Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.05 09:34

Forex Weekly Outlook September 7-11 (based on forexcrunch article)

September began with more volatility and more uncertainty. Rate decisions in Canada; New Zealand and the UK, Employment data in Australia and US consumer sentiment all stand out. These are the main events on our calendar for this week. Join us as we explore these financial highlights.

The U.S. economy produced 173,000 jobs in August,falling short of estimates but with positive revisions and upbeat wage growth. The release came at a crucial timing of the rate-hike debate and the mixed report raised uncertainty, but we think the Fed could still bring on a “dovish hike”. In the euro-zone, things are far from quiet, with Draghi showing his will to act, weighing heavily on the euro. Commodity currencies couldn’t enjoy the Chinese holiday and were hit hard. Things are going to get messy again.

- Canadian rate decision: Wednesday, 14:00. Canada’s central bank decided to lower its benchmark interest rate to 0.5% in July. This was the second cut this year, aimed to boost the economy. The BOC reduced its growth estimate in 2015 from its April projection after showing a mild contraction the first half of the year. However, the Central Bank forecasts a rebound in the second half of 2015, expecting 1.9% growth this year. Analysts expect the BOC will maintain rates this time.

- US JOLTS Job Openings: Wednesday, 14:00. Job opening are eyed by the Fed as they provide a wider indication about the job market, even if this figure is delayed. In June, the figure stood on 5.25 million, and a rise to 5.33 million is on the cards for July.

- New Zealand rate decision: Wednesday, 21:00. New Zealand’s central bank cut its benchmark interest rate by 25 basis points to 3.0% in July, in hope of raising inflation and boosting economic activity. The rate cut was in line with market forecast. The Central Bank growth outlook deteriorated since the last policy meeting in June. However, the local currency has decreased noticeably since then, aiding manufacturers with weaker commodity export prices. Analysts expect further cuts in September and in October as the slowdown in China starts to affect New Zealand’s economy. Economists forecast another rate cut to 2.75% this month.

- Australian employment data: Thursday, 1:30. The unemployment rate in Australia edged up 0.2% in July reaching 6.3%, despite a job creation of 38,500 positions in July. Analysts expected a smaller addition of 10,200 jobs and unemployment rate of 6.1%. The reason behind the sharp rise in unemployment was an increase in the participation rate, reaching 65.1%. The rise in the number of job seekers may contribute to jobs growth in the coming months, which is a good thing for the Australian economy. Analysts expect a job gain of 5,200 positions and a decline in the unemployment rate to 6.2%.

- UK rate decision: Thursday, 11:00. The Bank of England maintained interest rates at 0.5% in August despite one voting member calling to raise rates. Lack of inflationary pressures delayed the Central Bank’s decision to raise rates. However, Bank governor Mark Carney said a rise is “drawing closer”, but cannot “be predicted in advance”. The collapsing stock market in China and the talks over Greece’s debts painted a grim outlook of global growth, contributing to the Bank’s decision to postpone the rate hike. Nevertheless, the Bank expects inflation to return to target next year, rising 0.25% in the first four months and may double from 0.5% to 1% by the end of 2016. Analysts see not change in Carney’s monetary policy this time.

- US Unemployment Claims: Thursday, 12:30. The number of Americans filing new applications for unemployment benefits rose last week by 12,000 to 282,000, exceeding forecasts of 273,000. However, the number of applications remain relatively low in time of a global slowdown. The four-week average increased 3,250 to 275,500. That average has fallen 9.2% over the past 12 months. The combination of steady job growth and low levels of applications suggests that the US economy will continue to expand in the coming months. Economists forecast the number of new claim will reach 279,000 this week.

- US PPI: Friday, 12:30. U.S. producer prices in the US increased for a third straight month in July, rising 0.2% after a 0.4% gain in July. However, inflation pressures remained subdued against the backdrop of lower oil prices and a strong dollar. In the 12 months through July, the PPI declined 0.8% following 0.7% drop in June. It was the sixth straight 12-month decrease in the index. Producer prices are expected to decline by 0.1% in August.

- US UoM Consumer Sentiment: Friday, 14:00. U.S. consumer confidence weakened for a second month in August, as households were more pessimistic the rate hike aftermath. The University of Michigan’s preliminary index of sentiment contracted to 92.9 from 93.1 in July. Economists expected a reading of 93.5. The global financial turmoil caused by China has yet to affect future sentiment reports. Americans forecast an inflation rate of 2.8% in the next 12 months, the same as in July, the report showed. Over the next five to 10 years, they anticipated a 2.7%, down from 2.8%. U.S. consumer sentiment is expected to dip further to 91.6.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.06 15:53

USD, EUR, JPY, GBP, AUD: Outlooks For The Coming Week - Morgan Stanley (based on efxnews article)

USD: USD Strong Against EM. Bullish.

"We believe that USD strength will continue to be focused against

commodity and EM currencies. Volatility remains elevated and risks

surrounding China could keep it high. Should China be resolved, this

could lead to a temporary rally in EM FX, but it would not be long

before the market started bringing forward the timing of the first Fed

hike, ending any relief rally in EM FX. We remain generally bullish USD."

EUR: The ECB Pushes Back. Neutral.

"The latest ECB press conference was dovish in tone, and the central

bank increased the amount it can purchase of new issuances. In only

making one adjustment to its current policy, the central bank kept the

door open for further easing, contributing to the weakness seen in EUR.

The central bank will need to maintain its dovish tone going forward to

avoid the currency gaining ground once again off the back of its current

account surplus and inverse relationship with risk."

JPY: Watch Wages. Neutral.

"More global asset market volatility would support the safe haven JPY,

but we have to increasingly be aware of the risk of a BoJ response.

After a 2Q contraction, the ramp into 3Q growth remains disappointing.

Key will be cash earnings to test if the BoJ’s narrative of higher

corporate profits filtering through to wages is gaining traction."

GBP: Waiting for Opportunities to Sell. Bearish.

"We maintain our bearish GBP view, but are cautious that current levels

may not be the most attractive to enter short positions. Markets have

pushed the timing of the first hike in the UK back to August 2016, well

beyond our economists’ expectation of a February hike. However, risk

appetite remains weak and concerns in China are high. GBP tends to

underperform in periods of heightened volatility, and this could

continue."

AUD: Domestic Story Deteriorating. Bearish.

"Despite the sell-off already seen in AUD, we believe there is scope for

further weakness. It’s notable that AUD has sold off even as iron ore

prices rose recently, suggesting that it is more than simply a

reflection of external factors. Indeed, domestic data continue to

deteriorate and the market is now pricing in nearly a full cut by the

end of the year. Still, with our economists expecting a cut in November,

we believe the market will move to our more dovish view, pressuring

AUD."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.07 09:34

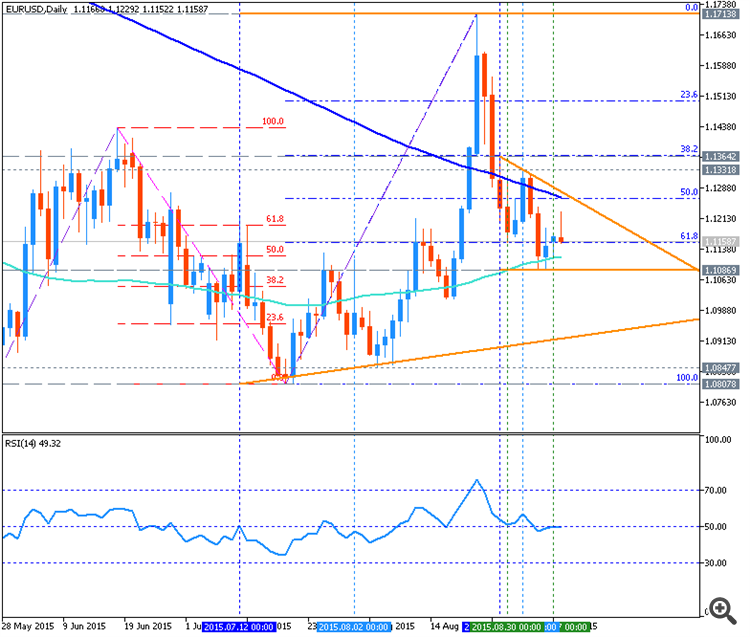

EUR/USD forecast: sideway trading for today and breaking the levels for tomorrow (based on efxnews article)

United Overseas Bank made a forecast for EUR/USD for today expecting the ranging market condition between 1.1105 and 1.1205:

- "Expect sideway trading for today, likely between 1.1105 and 1.1205."

- "As long as 1.1255 is not taken out, we continue to expect an eventual move lower to 1.1015."

Let's evaluate this forecast to estimate the levels for today and tomorrow.

EUR/USD: ranging for today and break the levels for tomorrow. This pair is ranging between 100-SMA and 200-SMA within the following key levels:

- 1.1339 key resistance level located above 100-SMA/200-SMA in the primary bullish area of H4 chart;

- 1.0947 key support level located below 100-SMA/200-SMA in the primary bearish area of the chart.

That

means - if the price crosses 1.1339 resistance from below to above so

we may see the bullish breakout with the reversal of the price movement

to the bullish market condition. If the price crosses 1.0947 support so

it may be reversal to the bearish with good breakdown possibility.

| Resistance | Support |

|---|---|

| 1.1339 | 1.0947 |

| 1.1713 | 1.0807 |

So,

the forecast of UOB may be the correct one but with the following

levels: 1.1339/1.0947. By the way, the daily levels for tomorrow are the

following: 1.1713 key resistance and 1.0807 key support: the price is

ranging between those 1.1713/1.0807 levels, and if the price breaks one

of those level - we may see the primary bearish/bullish trend to be

continuing/started.

Thus, intraday levels are 1.1339/1.0947, and the levels for daily trading for this week are 1.1713/1.0807.

Sergey Golubev:

- The EUR/USD pair closed last Friday with some limited gains around 1.1145, down on the week after the ECB announced a downgrade on its growth and inflation outlooks, and raised the ceiling in terms of its holdings of individual bonds from 25% to 33%. The US Nonfarm Payroll report showed that the US added 173,000 new jobs in August, missing expectations of 220,000, although the unemployment rate fell down to 5.1% the lowest in seven years. The mixed data failed to give a clear sign as to which the next FED'S move could be, spurring uncertainty and leaving financial markets susceptible to risk trading during the upcoming days.

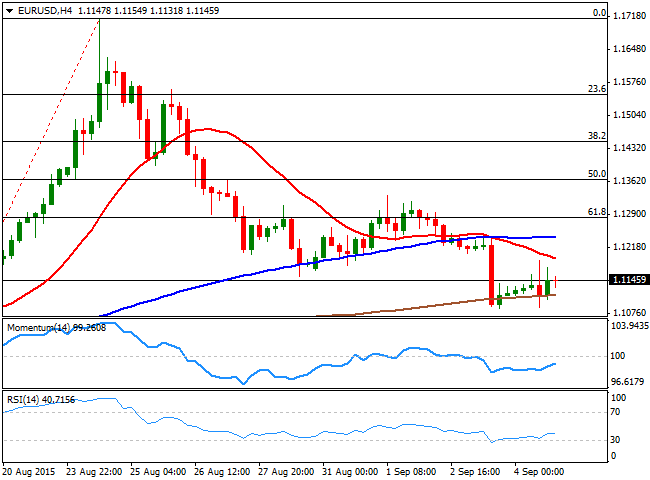

The pair advanced during the last American afternoon as local share markets sunk, although gains were limited, and looked more as position adjustments than a re-surge in buying interest. Technically, the daily chart shows that the price managed to close the day slightly above the 100 and 200 SMAs, but below the 20 SMA, whilst the Momentum indicator heads lower around the 100 level and the RSI hovers around 47, maintaining the risk towards the downside. The daily 200 SMA stands around 1.1090, from where the pair bounced several times over the last few trading days. In the 4 hours chart, the price is below a bearish 20 SMA, whilst the technical indicators lack directional strength, but remain below their mid-lines, supporting a downward continuation on a break below the 1.1080 support.

Support levels: 1.1120 1.1080 1.1050

Resistance levels: 1.1160 1.1200 1.1245

1957

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.07 19:44

Intraday Outlooks For EUR/USD, EUR/JPY, GBP/USD - SEB (based on efxnews article)

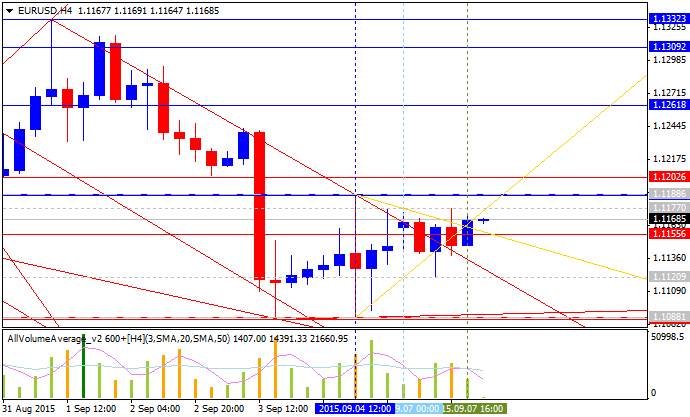

EUR/USD: Downside risks still persist. "Last week ended

with some rather choppy hours post the NFP and the hourly chart

indicates either a possible bear triangle or a bear flag in the making.

The first alternative points at resuming sellers in the 1.1170’s and

latter one closer to 1.12. Both alternatives will be given a bearish

confirmation breaking below 1.1090."

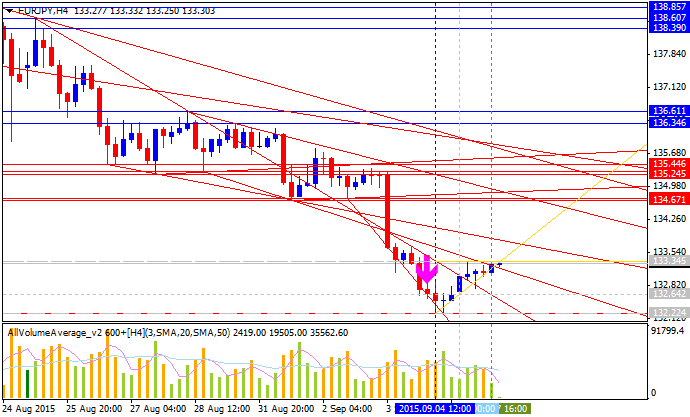

EUR/JPY: Should soon run into offers. "Last week ended with another clearly bearish weekly candle, the second consecutive one. On a shorter time frame the market traced, as outlined, out a couple of fresh lows before started to correct some of the latest decline. This corrective move higher is seen primarily ending towards 133.65. Thereafter our focus will again turn to the downside and a resumption of the bear trend."

GBP/USD: A small bounce, then lower again. "The pair reached 1.5170 support on Friday and the much muted reaction from the support is clearly sending a bearish message. The weekly candle also became a good follow through one to the preceding week’s bearish key week reversal. All in all the downside pressure remains high and only a minor bounce should hence be justified from current levels."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.08 14:03

Barclays - 'we recommend remaining short EURUSD' (based on efxnews article)

Barclays made a forecast for this week concerning EUR/USD related to funbdamental factors such as the following:

- "With the last employment report before the September meeting over, we think that markets will square positions ahead of the FOMC decision on September 17. With only a one-third chance of a lift-off at that meeting, we see limited downside risks to the USD in the short term and keep our bullish medium-term view, particularly vs. the EUR and EM currencies."

- "Market to continue to contemplate further ECB QE: We continue to expect the ECB to announce before year-end an extension of the current QE programme beyond September 2016; this view was encouraged by sizeable downward revisions to the ECB's inflation forecast for 2016 and 2017 to 1.1% and 1.7%, respectively."

- "As such, we continue to expect further material EUR depreciation and recommend remaining short EURUSD."

Let's evaluate this forecast concerning the technical point of view:

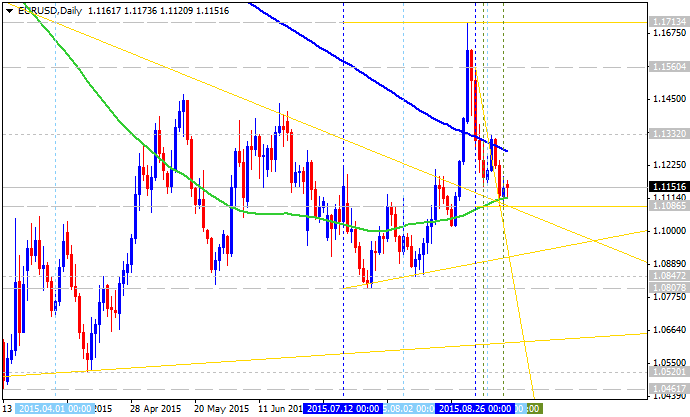

- Daily price is located below 200 day SMA (blue line on the chart) for the primary bearish and above 100 day SMA for the secondary ranging market condition.

- The price is crossing 61.8% Fibo support level at

1.1154 from above to below with Fibo support level at 1.0807 as the next

bearish target.

- Descending triangle pattern was formed by the price to be crossed for the bearish breakdown to be started.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.09 13:07

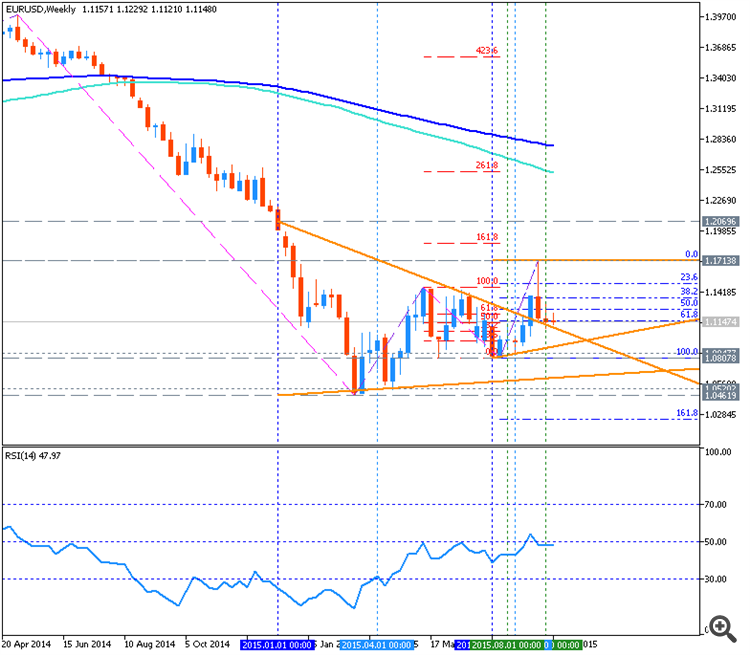

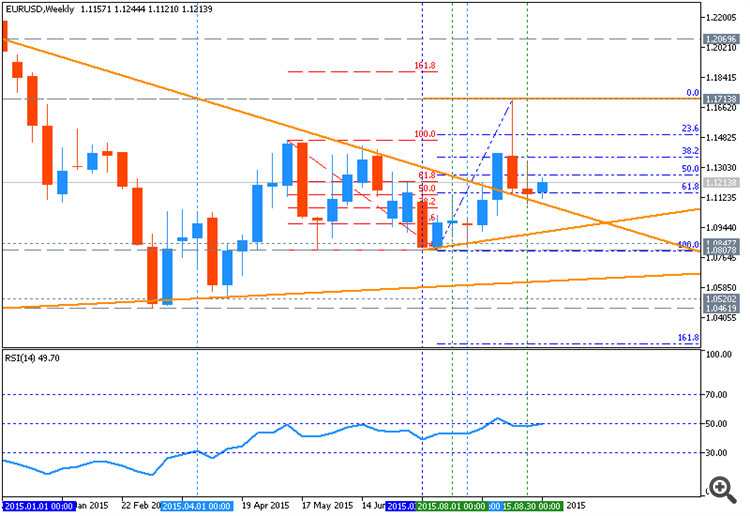

BTMU Forecasts for EUR/USD: 1.060 in December 2015 (based on efxnews article)

This pair is on bearish market condition for

ranging between Fibo resistance level at 1.1713 and Fibo support level

at 1.0850. Symmetric triangle pattern was formed by the price to be

broken with 1.0807 resistance level for the bearish trend to be

continuing, and the next bearish targets in this case are 1.0520 and

1.0461.

According to the forecast made by Bank of

Tokyo-Mitsubishi UFJ, this triangle pattern will be broken from above to

below together with 1.0807 target by the end of this year, and we may

see good bearish breakdown possibilities in the beginning of 2016: the

price will break 1.0520/1.0461 support levels by March 2016, and EUR/USD

will be at 1.000 in Jun'16.

| Pairs | Q3 Sep'15 | Q4 Dec'15 | Q1 Mar'16 | Q2 Jun'16 |

|---|---|---|---|---|

| EUR/USD | 1.120 | 1.060 | 1.020 | 1.000 |

Many int'l institutions made a prediction for the EUR/USD to be 1.000 or less than that at year-end but this is the first forecast which was clarified the values of this pair in detailed timing way: we will see the EUR/USD to be 1.000 in June 2016 only.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.09 18:03

Goldman Sachs about Next Week's FOMC: 'the first hike is not likely to come until December' (based on efxnews article)

Goldman Sachs made some forecast concerning USD related to the FOMC meeting which will be held next week on Thursday:

- "With an all-important FOMC meeting coming up next week, focus on the USD factor may increase once again. That has not typically been helpful for EM FX in recent years. But given our US Economics team’s view that the first hike is not likely to come until December and given the very sharp sell-off in EM FX in recent days, some stabilisation is certainly possible in the event of a dovish outcome."

-

"This would argue for some near-term caution in chasing the rapid moves

of recent days. However, such a reprieve is likely to prove temporary,

in our view, because the underlying external and internal adjustments

are not complete, and we continue to see room for EM FX weakness versus

the USD to extend in the medium term."

Just to remind about next week's FOMC metting:

2015-09-17 19:00 GMT (or 21:00 MQ MT5 time) | [USD - FOMC Statement, Federal Funds Rate]

- past data is 0.25%

- forecast data is 0.50% or 0.25%

- actual data is n/a according to the latest press release

if actual > forecast (or previous data) = good for currency (for USD in our case)

if hawkish > expected = (for USD in our case)

[USD - FOMC Statement] = It's the primary tool the FOMC uses to communicate with investors about monetary policy. It contains the outcome of their vote on interest rates and other policy measures, along with commentary about the economic conditions that influenced their votes. Most importantly, it discusses the economic outlook and offers clues on the outcome of future votes.

[USD - Federal Funds Rate] = Interest rate at which depository institutions lend balances held at the Federal Reserve to other depository institutions overnight. Short term interest rates are the paramount factor in currency valuation - traders look at most other indicators merely to predict how rates will change in the future.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.10 08:43

Credit Agricole for EUR/USD: 1.12 by the end of Q3, 1.06 by the end of the year, and 1.04 by the end of Q1 of 2016 (based on efxnews article)

Credit Agricole made an other forecast for EUR/USD: 1.12 by the end of

Q3, 1.06 by the end of the year, and 1.04 by the end of Q1 of 2016. It

means that old forecast (made few day ago) was updated for 1.12 target

for this pair by the end of September. This correction was made because

of fundamental factors changed: Credit Agricole is expecting dovish ECB

(ECB Meetings) and

hawkish Fed (FOMC).

Just to remind the general rules for fundamental news events concerning the speeches:

- EUR: if dovish > expected = good for currency (for USD in our case).

- USD: if hawkish > expected = good for currency (for USD in our case).

That means that Credit Agricole is expecting more bearish for EUR/USD in the medium term forecast:

- "We revise our near-term forecasts for EUR to the upside to account for the latest China-induced risk selloff. We expect the positive correlation between risk aversion and EUR to keep the single currency supported in the near term."

- "The resilience should be evident against USD given that the Crédit Agricole CIB economists have pushed their Fed lift-off call from September to October 2015. Going into year-end and into 2016 we expect the policy divergence trade to reinstate itself, however."

- "Strong EUR coupled with slowing global growth and lower commodity prices should increase the risk that the ECB QE will continue beyond September 2016, making the EUR an even more attractive funding currency."

- "All that should bring EUR NEER back down to its recent lows over the forecast horizon. We lower our medium-term outlook for EUR/USD in view of the persistent policy divergence between the dovish ECB and hawkish Fed."

- "We now target EUR/USD at 1.12 by the end of Q3, 1.06 by the end of the year, and 1.04 by the end of Q1 of 2016."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.11 05:55

USD trading strategy going into next week's FOMC meeting - Morgan Stanley (based on efxnews article)

Morgan Stanley estimated thew probability for Fed hike in September vs December meetings, and it was stated that a 30% chance only of a hike in September, so there is more chance to expect this events in December this year. And in this case, it may be more opportunity for EUR and JPY with related to USD: those pairs may be in bullish condition during the September 17th meeting for example.

Thus, there are 3 basic scenarios concerning Fed hike:

Base-Case: December. "The Fed has entered its

pre-meeting silent period, which means there are no speakers on the

agenda to move market expectations of the first hike before the

September 17th meeting. Comments from the Fed thus far suggest the

central bank wants to make the first hike as well flagged as possible

and avoid surprising the market. With markets pricing in less

than a 30% chance of a hike in September, it therefore is unlikely that

the Fed will hike now. Indeed, our US economists have maintained their

view for a December hike."

Get It Done: "A hike next Thursday would lead to

accelerated EM weakness, in our view. Current account surplus and net

foreign asset-supported FX such as EUR and JPY may rally should the Fed

hike; these currencies have developed an increasingly tight inverse relationship with the performance of risky assets."

Or Wait: "The Fed delaying action would be in line with current market pricing. In this scenario, USD would likely soften somewhat and the Fed would remain data-dependent in the statement and in the Chair’s press conference. Nonetheless, USD dips still represent buying opportunities as the reason for USD strength is mainly USD-supportive repatriation flows."

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price is on primary bullish for secondary correction: the price was stopped by 1.1086 support level located on the upper border of Ichimoku cloud with 1.0847 as the next bearish target located below Ichimoku cloud in the bearish area of the chart. if the price breaks 1.1086 on close daily bar so we may see the reversal of the price movement to the primary bearish market condition with the secondary ranging: the price will be located indie Ichimoku cloud; if not so the ranging bullish trend will be continuing.

D1 price - correction with possible bearish reversal:

W1 price is on bearish market condition with secondary ranging between 1.0807 bearish support level and 1.1713 bullish resistance level.

MN price is on ranging bearish with 1.0461 support level.

If D1 price will break 1.1086 support level on close D1 bar so we may see the reversal of the price movement to the primary bearish market condition with secondary ranging (ranging bearish).

If D1 price will break 1.1331 resistance level so the bullish trend will be continuing.

If not so the price will be on ranging between the levels (ranging bullish).

SUMMARY : correction

TREND : ranging