You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

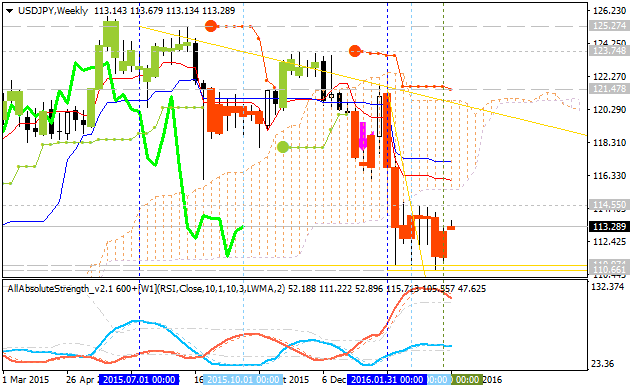

USDJPY Technical Analysis 2016, 13.03 - 20.03: ranging on reversal

Daily price is located below Ichimoku cloud for the primary bearish market condition: the price is ranging within the following key support/resistance lines:

Chinkou Span line is below the price for the ranging bearish condition by the direction, and Trend Strength indicator is estimating the local uptrend as the bear market rally to be started in the near future for example.

If D1 price will break 110.97 support level on close bar so the bearish trend will be continuing.

If D1 price will break 114.55 resistance level on close bar from below to above so the reversal of the price movement from the primary bearish to the ranging bullish condition will be started.

If not so the price will be on ranging within the levels.

SUMMARY : ranging within reversal area

TREND : bearishForum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.03.13 11:40

Fundamental Weekly Forecasts for US Dollar, GBP/USD, USDJPY, and GOLD (based on the article)

US Dollar - "The Dollar has dropped ahead of the important meeting deflating some of the hawkish premium, but there is still considerable bullish interest behind the currency considering it a mild pace would still be a severe contrast to its counterparts. Furthermore, we have seen a shift in how the market responds to further drive to the dovish extreme of the policy spectrum. The BoJ adopted negative rates and saw the markets flip against the traditional ‘dovish move equates to bullish capital market, bearish currency’ equation within 24 hours. The ECB’s stimulus bomb this past week broke the function instantly. The market response will likely be a settling of confused speculative interpretations."

GBP/USD - "For the British Pound the big-picture trend remains fairly clear—the GBP/USD exchange rate has fallen in 14 out of the past 19 months. The biggest risk remains a British exit (“Brexit”) from the European Union and the uncertainty it represents. Until there is clarity on that front we do not expect a material GBP recovery."

USD/JPY - "The strong JPY year-to-day is likely to have companies expanding more slowly as their goods have become more expensive by nearly 5% on a global scale to where they were at the end of 2015, and at the same time, demand from Asian countries may continue to drop on tightened lending conditions."

GOLD (XAU/USD) - "Gold looks to be marking a weekly doji after stretching into a fresh yearly high of 1284. Heading into the FOMC next week, the long-side is vulnerable for a pullback but the broader trade remains constructive while above slope support extending off the July low. Key near-term topside resistance objectives stand at the 2015 high-week close at 1239 backed by the 2014 high-week reversal close at 1334. A break sub-1151/55 would be needed to reassert the broader short-trend in bullion."

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.03.14 08:20

USD/JPY Intra-Day Fundamentals: Japan Machine Orders and 19 pips range price movement

2016-03-13 23:50 GMT | [JPY - Core Machinery Orders]

if actual > forecast (or previous one) = good for currency (for JPY in our case)

[JPY - Core Machinery Orders] = Change in the total value of new private-sector purchase orders placed with manufacturers for machines, excluding ships and utilities.

==========

USDJPY M5: 19 pips range price movement by Japan Machine Orders news event :

Forum on trading, automated trading systems and testing trading strategies

Market Condition Evaluation based on standard indicators in Metatrader 5

Sergey Golubev, 2016.03.17 16:39

Forecast for Tomorrow - levels for EUR/USD, GBP/USD, USD/JPY

EUR/USD: intra-day breakout. This pair is on bullish intra-day breakout for H4 timeframe: price broke key resistance levels on the way to uptrend and it was bounced from 1.1342 resistance level. Chinkou Span line is located to be above the price indicating the intra-day breakout to be continuing. If the price breaks 1.1342 resistance to above so the primary bullish trend will be re-started, otherwise - ranging bullish.

GBP/USD: bullish breakout with 1.4481 resistance to be broken for the breakout to be continuing. The intra-day price (H4) for this pair is on very similar situation with EURUSD: intra-day breakout. The price was bounced from 1.4481 level on the way to uptrend. Absolute Strength indicator is estimating the bullish trend, and Chinkou Span line is indicating the breakout to be continuing in the near future.

USD/JPY: ranging bearish. Intra-day price (H4) is located to be below Ichimoku cloud for the primary bearish market condition: the price is started to be ranging within 110.66 support and 112.22 resistance levels. Absolute Strength indicator is estimating for the bearish trend to be continuing, and Chinkou Span line is indicating the ranging bearish condition in the near future.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.03.19 09:30

Fundamental Weekly Forecasts for US Dollar, EURUSD, GBPUSD, AUDUSD, NZDUSD and GOLD (based on the article)

US Dollar - "The S&P 500 and other risk-oriented markets have extended a multi-week climb; but the fundamental backdrop to support the move is more than porous. Abrupt market moves are more likely to align to risk aversion; and the Greenback is likely to revert to a more responsive haven status. Risk or data moves this week however will be tempered somewhat by holiday trading conditions as March 25 is Good Friday for many markets."

EUR/USD - "Next week is devoid of high-importance news events out of Europe, but there are numerous medium and low-importance announcements on the docket. The highlights are German data on Tuesday, both the IFO and the German Zew Survey, while Wednesday brings consumer confidence numbers and Thursday brings PMI’s for the Euro-Zone, France and Germany. Each of these could be market moving, but given that much of this data was compiled before the announcement of Mr. Draghi, expect down-side prints to be somewhat muted while top-side data gets accentuated by markets."

GBP/USD - "In turn, a slew of positive U.K. data prints accompanied by waning U.S. interest-rate expectations may fuel a further short-squeeze in GBP/USD as there appears to be a shift in market positioning."

AUD/USD - "The correlation between the currency and the S&P 500 stock index – a benchmark for market-wide risk trends – remains elevated at 0.92 on rolling 20-day studies. Alternatively, upbeat outcomes may yield the opposite dynamic."

NZD/USD - "Considering the upcoming data, NZD/USD may continue to advance into the December high (0.6882), and the key developments coming out of New Zealand’s construction, retail spending and business services could make up for the drop in Dairy exports. If the New Zealand economy remains stable at the same time that the U.S. Dollar goes without a bid, we could soon move closer to 0.7000."

GOLD (XAU/USD) - "From a technical standpoint, gold is trading at some tricky levels as the pair struggles to solidify a break above a parallel extending off the 2015 October high as momentum continues to hold below the 70-threshold. The risk remains for a pullback in price with interim support eyed at 1246/50 backed by soft support at 1225 & our bullish invalidation level at 1194. We’ll be looking for move lower towards these levels to offer favorable long-entries with a breach of the highs targeting the 2015 high-week close backed at 1294 closely by the 2015 high-day close at 1301. Subsequent topside targets are eyed at the 2014 high week reversal close at 1293."

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.03.23 07:43

Technical Targets for USD/JPY by United Overseas Bank (based on the article)

USD/JPY: back to 110.66

Daily price is located below 100 period SMA and 200 period SMA for the primary bearish market condition with the secondary ranging within 110.66 support level and 113.81 resistance level.

RSI indicator is estimating the secondary ranging to be continuing.

USDJPY Technical Analysis 2016, 27.03 - 03.04: rally to the bullish reversal

Daily price is on bearish market condition located to be below Ichimoku cloud: the price is on secondary rally which was started in the middle of March this year.Key psy resistance level at 113.00 is going to be crossed by daily price for the rally to be continuing up to 114.87 resistance level as the next bullish reversal target. Chinkou Span line is located to be near and below the price to be ready for good possible breakout, and Absolute Strange indicator is evaluating the price movement as the secondary ranging condition to be started.

If D1 price will break 110.66 support level on close bar so the primary bearish trend will be re-started.

If D1 price will break 113.00 resistance level on close bar from below to above so the local uptrend as the bear market rally will be continuing.

If D1 price will break 114.87 resistance level on close bar so the reversal of the price movement from the primary bearish to the primary bullish market condition will be started with the secondary ranging: the price will be located inside Ichimoku cloud.

If not so the price will be on ranging within the levels.

SUMMARY : bear market rally

TREND : bearishForum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.03.28 17:55

A false warning signal for the speculative JPY longs (based on the article)

BNP Paribas publish the article today about "a warning signal for the speculative JPY longs which are running at the highest level since 2011 according to our positioning indicator" - just because "Japanese investors purchasing some JPY 2.3 trn in foreign dent on the week ended March 18."

Let's evaluate this information.

Daily price. If we look at the daily chart so the price is located to be below Ichimoku cloud in the primary bearish market condition within 114.55 key bullish reversal resistance level and 110.66 key bearish continuation support level. But the price broke symmetric triangle pattern to above together with Chinkou Span line to be going to cross the price to above for good possible breakout with the reversal of the price movement to the primary bullish market condition. So, the most likely scenario for daily price is the bear market rally to be continuing with the good breakout possibility: the key resistance level at 114.55 will likely to be broken with the possible reversal to the bullish trend.

Weekly price is on bearish market condition as well to be located below ichimoku cloud for the ranging within the same key s/r levels: 114.55 and 110.66. Chinkou Span line together with Absolute Strength indicator are estimating the trend to be ranging bearish. So, there are 3 most likely scenarios for weekly price movement for the next few months:

Thus, I do not see any technical reason for such a warning which BNP Paribas made about strengthening JPY against USD: the situation is going to be made in exact opposite way: bear market rally with the possible bullish reversal for D1 timeframe, and ranging rally to be started on weekly timeframed chart for example.Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.03.29 07:39

USD/JPY Intra-Day Fundamentals: Japan Household Spending and 10 pips price movement

2016-03-29 00:30 GMT | [JPY - Household Spending]

if actual > forecast (or previous one) = good for currency (for JPY in our case)

[JPY - Household Spending] = Change in the inflation-adjusted value of all expenditures by consumers.

==========

(1) "Expenditures for Two-or-more-person Households

The average of monthly consumption expenditures per household for February 2016 was 269,774 yen, up 1.6% in nominal terms and up 1.2% in real terms from the previous year."

(2) "Income and Expenditures for Workers' Households

The average of monthly income per household stood at 478,624 yen, down 2.0% in nominal terms and down 2.4% in real terms from the previous year.

The average of consumption expenditures per household was 297,662 yen, up 2.2% in nominal terms and up 1.8% in real terms from the previous year."

==========

USDJPY M5: 10 pips price movement by Japan Household Spending news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.03.29 21:17

"The FOMC left the target range for the federal funds rate unchanged in January and March, in large part reflecting the changes in baseline conditions that I noted earlier. In particular, developments abroad imply that meeting our objectives for employment and inflation will likely require a somewhat lower path for the federal funds rate than was anticipated in December.

Given the risks to the outlook, I consider it appropriate for the Committee to proceed cautiously in adjusting policy. This caution is especially warranted because, with the federal funds rate so low, the FOMC's ability to use conventional monetary policy to respond to economic disturbances is asymmetric. If economic conditions were to strengthen considerably more than currently expected, the FOMC could readily raise its target range for the federal funds rate to stabilize the economy. By contrast, if the expansion was to falter or if inflation was to remain stubbornly low, the FOMC would be able to provide only a modest degree of additional stimulus by cutting the federal funds rate back to near zero.9

One must be careful, however, not to overstate the asymmetries affecting monetary policy at the moment. Even if the federal funds rate were to return to near zero, the FOMC would still have considerable scope to provide additional accommodation. In particular, we could use the approaches that we and other central banks successfully employed in the wake of the financial crisis to put additional downward pressure on long-term interest rates and so support the economy--specifically, forward guidance about the future path of the federal funds rate and increases in the size or duration of our holdings of long-term securities. While these tools may entail some risks and costs that do not apply to the federal funds rate, we used them effectively to strengthen the recovery from the Great Recession, and we would do so again if needed."======

14 pips price movement for EURUSD was immediate effect after Fed Chair Yellen Speech. The medium term situation related to this Speech after publishing it on Federal Reserve website are the following:

1. EURUSD M5: 82 pips price movement by Fed Chair Yellen Speech news event :

2. GBPUSD M5: 106 pips price movement by Fed Chair Yellen Speech news event :

3. USDJPY M5: 55 pips price movement by Fed Chair Yellen Speech news event :

4. GOLD (XAU/USD) M5: 1,406 pips price movement by Fed Chair Yellen Speech news event :