Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.22 09:53

Forex Weekly Outlook August 24-28 (based on forexcrunch article)

The US dollar suffered in a week that saw doom and gloom in global markets. Will this continue? German Ifo Business Climate, US CB Consumer Confidence, US Durable Goods Orders and GDP data from the US and the UK are the main highlights in Forex calendar. Join us as we explore the market-movers for this week.

The Federal Reserve released its July meeting minutes, revealing a dispute over the rate hike timing. Despite clear signals from some Fed officials calling for a rate rise in September, many policy makers still believe such a move is premature. In her capacity as the chair and the leader, Janet Yellen will be the driving force behind September’s decision. Will we see a rate hike in September? The chances look more slim with growing worries about China and fresh political uncertainty about Greece. The euro is clearly positioned as a safe haven currency and enjoys the crisis, alongside the yen. Dollar longs are on the other end.

- German Ifo Business Climate: Tuesday, 8:00. Business sentiment improved unexpectedly in July following two monthly declines upon an agreement between Greece and its creditors. The Ifo business climate index edged up to 108.0 from a revised 107.5 in June, beating expectations fora 107.6 reading. The Greek crisis resolution and the nuclear deal with Iran boosted sentiment. The survey showed brighter expectations, as well as better current conditions. Business sentiment is forecasted to reach 107.6 in August.

- US CB Consumer Confidence: Wednesday, 12:30. U.S. consumers were less optimistic in July. The Conference Board’s Consumer Confidence Index declined to 90.9 in July from 99.8 in the prior month, missing forecasts for 100.1. The reading registered its lowest level since September 2014. Current conditions remain positive, but the short-term expectations deteriorated, amid uncertainty concerning the labor market, and volatility in financial markets prompted by the situation in Greece and China. U.S. consumers are expected to be more positive in August. The index is expected to rise to 93.1.

- US Durable Goods Orders: Wednesday, 12:30. Businesses rebounded after a slow start. Orders for long lasting manufactured goods edged up 3.4% in June after a 1.8% fall in May. Economists forecasted a 3.2% gain. Business investments in manufacturing equipment and software also suggests a pickup in manufacturing in the coming months. However, uncertainty remains since the Durable-goods can be volatile. Meanwhile, orders excluding transportation gained 0.8%, the largest increase since August 2014. Overall, new orders in the first half of 2015 remain weak, down 2% from the same period in 2014. Orders for durable goods are expected to decline 0.5%, while core orders are forecast to gain 0.3%.

- Jackson Hole Symposium: Thursday, Friday and Saturday. Quite a few central bankers will be making their way to Jackson Hole Wymong for the annual conference. While Fed Chair Janet Yellen will not be attending, some other important figures will be speaking and rubbing shoulders in the corridors. This includes Vice Chair Stanley Fischer, BOE Governor Mark Carney and others. Remarks about the Chinese slowdown ,the euro-zone recovery and of course a potential US Fed hike from the people that matter most will all stir markets.

- US GDP data: Thursday, 12:30. According to the initial estimate, the US economy grew by 2.6% in Q2, a bounce back from an upwards revised 0.6% in Q1 but certainly not convincing enough. In the second estimate, an upgrade to 3.2% is on the cards. Will a significant upwards revision improve the mood? Ir it the gloom of Q3 here to stay?

- US Unemployment claims: Thursday, 12:30. The number of Americans filing initial claims for unemployment aid increased mildly last week, reaching 277,000. The 4,000 climb is still consistent with a solid job market. The four-week average increased 5,500 to 271,500. The average number of claims remain near a 15-year low, indicating the US labor market continues to strengthen. However, wage growth has yet to improve. Average hourly pay increased a mere 2.1% from 12 months earlier, far less the 3.5% to 4% gains viewed in healthy economies. The number of jobless claims are expected to reach 275,000 this week.

- UK GDP data: Friday, 8:30. The UK economy returned to stronger growth in Q2: 0.7% according to the initial read. This was as expected and stronger than +0.3% seen in Q1. A confirmation of this number is on the cards for the first revision.

- US Goods Trade Balance: Friday, 12:30. This new report from the U.S. Commerce Department was released in July. The event is issued four to seven days prior to the existing report on International Trade in Goods and Services, excluding services or trade in goods on a balance of payments basis. This data is included in the GDP report aimed to improve the accuracy of the first estimate. The Goods Trade Balance for June showed a trade deficit at $62.26 billion.

- Mark Carney speaks: Saturday, 2:25. BOE Governor Mark Carney is scheduled to speak about inflation Dynamics and Monetary Policy at Jackson Hole Symposium. He may talk about the low inflation trend in the UK and his concerns that inflation might fall below zero again postponing any rate hike initiatives this year.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.23 19:46

EUR - Fundamental Outlook for the Current Week by Morgan Stanley (based on efxnews article)

Morgan Stanley is considering the this is a good time to be with EUR forecasting bullish for the next few weeks:

"We believe EUR is likely to outperform over the next few weeks. The risk-off environment is likely to drive repatriation flows, which should be EUR supportive. In addition, many risky holdings were funded in EUR, and the unwind of these positions should support EUR. With EUR not being used as funder in the near term, it should receive support from its current account surplus."

Let's evaluate this situation with technical points of vew:

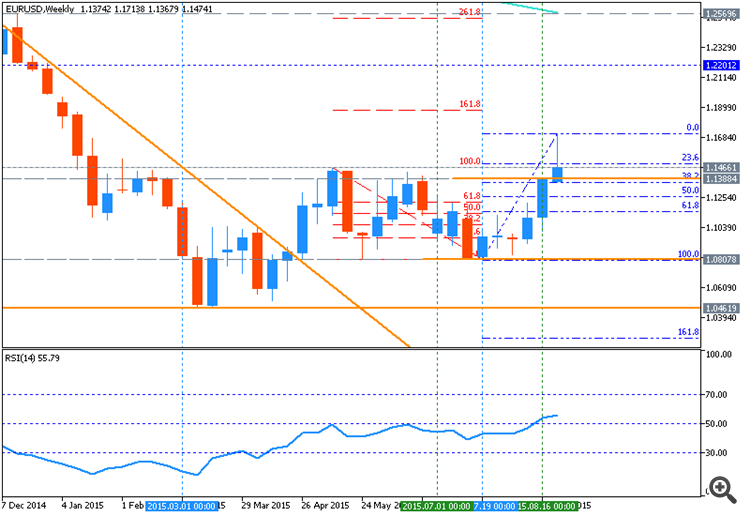

- Weekly price is still on bearish arket condition for trying to cross 1.1466 resistance for the bear market rally to be started. The reversal level is 1.2568, and if weekly price will break this reversal level from below to above so it will be the global reversal of the price movement to the primary bullish market condition.

- Daily price is on reversal to the bullish with 1.1466 as the nearest resistance level located in the bullish area of the chart. The price is breaking 200 day SMA, and if 1.1466 resistance will be broken so the price will be reversed to the bullish market condition.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.24 08:38

EURUSD Forecasts by Danske Bank (based on efxnews article)

Danske Bank is forecasting the ranging market condition for EUR/USD up to August 2016: the price will be ranging between 100 day SMA and 200 day SMA within 1.10/1.13 support/resistance channel:

| Pair | Q3 September'15 | Q4 November'15 | Q1 February'16 | Q3 August'16 |

|---|---|---|---|---|

| EUR/USD | 1.130 | 1.100 | 1.100 | 1.150 |

Thus, according to the Danske Bank - we should expect the bullish for daily EUR/USD only in the middle of the next year by the price to be turned to 1.15 which is located on the bullish area of daily chart.

Concerning weekly price for this pair so the price will be in total ranging condition within the primary bearish: all support/resistance levels (incl 1.25 'reversal' resistance level which is on the border between bearish and bullish on the weekly chart) are located on the bearish zone. So, Danske Bank expects for the EUR/USd to be in bearish market condition in long term situation for example.

This is daily/weekly breakout to be going on for right now.

1.2199 is the next bullish target.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.25 06:52

FOMC will raise rates in March 2016 - Barclays (based on efxnews article)

Barclays Capital made a conclusion that Fed rate hike will be March 2016. Barclays explained that FOMC can raise rates in December 2015 but FOMC FOMC may push rate hike in Mrach because of volatility of the market.

- "Given the uncertainty around the current global outlook, the timing of the rate hike seems more uncertain than usual. Should this episode of financial market volatility prove transitory, the FOMC could raise rates in December. On the other hand, if the volatility proves durable or reveals greater than expected weakness in global activity, the FOMC may push the first rate hike beyond March."

- "We see a delay past mid-2016 as a relatively low probability at this point given our views on US labor markets. The US has proven durable to shocks emanating from emerging markets in the past, and we believe the current bout of uncertainty to be less pronounced than the successive shocks from developed economies that rocked global markets in 2008, 2010, and 2010."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.25 18:23

Experts react to Black Monday (based on telegraph.co.uk article)

Markets now believe Federal Reserve won't rise rates until 2016, and this is what experts are talking about:

Economists at Barclays - expectation of a Fed rate rise to the first half of next year: "Given the uncertainty around the current global outlook, the timing of the rate hike seems more uncertain than usual. Should this episode of financial market volatility prove transitory, the FOMC could raise rates in December. On the other hand, if the volatility proves durable or reveals greater than expected weakness in global activity, the FOMC may push the first rate hike beyond March."

Economists at Capital Economics - September rate hike: "There are no signs of any major downturn in the US economy, economic growth in China still appears to slowing rather than collapsing and emerging markets are not about to endure a repeat of the 1997/98 Asian crisis. The current bout of market turmoil, if it continues, might persuade the Fed to hold off on raising interest rates in September. Since that volatility doesn’t reflect any genuine economic slump, however, we wouldn’t be surprised if it proved short-lived leaving the way open for the Fed to begin raising rates at some point this year."

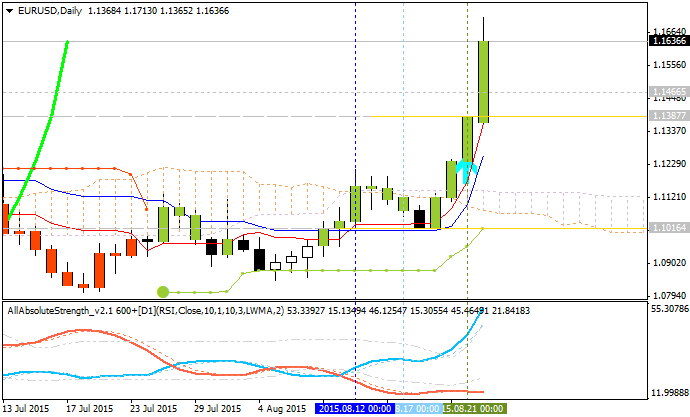

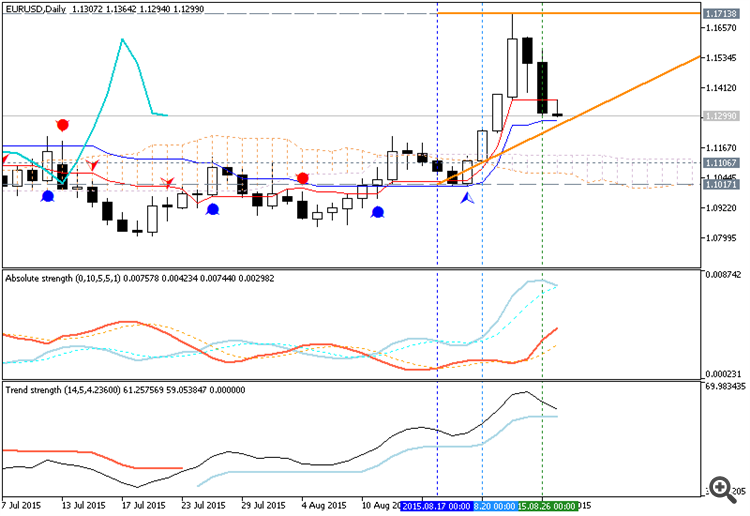

The International Monetary Fund (IMF) - delay raising rates until 2016: "The FOMC should defer its first increase in policy rates until there are greater signs of wage or price inflation than are currently evident. Based on staff’s macroeconomic forecast, and barring upside surprises to growth and inflation, this would imply a gradual path of policy rate increases starting in the first half of 2016."Daily price was reversed to the bullish market condition by breaking Ichimoku cloud from below to above. The price was stopped near 1.1409 resistance level on the way to 1.1466 bullish target. Chinkou Span line is indicating the breakout, and Tenkan-sen line is above Kijun-sen for the bullish trend to be continuing. If the price breaks 1.1466 resistance so the bullish trend will be continuing, if the price breaks 1.1213 so the secondary correction will be started.

D1 price - bullish breakout:

- Tenkan-sen line is above Kijun-sen line for bullish market condition.

- Absolute Strength indicator's data is for strong bullish condition to be continuing.

- Chinkou Span line is indicating the bullish breakout by direction.

- 'Reversal' Sinkou Span line as the border between the primary bullish and the primary bearish on the chart is located below the price.

- Nearest key support levels are are 1.1213 and 1.0807.

- Nearest key resistance levels are 1.1409 and 1.1466.

W1 price is on bearish market condition with the breakout to be started: Chinkou Span line is indicating breakout with 1.1466 nearest resistance level.

MN price is on ranging bearish with 1.0461 support level.

If D1 price will break 1.1213 support level on close D1 bar so we may see the secndary correction within the primary bullish market condition.

If D1 price will break 1.1466 resistance level so the bullish trend will be continuing.

If not so the price will be on ranging between the levels.

- Recommendation for long: watch close D1 price to break 1.1466 for possible buy trade

- Recommendation to go short: watch D1 price to break 1.1213 support level for possible sell trade

- Trading Summary: ranging

| Resistance | Support |

|---|---|

| 1.1409 (D1) | 1.1213 (D1) |

| 1.1466 (W1) | 1.0807 (W1) |

| 1.1466 (MN1) | 1.0461 (MN1) |

SUMMARY : bullish

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.26 11:01

United Overseas Bank believes in bullish on EUR/USD within 1-3 weeks (based on efxnews article)

United Overseas Bank (UOB) maintains a bullish forecast for EUR/USD within the next 3 weeks. United Overseas Bank previously known as United Chinese Bank or UCB and headquartered in Singapore is a financial int'l holding company. UOB was founded in 1935 and having the branches in most South-East Asian countries. The UOB Group estimated for EUR/USD to break 1.1710/1.1715 in the near future:

-

"The low of 1.1395/00 yesterday held just above our 1.1360 stop-loss.

Despite the sharp rebound from the low, the recent strong momentum has

been dented and this pair is likely in a short-term consolidation phase

that may last for a few days."

- "As long as 1.1360 is not taken out, a break above the 1.1710/15 high on Monday cannot be ruled out even though the odds for such a move appears to be quite low at this stage."

On the daily basis, UOB Group evalute the EUR/USD to be in ranging market condition within 1.1425/1.1580.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.26 21:33

EUR/USD: Topped Or Not (based on efxnews article)

- Morgan Stanley: "EUR/USD has not topped yet."

- SocGen: "If sustained above the triangle limit of 1.1385/70, the recovery should be persistent."

- Barclays: "We are neutral given stretched daily studies and look for signs of a top to re-establish our overall bearish view. We would only buy on a break above 1.1710 for a short-term upside squeeze towards the 1.1810/75 area. From there we would look for signs of a top to move lower in range."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.08.27 10:48

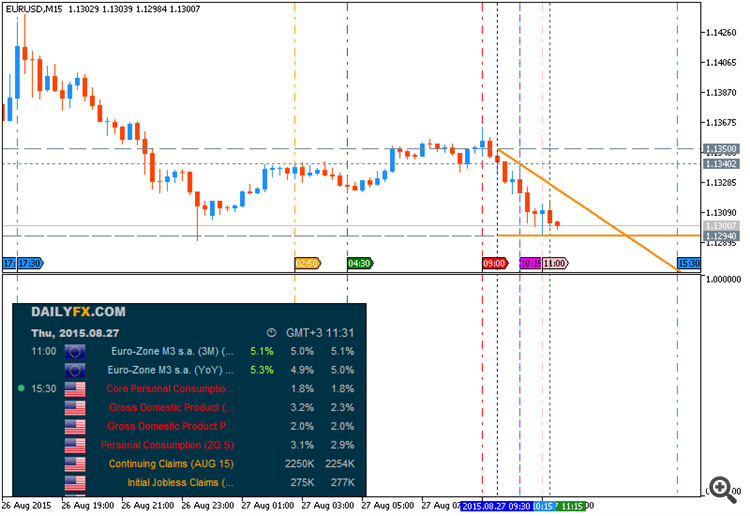

Trading News Events: U.S. Gross Domestic Product (based on dailyfx article)

An upward revision in the 2Q U.S. Gross Domestic Product (GDP) report may boost the appeal of the greenback and spark a larger pullback in EUR/USD as it fuels speculation for a September Fed rate hike.

What’s Expected:

Why Is This Event Important:

The Fed may stay on course to normalize monetary policy in 2015 as the central bank still anticipates a stronger recovery to materialize over the coming months, and data prints encouraging an improved outlook for growth & inflation may spur a greater dissent within the committee as the economy gets on a more sustainable path.

However, easing job growth paired with the slowdown in building activity

may drag on growth rate, and signs of a slower recovery may spur a

further delay of the Fed’s normalization cycle as the central bank

struggles to achieve the 2% target for inflation.

How To Trade This Event Risk

Bullish USD Trade: Growth Rate Expands Annualized 3.2% or Greater

- Need to see red, five-minute candle following the GDP report to consider a short trade on EURUSD.

- If market reaction favors a long dollar trade, sell EURUSD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

- Need green, five-minute candle to favor a long EURUSD trade.

- Implement same setup as the bullish dollar trade, just in reverse.

EURUSD Daily

- Near-term breakout in EUR/USD keeps the focus on the topside targets as the RSI retains the bullish momentum; will retail a constructive view along as the pair holds above former-resistance around 1.1180 (23.6% retracement) to 1.1210 (61.8% retracement).

- Interim Resistance: 1.1760 (61.8% retracement) to 1.1810 (38.2% retracement)

- Interim Support: Interim Support: 1.0790 (50% expansion) to 1.0800 (23.6% expansion)

1Q 2015 U.S. Gross Domestic Product (GDP)

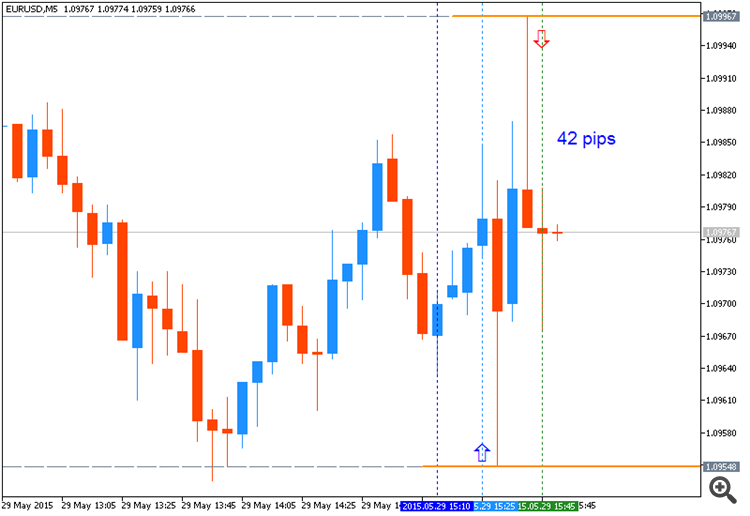

EURUSD M5: 42 pips range price movement by USD - GDP news event:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price was reversed to the bullish market condition by breaking Ichimoku cloud from below to above. The price was stopped near 1.1409 resistance level on the way to 1.1466 bullish target. Chinkou Span line is indicating the breakout, and Tenkan-sen line is above Kijun-sen for the bullish trend to be continuing. If the price breaks 1.1466 resistance so the bullish trend will be continuing, if the price breaks 1.1213 so the secondary correction will be started.

D1 price - bullish breakout:

W1 price is on bearish market condition with the breakout to be started: Chinkou Span line is indicating breakout with 1.1466 nearest resistance level.

MN price is on ranging bearish with 1.0461 support level.

If D1 price will break 1.1213 support level on close D1 bar so we may see the secndary correction within the primary bullish market condition.

If D1 price will break 1.1466 resistance level so the bullish trend will be continuing.

If not so the price will be on ranging between the levels.

SUMMARY : bullish

TREND : weekly breakout