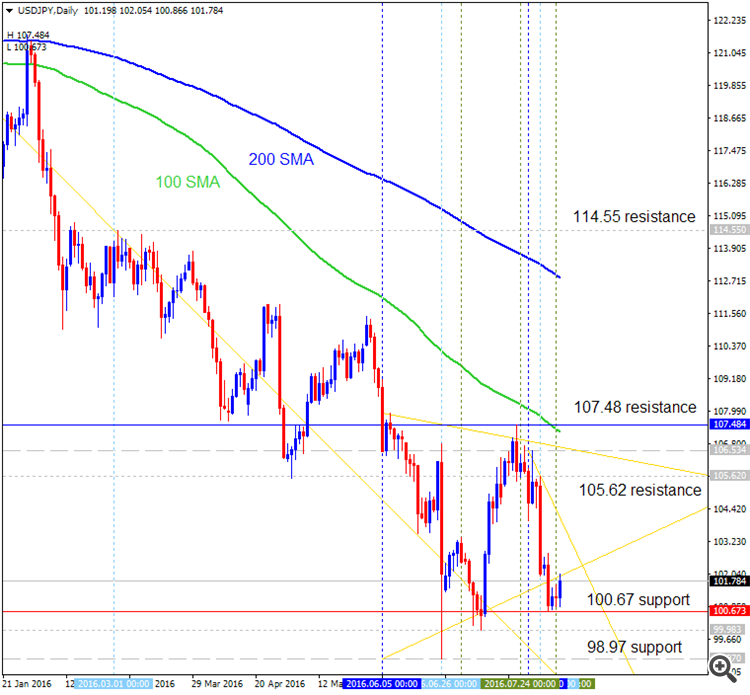

USD/JPY - "Will BOJ Governor Kuroda point to further policy easing at the bank’s September meeting? Its July statement said the bank would perform a “comprehensive assessment” on the effectiveness of its inflationary monetary policies in September. Such a statement suggests that officials knew the July announcement would come as a disappointment. And yet officials’ reluctance to act more aggressively underlines their hesitation on further policy easing."Daily price is below 100 period SMA and 200 period SMA in the bearish area of the chart. The price broke symmetric triangle pattern for the bearish trend to be continuing with 100.67 support level to be tested to below for the 98.97 level as a nearest bearish target. Alternative, if the price breaks 107.48 resistance level to above so the secondary rally within the primary bullish trend will be started with 114.55 bullish reversal level as a possible target.

If D1 price breaks 107.48 resistance level on close bar from below to above so the secondary bear market rally will be started.

If not so the price will be on bearish ranging within the levels.

- Recommendation for long: watch close daily price to break 107.48 for possible buy trade

- Recommendation

to go short: watch daily price to break 100.67 support level for possible sell trade

- Trading Summary: bearish

| Resistance | Support |

|---|---|

| 107.48 | 100.67 |

| 114.55 | 98.97 |

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.08.11 14:02

Technical Targets for USD/JPY by United Overseas Bank (based on the article)

H4 price

is located below 100 SMA/200 SMA in the bearish area of the chart for the ranging within

the following key reversal support/resistance

levels:

- 102.82 resistance level located near and below 100 SMA/100 SMA in the beginning of the bullish trend to be started, and

- 100.63 support level located far below 100 SMA/100 SMA in the bearish area of the chart.

Symmetric triangle pattern was fomed by the price to be crossed for the direction of the bearish trend to be continuing or the bullish reversal to be started.

Daily

price. United Overseas Bank is expecting for USD/JPY to be continuing with the ranging condition:

- If daily price breaks 111.44 resistance level

on close bar so the bullish reversal will be started.

- If daily price breaks 100.67 support level on close bar so the primary bearish trend will be continuing with 99.94 as a nearest bearish target to re-enter.

- If not so the price will be ranging within the levels.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.08.15 06:54

USD/JPY Intra-Day Fundamentals: Japan Gross Domestic Product and 16 pips range price movement

2016-08-14 23:50 GMT | [JPY - GDP]

- past data is 0.5%

- forecast data is 0.2%

- actual data is 0.0% according to the latest press release

if actual > forecast (or previous one) = good for currency (for JPY in our case)

[JPY - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

From the RTTNews article:

- "Japan's gross domestic product was flat on a seasonally adjusted quarterly basis in the second quarter of 2016, the Cabinet Office said on Monday."

- "That missed expectations for an increase of 0.2 percent following the 0.5 percent increase in the first quarter."

- "On a yearly basis, GDP expanded 0.2 percent - also beneath forecasts for 0.7 percent and sharply lower than 1.9 percent in the three months prior."

- "Nominal GDP advanced 0.2 percent on quarter - in line with expectations and down from 0.6 percent in the previous three months."

- "The GDP deflator was up 0.8 percent on year, exceeding estimates for 0.7 percent although down from 0.9 percent in the first quarter."

==========

USD/JPY M5: 16 pips range price movement by Japan Gross Domestic Product news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Quick Technical Overview: Technical Targets for USD/JPY - ranging bearish to be continuing or the secondary rally to be started

H4 price is located to be below 100 SMA/200 SMA on the primary bearish area of the chart. The price is on ranging within the following narrow ranging s/r levels:

If the price breaks 103.28 resistance level to above so the local uptrend as the secondary rally will be started with 106.80 level as a next bullish reversal target, if the price breaks 101.39 support to below so the primary bearish trend will be continuing with 98.97 target to re-enter, otherwise - the price will be on ranging condition within the levels.

Daily price is on primary bearish market condition with 101.39 support level to be tested for the bearish trend to be continuing.