You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.07.14 13:21

GBP/USD Intra-Day Fundamentals: BoE Official Bank Rate and 235 pips price movement

2016-07-14 11:00 GMT | [GBP - Official Bank Rate]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Official Bank Rate] = Interest rate at which the BOE lends to financial institutions overnight.

==========

"The Bank of England’s Monetary Policy Committee (MPC) sets monetary policy to meet the 2% inflation target and in a way that helps to sustain growth and employment. At its meeting ending on 13 July 2016, the MPC voted by a majority of 8-1 to maintain Bank Rate at 0.5%, with one member voting for a cut in Bank Rate to 0.25%. The Committee voted unanimously to maintain the stock of purchased assets financed by the issuance of central bank reserves at £375 billion. Committee members made initial assessments of the impact of the vote to leave the European Union on demand, supply and the exchange rate. In the absence of a further worsening in the trade-off between supporting growth and returning inflation to target on a sustainable basis, most members of the Committee expect monetary policy to be loosened in August. The precise size and nature of any stimulatory measures will be determined during the August forecast and Inflation Report round."

==========

GBP/USD M5: 235 pips price movement by BoE Official Bank Rate news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.07.16 11:34

Fundamental Weekly Forecasts for Dollar Index, GBP/USD, USD/CAD, USD/JPY, NZD/USD, AUD/USD, USD/CNH and GOLD (based on the article)

GBP/USD - "The UK stands at a significant crossroads, and the uncertainty will almost certainly continue to weigh on domestic markets and the British Pound through the foreseeable future. Voting to leave was easy; negotiating for special status may be substantively more difficult."

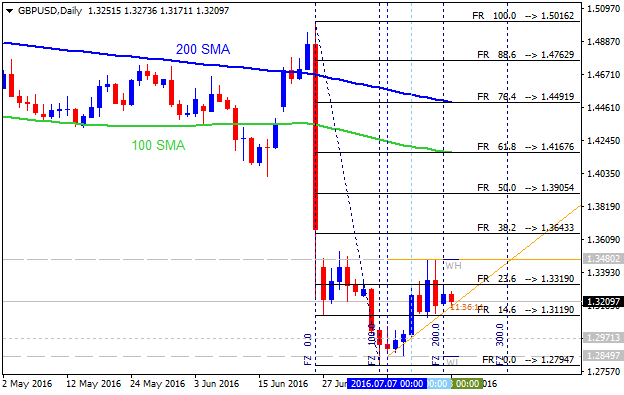

Daily price is on bearish ranging after the bearish reversal breakdown: the price is located below 200-day SMA within the following key support/resistance levels:

If the price breaks 1.3184 on daily close bar so the bearish trend will be continuing with 1.2794 nearest daily bearish target, otherwise - the ranging bearish within the levels.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.07.18 11:11

GBP/USD Intra-Day Fundamentals: Monetary Policy Committee Member Weale Speaks and and 47 pips price movement

2016-07-18 08:15 GMT | [GBP - MPC Member Weale Speaks]

[GBP - MPC Member Weale Speaks] = The speech about the implications of Brexit for monetary policy at the Resolution Foundation, in London.

==========

In his final speech as a member of the Monetary Policy Committee, Martin Weale outlined his analysis of the economic and financial market impact of the referendum vote and its implications for monetary policy.

Martin noted that the most prominent effect of the referendum result had been on the exchange rate, which has fallen sharply.

Martin stated that one reason this had happened was as a consequence of expected lower future productivity. He explained that, if expectations of a lower path for GDP are assumed to arise from a lower path for productivity, then it follows that real wages should also be weaker. To the extent that this is delivered through more inflation , then the exchange rate will have to be lower to offset the international effects of this. In other words, as Martin put it: "The relative fall in GDP resulting from Brexit might then be thought to set an upper limit to the decline in the exchange rate which would result from Brexit."

However, Martin also noted there were good reasons for thinking that the impact on the exchange rate will be larger than implied by the lower path for GDP. He said: "To the extent that the productivity effects work through reduced competition, then those are likely to be in the sectors of the economy most exposed to foreign competition - i.e. in the sectors of the economy producing internationally traded goods. If, say, half of our economic activity produces internationally tradable output and the productivity effect were actually limited to the tradeable sector, then the overall loss in productivity there would be twice as large in the economy as a whole. And, since the exchange rate needs to ensure that our internationally tradeable goods are competitive, the adjustment to the real exchange rate would need to be twice as large as if the loss were spread evenly across the economy."

Turning to the current policy decision, Martin noted that there remained a very high degree of uncertainty around the implications of leaving the EU. Uncertainty itself would suggest waiting for firmer evidence of what those implications might be. However, Martin does believe the short-term impact on demand will be more severe than that on supply, dampening inflation. "So is there a case for a stitch in time?"

Martin argued, however, that the effects of weaker demand needed to be traded off against the implications of the lower exchange rate for inflation; the Committee might need to address that even if it gave substantial weight to output movements.

==========

GBP/USD M5: 47 pips price movement by Monetary Policy Committee Member Weale Speech news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.07.19 07:30

Trading News Events: U.K. Consumer Price Index (adapted from the article)

2016-07-19 08:30 GMT | [GBP - CPI]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - CPI] = Change in the price of goods and services purchased by consumers.

==========

What’s Expected:Why Is This Event Important:

"With the U.K. preparing to depart from the European Union (EU), there’s growing speculation the BoE will reestablish its easing cycle at the next interest-rate decision on August 4, but we may see another split decision to retain the current policy as the marked depreciation in the British Pound raises the risk of overshooting the 2% target for inflation."

==========

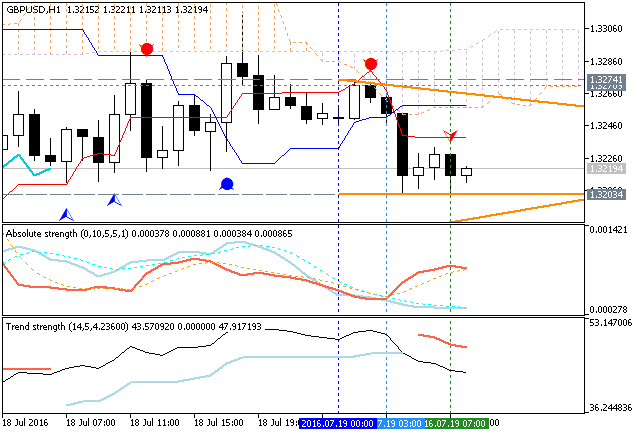

GBP/USD H1: ranging below Ichimoku cloud. The price is located below Ichimoku cloud in the bearish area of the chart for the ranging within the following key support/resistance levels:

Chinkou Span line and Absolute Strength indicator are estimating the trend as the secondary ranging, and Trend Strength indicator is evaluating the market condition as the bearish in the near future.

If the price breaks 1.3203 support level to below on close H1 bar so the primary bearish trend will be continuing.

If the price breaks 1.3274 resistance to above on close H1 bar so the reversal of the price movement from the ranging bearish to the primary bullish market condition will be started.

If not so the price will be continuing with the ranging within the levels.

GBP/USD M5: 30 range pips price movement by GBP - CPI news event

If we look at the daily chart so the price is contuning to be ranging below 100 SMA/200 SMA reversal area: the price is on ranging within 1.3480 resistance and 1.2794 support levels.

If the price breaks 1.3480 resistance to above on daily close bar so the local uptrend as the bear market rally within the primary bearish market condition will be started.

If the daily price breaks 1.2794 support level to below on close bar so the primary bearish trend will be continuing.

If not so the price will be on bearish ranging within the levels.

This is also the ranging bearish market condition in the medium-term situation (weekly chart). And the bearish continuation level is 1.2794 for example.

In the long-term situation in case of monthly price: the price is on ranging bearish market condition as well with the same bearish continuation as 1.2794. The 100 SMA/200 SMA is located too far from the market price for any possible bullish reversal in the current and the next year for example. Thus, this pair will be on bearish market condition for whole this year and next year just for sure.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.07.20 09:24

Trading News Events: U.K. Jobless Claims (adapted from the article)

2016-07-20 08:30 GMT | [GBP - Jobless Claims]

if actual < forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Jobless Claims] = Change in the number of people claiming unemployment-related benefits during the previous month.

==========

What’s Expected:Why Is This Event Important:

"Even though U.K. Jobless Claims are projected to increase 4.0K in June, another pickup in household earnings may generate a bullish reaction in GBP/USD as it highlights an improved outlook for growth and inflation."

==========

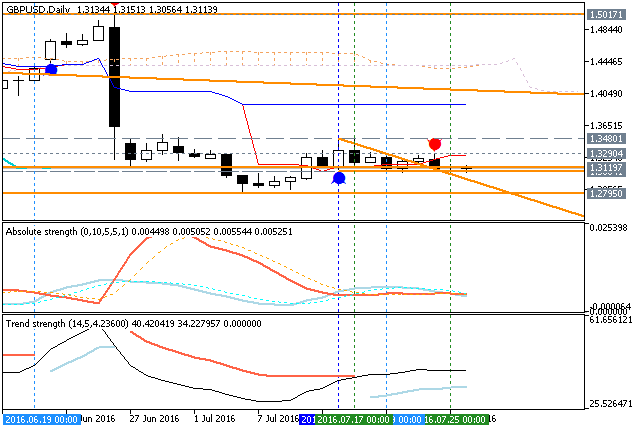

GBP/USD H1: bearish ranging within narrow s/r levels. The price is below Ichimoku cloud in the bearish area of the chart. Price is on ranging within the narrow support/resistance levels:

- 1.3064 support level located far below Ichimoku cloud in the primary bearish area, and

- 1.3119

resistance level located in the beginning of the rally to be started.

Chinkou Span line and Absolute Strength indicator are estimating the ranging condition waiting for the direction for breakout/breakdown.

If the price breaks 1.3064 support level to below on close H1 bar so the primary bearish trend will be continuing.If the price breaks 1.3274 resistance to above on close H1 bar so the local uptrend as the bear market rally will be started.

If not so the price will be continuing with the ranging within the levels.

GBP/USD M5: 55 pips price movement by U.K. Jobless Claims event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.07.21 11:11

GBP/USD Intra-Day Fundamentals: U.K. Retail Sales and and 52 pips price movement

2016-07-21 08:30 GMT | [GBP - Retail Sales]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Retail Sales] = Change in the total value of inflation-adjusted sales at the retail level.

==========

GBP/USD M5: 52 pips price movement by U.K. Retail Sales news event

M5 price broke 200 period SMA for the bearish breakdown: the price was bounced by 1.3154 support level to above for the secondary ranging to be started.If M5 price breaks 1.3224 resistance level to above on close bar so the primary bullish trend will be resumed for this timeframe.

If M5 price breaks 1.3154 support level to below on close bar so the bearish trend will be continuing.

If not so the price will be on bearish ranging within the levels.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.07.25 13:51

Technical Targets for GBP/USD by United Overseas Bank (based on the article)

H4 price is located below 200 SMA and near 100 SMA: the price is testing 1.3064 support level for the bearish trend to be resumed. Descending triangle pattern was formed by the price to be crossed for the bearish market condition.

Daily price. United Overseas Bank is considering for GBP/USD for the secondary ranging market condition to be continuing:

"The choppy trading over the last several trading days has resulted in a mixed outlook for GBP. We continue to hold a neutral view and expect this pair to trade in a broad 1.2960/1.3320 range for now."

GBP/USD Technical Analysis: bearish ranging within narrow support/resistance levels

GBP/USD D1: bearish ranging within narrow levels. The price is located below Ichimoku cloud for the ranging within the following support/resistance levels:

If the price breaks 1.2795 support level to below on close D1 bar so the bearish trend will be continuing.If the price breaks 1.3480 resistance to above on close D1 bar so the local uptrend as a bear market rally will be started.

If not so the price will be continuing with the ranging within the levels.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.07.27 10:57

GBP/USD Intra-Day Fundamentals: U.K. Gross Domestic Product and 51 pips range price movement

2016-07-27 08:30 GMT | [GBP - GDP]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

"Change in gross domestic product (GDP) is the main indicator of economic growth. GDP was estimated to have increased by 0.6% in Quarter 2 (Apr to June) 2016 compared with growth of 0.4% in Quarter 1 (Jan to Mar) 2016."==========

GBP/USD M5: 51 pips range price movement by U.K. Gross Domestic Product news event