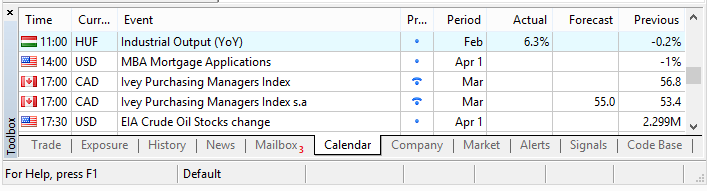

USD/CAD Intra-Day Technical Analysis - deep bearish

H4 price

is located below SMA with period 100 (100 SMA) and SMA with the period

200 (200 SMA) for the primary bearish market condition: price broke key support levels to below to be stopped by 1.2875 and 1.2831 support levels. For now, the price is on bearish ranging within 1.2831 bearish continuation support level and 1.3010 resistance level. RSI indicator is estimating the bearish trend to be continuing with the secondary ranging.

- If the price will break 1.3010 resistance level so the local uptrend as the bear market rally will be started.

- If price will break 1.2831 support so the bearish trend will be continuing.

- If not so the price will be ranging within the levels.

| Resistance | Support |

|---|---|

| 1.3010 | 1.2875 |

| 1.3080 | 1.2831 |

- Recommendation to go short: watch the price to break 1.2831 support level for possible sell trade

- Recommendation to go long: watch the price to break 1.3010 resistance level for possible buy trade

- Trading Summary: ranging

SUMMARY : ranging

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.04.02 09:21

Fundamental Weekly Forecasts for GBPUSD, USDJPY, AUDUSD, USDCAD and GOLD (based on the article)

USD/CAD - "Next week, Canada will announce employment data which has been volatile this year. In February, the rate was 7.3% with a drop in employment of 2.3 thousand jobs. Another critical component will be housing starts, which will help traders to see if the economy is weathering the year-over-year drop in oil price. Stability or improvement in these measures could further support the price of the Canadian Dollar, and the critical 1.2836 level could soon break."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.04.05 15:25

USD/CAD Intra-Day Fundamentals: Canadian international merchandise trade and 36 pips price movement

2016-04-05 13:30 GMT | [CAD - Trade Balance]

- past data is -0.6B

- forecast data is 0.9B

- actual data is -1.9B according to the latest press release

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - Trade Balance] = Difference in value between imported and exported goods during the reported month.

==========

"Canada's exports fell 5.4% to $43.7 billion in February, after reaching a record high in January. Export prices decreased 3.2% and volumes were down 2.2%. Imports declined 2.6% to $45.6 billion, as prices were down 1.4% and volumes decreased 1.2%. Consequently, Canada's merchandise trade deficit with the world widened from $628 million in January to $1.9 billion in February."

==========

USDCAD M5: 36 pips price movement by Canadian international merchandise trade news event :

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.04.06 12:44

Trading the News: Canada Ivey Purchasing Manager Index (PMI) (based on the article)

What’s Expected:

Why Is This Event Important:

A meaningful pickup in business spending may prompt BoC Governor

Stephen Poloz to adopt a hawkish tone for monetary policy, and the

central bank may show a greater willingness to move away from its easing

cycle following the ‘insurance’ rate-cuts from 2015.

However, subdued confidence paired with the slowdown in global trade may

drag on private-sector activity, and a dismal PMI print may spur a

further advance in USD/CAD as it fuels speculation for lower

borrowing-costs.

How To Trade This Event Risk

Bullish CAD Trade: Ivey PMI Advances

- Need to see red, five-minute candle following the release to consider a short trade on USD/CAD.

- If market reaction favors a bullish loonie trade, sell USD/CAD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

- Need green, five-minute candle to favor a long USD/CAD trade.

- Implement same setup as the bullish Canadian dollar trade, just in reverse.

USD/CAD Daily

- The downward trend from earlier this year may largely unwind in the days ahead amid the failed attempts to close below 1.2930 (61.8% expansion) to 1.2980 (61.8% retracement), while a bullish divergence appears to be taking shape in the Relative Strength Index (RSI).

- Interim Resistance: 1.3560 (100% expansion) to 1.3630 (38.2% retracement)

- Interim Support: 1.2800 (38.2% expansion) to 1.2831 (October low)

USDCAD M5: 24 pips price movement by Canada Ivey Purchasing Manager Index news event :

USDCAD Intra-Day Technical Analysis - secondary correction to the possible bearish reversal

H4 price

is on primary bullish condition with the secondary correction with the possible bearish reversal: the price is testing 1.3076 support level to be reversed from the primary bullish to the ranging bearish market condition. Chinkou Span line is located above the price for the ranging bullish trend by direction, and Absolute Strength indicator is estimating the ranging condition in the near future.

| Resistance | Support |

|---|---|

| 1.3180 | 1.3076 |

| 1.3218 | 1.3018 |

If

H4 price will break 1.3076 support level on close H4 bar so the reversal of the price movement from the primary bullish to the ranging bearish will be started.

If H4 price will break 1.3180 resistance level so the primary bullish trend will be continuing.

If not so the price will be ranging within the levels.

- Recommendation for long: watch close H4 price to break 1.3180 for possible buy trade

- Recommendation

to go short: watch H4 price to break 1.3076 support level for possible sell trade

- Trading Summary: correction

SUMMARY : bullish

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.04.08 16:03

USD/CAD Intra-Day Fundamentals: Canada's Employment Change and 62 pips price movement

2016-04-08 13:30 GMT | [CAD - Employment Change]

- past data is -2.3K

- forecast data is 10.4K

- actual data is 40.6K according to the latest press release

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - Employment Change] = Change in the number of employed people during the previous month.

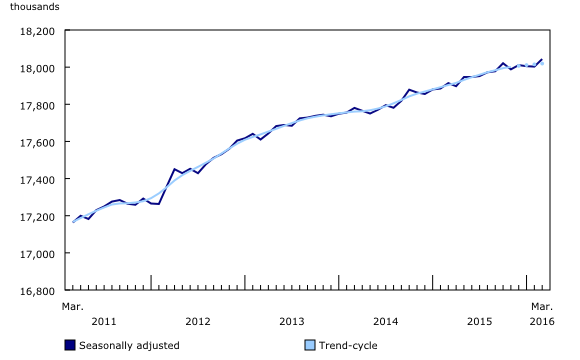

==========

- "After three months of little change, employment increased by 41,000 (+0.2%) in March, lowering the unemployment rate by 0.2 percentage points to 7.1%."

- "With the gains in March, employment grew by 0.2% in the first quarter (+33,000). This was the fourth consecutive quarter with 0.2% employment growth."

- "In the 12 months to March, employment increased by 130,000 (+0.7%), the result of growth in full-time work. Over the same period, the number of hours worked increased by 1.2%."

==========

USDCAD M5: 62 pips price movement by Canada's Employment Change news event :

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.04.13 16:28

USD/CAD Intra-Day Fundamentals: BoC Overnight Rate and 71 pips range price movement

2016-04-13 14:00 GMT | [CAD - Overnight Rate]

- past data is 0.50%

- forecast data is 0.50%

- actual data is 0.50% according to the latest press release

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - Overnight Rate] = Interest rate at which major financial institutions borrow and lend overnight funds between themselves.

==========

"The Bank of Canada today announced that it is maintaining its target for the overnight rate at 1/2 per cent. The Bank Rate is correspondingly 3/4 per cent and the deposit rate is 1/4 per cent."

"Growth in the global economy is expected to strengthen gradually from about 3 per cent in 2016 to 3 1/2 per cent in 2017-18, a weaker outlook than the Bank had projected in its January Monetary Policy Report (MPR). After a slow start to 2016, the US economy is expected to regain momentum, but with a lower profile and a composition that is less favourable for Canadian exports. Financial conditions have improved, partly in response to expectations of more accommodative monetary policy in some major economies."

==========

USD/CAD M5: 71 pips range price movement by BoC Overnight Rate news event :

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.04.15 14:57

USD/CAD Intra-Day Fundamentals: Canada Manufacturing Shipments and 15 pips range price movement

2016-04-15 12:30 GMT | [CAD - Manufacturing Sales]

- past data is 2.3%

- forecast data is -1.4%

- actual data is -3.3% according to the latest press release

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - Manufacturing Sales] = Change in the total value of sales made by manufacturers.

==========

- "Manufacturing sales decreased 3.3% to $51.2 billion in February, following three months of consecutive gains."

- "Sales were down in 16 of 21 industries, representing 73.5% of the manufacturing sector. Motor vehicles and petroleum and coal products were responsible for over two-thirds of the decrease. Motor vehicle parts, aerospace product and parts, and machinery also contributed to the decline."

- "In constant dollars, sales declined 2.0%, reflecting a lower volume of goods sold."

==========

USD/CAD M5: 15 pips range price movement by Canada Manufacturing Shipments news event :

Forum on trading, automated trading systems and testing trading strategies

Market Condition Evaluation based on standard indicators in Metatrader 5

Sergey Golubev, 2016.04.18 10:29

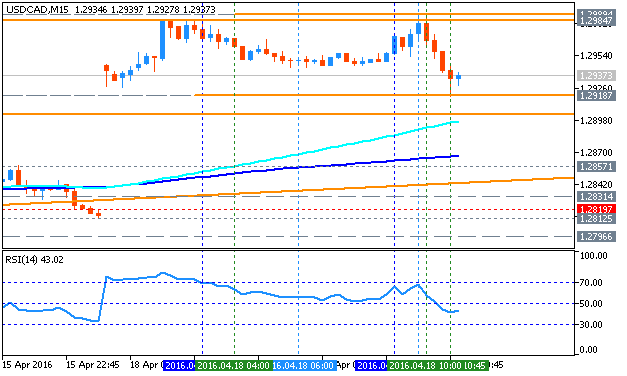

After Doha failure - new intra-day levels for AUD/USD and USD/CAD

USD/CAD M15: ranging on the bearish reversal area after good bullish breakout. This price for this pair broke 100 period SMA (100 SMA) and 200 period SMA (200 SMA) for good breakout up to 1.2989 resistance level. Intra-day price is located on the bullish area of the chart for the ranging within key s/r levels for the intra-day bullish trend to be continuing or to the bearish reversal to be started.

- if the price breaks 1.2989 resistance so the primary bullish trend will be continuing;

- if the price breaks 1.2819 support level so the bearish reversal will be started without secondary ranging with good possible breakdown;

- if not so the price will be moved within the channel.

| Resistance | Support |

|---|---|

| 1.2989 | 1.2918 |

| 1.2984 | 1.2819 |

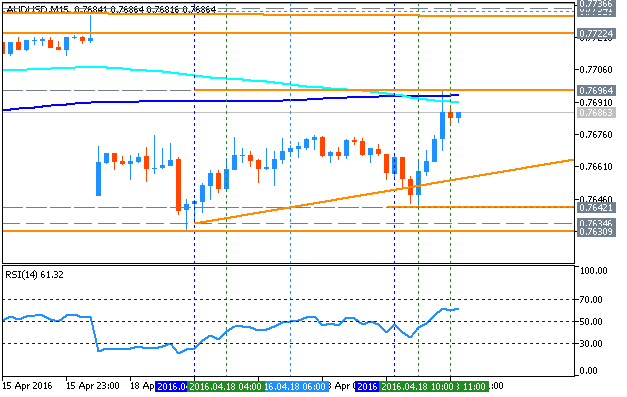

AUD/USD M15: breaking 0.7696 resistance to above for the reversed back to intra-day bullish. The price broke 100 SMA/200 SMA ranging reversal area to below for the primary bearish market condition. Intra-day price is on bear market rally for now for trying to break 100 SMA/200 SMA together with 0.7696 resistance once again to above to be reversed back to the bullish market condition.

- if the price breaks 0.7696 resistance so the reversal of the price movement from the ranging bearish to the primary bullish condition will be started;

- if the price breaks 0.7642 support level so the primary bearish will be continuing without ranging up to 0.7630 level as the nearest bearish target;

- if not so the price will be moved within the channel.

| Resistance | Support |

|---|---|

| 0.7696 | 0.7642 |

| 0.7722 | 0.7630 |

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.04.19 17:21

USD/CAD Intra-Day Fundamentals: BOC Governor Stephen Poloz speech and 18 pips price movement

2016-04-19 15:00 GMT | [CAD - BOC Gov Poloz Speaks]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[CAD - BOC Gov Poloz Speaks] = The speech along with Deputy Governor Carolyn Wilkins before the House of Commons Standing Committee on Finance, in Ottawa.

==========

"In terms of the Bank’s primary mandate, total CPI inflation is currently below our 2 per cent target. The upward pressure on imported prices coming from the currency depreciation is being more than offset by the impact of lower consumer energy prices and the downward pressure coming from excess capacity in the economy. As these factors diminish, total inflation is projected to converge with core inflation and be sustainably on target sometime in the second half of next year."

"To sum up where we are, while recent economic data have been encouraging on balance, they’ve also been quite variable. The global economy retains the capacity to disappoint further, the complex adjustment to lower terms of trade will restrain Canada’s growth over much of our forecast horizon, and households’ reactions to the government’s fiscal measures will bear close monitoring. We have not yet seen concrete evidence of higher investment and strong firm creation. These are some of the ingredients needed for a return to natural, self-sustaining growth with inflation sustainably on target."

==========

USD/CAD M5: 18 pips price movement by BOC Governor Stephen Poloz speech news event :

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.03.31 14:41

USD/CAD Intra-Day Fundamentals: Canada's Gross Domestic Product and 51 pips price movement

2016-03-31 13:30 GMT | [CAD - GDP]

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

==========

USDCAD M5: 51 pips price movement by Canada's Gross Domestic Product news event :