You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

How to Start with Metatrader 5

Sergey Golubev, 2013.09.20 08:21

Summaries :

====

Forum on trading, automated trading systems and testing trading strategies

NEWBIE: Is the signal I subscribed workable on MT4 Demo account?

Stuart Browne, 2016.03.31 06:20

Paid signal works only on real account

Free signal works only on demo account

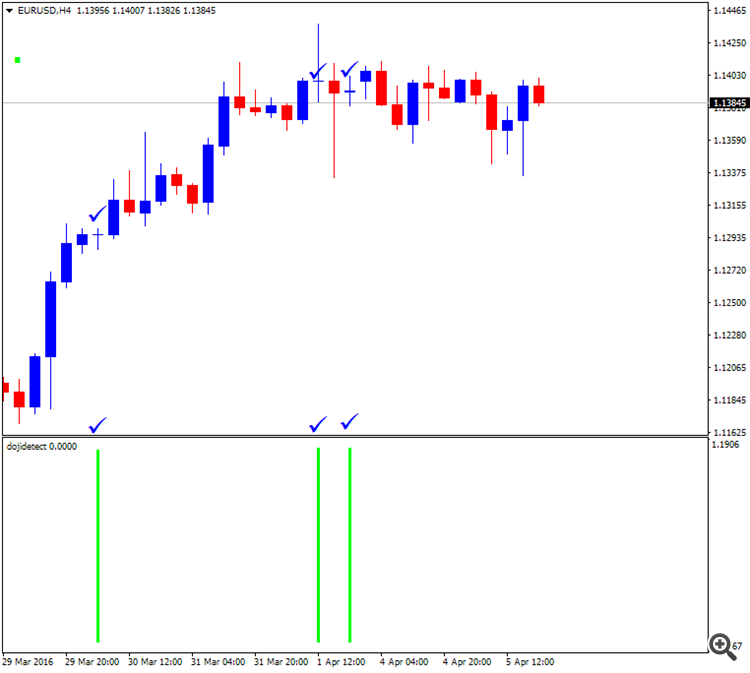

Doji Candle Detection - indicator for MetaTrader 4

This is interesting indicator which is detecting the Doji in separate window as a histogram with alerts:

Schaff Trend Cycle

Schaff Trend Cycle - indicator for MetaTrader 4

Schaff Trend Cycle - indicator for MetaTrader 5

=======

MetaTrader Trading Platform Screenshots

EURUSD, M15, 2013.07.30

MetaQuotes Software Corp., MetaTrader 5, Demo

135 pips

Forum on trading, automated trading systems and testing trading strategies

Indicators: Schaff Trend Cycle

Sergey Golubev, 2013.07.30 08:50

There are a lot of trading systems based on this indicator. So, this is the one of them :

Schaff Trend Cycle with EMA 100

1. Time Frame: 15 min and above

2. Pairs: Any

3. Indicators:

Rules to enter a long trade

Rules to enter a short trade

Template is attached. If you instal indicatiors and use this template so you will get the chart like that:

The system is really very profitable - look at the other chart with D1 timeframe: +439 pips (4 digit pips) :

MetaTrader Trading Platform Screenshots

USDJPY, H1, 2013.07.30

MetaQuotes Software Corp., MetaTrader 5, Demo

schaff ema 100

MetaTrader Trading Platform Screenshots

USDJPY, D1, 2013.07.30

MetaQuotes Software Corp., MetaTrader 5, Demo

439 pips in profit

Ilan1.4 - expert for MetaTrader 4

This is old but famous martingale EA. If you go to the link above so you will find EA itself together with set files - more than 30 set files/settings for many pairs and timeframes. I traded by this EA today for few hours for EURUSD M15 and USDJPY M30 (on demo account sorry) with the settings/set files attached (see nd_set.zip attachment). Statement is attached as well (look at trading_statement.zip attachment):

Some comments about lot size: if you use the setting from this CodeBase link so make sure to check the following:

Just to remind: this EA is very dangerous one so it may be good to use it on demo account only sorry.

============

PS. Updated statement is attached:

============

PS. Statement was updated once more time (13 of April 2016):

Risk to Reward Ratio

Forum on trading, automated trading systems and testing trading strategies

Importance of Risk / Reward ratio to make profits

pankaj bhaban, 2014.11.21 04:17

Importance of Risk / Reward ratio in Forex

What could be the most important thing to keep making money in long term without failing?

What ever be the winning / losing ratio of your strategy!

Whichever be the timeframe and pair!

Yeah its Risk / Reward ratio in your trading

What is Risk / Reward ratio? --

This ratio is mathematical formula dividing the amount trader afford to lose if the price moves in the unexpected direction (i.e. the risk) by the amount of profit the trader expects to have made when the position is closed (i.e. the reward).

Or in very simple stoploss / takeprofit ratio on each trade.

Why is it important? --

eg.

Considering all above cases with say winning percent only 70% i.e out of 10 trades 7 are won.

Case 1 :

Profits = 300 pips X 7 trades = 2100 pips

Loss = 100 X 3 trades = 300

Total profits = 2100-300 = 1800 pips

Case 2 :

Profits = 200 pips X 7 trades = 1400 pips

Loss = 100 X 3 trades = 300

Total profits = 1400-300 = 1100 pips

Case 3 :

Profits = 100 pips X 7 trades = 700 pips

Loss = 100 X 3 trades = 300

Total profits = 700-300 = 400 pips

Case 4 :

Profits = 50 pips X 7 trades = 350 pips

Loss = 100 X 3 trades = 300

Total profits = 350-300 = 50 pips

Case 5 :

Profits = 25 pips X 7 trades = 175 pips

Loss = 100 X 3 trades = 300

Total profits = 175-300 = -125 pips

In the above strategy you can see as risk / reward ratio increases the profits decreases eventually.

So in trading do maintain a good stoploss to takeprofit ratio.

Maintaining such ratio becomes difficult in manual trading due to emotions trader tries to close profitable trades as soon as possible where as waits long for for a losing position to recover!

Maintaining Good risk / reward ratio : I would recommend using Expert advisor in such case which sticks to strategy and exits though on profitable as well floating negative trades.

Which ever strategy with good risk/reward ratio you use in manual trading get it coded into Expert advisor i.e automatic trading robot in MT4 /MT5 and use it to trade.

Any comments / suggestions most welcome

Thank you.

Forum on trading, automated trading systems and testing trading strategies

Food for thought and brainstorming

Simon Gniadkowski, 2013.03.14 23:13

Take a look at this chart, it shows the relation between Win rate (WR) and Risk:Reward (R:R), in this case the spread was 0 and uses a simulated coin toss with an even number of Long and Short trades taken at random with no attempt to predict the direction of the market. You will see for a 50:50 R:R scenario the WR is 50%.

You said TP and SL are 40 pips, did you mean 40 pips or 40 points ? Yo need a figure that is at last 10 times the spread or the spread will play a big part in your results.

---------

Risk/Reward Ratio - indicator for MetaTrader 4

"This code help to decide fast what trades respects your ratio requirements."

Directed Movement - indicator for MetaTrader 4

Forecast Trend for Midterm

DELETE ADS

By the way, braintrading system was already converted to MT5 and we can find it in CodeBase. But BrainTrading system is very different from asctrend:

So, those systems may look very similar on the charts but they are having different ideology concerning enter and exit. 'Different ideology' means the following: we need different additional indicators for those systems.

Forum on trading, automated trading systems and testing trading strategies

Signal Systems

Sergey Golubev, 2016.04.17 08:34

This indicator is very similar with Brainwating indicator: it gives the signals on reversal of the trend (in the beginning of the trend started):

AltrTrend Signal v2 2 - indicator for MetaTrader 4

This indicator is having many false signals so it is necessary to filter the signals by using the other indicator asa filter. Anyway, this AltrTrend Signal v2 2 is providing more earlier signal than BrainTrading indicators.Just for the people who are following the thread:

Forum on trading, automated trading systems and testing trading strategies

How to Start with Metatrader 5

Sergey Golubev, 2016.04.21 16:35

This is very good thread was started (for discussion, to follow, or just simple talking, or whatsoever): Are you ready to give up MT4 for MT5 ?

Just for information