Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.01 12:54

Non-Farm Payrolls: actual data forecasting related to September hike - BNP Paribas (based on efxnews article)

2015-09-04 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Non-Farm Payrolls]

- past data is 215K

- forecast data is 220K

- actual data is n/a

If actual > forecast = good for currency (for USD in our case)

[USD - Non-Farm Payrolls] = Change in the number of employed people during the previous month, excluding the farming industry. Job creation is an important leading indicator of consumer spending, which accounts for a majority of overall economic activity.

==========

BNP Paribas made the comments on Friday's NFP related to September Fed hike and actual data forecasting. As we know - the forecast data is 220K, and if actual data is more than 220K for example so the USD to be more stronger in this case. Concerning EUR/USD, we can see that it may be bearish condition to be ibncrease for this pair during and immediate after this high impacted news event:

- "Our economists expect an above-consensus 230K increase in jobs and a steady unemployment rate of 5.3%."

- "Although this probably won’t be enough to force a September hike, there is scope for the US yield curve to turn more USD supportive if markets have greater conviction in the strength of the US economy and the Fed’s ability to pursue a sustained policy normalization cycle."

==========

EURUSD M5: 90 pips range price movement by USD - Non-Farm Employment Change news event:M5 chart

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.01 15:17

What Fed Officials Are Saying About a September Rate Increase (based on wsj article)

"Federal Reserve officials made clear in recent days they have not agreed on when to start raising short-term interest rates, and the possibility of a September move remains on the table. The odds of a rate increase next month have appeared to diminish amid worries about China’s economic slowdown and turmoil in financial markets. Some officials want to see more economic data before deciding, while others think they’ve waited long enough. The most powerful decision maker, Chairwoman Janet Yellen, has not commented on the topic in the past few days. Here are some key quotes from those who have."

- Fed Vice Chairman Stanley Fischer: "I will not and indeed cannot tell you what decision the Fed will reach by Sept. 17."

- New York Fed President William Dudley: "At this moment, the decision to begin the normalization process at the September [Federal Open Market Committee] meeting seems less compelling to me than it did several weeks ago."

- St. Louis Fed President James Bullard: "I’m willing to respect the volatility in markets and see how it shakes out here. But just sitting here today, I’m not seeing how this is going to change the forecast and therefore I think the contours of monetary policy are about the same today as they were a couple weeks ago."

- Cleveland Fed President Loretta Mester: "I think the economy can support a modest increase in interest rates. I want to take the time I have between now and the September meeting to evaluate all the economic information that's come in, including the recent volatility in the markets and the reasons behind that. But it hasn't so far changed my basic outlook that the U.S. economy is solid and it could support an increase in interest rates."

- Kansas City Fed President Esther George: "In my own view, the normalization process needs to begin and the economy is performing in a way that I think it is prepared to take that."

- Atlanta Fed President Dennis Lockhart: "We are sort of anxious to get going, but given the events of the last several weeks, a risk factor has arisen” …“It has to be considered an open question whether we move now or wait a little while."

- Minneapolis Fed President Narayana Kocherlakota: "It’s definitely premature to be thinking about the removal of accommodation in the form of lifting off, at least based on my current outlook for inflation."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.01 18:18

Gold Prices Higher as Possible Fed Rate Rise Seen Later (based on wsj article)

- "Gold prices were higher on the London spot market Tuesday, as the potential timing of an impending U.S. interest rate raise continued to move into the long grass."

- "Spot gold prices were up 0.7% at $1,142.11 a troy ounce in morning European trade, having hit a four-day high earlier in the session at $1,144.28 an ounce."

- "Long-held expectations that the Federal Reserve will raise rates in September have reduced among market participants given some wobbles in key economic data."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.02 17:43

Gold Prices Slip on Strong Dollar (based on wsj article)

- "Gold prices edged lower on Wednesday as a stronger dollar and gains in equity markets tempered investor appetite for the haven asset."

- "The most actively traded contract, for December delivery, was recently down 70 cents, or 0.1%, at $1,139.10 a troy ounce on the Comex division of the New York Mercantile Exchange."

- "Gold rallied to a one-week high on Tuesday as turbulence in global stocks and fears of an economic downturn in China sparked a rush to assets perceived as low risk, like precious metals. Gold doesn’t derive its value from a country or government and has historically weathered financial and economic upheaval better than stocks and bonds, whose value is backed by private or public institutions."

- "But as stability returns to global stock markets, gold’s allure is fading. The S&P 500 stocks index was recently up 1% at 1933, while the Dow Jones Industrial Average is up 1.1% at 16,236."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.04 07:27

The Royal Bank of Scotland: Non-Farm Employment Change and basic trading scenarios (based on efxnews article)

The Royal Bank of Scotland evaluated some scenarios concerning NFP for today (September 4 at 13:30 GMT).

- "250k to 300k: Long USD/CHF."

- "200k to 250k (Base-Case): Short EUR/USD."

- "150k to 200k: Short USD/CAD."

-

"150k or below: Short USD/JPY."

As we know - Non-Farm

Payrolls is the most high impacted news event which can move the price

for the pairs and estimate the direction of the trend for the next week

for example.

Just to remind about this news event:

==========

2015-09-03 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Non-Farm Employment Change]

- past data is 215K

- forecast data is 215K

- actual data is n/a according to the latest press release

if actual > forecast (or previous data) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry. Job creation is an important leading indicator of consumer spending, which accounts for a majority of overall economic activity.

==========

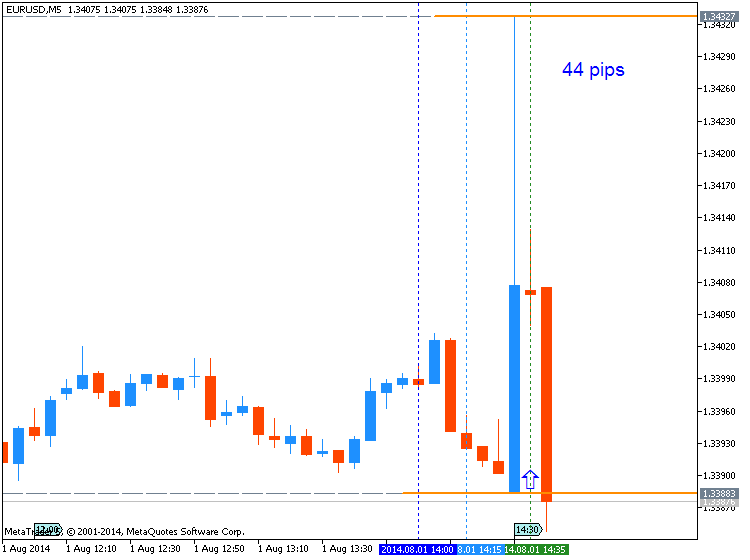

EURUSD M5 : 44 pips price movement by USD - Non-Farm Payrolls news event:

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.04 12:08

Trading NFP by Credit Agricole (based on efxnews article)

Credit Agricole expects NFP to be 220K and unemployment rate of 5.3%:

- "A NFP print in line of stronger than consensus accompanied by solid weekly earnings' gains will suggest that lift-off cannot be postponed for too long. Given that the investors have pared back significantly their rate hike expectations for September and October, a stronger NFP print will also have a more pronounced market impact in our view. We expect the USD to do well under this outcome with EUR and risk-correlated among the biggest losers."

- "A weak print, eg a NFP print below 190K and a soft weekly earnings' gain (essentially a sub 2% YoY growth), could lead the markets to pare back lift-off bets. We suspect that while negative for USD, the

overall impact may be less pronounced and could see investors selling

USD against JPY, EUR and CHF yet again. Any relief rally in

risk-correlated currencies should prove short-lived."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.04 15:14

2015-09-04 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Non-Farm Employment Change]- past data is 245K

- forecast data is 215K

- actual data is 173K according to the latest press release

if actual > forecast (or previous data) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

2015-09-04 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Unemployment Rate]

- past data is 5.3%

- forecast data is 5.2%

- actual data is 5.1% according to the latest press release

if actual < forecast (or previous data) = good for currency (for USD in our case)

[USD - Unemployment Rate] = Percentage of the total work force that is unemployed and actively seeking employment during the previous month.

==========

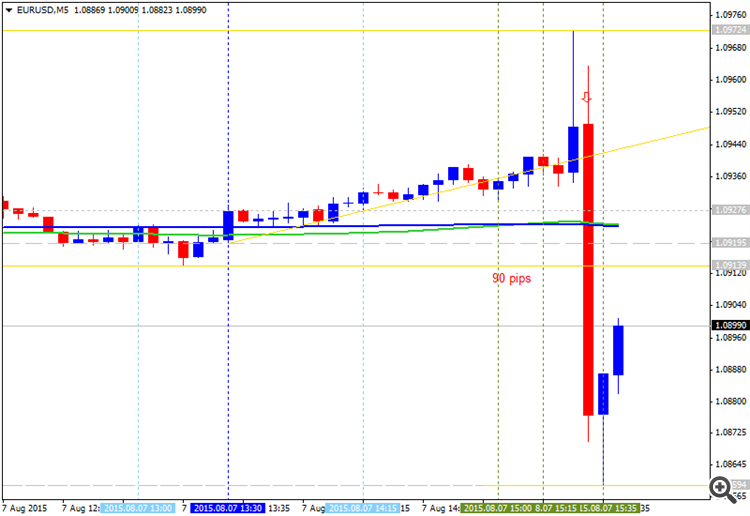

This is ranging price movement during this high impacted news events. Ranging because of the following:

- [USD - Non-Farm Employment Change]: 173K < 215K = bad for USD related to EUR for example (the price is moved on the way to EUR)

- [USD - Unemployment Rate] 5.1% < 5.2% = good for USD related to EUR (downtrend for EUR/USD pair).

That is why ranging.

==========

EURUSD M5: 100 pips ranging price movement by USD - Non-Farm Employment Change news event:

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.09.05 09:34

Forex Weekly Outlook September 7-11 (based on forexcrunch article)

September began with more volatility and more uncertainty. Rate decisions in Canada; New Zealand and the UK, Employment data in Australia and US consumer sentiment all stand out. These are the main events on our calendar for this week. Join us as we explore these financial highlights.

The U.S. economy produced 173,000 jobs in August,falling short of estimates but with positive revisions and upbeat wage growth. The release came at a crucial timing of the rate-hike debate and the mixed report raised uncertainty, but we think the Fed could still bring on a “dovish hike”. In the euro-zone, things are far from quiet, with Draghi showing his will to act, weighing heavily on the euro. Commodity currencies couldn’t enjoy the Chinese holiday and were hit hard. Things are going to get messy again.

- Canadian rate decision: Wednesday, 14:00. Canada’s central bank decided to lower its benchmark interest rate to 0.5% in July. This was the second cut this year, aimed to boost the economy. The BOC reduced its growth estimate in 2015 from its April projection after showing a mild contraction the first half of the year. However, the Central Bank forecasts a rebound in the second half of 2015, expecting 1.9% growth this year. Analysts expect the BOC will maintain rates this time.

- US JOLTS Job Openings: Wednesday, 14:00. Job opening are eyed by the Fed as they provide a wider indication about the job market, even if this figure is delayed. In June, the figure stood on 5.25 million, and a rise to 5.33 million is on the cards for July.

- New Zealand rate decision: Wednesday, 21:00. New Zealand’s central bank cut its benchmark interest rate by 25 basis points to 3.0% in July, in hope of raising inflation and boosting economic activity. The rate cut was in line with market forecast. The Central Bank growth outlook deteriorated since the last policy meeting in June. However, the local currency has decreased noticeably since then, aiding manufacturers with weaker commodity export prices. Analysts expect further cuts in September and in October as the slowdown in China starts to affect New Zealand’s economy. Economists forecast another rate cut to 2.75% this month.

- Australian employment data: Thursday, 1:30. The unemployment rate in Australia edged up 0.2% in July reaching 6.3%, despite a job creation of 38,500 positions in July. Analysts expected a smaller addition of 10,200 jobs and unemployment rate of 6.1%. The reason behind the sharp rise in unemployment was an increase in the participation rate, reaching 65.1%. The rise in the number of job seekers may contribute to jobs growth in the coming months, which is a good thing for the Australian economy. Analysts expect a job gain of 5,200 positions and a decline in the unemployment rate to 6.2%.

- UK rate decision: Thursday, 11:00. The Bank of England maintained interest rates at 0.5% in August despite one voting member calling to raise rates. Lack of inflationary pressures delayed the Central Bank’s decision to raise rates. However, Bank governor Mark Carney said a rise is “drawing closer”, but cannot “be predicted in advance”. The collapsing stock market in China and the talks over Greece’s debts painted a grim outlook of global growth, contributing to the Bank’s decision to postpone the rate hike. Nevertheless, the Bank expects inflation to return to target next year, rising 0.25% in the first four months and may double from 0.5% to 1% by the end of 2016. Analysts see not change in Carney’s monetary policy this time.

- US Unemployment Claims: Thursday, 12:30. The number of Americans filing new applications for unemployment benefits rose last week by 12,000 to 282,000, exceeding forecasts of 273,000. However, the number of applications remain relatively low in time of a global slowdown. The four-week average increased 3,250 to 275,500. That average has fallen 9.2% over the past 12 months. The combination of steady job growth and low levels of applications suggests that the US economy will continue to expand in the coming months. Economists forecast the number of new claim will reach 279,000 this week.

- US PPI: Friday, 12:30. U.S. producer prices in the US increased for a third straight month in July, rising 0.2% after a 0.4% gain in July. However, inflation pressures remained subdued against the backdrop of lower oil prices and a strong dollar. In the 12 months through July, the PPI declined 0.8% following 0.7% drop in June. It was the sixth straight 12-month decrease in the index. Producer prices are expected to decline by 0.1% in August.

- US UoM Consumer Sentiment: Friday, 14:00. U.S. consumer confidence weakened for a second month in August, as households were more pessimistic the rate hike aftermath. The University of Michigan’s preliminary index of sentiment contracted to 92.9 from 93.1 in July. Economists expected a reading of 93.5. The global financial turmoil caused by China has yet to affect future sentiment reports. Americans forecast an inflation rate of 2.8% in the next 12 months, the same as in July, the report showed. Over the next five to 10 years, they anticipated a 2.7%, down from 2.8%. U.S. consumer sentiment is expected to dip further to 91.6.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

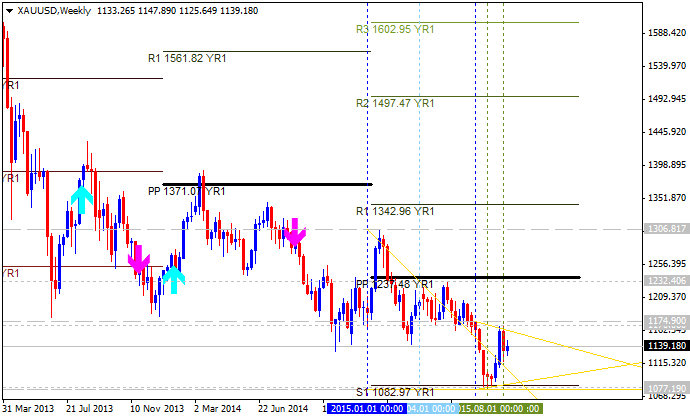

Daily price is on ranging market condition located inside Ichimoku cloud betweeb Sinkou Span A and Sinkou Span B lines. The key resistance level for the bullish trend to be continuing is 1174.90; the key support level for the price to be fully reversed to the bearish market condition is 1077.19.

D1 price - ranging:

W1 price is on bearish market condition with secondary ranging between 1077.19 support level and 1174.90 resistance level.

MN price is on ranging bearish with 1077.19 support level.

If D1 price will break 1077.19 support level on close D1 bar so we may see the primary bearish market condition.

If D1 price will break 1174.90 resistance level so the price will be in primary bullish trend.

If not so the price will be on ranging between the levels.

SUMMARY : ranging

TREND : waiting for direction