Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.14 06:22

September FOMC Forecast by Nomura (based on efxnews article)

Nomura is expecting the first Fed hike in December and explaining about it: the FOMC will not raise rates this week during September FOMC:

- "Even without a decision to raise short-term interest rates, markets will have a lot to digest. We will get a new round of forecasts from FOMC participants. The economic forecasts for this year are likely to change in response to data that have already been released. We are not expecting big changes to the economic forecasts for 2016 and beyond. More importantly, we will also get another set of interest rate forecasts. We are expecting significant declines in the FOMC’s expected path of interest rates."

- "At a minimum, we expect the Committee’s forecast for 2015 to coalesce on one hike this year. We are expecting the FOMC to raise rates for the first time in December. We do not expect the Committee to endorse a more rapid pace of interest rate adjustment after liftoff. Consequently, the delay in liftoff should imply a lower path of rates over the whole forecast horizon. We also think that the downward adjustment of the rate path is consistent with the recent tightening of financial conditions. We think that those changes in financial conditions will primarily be reflected in the FOMC participants’ paths of interest rates rather than their paths for growth and inflation."

- "Finally, we will hear from Chair Yellen in her post-FOMC press conference. We think Yellen will stress that the FOMC is getting closer to raising rates and that the Committee expects to raise rates this year. We expect her to acknowledge that downside risks have increased and those had played a role in the Committee’s decision. We expect her to reiterate that the Committee’s future decisions will continue to be sensitive to how the outlook for the economy and inflation evolves and that the pace of interest rate adjustment, once it begins, is likely to be slow and data dependent."

As we know - some int'l financial institutions are still expecting for Fed hike to rise this week so that is why the opinion of Nomura Holdings is important for us here.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.14 07:53

Morgan Stanley made weekly forecast for EUR in fundamental/technical mixed way expecting bearish EUR (based on efxnews article):

"We remain bearish on EUR over the medium term but see reason for some support in the near term. EURUSD continues to be inversely correlated with risk appetite. This suggests that as global volatility remains high and risk appetite weak then there is reason to see EUR supported. Draghi sounded very dovish at the recent ECB press conference so, should the voices from the central bank suggest more aggressive monetary action, then this would be a risk factor to our near-term view."

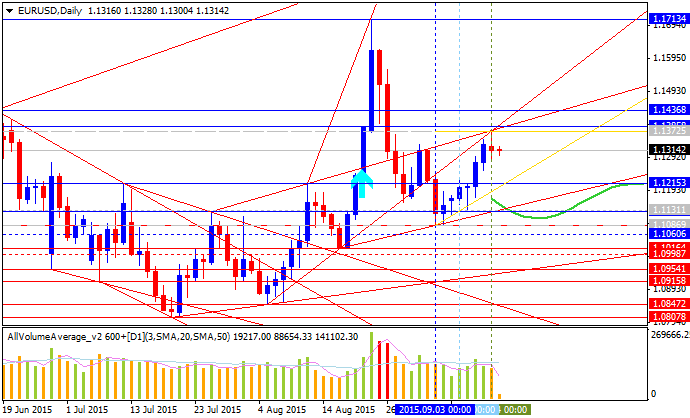

From

the technical point of view - EUR/USD is located below

100-SMA/200-SMA for ranging within 1.1713 key resistance and 1.0807 key

support levels for crossing symmetric triangle pattern for the

trend to be continuing. Intermediate support level as the nearest

bearish target is 1.0925, and the key bearish target is 1.0807. The

situation with EUR/USD may be described on the following way:

- market rally to be continuing, or

- the bearish trend to be re-started.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.14 13:53

EUR/USD: Levels & Targets by United Overseas Bank (based on efxnews article)

United Overseas Bank estimated the nearest bullish target for EUR/USd as 1.1475 with 1.1250/55 as the bearish reversal level.

- "The break above 1.1255 late last week has shifted the outlook for EUR to bullish with a target of 1.1475."

- "In order to maintain the current nascent momentum, any pull-back should not move back below the break-out level of 1.1250/55."

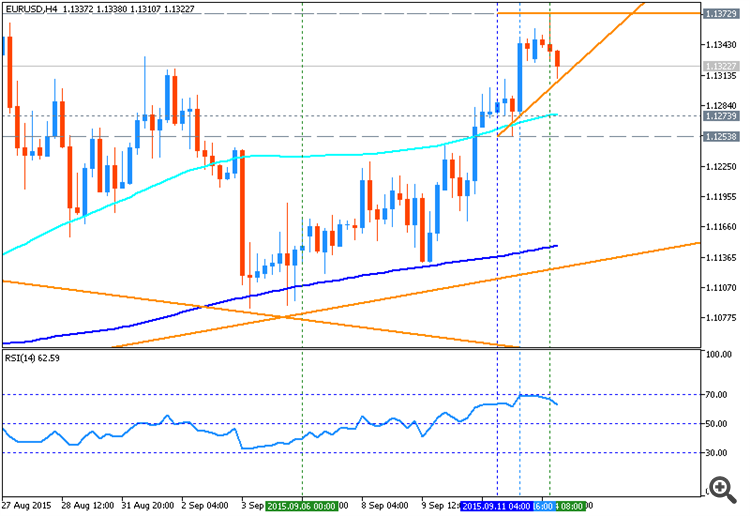

This situation is mostly related to intra-day trading: as we see from H4 chart - the EURUSD is on bullish trend with 1.1379 as the next target; and the reversal bearish target is 1.1253. It means the following:

- if the price breaks 1.1379 resistance level from below to above so the bullish trend will be continuing with 1.1475 as the next target in this case;

- if the price breaks 1.1253 support level so the price is started to be reversed to the bearish market condition with the secondary ranging: price will be located between 100-SMA and 200-SMA.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.14 18:32

Trade Ideas For EUR/USD and GBP/USD by UBS Group (based on efxnews article)

UBS Group made a trading forecast for EUR/USd and GBP/USD for today and tomorrow:

EUR/USD: "traded bid last week and ended with a short squeeze. Flows were mixed but demand improved as the weekend got closer so it seems that the market is happy to play the pair from the short side, although conviction is low. All eyes are on the FOMC meeting this week, and activity could be limited until then."

GBP/USD: "Cable has found good support around the 200-day moving average and with the positive tone from the BoE last week, this bounce should continue. This is a busy week for data, with CPI, earnings, unemployment, and retail sales due. Buy dips, with a stop below 1.5350, for a test of 1.5500 and 1.5550."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.15 07:44

EUR/USD Tech Review: 'correcting the to 1.11' by Nomura; 'it isn’t very clear' by Goldman Sachs (based on efxnews article)

Nomura made a forecast for EUR/USD stated about correction for this pair to 1.11 :

-

"It is complex correction that is expected to complete

via 2 a-b-c rallies, currently the latter stages of the second a-b-c

are unfolding. A rally from near 1.13 to 1.14 can complete the larger

wave-B."

- "S/t, support via old pivots and an uptrend line is between 1.1300/1288, more critical support below is 1.1254. Resistance is 1.1340 and then the recent pivot high at 1.1374."

By the way, Goldman Sachs noted that the setup in EUR/USD isn’t very clear:

-

"A complete correction should retrace within wave 4 territory and near

38.2% of the preceding trend. In this case the high at 1.1713 is near

enough to 38.2% at 1.18 and actually exceeds the 4 th wave

(1.1533-1.1099). Moreover, an ABC extension from the March low targets

1.1818 (again, near enough?)."

- "At this point it seems reasonable to take a neutral stance until further signal develops."

Anyway, as we see from daily chart - the price is located near above 200 day SMA with 1.1372 resistance level to be ready for two scenarios to be implemented:

- bullish trend will be continuing by breaking 1.1372 resistance with 1.1713 as the next bullish target, or

- the price will be reversed to the bearish trend by breaking 1.11/1.10 support levels.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.15 18:06

2015-09-15 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Retail Sales]- past data is 0.7%

- forecast data is 0.3%

- actual data is 0.2% according to the latest press release

if actual > forecast (or previous data) = good for currency (for USD in our case)

[USD - Retail Sales] = Change in the total value of sales at the retail level. It's the primary gauge of consumer spending, which accounts for the majority of overall economic activity.

==========

EURUSD M5: 30 pips price movement by USD - Retail Sales news event:

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.16 09:12

EUR/USD Into FOMC - BNPP (based on efxnews article)

BNPP is expecting for Thursday’s FOMC statement to be in dovish way and as a result - the EUR/USD should come to 1.10 to be near 1.1088 reversal support level located inside Ichimoku cloud and below 200 day SMA in the ranging bearish area of the chart.

- "The pattern, if extended through Thursday’s Fed result, would bode well for EURUSD to trade back towards 1.10 and USDJPY to extend its recovery towards 123."

- "Still, we think risk-reward remains attractive for maintaining USD long exposure given our medium-term constructive view and light positioning."

For now - the price is located near above 200 day SMA to be ready for the bullish trend to be continuing, or to reverse to the primary bearish market condition with secodary ranging. If daily price crosses 1.1088 from above to below so we may see the reversal of the price movement to the primary bearish market condition.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.16 12:00

Intraday Outlooks For EUR/USD - SEB (based on efxnews article)

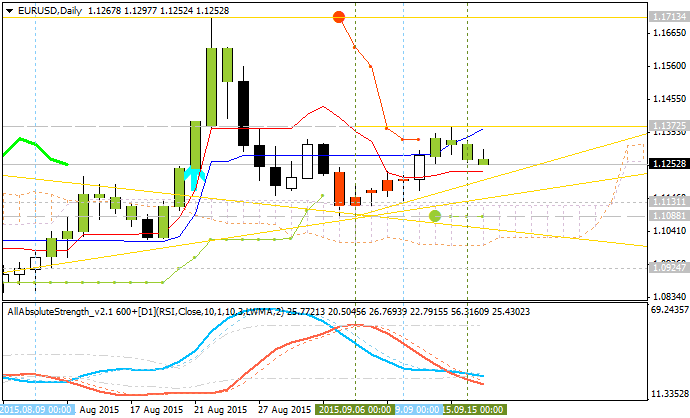

Skandinaviska Enskilda Banken made an intra-day forecast for

EUR/USD. As we see from the chart below - the price is located between

100 SMA and 200 SMA for ranging market condition waiting for direction.

On daily base - the price is near above 200 day SMA for trying to cross

it from above to below for the ranging bearish condition to be started

in this case.

EUR/USD: Bears are happier below 1.1329. "A near-term bearish impulse may or may have not yet started. If holding from breaking back over 1.1329 and instead extending the drop below the near-term "Equality point" at 1.1240 we believe in the former. Current intraday stretches (shouldn't really become tested ahead of Fed) are located at 1.1200 & 1.1370."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.17 12:57

How To Trade The FOMC - Credit Agricole (based on efxnews article)

-

"USD longs funded in low yielding currencies like CHF seem still attractive in our view.

A Fed hike could boost the USD but may not necessarily trigger a sharp

risk selloff. As a result the likes of EUR, CHF and JPY need not receive

a massive boost. We like being long USD against CHF in particular

because the positive correlation between CHF and risk aversion has been

weakening recently."

- "If the Fed doesn't hike and signal a lower glide path for Fed fund rates while downgrading its core inflation and unemployment projections, chances are that risk appetite could recover some more. While we could see investors unwinding decoupling trades and USD underperforming, we doubt that this will be sustained as markets will continue to see any decision to keep rates unchanged as delaying the inevitable. Under this scenario, the USD may lose some ground against EUR, CHF and JPY initially but the underperformance should be ultimately capped by the prospects for more policy divergence (eg more ECB QE) and resilient risk appetite. We think that USD/CHF should hold up well as EUR appreciates against both CHF and USD. When it comes to risk-correlated or commodity currencies, we doubt that any of them could regain ground on a sustained basis, given the lingering risks from China and the Fed."

-

"GBP could be among the more resilient currencies today

especially if the Fed boosts investors’ demand for decoupling trades.

Indeed, accelerating wage growth in the UK and increasingly hawkish

rhetoric from the BoE has helped GBP regain some ground of late."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.18 07:14

USD Post-FOMC by Major Banks (based on efxnews article)

The dovish FOMC was on Thursday at 19:00 GMT so the major banks are made a forecast about the USD after FOMC.

Morgan Stanley: "Long USD positioning is vulnerable over coming days and perhaps weeks...But USD Impact Temporary. Our structurally bullish USD view has never been Fed-focused. Rather, our framework is built on the reduced investment attractiveness in much of the rest of the world. Any setback in the USD is likely to be short-lived in our view, providing a renewed buying opportunity against EM and commodity-related currencies."

BofA Merill: "The lowering of the median dots raises risks around a hike this year. But, the FOMC’s confidence in the outlook (particularly in the labor market) underpins hikes later this year, and therefore, the policy divergence theme we expect to support the USD. With a 30% chance priced into the meeting, we would expect some near-term pressure on the USD—particularly versus commodity-linked currencies where USD positioning is largest—as the timing of the first hike is now less certain. However, with any significant USD weakness likely to incent other central banks (like the ECB) to ease further and given our view for a December Fed hike, we see USD downside as limited here."

Nomura: "For the FX market specifically, Nomura doesn't think the information received today will lead to a sustained unwinding of USD longs versus G10 currencies—i.e., momentum could fade within a few sessions. We have been flat in terms of USD exposure versus majors for the last several weeks in anticipation of this outcome. But looking ahead, the Fed is still operating with liftoff this year as the central case, as the 2015 dots clearly signal. Bottom line: We still believe that our 1.10 year-end target for EURUSD is likely to be achieved under the assumption th that the Fed is able to raise rates by the December meeting, which seems fairly likely."

SocGen: "The Fed’s decision to leave rates on hold was not a surprise to a market positioned that way but the tone of the statement and the new lowered ‘dot-path’ (median sees one hike this year, 4 in 2016, 5 in 2017 and 3 in 2018 for a 3.375% Funds rate peak) have dragged Treasury yields down. That is not dollar-supportive. However, any bounce in risk assets will be short-lived. A dovish and dithering Fed inspires little confidence. Once EMinspired reduction in dollar long positions is over, we look for AUD, NZD and CAD to weaken again, with NZD the most vulnerable. And the biggest winner could still be the yen if the risk mood sours."

Danske: "We target EUR/USD at 1.10 in 3M and 6M and then up to 1.15 in 12M. We forecast JPY to underperform among the G4 as rising expectations for additional BoJ easing will support USD/JPY going into the 30 October Bank of Japan meeting. Moreover, we note that the upside potential in USD/JPY has increased following the past week’s substantial reduction in specualtive short JPY positions. We target USD/JPY at 124 and 125 in 3M and 6M, respectively. In contrast to EUR and JPY, GBP is also expected to perform on a 3M to 6M horizon supported by higher Uk interest rates as we still project Bank of England to hike in February. In the very short term, however, GBP is likely to come under pressure on low inflation prints in the UK as due to BoE’s explicit concerns about the weak short term inflation outlook. We forecast GBP/USD at 1.53 in 3M."

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price is on bullish market condition for secondary ranging between 1.1713 key resistance level and 1.0847 support level. The price is located above Ichimoku cloud by crossing 1.1294 resistance level from below to above for the bullish trend to be continuing. Chinkou Span line is above the price indicating the bullish breakout in the near future.

D1 price - possible bullish breakout:

If D1 price will break 1.1086 support level on close D1 bar so we may see the reversal of the price movement to the primary bearish market condition with secondary ranging (ranging bearish).

If D1 price will break 1.1713 resistance level so the bullish trend will be continuing.

If not so the price will be on ranging between the levels (ranging bullish).

SUMMARY : bullish

TREND : ranging