Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.07.26 19:29

Crédit Agricole for Week Ahead: FOMC, GDP, Durable Goods, ECI, Cons Conf (based on efxnews article)

- "Durable goods orders are expected to rise by a sturdy 3.0% in June, boosted by a jump in non-defence aircraft orders. The bi-annual Paris air show in mid-June reported record levels of attendants and exhibitors, with over USD130bn orders announced. The strong showing was apparent in June’s Boeing aircraft orders: 161 new orders compared with 11 in May.

- We see risk of a small slip in the July consumer confidence index to 99.0, which bounced by almost 7pt in June. That rise fully reversed the April/May weakness and pushed the index close to its post-recession high of 103.8, reached in January. A likely decline in July would primarily reflect a partial reversal from the June jump.

- No rate hikes are expected in July. There are no updates to the Fed’s Summary of Economic Projections or a press conference following the meeting. Fed officials are looking for more evidence that economic growth is sufficiently strong and labour market conditions continue to firm enough to return inflation to the Committee’s longer-run 2% objective over the medium term. We believe that the FOMC will begin rate normalisation in September with a gradual, data-dependent pace of rate hikes thereafter.

- We look for Q2 real GDP to grow at a 2.5% pace in the advance release following a 0.2% contraction in Q1. The Q1 stall reflected a wide range of transitory factors, in our view. While oil and dollar impacts may continue to weigh, we expect a broad-based recovery in activity in Q2. We look for consumer spending to pick up to a 2.6% rate from 2.1% in Q1, on the back on cheap gasoline prices and a stronger labour market. The deep negative contribution of net exports in Q1 (−1.9pp) is expected to turn slightly positive as trade flows recovered from the port disruptions. We expect greater residential investment in line with robust growth in housing starts, while nonresidential investment likely recovered but remained relatively weak.

- The Q2 Employment Cost Index (ECI), a measure of total worker compensation costs, likely rose at a 0.6% pace, easing modestly from a 0.7% rate in Q1. Wages and salaries, which account for 70% of the index, are expected to rise at a slower pace, in line with the Q2 average hourly earnings growth of 0.5% on the quarter (Q1: 0.7%). We do see upside risk, however, drawing from encouraging developments in survey data.

USD: Focus on the Fed. Bullish.

With risks from Greece and China weakening, I believe that the market will once more focus on Fedrate hikes.

EUR: Short Positions to Come Back. Bearish.

With uncertainty regarding Greece weakened, I believe that investors will feel more comfortable re-initiating EUR shorts.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.07.27 09:32

SEB bank - Intraday Outlooks For EUR/USD, USD/JPY, EUR/CHF (based on efxnews article)

EUR/USD: "Testing nearby dynamic resistance. Buyers keep

testing dynamic resistance at the low end of the short-term "Cloud" (at

market). An "Upper Range Extension" (topside violation of the European

opening hour range) would set some pressure on more resistance at

1.1075/85."

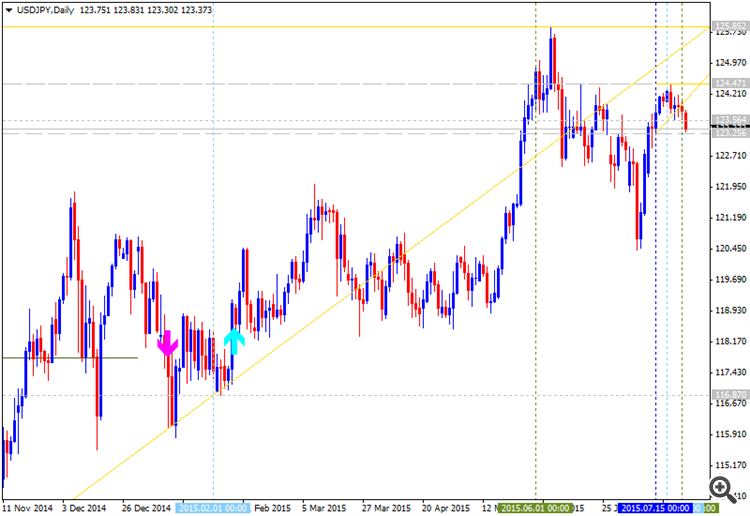

USD/JPY: "Short-term "Round-top" forming. Price action is tilted to the downside and first-hand dynamic support has been eroded. A counter-trend move lower has become increasingly likely - more so if breaking a near-term "Equality point" at 123.28 and after this not breaking back over 124.19. If this unfolds as thought, the next attraction/support below to scout is located at 122.72/45."

EUR/CHF: "An ongoing inter-range climb - Price action was bullish throughout the week last week, but little to take note of until now when a short-term "Equality point" has been violated and the early Jun high is under pressure. If not stopping here 1.0610 & 1.0650 are attraction/resistance levels to scout. In a medium-term perspective the next key level must be the Mid-Feb reaction high of 1.0811."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.07.27 17:46

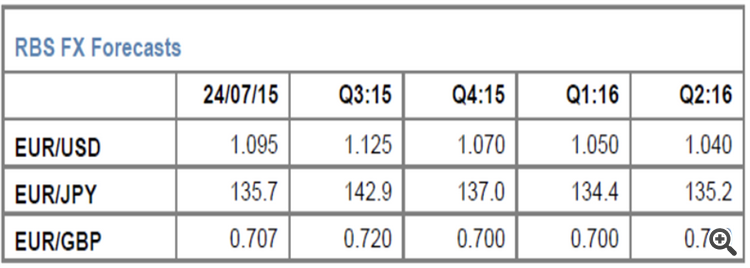

RBS - 1.05 target for EURUSD (based on forexlive article)

The Royal Bank of Scotland predicted the price for EURUSD as 1.05 1-year target, and those are the 5 key factors from RBS about why 1.05:

- "None of this has much directly to do with Greece."

-

"Other factors that support some renewed fall in

EUR/USD this year: faster money positioning in EUR/USD is now much

cleaner than it was a few months ago, short EUR/USD is a far less crowded trade."

- "The German government bond market, which went into price melt-down in March, raising serious risks to other most owned positions like short EUR/USD, has stabilised."

- "Oil prices are falling again steadily."

-

"Another key variable is US data and the US Federal Reserve. Informing

our EUR/USD lower view is the assumption that the Federal Reserve makes

its first tightening move in September his year. That is a close call.

But a September rate cut is not fully priced and -if manifest - could

give the Dollar a boost into Q4."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.07.28 09:00

Deutsche Bank with updated EURUSD review: target at 1.02 by Q3-end (based on efxnews article)

The Deutsche Bank updated their view on EUR/USD summarized all the factors and made a conclusion about target EUR/USD at 1.02 by Q3-end:

-

"The European outflow story remains fully on track.

We continue to see European outflows as part of a multi-year shift in

portfolio allocation behaviour towards foreign assets."

-

"The

most important is the Fed's re-investment policy on QE assets, because

decisions here will determine the prospect of what would essentially be

QT, or quantitative tightening: nearly half a trillion dollars matures

in 2016, almost equivalent to a full QE program in reverse."

- "Irrespective of lift-off, the key point then is that Fed tightening is multi-dimensional and likely to steadily reinforce a persistent shift away from the dollar as the world's major funding currency."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.07.28 16:34

Buying the dollar correction before Thursday and selling EUR/USD if it pushes any higher' (based on efxnews article)

Societe Generale made some prediction concerning EUR/USD based on fundamental analysis:

- "The overall picture is sufficiently blurred that month-end flows and pre-FOMC position-squaring will probably dominate. The 10-year EU/US yield spread is range-bound and the 2-year rate spread is back up over the last couple of days, both very consistent with the EUR/USD bounce, and doing absolutely nothing to suggest the range will break without new developments."

- "No-one (us included) expects much from the FOMC statement tomorrow other than affirming data-dependence, so we’ll have to wait for the GDP data Thursday (expect a strong 3.3% growth rate)."

- "The overall pattern of the news in the next three days supports the idea of buying the dollar correction before Thursday and selling EUR/USD if it pushes any higher."

it is not very clear but the right.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.07.29 11:58

Credit Agricole - 'The Fed in our view is unlikely to pre-commit to a September rate hike at today’s meeting' (based on efxnews article)

- "The Fed in our view is unlikely to pre-commit to a September rate hike at today’s meeting. Instead, it is more likely to remain data dependent, noting a cautiously upbeat assessment of progress on its dual mandate. Indeed, its statement will likely reflect the strength of the labour market, indicating the absorption of slack and the tentative signs of wage pressure."

- "Any shift in the FOMC’s statement will likely drive the FX market’s response."

- "The biggest losers will likely remain commodity currencies and those with large external imbalances."

- "We think any pullback will be short-lived, especially given that markets still have plenty of data to digests before the September meeting."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.07.29 17:16

What To Expect From FOMC (based on efxnews article)

- Goldman: "We don't expect additional language intended to prepare for rate hikes in the statement."

- Citi: "We see hawkish risks on the Fed and with investors consolidating positioning at present."

- Morgan Stanley: "Investors hope that today’s Fed statement may provide some guidance with respect to future Fed monetary policy, but with inconclusive data, Yellen’s Fed should have no incentive to diverge from her HH remarks made less than a couple of weeks ago."

-

Credit Suisse: "Credit Suisse’s US economics team

believes the Fed will hike by 25bp in September, followed by four

further hikes in 2016. To this extent, they have a strong expectation

that the Fed will use this week’s Fed meeting to provide a strong hint

that a rate hike is around the corner, as was done in previous hiking

cycles starting in 1999 and 2004."

- SocGen: "We don't expects much from the FOMC statement

tomorrow other than affirming data-dependence, so we’ll have to wait for

the GDP data Thursday (expect a strong 3.3% growth rate)."

- BNPP: "The FOMC meeting is unlikely to provide new

support for the USD, with the statement not expected to change

materially in terms of forward guidance."

- Barclays: "We expect no clear signal from the FOMC

today."

- Credit Agricole: "The Fed in our view is unlikely to

pre-commit to a September rate hike at today’s meeting. Instead, it is

more likely to remain data dependent, noting a cautiously upbeat

assessment of progress on its dual mandate."

- UBS: "UBS believes that a rate hike is likely only as

late as September, but expects this week's meeting to provide language

suggestive of a Fed rate hike in the next meeting."

- RBS: "We don't expect the Fed to move the policy rate at this week’s meeting and see little necessity to change the statement this week...A lack of a clear signal that the Fed’s consensus view is shifting in the dovish direction may be a modest support for the USD."

-

BofA: "We don't expect any explicit changes to the July

FOMC policy language to signal something about the timing of liftoff."

- SEB: "SEB has for a long time held the view that the Fed

will start hiking rates in September; the probability for postponing

that hike has increased lately. Continued strong employment growth and

downward trend for unemployment will strengthen the board's belief that

the US economy is normalizing and support its assessment that inflation

eventually will rise."

- Commerzbank: "Attention today is likely to mainly focus

on the conclusions the July statement allows on the timing of the first

expected rate step."

- Danske: "The main event will be the FOMC meeting

tonight. There will be no press conference following today’s

announcement. Instead, focus will be on the statement released in

connection with the announcement. We expect the Fed’s rhetoric to turn

more hawkish, which will keep our long-held call for a September hike

alive."

- Deutsche Bank: "It is doubtful that financial market participants will glean much new information from today’s FOMC statement. However, we expect to learn a little bit more of what it will take to get the Fed to raise rates (possibly in September), when the meeting minutes are released on August 19. Until then, investors should treat today’s statement as a placeholder... Officially, we still have the Fed hiking in September, but as we highlighted several weeks ago, a lot has to break in our direction for the Fed to raise rates—the inflation outlook has to improve, and we need stability in overseas markets."

- LIoyds: "The outlook of today’s FOMC policy meeting will be watched closely by markets. No immediate policy move is expected. However, with recent comments from Fed Chair Yellen seemingly increasing the odds of a September hike, investors will be looking for a clearer signal on the timing. There is no press conference, nor will the Committee update its forecasts, and so the only immediate clues will be in the post-meeting press statement. This will likely be more upbeat on recent economic performance."

-

HSBC: "The committee is expected to keep the target rate

for the Fed funds rate unchanged at 0-0.25% and are unlikely to change

its forward guidance on the expected path of monetary policy

normalisation. The decision to begin raising rates will be data

dependant. The economic data since the last meeting has been mixed, with

gradual improvement in the labour and housing markets being offset by

disappointing retail sales growth and new orders for capital equipment."

- Westpac: "Being the last meeting before an anticipated

September commencement to the rate normalisation process, expect the

FOMC to maintain a data-dependent but positive perspective on the

outlook, signalling a readiness to act in the near term."

BTMU: "The FOMC may well still be missing that “decisive” information to warrant a shift in policy in order for the FOMC to signal any potential for a move in this evening’s statement. To signal a more to the markets would also be inconsistent with the message from the Fed that the FOMC would decide from meeting to meeting and that decisions were data-dependent. With key wage data on Friday (ECI) and two further non-farm payrolls reports before the meeting in September, a signal in the statement today is very unlikely." - NAB: "The Fed are not expected to change policy today, but provide some guidance as to the first ‘lift-off’ of rates since 2006. It is possible that they change the risks to balanced, acknowledging the better employment market, but some inflation disappointment. It’s been a long time between cycles. That prolonged period of policy easing has made markets nervous about the coming cycle and how various asset classes, including or especially those outside of the US, will cope... So a September versus December kick-off will generate short-term moves in the USD and yields, but it is the path ahead that should be the most important factor. In that, the Fed is likely to reassure on a steady, and very slow, hiking cycle in the statement."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.07.29 20:20

2015-07-29 19:00 GMT (or 21:00 MQ MT5 time) | [USD - Federal Funds Rate & FOMC Statement]- past data is 0.25%

- forecast data is 0.25%

- actual data is 0.25% according to the latest press release

if actual > forecast (or previous data) = good for currency (for USD in our case)

[USD - Federal Funds Rate & FOMC Statement] = Interest rate at which depository institutions lend balances held at the

Federal Reserve to other depository institutions overnight. Short term interest rates are the paramount factor in currency valuation

- traders look at most other indicators merely to predict how rates

will change in the future.

==========

"To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. In determining how long to maintain this target range, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen some further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term.The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. This policy, by keeping the Committee's holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent. The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run."

==========

GBPUSD M5: 54 pips range price movement by USD - Federal Funds Rate & FOMC Statement news event:

==========

EURUSD M5: 75 pips range price movement by USD - Federal Funds Rate & FOMC Statement news event:

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.07.30 14:10

Bank of America Merrill Lynch - preview for today's US 2Q GDP (based on efxnews article)

- "The first estimate of 2Q GDP is likely to show growth of 3.0%, which would be a bounce from the contraction of 0.2% in 1Q."

- "Based on the high frequency data, we look for modest growth of 2.8% for consumer spending, reflecting the strong start to retail sales in the quarter and healthy auto sales. We also look for particular strength in residential investment, with the sector adding 0.4pp to growth. Elsewhere, the trade deficit should narrow a bit after the dramatic widening in 1Q."

- "2Q inflation measures should be a bit stronger. We are looking for a 1.3% qoq saar rise in the GDP price index and a 1.7% qoq saar rise in the core PCE deflator. On an annual basis inflation remains muted, with the GDP price index likely rising just 0.7% yoy for 2Q while the core PCE inflation rate should be 1.2%."

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

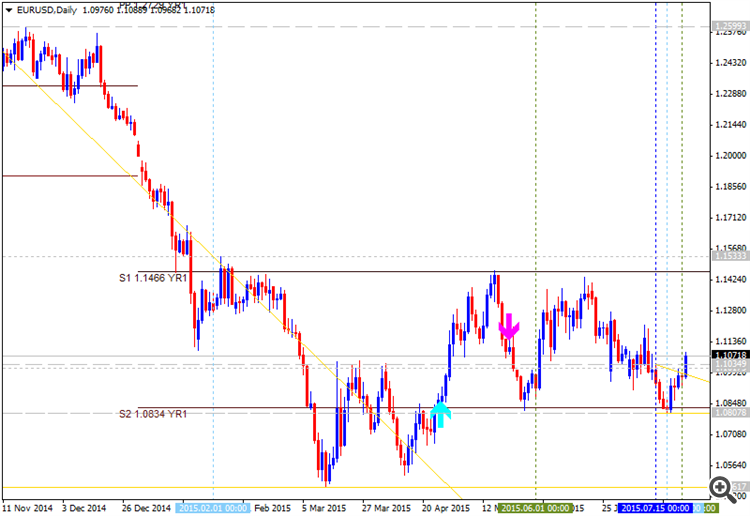

Daily price is on bearish market condition for ranging between the followings/r levels:

Chinkou Span line is indicating the ranging market condition.

D1 price - ranging market condition:

W1 price is on bearish market condition with secondary ranging between 1.0818 (W1) support level and 1.1436 (W1) resistance level.

MN price is on ranging bearish with 1.0461 support level.

If D1 price will break 1.0818 support level on close D1 bar so the bearish trend to be continuing for the week.

If D1 price will break 1.1436 resistance level so the price will be on strong bullish market condition.

If not so the price will be on ranging between 1.0818 and 1.1436 levels.

SUMMARY : bearish

TREND : ranging bearish