Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.20 18:18

USD, EUR, JPY, GBP and AUD For The Coming Week By Morgan Stanley (based on efxnews article)

USD: Bullish Despite the Fed. Bullish

"The more dovish Fed meeting does not change our bullish USD view. To

us, the story for USD strength has always been much more about growth

differentials than rate differentials. The Fed’s concern about global

growth only highlights the extent to which this divergence continues. In

the near term, there may be some short-lived retracement as markets

reprice the first Fed hike, but we would use dips as a buying

opportunity against EM and commodity currencies."

EUR: Still Supported from Risk. Neutral

"We remain bearish on EUR over the medium term but see reason for some

support in the near term. EURUSD has been supported in the immediate

aftermath of the Fed’s decision to keep rates on hold, benefiting from

its inverse relationship with risk appetite. Eventually, we believe the

effects of ECB policy and other bearish factors will push EUR lower, but

we are not maintaining any shorts currently in our portfolio."

JPY: Expect Strength on Crosses. Neutral

"We see upside to USDJPY as limited and believe there is scope for JPY

to strengthen on the crosses. The S&P downgrade is likely to have

limited impact on the currency, with most debt held domestically and

Japanese pension fund reallocation largely completed. Market

expectations for further BoJ easing are still high, but our economists

are not expecting such a development. Rather, they see focus on building

domestic inflationary pressures, rather than importing it via weaker

FX."

GBP: Risk-Appetite Driven. Bearish

"We maintain our long bearish GBP view and like to sell against USD and

JPY. We note that GBP is highly sensitive to risk appetite as can be

seen by its high correlation with our global risk demand index

(GRDIIDX). For this reason we continue to monitor the equity market

reaction in this Fed-dependent environment. With inflation remaining low

and the BoE not changing its tone in the recent minutes, we remain

watchers of rate expectations too."

AUD: A Relative Outperformer. Bearish

"We see scope for AUD to outperform in the near term, but prefer to play

this via long AUDNZD or long AUDCAD positions, given our generally

bearish view on commodity and EM currencies. Scope for fiscal stimulus

from China should offer some support to the currency as well. On top of

this, with a new prime minister, political uncertainty should be reduced

somewhat, offering further support."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.20 20:28

Goldman Calls It: No Rate Hike Until Mid-2016 (based on zerohedge article)

Q: Is October on the table?

A: Not really. We believe that Chair Yellen’s baseline since the June meeting has been a December liftoff, and it would be very unnatural for her to pull forward given the information received in the meantime. Besides, there is only one round of monthly economic data on the calendar before then. Last but not least, the logistics are daunting. There will not be a fresh SEP, and the committee would need to announce an impromptu press conference in the October 29 FOMC statement announcing the rate hike itself; an earlier addition of a press conference to the calendar does not work because this would lead the market to conclude that the FOMC has decided to hike, without any room for explanation at that point. This all seems too sudden and dramatic for a Committee that, we think, would like the first hike to be as unexciting as possible.

Q: What could shift the liftoff into 2016?

A: Although we expect the conditions for liftoff regarding employment, inflation, and financial conditions to be in place by December, there is some risk of disappointment in each of them. Missing on any one of them would call December into question, missing on more than one would almost certainly shift liftoff into 2016. Regarding growth and employment, the data looked quite solid until recently but the early information for September has been weak so far. As shown in Exhibit 1, the average of the New York Empire State and Philly Fed index in September fell to the lowest level since the 2011 recession scare, and consumer sentiment also weakened significantly. These are all volatile indicators that could bounce back quickly, but we would put at least a bit of weight on the possibility that they indicate a larger-than-expected drag from the recent tightening in financial conditions and the weakness in global growth.

Finally, regarding financial conditions, our baseline expectation is an easing but the uncertainty is significant as always. And at least so far, the response of the financial markets to the FOMC—especially the sharp selloff in the stock market—has probably disappointed the committee’s expectations.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.21 09:06

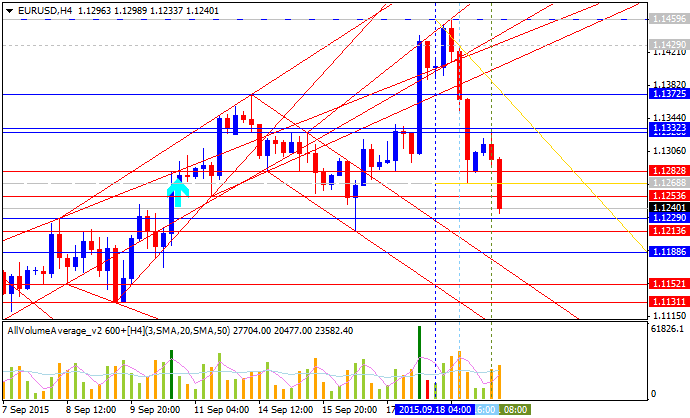

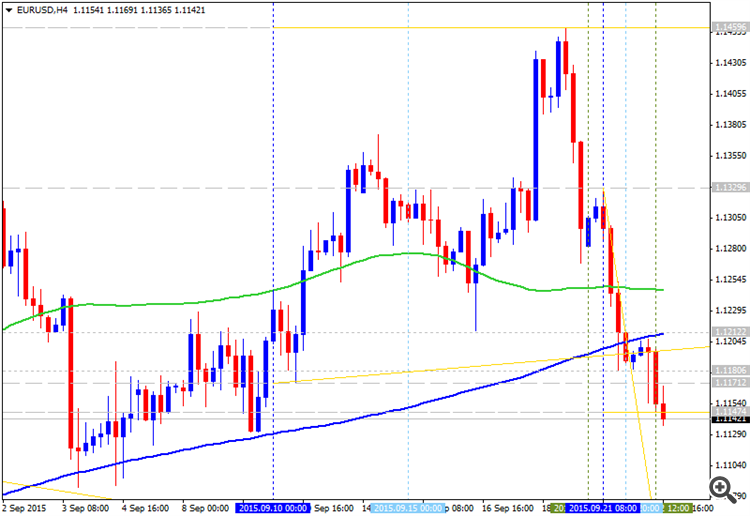

EUR/USD: Choppy Sideways Consolidation - by UOB (based on efxnews article)

- "EUR/USD surged to a high of 1.1458/63 before reversing quickly to close on Friday almost 150 pips lower from the high."

- "Only a move back above 1.1350 would indicate that the downward pressure has eased."

- "The current outlook is deemed as neutral and we expect to see a period of broad and choppy sideways consolidation. Key levels are at 1.1170 and 1.1460."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.21 14:48

Trade ideas for EUR/USD by UBS (based on efxnews article)

EUR/USD: "In the short term, the pair may have come a

bit too far in low volumes during the late US/early Asia trading hours,

but we prefer playing the short side, looking to add around 1.1350, with

an intraday stop at 1.1425."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.22 16:31

Trade Ideas For EUR/USD by UBS (based on efxnews article)

EUR/USD: "The first hurdle on the way lower is

1.1150/55, and if that breaks we think the pair may test the low of

1.1090 from the previous US payrolls release. We do not want to be short

at these levels, but would get involved on any move closer to today's

high of 1.1206, with a stop at 1.1255."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.23 08:08

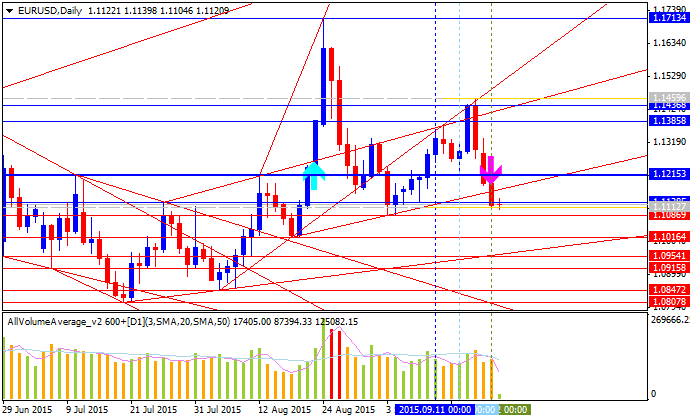

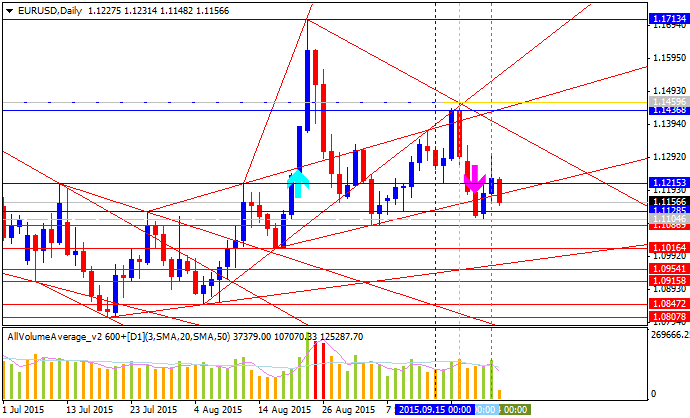

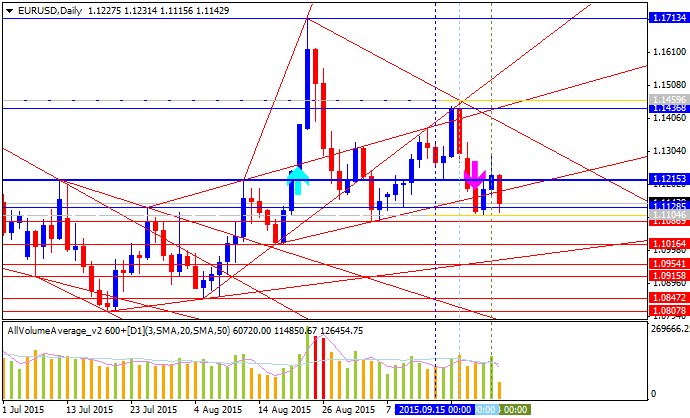

EUR/USD Daily Outlook (based on actionforex article)

- "Intraday bias in EUR/USD remains on the downside for 1.1086 support. Break will resume the decline from 1.1713 and would target 1.0807 key near term support, which is close to 100% projection of 1.1713 to 1.1086 from 1.1459. Also, noted that whole corrective rise from 1.0461 has completed at 1.1713, ahead of 38.2% retracement of 1.3993 to 1.0461 at 1.1810. Break of 1.0807 would pave the way back to 1.0461. On the upside, above 1.1206 minor resistance will turn bias neutral first."

- "In the bigger picture, overall price actions from 1.6039 long term top is viewed as a corrective pattern with fall from 1.3993 as the third leg. Price actions from 1.0461 are viewed as correction to fall from 1.3993. Such correction could have completed ahead of 38.2% retracement of 1.3993 to 1.0461 at 1.1810. Break of 1.0461 will extend the decline from 1.3993. On the upside, break of 1.2042 support turned resistance is needed to be the first sign of trend reversal. Otherwise, we'll stay bearish and expect a new low below 1.0461 at a later stage."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.24 11:04

Trading the News: U.S. Durable Goods Orders (based on dailyfx article)

A 2.3% decline in demand for U.S. Durable Goods accompanied by a

weakening outlook for business investments may produce near-term

headwinds for the greenback as it fuels speculation for a further delay

in the Fed liftoff.

What’s Expected:

Why Is This Event Important:

The Federal Open Market Committee (FOMC) may continue to endorse a

wait-and-see approach at the October 28 interest rate decision as the

central bank adopts a more cautious outlook for the region, and signs of

a slower recovery may encourage Chair Janet Yellen to preserve the

zero-interest rate policy (ZIRP) throughout 2015 in an effort to further

insulate the real economy.

On the other hand, the ongoing expansion in building and service-based

activity may spur greater demand for durable goods, and a positive data

print may keep the central bank on course to raise the benchmark

interest rate in 2015 as Chair Yellen remains confident in achieving the

Fed’s dual mandate for full-employment and price stability.

How To Trade This Event Risk

Bearish USD Trade: Orders Contract 2.3% or Greater in August

- Need to see green, five-minute candle following the release to consider a long trade on EURUSD.

- If market reaction favors a bearish dollar trade, buy EURUSD with two separate position.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

- Need red, five-minute candle to favor a short EURUSD trade.

- Implement same setup as the bearish dollar trade, just in the opposite direction.

EURUSD Daily

- EUR/USD may face a larger rebound as it fails to retain the recent series of lower-highs and preserves the monthly-opening low (1.1086); need a break of the bullish RSI formation carried over from March to favor a resumption of the long-term downward trend.

- Interim Resistance: 1.1760 (61.8% retracement) to 1.1810 (38.2% retracement)

- Interim Support: Interim Support: 1.0790 (50% expansion) to 1.0800 (23.6% expansion)

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.25 08:59

EUR/USD: Levels & Targets - UOB (based on efxnews article)

- "The wild swing has resulted in a mixed outlook for today. In other words, the 1.1105 low seen two days ago is the extent of the current down-move and the 1.1085 target is not met."

- "From here, we hold a neutral view and expect the recent volatile to persist for a while more. Expected range; 1.1085/1.1300."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.25 11:33

Here Are The Trades We Like - SocGen (based on efxnews article)

Societe Generale is forecasting the ranging market condition for EUR/USD and USD/JPY, short for CHF/SEK and long-term short in GBP/JPY. In the short-term situation: shorts for USD/CAD and EUR/NOK.

- "Market volatility has been elevated following the Chinese FX regime shift and has remained so despite the Fed delaying its rate lift-off. Pressure on risk assets have persisted, and the fragile market sentiment is restraining G3 bond yields, which are in turn constraining EUR/USD and USD/JPY in tight ranges."

- "We like shorts in CHF/SEK as the case for such negative rates in Sweden slowly fades."

- "We like long-term shorts in GBP/JPY as the UK growth rate crests and Brexit risk flares higher."

- "Being short the G10 economies with the biggest current account deficits appeals too. USD/CAD and EUR/NOK are too oil-sensitive to have conviction about here. For choice, we like to be short NOK and CAD in the very short-term."

- "As for EUR/USD, it’s barely worth trading. It fell this week with the VW share price, and having a view on where it goes next is way outside my skill set."

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price is on bullish market condition for secondary ranging between the following support/resistance levels:

Intermediate s/r levels for this pair on the way to the key s/r are the following: 1.1440 resistance and 1.1131 support level.

D1 price - ranging bullish:

If D1 price will break 1.0924 support level on close D1 bar so we may see the reversal of the price movement to the primary bearish market condition.

If D1 price will break 1.1713 resistance level so the bullish trend will be continuing.

If not so the price will be on ranging between the levels.

SUMMARY : bullish

TREND : ranging