Follow The Fractal Tool Toward Better Breakout Entries (based on dailyfx article)

- Fractals Defined

- How Traders Can Use Fractals

- Real-Time Fractal Set-Up

-Bill Williams

Many traders spend too much time looking for the best possible entry. However, the entry can be based on any number of technical indicators. For traders who are a fan of price-action, you could do no worse than finding triggers based on a fractal breakout in the direction of the trend.

Fractals Defined

Let’s start with an introduction to fractals. The actually are applied

to trading from nature and not the other way around. It may be helpful

to know that fractals are effectively a way of looking a sub-sets of

large pieces of data to understand what developments are being created

in real-time. From a trading / market perspective, fractals are an

indicator highlighting the chart’s local highs and lows where the price

movement reversed marking a 5-bar high or low. These reversal points are

called respectively Fractal highs and lows.

The Hand is a Perfect Fractal

Before we take this natural reoccurrence to the market, you should see

how your hand, with fingers pointing up is the perfect up fractal and

with your palm facing you, is a perfect down fractal. A Market swing

Fractal shows a price extreme in the middle of 5 bars whereas an up

fractal has the middle bar with a highest high in the middle with two

lower highs on the left and two lower highs on the right. A down fractal

will have a low price extreme in the middle bar of a 5-bar sequence

with the higher lows on the left and two higher lows on the right.

How Traders Can Use Fractals

Volatility is a key determinant to trading opportunities. One of the common triggers that volatility is in play is when a prior high or low is taken out and a new trend begins. Fractals can be applied to the chart so that you can see when a recent key level has broken which can lead to a price-action trading opportunity.

Fractals revolve around price action highs and lows and can easily

pinpoint places for a breakout entry or tight price action based stop.

Fractals can be used in a variety of ways. Most commonly, traders will

look for a bar to close above a prior up fractal to show an upside

breakout or a close below a prior down fractal to signal a downside

breakout that is potentially worth trading. Another positive aspect is

that when you have a comfortable view of a strong trend in play, you can

use fractals as a trailing stop from a prior counter-trend move which

made a fractal.

Real-Time Fractal Set-Up

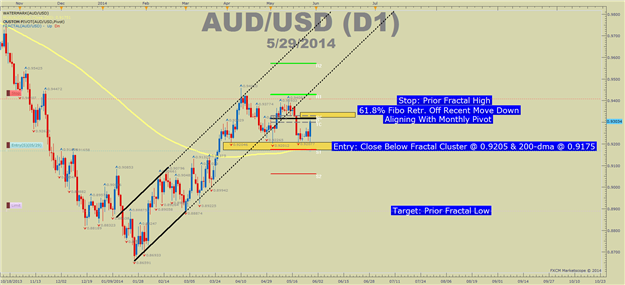

For purpose of review, fractals mark price changes or pivots in the

market. For reasons known or unknown, they are reaction points that can

help you spot key places to place an entry order or stop. From a

trader’s stand-point, they allow you to enter on a confirming view of

your analysis vs. a hunch that a market is oversold or overbought and is

time to enter like this trade set-up on the Australian Dollar.

A Fractal Based Entry on AUDUSD :

Every trader should embrace the following seven words:

I don’t know what will happen next

This isn’t meant to disregard your analysis but tell a simple fact about

trading. Anything can happen in the market place and an infinite number

of possibilities are plausible. As a trader, we can develop a strategy

with set rules that work with our psychology to give us an edge but it

will not predict the future. Therefore, we can use fractals as a trigger

to put us into a trade or out of a trade and we may not know if the

trade will end in a profit but we can now that we’re only acting on

objective evidence.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

i-Fractals-sig:

Author: Nikolay Kositsin