You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.06.08 10:48

GBP/USD Intra-Day Fundamentals: U.K. Manufacturing Production and 37 pips price movement

2016-06-08 08:30 GMT | [GBP - Manufacturing Production]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Manufacturing Production] = Change in the total inflation-adjusted value of output produced by manufacturers.

==========

"Total production output is estimated to have increased by 2.0% in April 2016 compared with March 2016. There were increases in 3 of the 4 main sectors, with the largest contribution coming from manufacturing, which increased by 2.3%, the largest rise since July 2012."

==========

GBP/USD M5: 37 pips price movement by U.K. Manufacturing Production news event

H4 price is on ranging near 100 SMA/200 SMA reversal area waiting for the direction of the trend.

If the price breaks 1.4658 resistance to above on close H4 bar so the primary bullish trend will be resumed with 1.4724 level as a nearest possible target.If H4 price breaks 1.4434 support level to below on close bar so the primary bearish market condition will be continuing with 1.4351 possible bearish target to re-enter.

If not so intra-day price will be on ranging for direction.

SUMMARY : ranging inside reversal area

TREND : waiting to breaks the levels for the direction of the trendForum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.06.09 10:57

GBP/USD Fundamentals: U.K. Goods Trade Balance and 12 pips price movement

==========

2016-06-09 08:30 GMT | [GBP - Goods Trade Balance]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Goods Trade Balance] = Difference in value between imported and exported goods during the reported month.

==========

"The deficit on trade in goods was £10.5 billion in April 2016; narrowing by £0.1 billion from March 2016. This narrowing reflected an increase in exports (up £2.2 billion to £26.1 billion) and an increase in imports (up £2.0 billion to £36.6 billion)."

==========

GBP/USD M5: 12 pips price movement by Goods Trade Balance news event

==========

GBP/USD Daily Technicals: ranging within 2-week high/low levels for direction

Daily price is on ranging between 100 SMA and 200 SMA reversal area waiting for direction within the following support/resistance levels:

Descending triangle pattern was formed by the price to be crossed for the bearish condition to be continuing.

- Recommendation

to go short: watch close daily price to break 1.4351 support level for possible sell trade

- Recommendation

to go long: watch close daily price to break 1.4739 resistance level for possible buy trade

- Trading Summary: ranging

SUMMARY : ranging for directionForum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.06.11 10:11

Fundamental Weekly Forecasts for Dollar Index, NZD/USD, GBP/USD, USD/CAD, USD/CNH, USD/JPY, AUD/USD and GOLD (based on the article)

GBP/USD - "What happens to the Sterling if the UK votes for “Brexit”? The short answer seems obvious—the GBP will fall. By how much? This question is substantially more complicated, but current FX Options prices suggest anywhere between 4-7 percent in one fell swoop. The ensuing uncertainty would almost certainly produce shockwaves beyond Britain’s shores and onto broader global financial markets, and modeling every possibility seems nearly impossible."Daily price is breaking 1.4351 support level together with 100 SMA for the primary bearish market condition to be resumed. descending triangle pattern was formed by the price to be broken to below for the bearish trend to be continuing with 1.4089 as a nearest bearish target. Alternative, if the price crosses 1.4769 resistance to above so the bullish reversal will be started, otherwise - ranging within 100 SMA/200 SMA levels for the waiting for direction.

SUMMARY : breakdown

TREND : bearishForum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.06.14 08:45

Trading News Events: U.K. Consumer Price Index (adapted from the article)-

"A pickup in the headline & core U.K. Consumer Price Index (CPI) may

spark a near-term rebound in GBP/USD as it puts pressure on the Bank of

England (BoE) to normalize monetary policy sooner rather than later."

- "Even though the economic outlook remains clouded by the U.K. Referendum

on June 23, signs of heightening price pressures may encourage the BoE

to adopt a more hawkish tone for monetary policy as Governor Mark Carney

and Co. see a risk of overshooting the 2% inflation-target over the

policy horizon."

What’s Expected:===

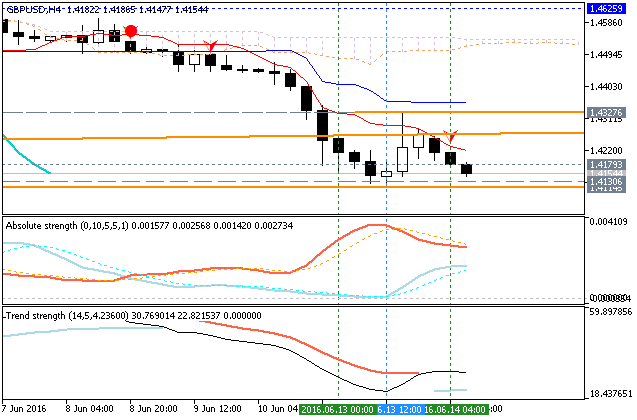

GBP/USD Technical Analysis: daily bearish breakdown, intra-day ranging bearish

GBPUSD D1: bearish breakdown. The daily price is on bearish market condition: price broke Ichimoku cloud to below for good breakdown with 1.4130 support level. Absolute Strength indicator and Trend Strength indicator are estimating the bearish trend to be continuing.

If the price breaks 1.4130 support to below on close D1 bar so the bearish breakdown will be continuing.

If the price breaks Senkou Span line at 1.4480 to above so the reversal of the price movement to the primary bullish condition will be started.

If not so the price will be on ranging bearish within the levels.

GBPUSD H4: bearish ranging within narrow levels. The price is on bearish condition for the ranging within narrow support/resistance levels: 1.4130 support and 1.4327 resistance.

If the price breaks 1.4130 support to below on close H4 bar so the bearish trend will be continuing.If the price breaks 1.4327 resistance to above so the local uptrend as the bear market rally will be started.

If not so the price will be on ranging bearish within the levels.

GBP/USD M5: 36 pips range price movement by U.K. CPI news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.06.15 11:58

GBP/USD Intra-Day Fundamentals: U.K. Jobless Claims and 34 pips price movement

2016-06-15 08:30 GMT | [GBP - Claimant Count Change]

if actual < forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Claimant Count Change] = Change in the number of people claiming unemployment-related benefits during the previous month.

==========

==========

GBP/USD M5: 34 pips price movement by U.K. Jobless Claims news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.06.16 14:20

GBP/USD Intra-Day Fundamentals: BoE Official Rate and 26 pips price movement

2016-06-16 11:00 GMT | [GBP - Official Bank Rate]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Official Bank Rate] = Interest rate at which the BOE lends to financial institutions overnight.

==========

"The Bank of England’s Monetary Policy Committee (MPC) sets monetary policy to meet the 2% inflation target and in a way that helps to sustain growth and employment. At its meeting ending on 15 June 2016 the MPC voted unanimously to maintain Bank Rate at 0.5%. The Committee also voted unanimously to maintain the stock of purchased assets financed by the issuance of central bank reserves at £375 billion."==========

GBP/USD M5: 26 pips price movement by BoE Official Rate news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.06.23 09:08

U.K. Brexit Referendum: Polls Open (based on the article)

==========

EUR/USD M5: 17 pips price movement by Brexit Referendum: Polls Open news event

==========

GBP/USD M5: 67 pips price movement by Brexit Referendum: Polls Open news event

FTSE 100 and GBP/USD - breakout with daily bullish reversal

FTSE 100 index and GBP/USD pair is on bullish breakout: the prices broke 200 SMA to be reversed from the bearish to the primary bullish market condition.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.06.24 08:45

U.K. Voters Back 'Brexit,' Will Leave European Union (based on the article)

==========

EUR/USD : 465 pips price movement by Brexit Referendum Final Results Expectation

==========

GBP/USD : 1,639 pips price movement by Brexit Referendum Final Results Expectation