EURUSD Technical Analysis 2015, 05.07 - 12.07: ranging between the levels to be ready for breakdown

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.07.05 07:49

Forex Weekly Outlook July 6-10 (based on forexcrunch article)

Greece has been left front and center, with safe haven currencies riding higher and commodity currencies lower. The climax is still ahead of us. The week commences with the Greek referendum but there are other important events as well: US ISM Non-Manufacturing PMI, the FOMC Meeting Minutes, rate decisions in Australia and the UK and more. These are the major Forex events for the coming week. Join us as we explore these main market-movers.

The Greek crisis has dominated the news. The situation deteriorated as talks broke down. Banks are closed, the country failed to pay the IMF and all eyes are now on the referendum on Sunday, where polls show a close race. However, this is far from being the end of the story, especially as we learned that the IMF supports debt restructuring. While Greece is only 2% of the euro-zone economies, the political implications are huge. For the euro, the reaction was mixed: a Sunday gap was followed by a rally (for various reasons), but this was eventually eroded.

Elsewhere, the US Non-Farm Payrolls showed the economy created 223,000 positions in June but the downwards revisions, disappointing wages and the low participation rate left a bad taste. This may slow the pace of rate hikes, but the first one could come still come in September. It also depends on Greece. Commodity currencies suffered with China: AUD/USD reached a 6 year low and also the kiwi and CAD suffered. Sterling stood relatively strong thanks to good positive UK data.

- Greek Bailout Vote: Sunday. Sunday. Exit polls expected in the European afternoon, well before markets open, with full results later on. The referendum, now dubbed #Greferendum, has been announced by Greek PM Alexis Tsipras on June 26th and is on the creditors’ proposal that was described by Greece as “take it or leave it”. The Greek government rejected it and calls for a vote against it. It is unclear if this proposal is still on the table. Some European leaders have described it as a vote on euro-zone membership. What’s clear is that it is a vote on the current government’s future. A Yes vote, which is more likely due to the deteriorating situation in Greece, will likely result in a relief rally, as it opens the door to a new government that will accept whatever it’s told, but it’s unclear what government that will be. A No vote complicates the situation and could result in a big fall for the euro. And if the vote is very close, it adds another level of complication The referendum is one climax, but the Greek crisis is set to accompany us throughout the week. This is especially true as the creditors are now divided on debt restructuring.

- US ISM Non-Manufacturing PMI: Monday, 14:00. Service sector activity slowed more than expected in May. The non-manufacturing purchasing manager’s index fell to 55.7 compared to 57.8 posted in April. Analysts expected a reading of 57.1. The New Orders Index came 1.3 points lower than 59.2 registered in April. The Employment Index fell 1.4 points to 55.3. Overall, the reading still indicated expansion and respondents were mostly positive about business conditions outlook on economic growth.

- Australia: rate decision: Tuesday, 4:30. The Reserve Bank of Australia kept its official cash rate on hold at 2.0% in June, following a 0.25% cut in May and a 0.25% cut in February. Economists forecast another 25 basis points cut in August following disappointing economic data such as subdued consumer spending and poor business investment, downgrading economic growth forecast. However, the Australian economy had continued to grow at a slower than expected pace. The RBA awaits further financial data before deciding on another rate cut.

- US Trade Balance: Tuesday, 12:30. US trade contracted 10% in April, reaching $40.9 billion compared to a revised reading of $50.6 billion in March. Exports edged up to $189.9 billion in April from $188.0 billion in March, and manufactured advanced to almost $2 billion. Imports declined to $230.8 billion in April from $238.6 billion in March, including consumer goods and services.

- US FOMC Meeting Minutes: Wednesday, 18:00. These are the minutes of the June decision, in which the Fed published a somewhat lower dot plot. Given the generally dovish tone of that decision and the dovish composition of the voting members, it will be interesting to see if somebody wanted a rate hike already in June. In addition, worries about Greece (even though somewhat outdated given the recent events), the state of inflation and other topics will be interesting to watch.

- Australian employment data: Thursday, 1:30. Australia’s job market improved in June with a bigger than expected jobs gain of 42,000, pushing unemployment rate down to 6% from a revised 6.1% in May. The recent rise in labor force was mainly due to part-time employment increasing by 29,800 while full-time addition was 15,900. Nevertheless, the figure was much higher than the 12,100 gain anticipated by analysts. The participation rate, however, remains unchanged at 64.7%. Analysts believe the unemployment rate will rise in the coming months due to subdued economic growth.

- UK Rate decision: Thursday, 11:00. The Bank of England maintained the ultra-low rates at 0.50%, and kept its bond-buying stimulus program unchanged at £375bn. The Bank stated it intends to raise rates in the middle of next years after 6 years of ultra-low rates. However, in light of positive consumer and housing data, economists believe a rate hike will be in order in the first half of 2016 but much will depend on future economic growth data.

- Canadian employment data: Friday, 12:30. The Canadian labor market rebounded slightly in May after a job contraction of 19,700 in April. May’s job numbers show a job creation of around 59K positions, although, nearly half are part-time. Economists point out that the job growth is actually weak, barely keeping up with the number of people entering the workforce. The unemployment rate remained at 6.8%, up from 6.6 per cent last October.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.07.05 08:01

EUR/USD Forecast July 6-10 – Another Greek climate (based on forexcrunch article)

EUR/USD had a wild week, moving on the deterioration of the crisis, but not always in the most straightforward manner. The new week begins with the Greek referendum and continues with data from Germany and France. Greece will certainly remains in the headlines throughout the week. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Greek summary: the announcement of the referendum was followed by the Eurogroup rejecting a short term extension, the ECB capping assistance to Greek banks and triggering capital controls. This escalation resulted in a Sunday gap for the euro, but it found ways to recover and even rally. We then had ongoing negotiations, the eventual default of Greece to the IMF, more offers as both sides stopped talking and awaited the Greferendum, the IMF came out suggesting debt restructuring. For the latest, see: Greek crisis – all the updates in one place

In other news, euro-zone inflation slowed to 0.2% as expected and PMIs also came out within expectations. The US gained 223K jobs in June, slightly below expectations but revisions were negative and the bigger disappointment came from wages. Nevertheless, the Fed seems to be on track for a hike in September, but Greece is having a growing impact also on Yellen.

- Greek referendum: Sunday. Exit polls expected in the European afternoon, well before markets open, with full results later on. The referendum, now dubbed #Greferendum, has been announced by Greek PM Alexis Tsipras on June 26th and is on the creditors’ proposal that was described by Greece as “take it or leave it”. The Greek government rejected it and calls for a vote against it. It is unclear if this proposal is still on the table. Some European leaders have described it as a vote on euro-zone membership. What’s clear is that it is a vote on the current government’s future. A Yes vote, which is more likely due to the deteriorating situation in Greece, will likely result in a relief rally, as it opens the door to a new government that will accept whatever it’s told. A No vote complicates the situation and could result in a big fall for the euro. The referendum is one climax, but the Greek crisis is set to accompany us throughout the week. Polls look too close to call.

- German Factory Orders: Monday, 6:00. Europe’s powerhouse has seen a rise of 1.4% in April, better than expected. Despite usually being a volatile figure, this indicator has an impact. No change is expected now.

- Retail PMI: Monday, 8:10. Markit’s measure for the retail sector finally edged up to the growth zone. It topped 50 points in May and hit 51.4 points. A similar number is on the cards for May.

- Sentix Investor Confidence: Monday, 8:30. This survey of 2000 analysts and investors fell for the second time in June and fell to 17.1 points, below expectation. Nevertheless, it remained in positive territory, reflecting optimism. A score of 15.6 points is on the cards now.

- German Industrial Production: Tuesday, 6:00. As with factory orders, also industrial output was good in April, advancing 0.9% and enjoying an upwards revision. A smaller change is on the cards now: +0.1%.

- French Trade Balance: Tuesday, 6:45. The continent’s second largest economy has seen its trade deficits shrinking from the highs. In April, it reached a level of 3 billion euros, the lowest since 2009. A similar number is on the cards now: a deficit of 3.3 billion.

- German Trade Balance: Thursday, 6:00. Contrary to France, Germany enjoys surpluses in the euro era. This surplus reached 22.3 billion euros in April, higher than expected and the highest so far this year. For May, a surplus of 20.6 billion is expected.

- French Industrial Production: Friday, 6:45. In the past two months, France reported a contraction in the most recent industrial output data, but these were countered by positive revisions. For April, production fell by 0.9%. A bounce back is on the cards now: +0.5%.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.07.06 06:09

The Meaning Of No (based on seekingalpha article)

It appears that a majority of Greek votes have been cast for rejecting the creditors' offer. The government campaigned for this result. Prime Minister Tsipras may find, however, that it has not strengthened his negotiating hand. To the contrary, the range of options has narrowed and the financial system is collapsing.

The ECB reportedly will meet to discuss the Greek central bank's request for new ELA access. There is no reason to expect this to be forthcoming. The job of the ECB is not to support banks unconditionally. They need to be solvent. Bank can use a broader range of collateral in ELA borrowings than on loans from the ECB. There has been a concern that Greek banks were exhausting their supply of such assets. The past week only exacerbated this pressure.

Without ELA funding, the image of monetary asphyxiation seems fitting (though it gives the Greek government no reason, then, to threaten to hold its breath). Banks are running out of cash. Some suggest that there are sufficient notes until around mid-week, but not one seems to know. The longer it persists, of course, the greater the economic impact. Business failures, in turn, worsen the quality of the Greek banks' loan book.A 2-bln T-bill matures on Friday, July 10. To secure the funding, the government plans on auctioning bills on Wednesday. Greek banks are primary buyers of the government bills, simply to roll-over their current holdings. While this has been a fairly routine exercise, it could be more problematic this week. It is worth noting the auction as a potential event risk.

The results of the referendum do not necessarily mean that Greece will leave the monetary union. There are still many steps to get from here to there. The political commitment to the irreversible nature of monetary union should not be under-estimated.

The euro is set to open lower, but within the range seen a week ago. A "no" victory was largely anticipated. The key now is the response by policymakers. The creditors may be somewhat more divided now. Tsipras may feel bolder, but he is playing with the same, or fewer, cards now.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.07.06 11:48

Credit Suisse about Grexit: 'You Don't Leave The Euro; It Leaves You' (based on efxnews article)

"Countries don’t leave the euro.

If countries try to leave, or show signs that they might, the euro leaves them first.

To avoid getting trapped, devalued or defaulted.

A liquidity crisis occurs and domestic liabilities are replaced by foreign ones that cannot be redenominated.

So on exit a solvency crisis appears certain.

As “the euro leaves”, it takes the country’s banking system, and country’s credit, with it.

So a Greek “failure” would mean sovereign and banking sector default more than it would mean a new currency, we think."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.07.06 13:40

UBS: Trade Ideas for EURUSD, GBPUSD and AUDUSD (based on efxnews article)

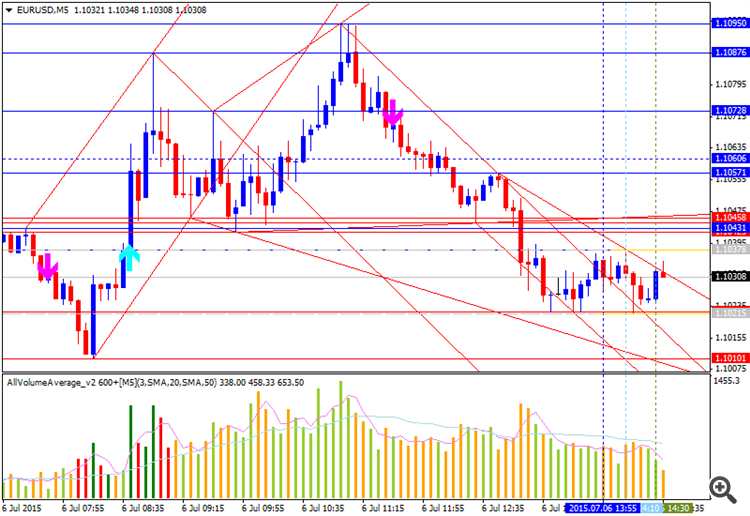

EURUSD: "it has had a muted reaction despite the surprise outcome from the Greece referendum. Even though the market is positioned short, we expect the pair to test the downside sooner rather than later this week. Keep it tight but prefer short and add on more spikes above 1.1055 with stops above 1.1125."

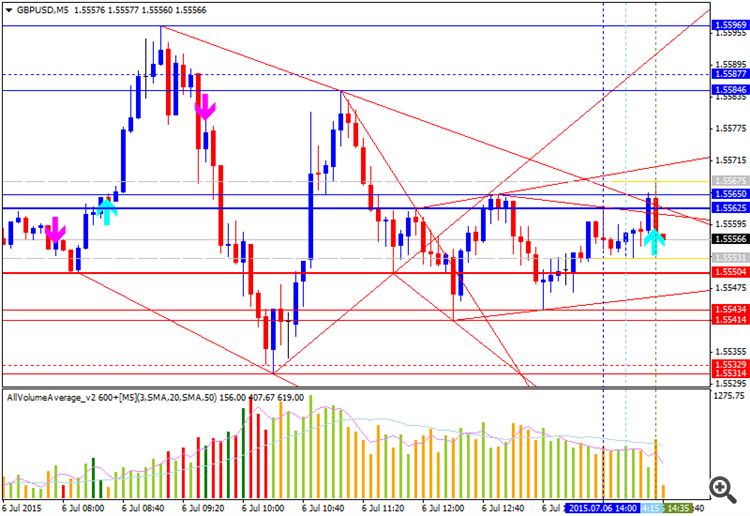

GBPUSD: "Cable should remain vulnerable to Greek

updates. Cable could continue holding the recent downtrend with the

double top just ahead of 1.6000 while approaching the 200-day moving

average at 1.5447. Stay flexible and keep stops extremely tight, but

prefer selling."

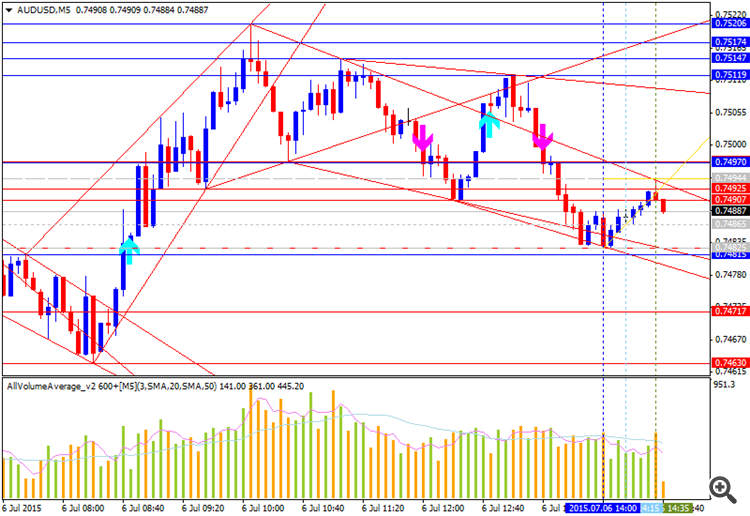

AUDUSD: "The reaction to the Greek 'No' vote has been muted so far but risk should trade soft given the likelihood of further escalation of the crisis. Sell rallies to 0.7500-0.7550 with stops through 0.7610."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.07.06 18:18

EURUSD moves back toward trend line and MA resistance (based on forexlive article)

'The EURUSD was able to move back above the 100 day MA at the 1.10379 level and we are now seeing a further move higher in the pair. Earlier today, the price extended to the 100 hour MA (blue line in the chart below) and a topside trend line (see blue circles) and held. The price is looking toward that same combination. This time it is a bit lower at the 1.1088.'

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.07.07 08:04

Deutsche Bank - What Risk Resilience Implies For Grexit & The EUR (based on efxnews article)

-

"Opinion is divided between the following two trains of thought: i) that the market is still optimistic that a negotiated settlement can be reached and Grexit averted. Or, ii) Grexit is no longer seen as particularly disruptive for global markets, at least in the short-term. Importantly i) and ii) are deeply inter-connected."

- "The most important aspect of the latest risk resilience is that it has dramatically weakened Greece’s negotiating power. Market resilience adds to the prospects of either Grexit, or Greece agreeing to terms that are not that different from what was on offer prior to the referendum, which may not be credible as a long-term solution."

- "So where does this leave the EUR? The worst case scenario, we have been staring at, notably Grexit, has not hurt the EUR much for now, while the best case scenarios (a negotiated settlement) are not a great reason to buy the EUR either, not least because it will be tough to reach a deal that has long-term credibility," DB adds.

-

"One implication is that there is definitely a case

to be made to sell short-dated (1m or 2m) realized EUR/USD volatility,

especially versus implied vols that will remain pumped up by

uncertainty. We

still like EUR/USD digital risk reversal trades, where selling 3m 1.14

strikes can finance a 3m 1.08 put at close to zero cost, and the

timeline potentially covers a Grexit, or a September Fed tightening."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.07.07 16:47

Trade Ideas For EUR/USD, AUD/USD, NZD/USD - UBS (based on efxnews article)

EUR/USD: "It looks like summer markets have kicked in, but the Greek uncertainty is keeping things alive. We still prefer shorts even though the range play will most likely continue. Sell at 1.1055 and add at 1.1090 with stops above 1.1125. Flows are mixed with no clear direction."

AUD/USD: "The RBA kept the target rate on hold, as expected. Stay short and add on rallies to 0.7550 with stops through 0.7625, targeting 0.7200."

NZD/USD: "price action remains very soft after the pair got capped above 0.6710 yesterday. We prefer to remain short and add on rallies toward 0.6750 with stops through 0.6850."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.07.08 08:09

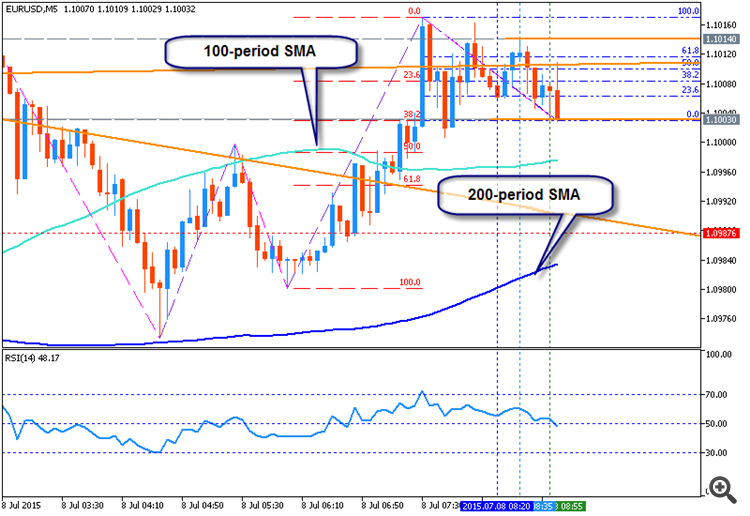

EURUSD has a squeeze higher and a rotation back lower (based on forexlive article)

'The EURUSD moved above the 100 bar MA on the intraday 5-minute chart and

the 50% of the last leg down. That was enough to trigger some stops

above 1.0958. The move back above the 50% of the move up from the March

2015 low at 1.1063 (not shown) also contributed to the rise and the

price scooted to 1.09749.'

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.07.08 17:28

EURUSD can't do what it should do technically (based on forexlive article)

"We are midway through the trading week and the EURUSD has a trading range of 191 pips. ON May 24, the range was 190 pips. ON Feb 8 and Feb 15 the range for the week was 173 and 172 pips. If the EURUSD stayed inside the current range with 1.10945 as the high and 1.10915 as the low, it would be the 4th lowest range week this year (we are half way through). Can it remain low (i.e., keep the same range)? Yes. It it likely? UMMM.... I like to think at some point a boundary will be broken."

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

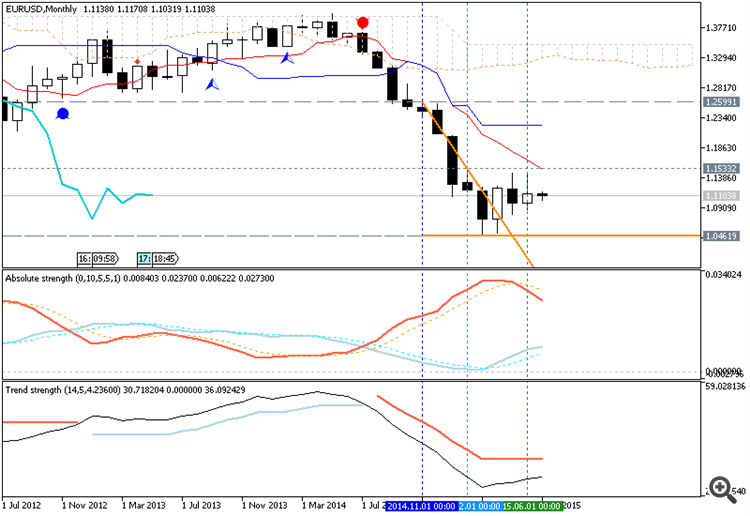

Daily price is on ranging market condition located below and near 'reversal' Sinkou Span A line which is the border between primary bullish and the primary bearish on the chart. The price formed descending triangle with 1.0953 key strong support level located below Ichimoku cloud in primary bearish area of the chart. Chinkou Span line is located above the price to be ready for good possible breakdown of the price movement in the near future.

D1 price - ranging market condition:

W1 price is on bearish market condition with secondary ranging between 1.0818 (W1) support level and 1.1466 (W1) resistance level.

MN price is on ranging bearish with 1.0461 support level.

If D1 price will break 1.0953 support level on close D1 bar so the primary bearish trend will be continuing with good possibility to breakdown.

If D1 price will break 1.1346 resistance level so the price will be fully reversed to the bullish market condition.

If not so the price will be on ranging between 1.0953 and 1.1346 levels.

SUMMARY : bearishTREND : ranging bearish