- Harmonic trading. Did you traders ever tried it?

- Harmonic Trading

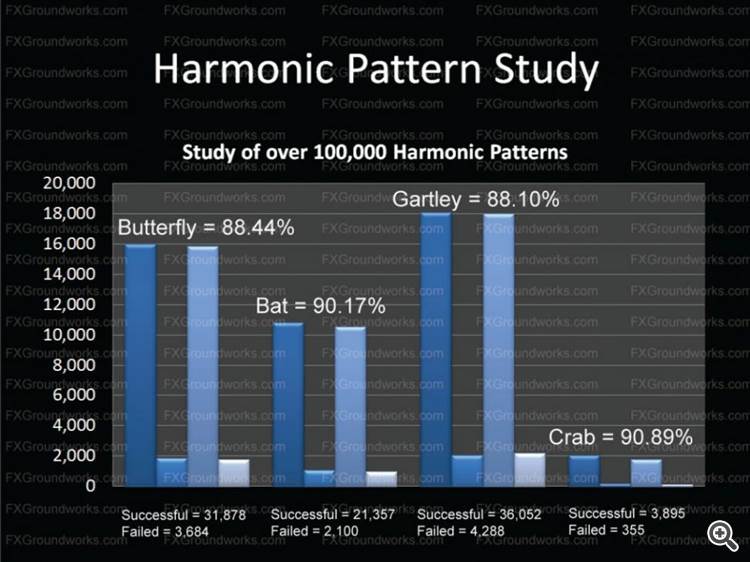

- Price Patterns(Gartley,Butterfly,Bat,...)

Some of the traders I know trade harmonic patterns. I know some traders who are succesful trading these systems. I would like to know what your experience is with Harmonic trading

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video November 2014

Sergey Golubev, 2014.11.27 10:23

Suri Duddella, Webinar: The Success and Failure of Chart Patterns

Suri Duddella, 19+ years full-time Futures/Equities/Options Trader.

Patterns based Algorithmic Trading. Author -- "Trade Chart Patterns

Like The Pros" book.

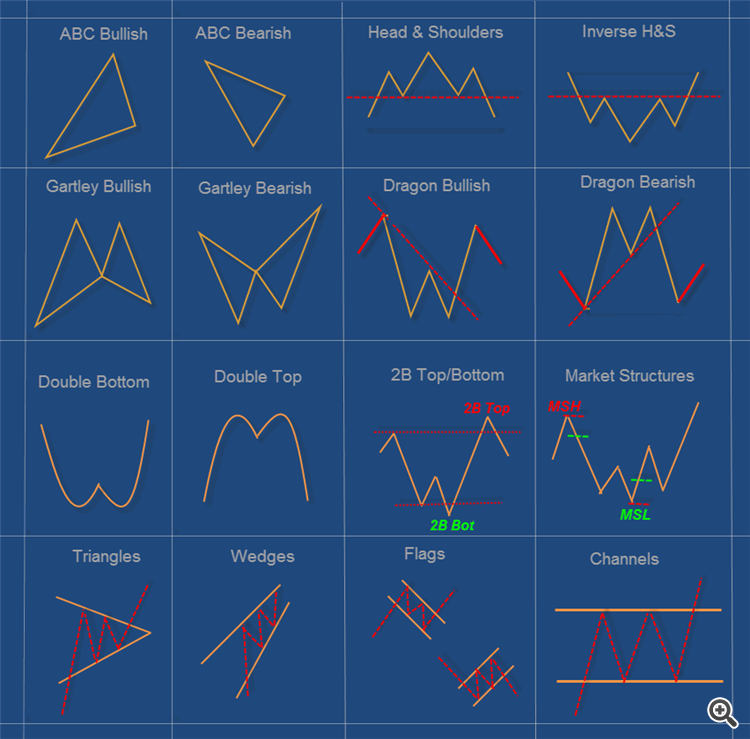

- Chart Pattern Modeling

- Essential pattern structure components and analysis

- Practical statistics of patterns success and failures

- Examples of many patterns

======

A chart pattern is a distinct formation on a stock chart that

creates a trading signal, or a sign of future price movements. Chartists

use these patterns to identify current trends and trend reversals and

to trigger buy and sell signals.

Identifying chart

patterns is simply a system for predicting stock

market trends and turns! Well, a trend is merely an indicator

of an imbalance in the supply and demand. These

changes can usually be seen by market action through

changes in price. These price changes often form

meaningful chart patterns that can act as signals

in trying to determine possible future trend developments.

Research has proven that some patterns have high

forecasting probabilities. These patterns include:

The Cup & Handle, Flat Base, Ascending and

Descending Triangles, Parabolic Curves, Symmetrical

Triangles, Wedges, Flags and Pennants, Channels and

the Head and Shoulders Patterns.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use