Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.11.01 05:50

Fundamental Analysis by Credit Agricole: what we’re watching (based on efxnews article)

Credit Agricole made a fundamental forecasts related to the price of some pairs movement during some high impacted news events for the week.

Fundmental analysis:

- USD - "Friday’s US labour data should prove constructive enough to keep the Fed on track with considering higher rates in December. As such, we remain in favour of buying USD on dips."

- GBP - "Although next week’s inflation report is likely to confirm rising downside risks to growth and inflation, we believe there is little scope of falling BoE rate expectations from the current levels."

- AUD - "Given more muted price developments and ongoing uncertainty as related to Asia, it cannot be ruled out that the RBA will decide in favour of lower rates. We favour selling AUD rallies."

- NOK - "We see little scope of the Norges Bank turning more dovish next week. The NOK should remain driven by external factors such as oil prices."

Technical analysis:

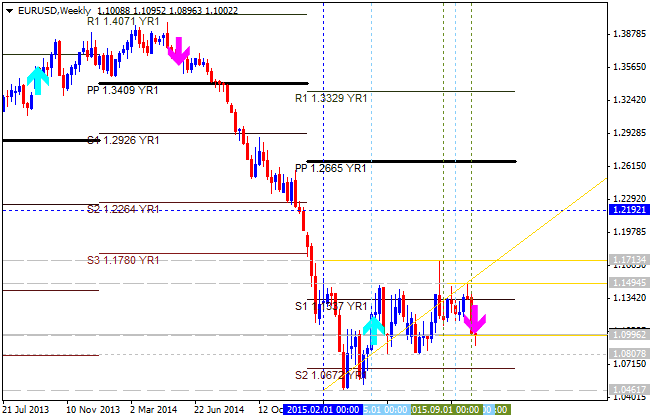

- EUR/USD - the price is located below YR1 Central Pivot for the bearish market condition with the ranging within S1 Pivot at 1.1337 and S2 Pivot at 1.0672 for crossing 1.0962 support level from above to below. if the price breaks S2 Pivot at 1.0672 so we may see good breakdown possibility with 1.0461 as the next bearish target.

| Instrument | S2 Pivot | S1 Pivot | Yearly PP | R1 Pivot |

|---|---|---|---|---|

| EUR/USD | 1.0672 | 1.1337 | 1.2665 |

1.3329 |

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.11.01 06:20

EUR/USD Forecast Nov. 2-6 (based on forexcrunch article)

EUR/USD looked for a new direction after the big blows eventually closing around the same levels. Final PMIs dominate the first week of November. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Germany’s IFO data came out a bit mixed when looking at the different components, but inflation is on the rise. The debate in the ECB is raging on. In the US, a hint about a December hike from the Fed sent the pair falling and dipping under 1.09, but also in the US, things aren’t that clear, especially as growth is weak. It’s going to get even busier.

- Manufacturing PMIs: Monday: Spain at 8:15, Italy at 8:45, the final French number at 8:50, the final German number at 8:55 and the final euro-zone figure at 9:00. In September, Markit reported a drop in Spain’s manufacturing purchasing managers’ index to only 51.7 points. A small rise to 51.9 is expected. Italy, the third largest economy, saw 52.7 points and also here, an advance to 52.9 is on the cards. Both figures reflect growth – above 50 points. The preliminary figure for France in October stood on 50.7 points. Germany, the largest economy in the continent, saw 51.6 points and the whole euro-zone’s first estimate stood on 52. The final numbers are expected to confirm the initial reads.

- Spanish Unemployment Change: Tuesday, 8:00. The zone’s fourth largest economy has seen significant advance in its labor market. The monthly changes in unemployment are volatile and depend on seasonality in tourism, but still have an impact. In September, a rise of 26.2K unemployed was recorded. A bigger rise to 70.3K is on the cards.

- Mario Draghi talks: Tuesday at 19:00, Wednesday at 9:00 and Thursday at 11:45. The president of the ECB hit the euro hard in the recent rate decision and then repeated this stance in a weekend interview. In his three public appearances, the most important one on Wednesday, he may relate to the upbeat inflation figures and perhaps to the exchange rate. Will he provide more details about the tools he wants to use in December? He almost always moves markets.

- Services PMIs: Wednesday: Spain at 8:15, Italy at 8:45, the final French number at 8:50, the final German number at 8:55 and the final euro-zone figure at 9:00. In September, Spain’s services sector saw robust growth according to Markit: 55.1 points. 55.5 is expected now. Italy was behind with 53.3. In October and 53.7 is now predicted, France was somewhat behind with 52.3 points but Germany surprised according to the initial figure with 55.2 points. The whole euro-zone saw 54.2 points in the first read for October. The last three figures are expected to be confirmed.

- PPI: Wednesday, 10:00. Producer prices eventually reach the consumer and they continue falling. In August, a drop of 0.8% was seen. A smaller drop of 0.4% is expected.

- German Factory Orders: Thursday, 7:00. The level of orders dropped in the summer months of July and August, with a slide of 1.8% in August, below expectations. Did September see a rise? +1.1% is predicted.

- ECB Economic Bulletin: Thursday, 9:00. Two weeks after Draghi’s drama, we will get to see the data that ECB members had before their eyes, and how worrying it really was.

- Retail PMI: Thursday, 9:10. In the past 5 months, the retail sector has seen growth according to Markit. A similar figure is on the cards.

- EU Economic Forecasts: Thursday, 10:00. Once a quarter, the European Commission updates its estimates about growth. Will they continue seeing steady growth or are downgrades expected following the Chinese slowdown? This is an open question.

- Retail Sales: Thursday, 10:00. While the data is released after similar figures have already been published by Germany and France, the data is of importance. Sales were flat in August. A rise of 0.2% is predicted.

- German Industrial Production: Friday, 7:00. Industrial output, like factory orders, dropped in August. We may see a rise in September after Augsut’s fall of 1.2%. A rise of 0.6% is on the cards.

- French Trade Balance: Friday, 7:45. The zone’s second largest economy is experiencing somewhat narrower trade deficits in recent months. The number stood on -3 billion in August. A similar deficit of 3.1 billion is forecast.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.11.02 07:25

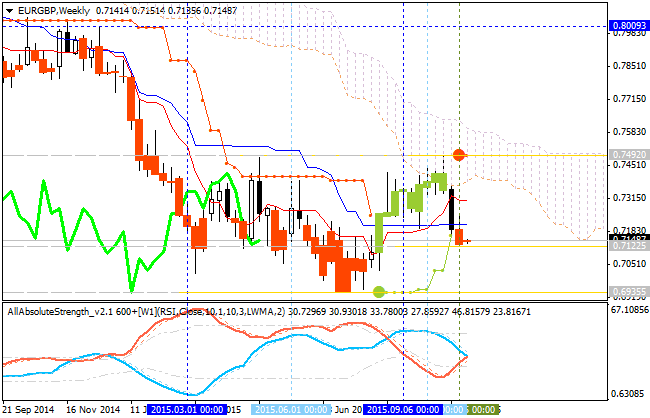

Trading Weekly Review - Sell EUR/GBP (based on efxnews article)

Deutsche Bank adviced to sell EUR/GBP this week based on some fundamental weekly forecast:

- "It’s

a big week for sterling followed by the BoE’s QIR on Thursday. The

question is whether the MPC follow the ECB or Fed’s lead by

signaling either that tightening will be delayed or reiterating the

belief that rate hikes would come into focus at the turn of the year."

- "We think the latter, and with a hike not fully priced by the end of next year, think the risk/reward to being long GBP is favorable going into the meeting."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.11.02 13:59

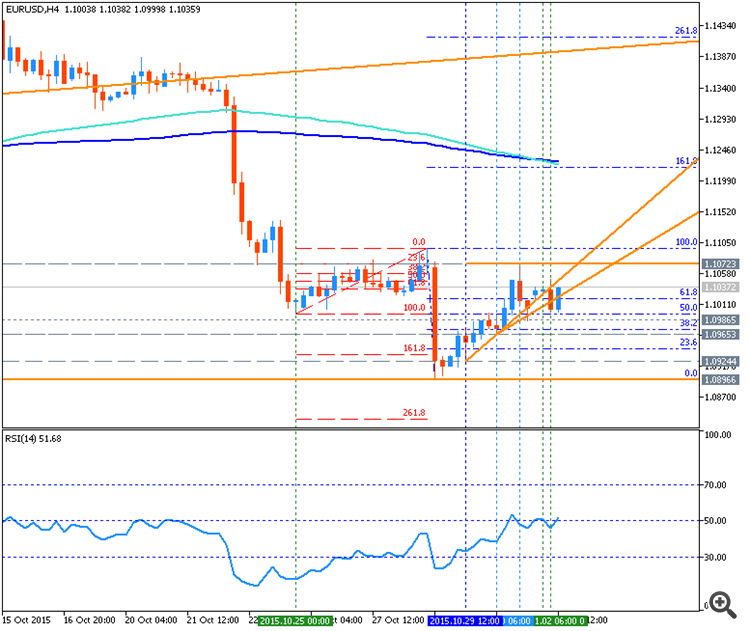

Trading Ideas for EUR/USD - bearish key month reversal (based on efxnews article)

Skandinaviska Enskilda Banken made some technical analysis for EUR/USD:

EUR/USD: secondary correction is started "Mr. Market did chose to follow the alternate correction path and prices accordingly moved up in close proximity to the recent correction high, 1.1098. With the rejection lower there’s a relatively high probability that the minor correction now is over and done hence lower levels waiting around the corner. The monthly close below 1.1087 also created a bearish key month reversal (here seen as a bearish continuation pattern given that it didn’t come from a correction high)."

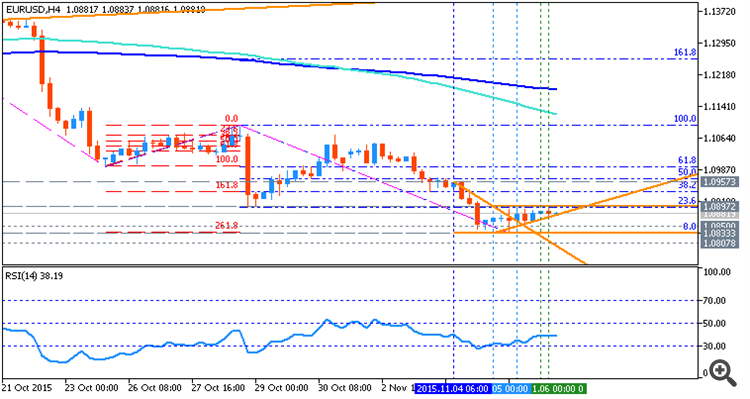

H4 price is on bearish market condition with the ranging within 1.1072 resistance and 1.0896 Fibo support level. Ascending triangle pattern is formed by the price to be crossed from below to above, but the price broke trendline to above for the secondary correction to be started.

| Resistance | Support |

|---|---|

| 1.1072 | 1.0896 |

| 1.1218 | N/A |

If

H4 price will break 1.0896 support level on close H4 bar so the primary bearish will be continuing.

If H4 price will break 1.1072

resistance level so the bear market rally will be started with the good

possibility to the reversal of the price movement from the primary

bearish to the primary bullish market condition.

If not so we may see the ranging within the levels.

- Recommendation for long: watch close H4 price to break 1.1072 for possible buy trade

- Recommendation

to go short: watch H4 price to break 1.0896 support level for possible sell trade

- Trading Summary: ranging

SUMMARY : bearish

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.11.03 08:02

Trading Weekly Review - Sell EUR/USD (based on efxnews article)

Credit Suisse adviced to sell EUR/USD this week based on the following some fundamental factors:

- "The monetary policy divergence has re-emerged, in our view.

We would stick to EUR shorts, following the ECB's dovish surprise at

its last meeting as the threat of more negative front-end rates could be

fairly effective in pushing funds out - for instance reserve managers

should be sensitive to negative rates given the short duration of their

fixed income holdings."

- "We expect unemployment to fall further to 5.0% (consensus is 5.1%), non-farm payrolls print to recover to 170k from 140k (consensus 180k) with positive backward revisions to the August and September prints (historically these two months tend to be revised up by 80k on average)."

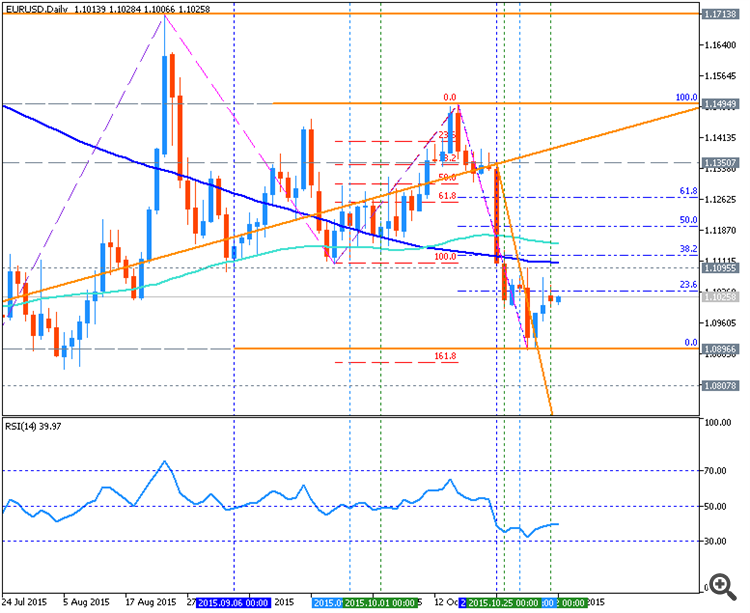

From the technical point of view - the price for the pair broke 100 day SMA and 200 day SMA from above to below for the primary bearish market condition: the price was bounced off Fibo support level at 1.0896 to start ranging around 23.6% Fibo level. By the way, descending triangle pattern was formed by the price to be crossed to below, and RSI indicator is estimating the bearish trend to be continuing, so the mist likely scenario for this pair for the week is to continuing with bearish trend with the possible breakdown possibility.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.11.04 08:39

Major Currencies Forecasts - Goldman Sachs (based on efxnews article)

Please find the latest updated currency forecasts made by Goldman Sachs:

M5 price broke 100 period SMA together with key support levels from above to below, and bearish breakdown is continuing for right now:

M5 price broke 100 period SMA together with key support levels from above to below, and bearish breakdown is continuing for right now:

This price movement is based on USD - Trade Balance news event: if actual data is more than forecast = good for currency. In our case:

- actual data is -40.8B

- forecast data is -42.7B

So, it was good for currency (for USD), and that is why we have downtrend for EUR/USD pair for example.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.11.05 14:02

Intraday Outlooks For EUR/USD by SEB (based on efxnews article)

EUR/USD: Time for a short break? "The rejection from the previously broken trend line did trigger the anticipated selling and the pair accordingly yesterday continued to decline. Now having arrived at the equality point (between the current decline and the wave 1 one) and with prices outside the 55d Bollinger bands there’s a slightly elevated risk that we will see a corrective bounce higher before continuing lower. On a grander scale the current down-wave, three, is expected to terminate in the 1.05-area."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.11.06 07:12

EUR/USD into Payrolls (based on efxnews article)

Some major int'l financial institutions are making fundamental forecasts concerning NFP for today. For example:

- Deutsche Bank stated that EUR/USD price may reach 1.05 as a target;

- Morgan Stanley are talking about intra-day ranging market condition for today for this pair;

- The Royal Bank of Scotland evaluated 3 scenarios soncerning NFP figures: 200k and above, 175k to 200k and 175k or below. And it was made one conclusion only: Short EUR/USD.

From the technical point of view - the intra-day price is on bearish market condition located below 100 period SMA and 200 period SMA.

- If the price will continuing with the bearish condition for today during anf after NFP so 1.0807 may be the nearest bearish target in this case, and the next targets are 1.0461 and year-end target as 1.0059.

- If the price will start with local uptrend as the bear market rally today so the nearest target is 23.6% Fibo resistance at 1.0897 and Fibo reversal resistance at 1.1094 located on the border between the primary bearish and the primary bullish on the chart.

I think, the most real scenario for today is the following: intra-day price will be in secondary ranging market condition within the primary bearish.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price is on the primary bearish market condition for the secondary ranging below Ichimoku cloud and 'reversal' Sinkou Span lines within the following key support/resistance levels:

Intermediate s/r levels for this pair on the way to the key s/r are the following:

D1 price - ranging bearish:

If D1 price will break 1.0896 support level on close D1 bar so the bearish trend will be continuing with possible breakdown up to 1.0461 as the next bearish target.

If D1 price will break 1.1494 resistance level on close D1 bar so the price will be reversed from the primary bearish to the primary bullish market condition.

If not so the price will be on ranging within the levels.

SUMMARY : bearish

TREND : ranging bearish