EURUSD Technical Analysis 2015, 21.06 - 28.06: ranging bullish since the beginning of June - how much longer do we have to wait for direction?

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.06.21 11:48

Morgan Stanley: Outlooks For USD, EUR, JPY, GBP and AUD (based on efxnews article)

USD: Neutral

"We remain medium-term USD bulls, but we continue to believe USD will struggle in the near term. We believe inflation readings will have more importance with employment bouncing back but core inflation remaining low. Should inflation start materially surprising to the upside, the Fed may need to reconsider its plan for a very muted hiking pace."

EUR: Bearish

"We remain bearish EUR over the medium term, but see scope for near term support. Should European equities sell off as concerns about Greece rise, European investors would need to buy back their short EUR currency hedges. That said, Greece remains a major risk and tensions are escalating, which could drive markets to increase the risk premia in the price of EUR, weighing on the currency."

JPY: Bullish

"We believe JPY is likely to be one of the outperformers over the next few weeks, due to a few factors."

GBP: Neutral

"GBPUSD is being mainly driven by rate expectations. The strong wage data this week should bring forward the first rate hike in the UK and keep GBP supported. We particularly like buying against more vulnerable crosses."

AUD: Bearish

"We remain bearish on AUD as we expect risk appetite to soften amidst rising volatility and tighter liquidity, removing support for carry currencies. What’s more, the RBA suggested there is scope for further rate cuts, and specified the need for further currency depreciation going forward. With external and domestic factors both suggesting AUD should be lower, we remain bearish."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2014.01.17 15:52

How Forex News Traders Use ISM Numbers (adapted from dailyfx article)

- The Institute for Supply Management (ISM) was founded in 1915 and is the first supply management institute in the world.

- Servicing 40,000 business professionals in more than 90 countries, ISM focuses on supply chain management.

- Forex traders rely heavily on ISM’s release their Purchasing Managers Index (PMI) on the first business day of each month to gauge economic growth.

NZDUSD M5 : 17 pips prrice movement by USD ISM Manufacturing PMI :

What is ISM?

A country’s economy is as strong as its supply chain. The Institute for Supply Management (ISM) measures the economic activity from both the manufacturing side as well as the service side. Formed in 1915, ISM is the first management institute in the world with over 40,000 members in 90 countries. Since it can draw from information gathered from the surveying its large membership of purchasing managers, the ISM economic news releases are carefully watched by Forex traders around the world as a reliable guide to economic activity.

ISM Surveys

ISM publishes three surveys; manufacturing, construction, and services. Published on the first business day of the month, the ISM Purchasing Managers Index (PMI) is compiled from surveys of 400 manufacturing purchasing managers. These purchasing managers from different sectors represent five different fields; inventories and employment, speed of supplier deliveries, production level, and new orders from customers.

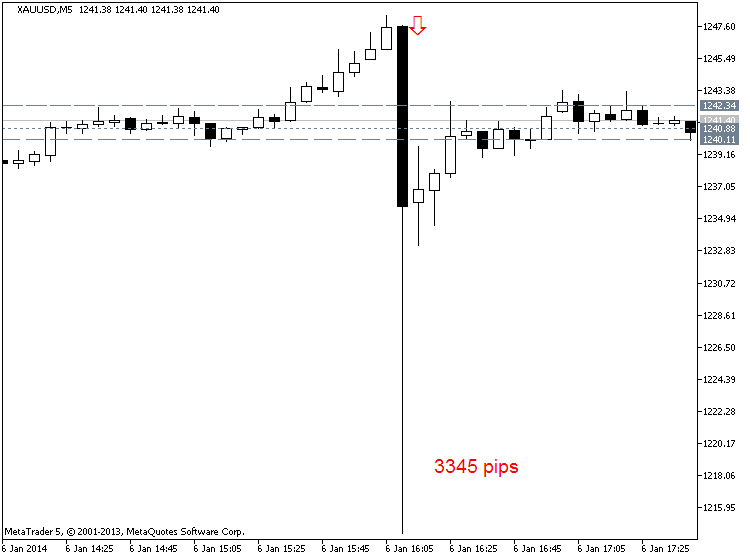

XAUUSD M5 : 3345 pips price movement by USD - ISM Non-Manufacturing PMI news event :

In addition, ISM construction PMI is released on the second business day of the month, followed by services on the third business day. Forex traders will look to these releases to determine the risks at any given time in the market.

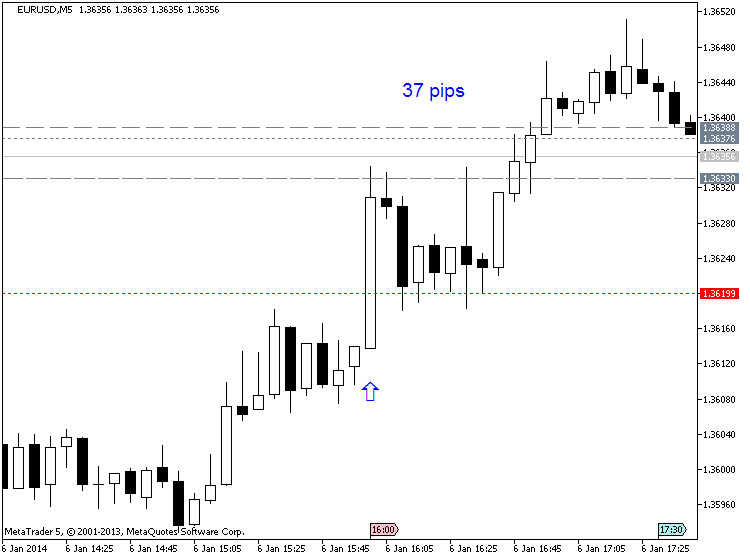

EURUSD M5 : 37 pips price movement by USD - ISM Non-Manufacturing PMI news event :

Forex Market Impact

The Manufacturing and Non-manufacturing PMI’s are big market movers.

When these reports come out at 10:30 AM ET, currencies can become very

volatile. Since these economic releases are based on the previous

month’s historical data gathered directly from industry professionals,

Forex traders can determine if the US economy is expanding or

contracting.

Forex traders will compare the previous month’s number with the forecasted number that economists have published. If the released PMI number is better than the previous number and higher than the forecasted number, the US dollar tends to rally. This is where fundamental and technical analysis comes together to create a trade setup.

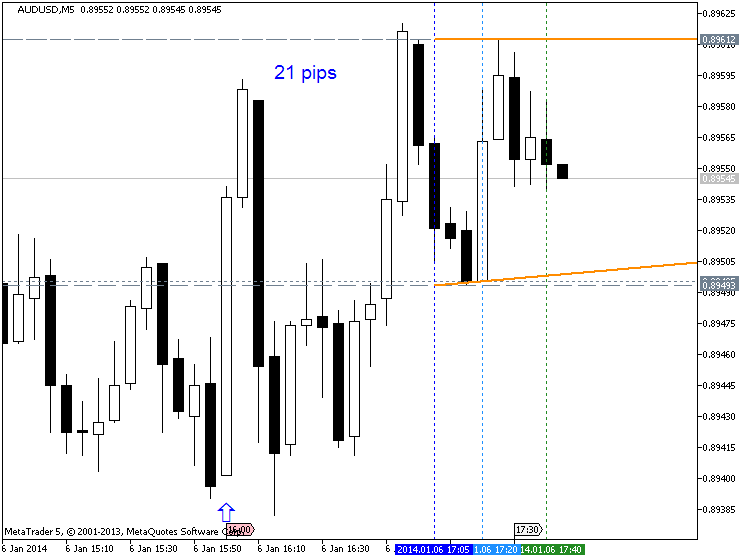

AUDUSD M5 : 21 pips price movement by USD - ISM Non-Manufacturing PMI news event :

In the example above, notice how the better than expected PMI number

triggered a US dollar rally against the Euro. As seen in the chart above

of the EURUSD, the ISM Non-Manufacturing was not only above 50 but at

55.4, beat the forecasts calling for a drop from 54.4 to 54.0.

When an economic release beats expectations, like in the example above,

sharp fast moves can result. In this case, EURUSD dropped 22 pips in 15

minutes. Traders often choose the Euro as the “anti-dollar” to take

advantage of capital flows between two of the largest economies.

The Euro zone has a large liquid capital markets which can absorb the huge waves of capital seeking refuge from the U.S. So a weak US ISM Non-Manufacturing number usually leads to a dollar sell-off and a rise in the Euro. Another scenario is when the number released is in line with forecasts and/or unchanged from the previous month, then the US dollar may not react at all to the number.

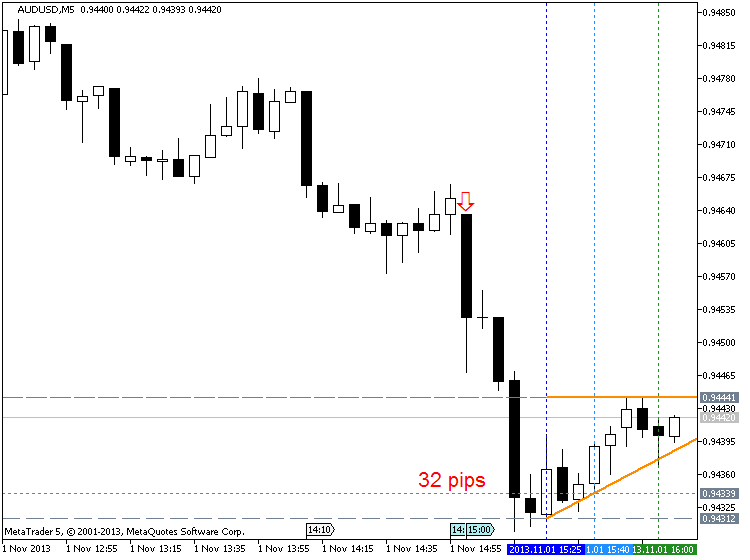

AUDUSD M5 : 32 pips price movement by USD - ISM Manufacturing PMI :

Overall, an ISM PMI number above 50 indicates that the economy is

expanding and is healthy. However, a number below 50 indicates that the

economy is weak and contracting. This number is so important that if the

PMI is below 50 for two consecutive months, an economy is considered in

recession.

PMI’s are also compiled for Euro zone countries by the Markit Group while US regional and national PMIs are compiled by ISM. As you can see, traders have good reason to pay special attention to the important releases from the Institute of Supply Management.

================

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.06.22 10:56

Societe Generale: Greece is not the biggest EUR/USD driver (based on efxnews article)

"You could be forgiven for thinking that the biggest driver of the EUR/USD rate is not Greek debt talks, but the pricing of the December 2016 Fed Funds futures contract. This closed on Friday at 1.02%, the lowest level since mid-May."

"Neither is high profile enough to change market thinking about Fed policy, which prices a 1% rise in rates over 18 months. All of which just suggests we will get a stronger dollar once a faster pace of fed rate hikes is priced in, but this needs a catalyst that today’s data won’t provide. In the meantime, we watch the combination of (super-low) Fed pricing and hope of a Greek deal boost risk sentiment and undermine the dollar for the start of the week."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.06.22 11:53

Deutsche Bank - Durable Goods Orders and PCE are the next big data (based on efxnews article)

EUR/USD continues to grind higher as Greece continues to dominate the headlines.

"The main focus was the June Fed meeting where early year expectations of a hike this month now feel a long time ago. There was speculation that Yellen shifted her 2015 dot lower, although as our US economist noted it is hard to tell. With the Fed still in data-dependent mode, more convincing evidence of a Q2 growth pick-up is needed. This week’s May durable goods orders and PCE are the next big data," DB argues.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.06.22 19:00

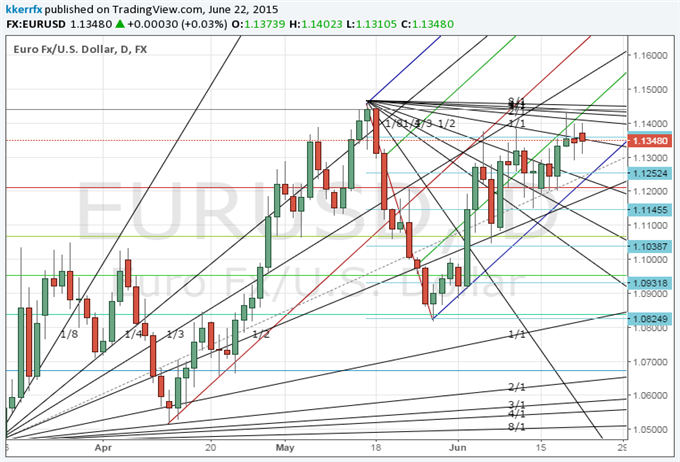

EUR/USD Double Top or About to Breakout? (based on dailyfx article)

'EUR/USD recorded a new month-to-date high late last weekand actually came within a few pips of testing the quarter-to-date closing high at 1.1442 before stalling out. Is the euro undergoing a double top backtest before turning lower or is it about to break out and extend the multi-month advance? The next 24-28 hours should prove key in determining which path the euro will take as near-term cyclical analysis suggests we have reached an inflection point of sorts. If the broader downtrend is going to re-assert itself here then EUR/USD shouldn’t really rally past last week’s 1.1435 high. Traction above this level would be a strong sign that multi-month correction in the single currency is nowhere near finished. A failure, on the other hand, at or around current levels followed by a break of median-line channel support at 1.1230 over the next few sessions would confirm a change in behavior and re-focus attention lower in the single currency.'

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.06.23 09:26

Video: Euro Tempts with Greece Progress, Equities Rally Bolsters Risk (based on dailyfx article)

- A light at the end of the tunnel has appeared in the standoff between Greece and creditors

- Global equities rallied uniformly to open the week, with the DAX posting its biggest surge in years

- These prominent trade opportunities deserve a deeper conviction as the stakes are far too high

The skirmish line between Greece and its creditors seems to have moved to start the week and the market is responding. Global equities took reports of progress to heart with a universal rally led by the biggest DAX (Germany's benchmark equity index) in years. Yet, the same optimistic response was not realized with the Euro. EURUSD held to its coiled wedge below 1.1500 as FX traders think 'we've been here before'. Skepticism and caution remains for an 'easy' solution to Greece - whether positive or negative - and the markets are unwilling to commit until the air is clear. That is as true for the limited risk response in equities as it is the cool Euro view. It is better wait for commitment from the speculative ranks before jumping in and sacrifice an early entry than jumping in on the wrong direction of a dramatic market move. We review the Euro, Dollar, global equities and unusual pairs like NZDJPY in today's Trading Video.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.06.23 11:25

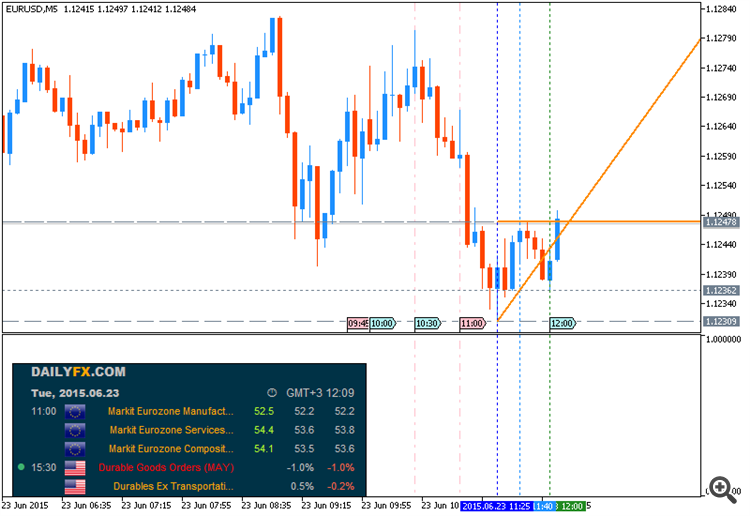

Trading News Events: U.S. Durable Goods Orders (based on dailyfx article)

Another 1.0% contract in demand U.S. Durable Goods may dampen the appeal

of the greenback and generate a near-term advance in EUR/USD as ongoing

slack in the real economy raises the risk for a further delay in the

Fed’s liftoff.

What’s Expected:

Why Is This Event Important:

Fears of a slower recovery may encourage a growing number of Fed

officials to adopt a more dovish tone for monetary policy, and we may

see the Federal Open Market Committee (FOMC) retain the zero-interest

rate policy (ZIRP) throughout 2015 in order to mitigate the downside

risks for growth and inflation.

On the other hand, discounted prices paired with the pickup in

private-sector wages may foster greater demand for U.S. Durable Goods,

and a positive development may keep the Fed on course to raise the

benchmark interest rate later this year as the central bank remains

confident in achieving its dual mandate for full-employment and price

stability.

How To Trade This Event Risk

Bearish USD Trade: Orders Contract Another 1.0% or Greater

- Need to see green, five-minute candle following the release to consider a long trade on EURUSD

- If market reaction favors a bearish dollar trade, buy EURUSD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

- Need red, five-minute candle to favor a short EURUSD trade

- Implement same setup as the bearish dollar trade, just in the opposite direction

EURUSD Daily

- Long-term outlook for EUR/USD remains bearish amid the deviation in the policy outlook, but the single currency remains at risk for a relief bounce as European policy makers work to keep Greece within the monetary union.

- Interim Resistance: 1.1510 (61.8% expansion) to 1.1532 (February high)

- Interim Support: 1.0970 (38.2% expansion) to 1.1000 (50% retracement)

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| APR 2015 |

05/26/2015 12:30 GMT | -0.5% | -0.5% | -22 | -53 |

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

EURUSD M5: 54 pips price movement by USD - Durable Goods Orders news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.06.23 20:34

Barclays - Trading Setups For EUR/USD, USD/JPY, GBP/USD and AUD/USD (based on efxnews article)

EUR/USD: A succession of “doji” topping candles adds to our bearish conviction. We are looking for a move lower towards the 1.1050 area after reaching our initial downside targets near 1.1150. Beyond there we look for a move towards 1.0815 and then the 1.0460 year-to-date lows. The 1.1470 highs provide selling interest.

USD/JPY: Monday’s engulfing candle endorses our bullish view. We are looking for a move higher towards initial targets near 124.45 and then 125.85. Further out we are targeting the 132.20 area.

GBP/USD: We have turned neutral in the short term. Monday’s low close confirms the prior topping candle and signals a move lower in range as investors lock in profits from the June rally. Risk is seen towards 1.5640, possibly 1.5550, before a base can form. Overall we are bullish towards 1.6000 and then targets near 1.6200.

AUD/USD: We are bearish against the 0.7850 recent

highs and look for a move lower towards targets near 0.7600 and then the

0.7530 year-to-date lows. Further out, we are targeting the 0.7100

area.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.06.24 08:42

Credit Agricole: Is It Time To Sell EUR/USD Again? (based on efxnews article)

"This could be due to lingering uncertainty about the deal. Indeed, various media reports have highlighted creditors' concerns that the new proposal is putting too much emphasis on new taxes (on both businesses and households) to balance the books. Excessive taxation could hamper the Greek economic recovery and make the proposal less credible."

"In addition, there are concerns that the proposed VAT and pension reform could erode the support from Syriza's main coalition partners - the Greek Nationalist - when the measures are put for a vote in the Greek parliament."

"While investors' cautiousness could explain some of the recent EURunderperformance, the contrasting response of the FX and the European stock and peripheral bond markets may also indicate that investors have moved away from Greece to re-focus on the lingering policy divergence between the increasingly hawkish Fed and persistently dovish ECB. Indeed, a Greek resolution will arguably make it easier for the FOMC to hike rates as soon as September."

"At the same time, the ECB remains very committed to QE and this should continue the make the EUR an attractive funding currency."

"In addition, we suspect that renewed inflows into the Eurozone stocks and bondd could lead to renewed selling pressure on EUR in the forward markets."

"The above could suggest that EUR/USD could be offering attractive selling opportunity at current levels."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.06.24 12:29

Trading News Events: U.S. Gross Domestic Product (GDP) (based on dailyfx article)

What’s Expected:

Why Is This Event Important:

Even though the Fed remains on course to raise the benchmark interest

rate in 2015, signs of a slower recovery raises the risk for a further

delay in the normalization cycle as the central bank remains in no rush

to switch gears.

However, slowing outputs along with the ongoing weakness in business

investments may continue to drag on the real economy, and a dismal print

may drag on the greenback as it dampens the likelihood for the Fed

liftoff at the September 17 meeting.

How To Trade This Event Risk

Bullish USD Trade: U.S. Economy Contracts 0.2% or Less

- Need to see red, five-minute candle following the GDP report to consider a short trade on EURUSD.

- If market reaction favors a long dollar trade, sell EURUSD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

- Need green, five-minute candle to favor a long EURUSD trade.

- Implement same setup as the bullish dollar trade, just in reverse.

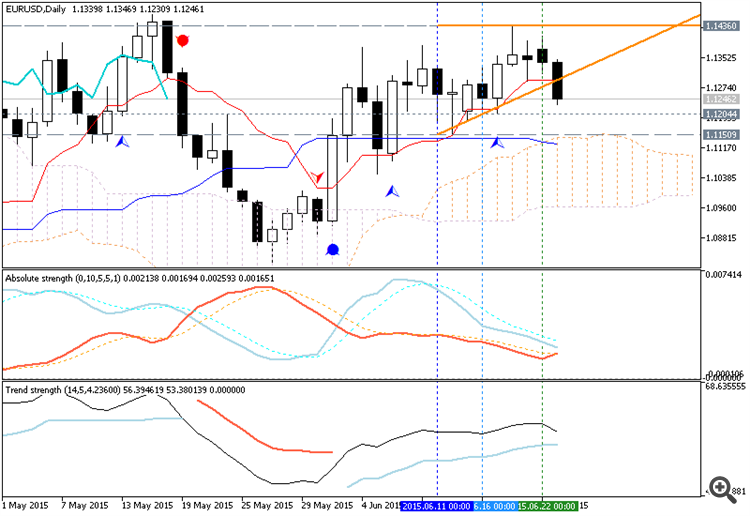

EURUSD Daily

- Lack of momentum to test the May high (1.1465) may highlight a lower-high in EUR/USD; break of the bullish RSI formation to provide conviction/confirmation for a further decline in the exchange rate.

- Interim Resistance: 1.1510 (61.8% expansion) to 1.1532 (February high)

- Interim Support: 1.0970 (38.2% expansion) to 1.1000 (50% retracement)

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| 4Q F 2014 |

03/27/2015 12:30 GMT | 2.4% | 2.2% | +15 | +24 |

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

EURUSD M5: 21 pips price movement by USD - GDP news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

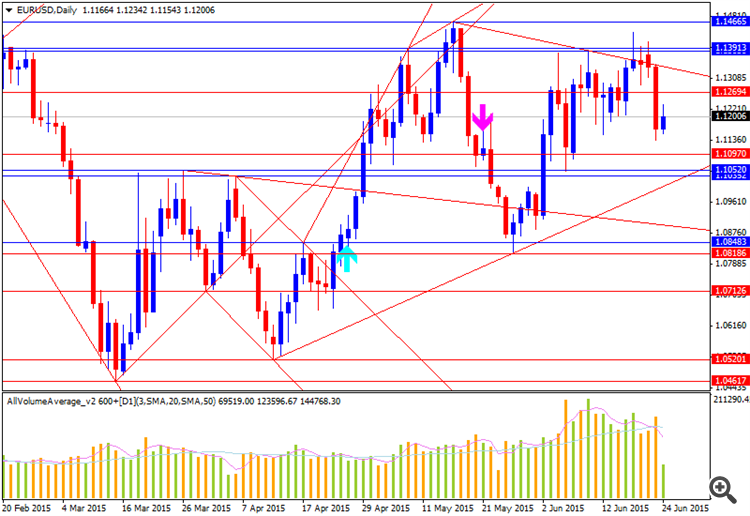

Daily price is on primary bullish with the secondary ranging between 1.1436 resistance level and 1.1150 support level which was started on close daily bar in the beginning of this month. The price is located above Ichimoku cloud/kumo for primary bullish with Chinkou Span line to be crossed with the price from above to below and to below to above few times since 5th of June this year which is indicating the ranging market condition.

D1 price - ranging bullish:W1 price is on bearish market condition with secondary ranging between 1.0659 (W1) support level and 1.1466 (W1) resistance level.

MN price is on ranging bearish with 1.0461 support level.

If D1 price will break 1.1150 support level on close D1 bar so the price will be fully reversed to the primary bearish market condition.

If D1 price will break 1.1436 resistance level so the bullish trend will be continuing with possible good breakout.

If not so the price will be on ranging between 1.1150 and 1.1436 levels.

SUMMARY : bullish

TREND : ranging