EURUSD Technical Analysis 2015, 14.06 - 21.06: bullish ranging between 1.0915 and 1.1385 with possible breakout of key resistance levels - page 2

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.06.17 19:42

2015-06-17 19:00 GMT (or 21:00 MQ MT5 time) | [USD - Federal Funds Rate]if actual > forecast (or previous data) = good for currency (for USD in our case)

[USD - Federal Funds Rate] = Interest rate at which depository institutions lend balances held at the Federal Reserve to other depository institutions overnight. Short term interest rates are the paramount factor in currency valuation - traders look at most other indicators merely to predict how rates will change in the future.

==========

"The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. This policy, by keeping the Committee's holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions."

"When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent. The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run."

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2015.06.17

MetaQuotes Software Corp., MetaTrader 5

EURUSD M5: 111 pips price range movement by USD - Federal Funds Rate news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.06.18 07:39

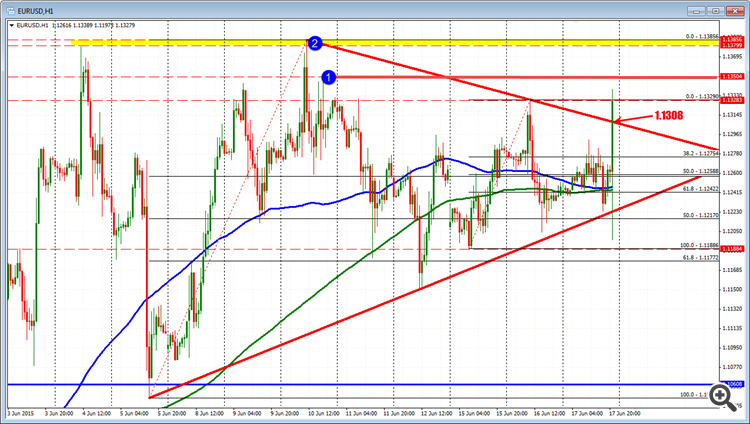

Forex technical analysis: EURUSD above trend line. Now close support/Risk (based on forexlive article)

The next targets at 1.1350 and 1.1385The EURUSD has moved higher as Yellen shows more constraint than aggressiveness in her commentary The pair is above the upper trend line at 1.1308 and this is now the risk for the pair with 1.1350 and 1.1385 targets. The FOMC is the focus and that is supportive for the pair. But sentiment can shift as stories end and we go back to Greece. So define your risk. The 1.1308 is the close level to watch for longs (risk).Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.06.18 10:16

BNP Paribas - 'What USD Bulls Need Post-FOMC?' (based on efxnews article)

The Fed’s June statement and press conference failed to provide a catalyst for renewed USD gains and the currency has weakened in the aftermath of the meeting, notes BNP Paribas.

"Market participants seemed to focus on the shift lower in the Fed’s projection for the Fed funds rate, with the average “dot” for end 2015 falling to 57bp from 77bp. In her press conference, Chair Yellen noted that the conditions for justifying policy tightening were not yet in place and that, once tightening began, the pace of hikes would be very gradual," BNPP adds.

"However, we would emphasize that, according to the projections, a majority of FOMC members continue to anticipate at least two rate hikes before the end of 2015," BNPP argues.

"Moreover, the message from the Fed is clearly one of data dependency—if data continues to improve over the summer, markets will be forced to bring forward pricing for Fed hikes closer to our September forecast for lift-off," BNPP projects.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.06.18 12:32

Trading tNews Events: U.S. Consumer Price Index (CPI) (based on dailyfx article)

What’s Expected:

However, subdued input costs paired with the persistent slack in the real economy may continue to drag on price growth, and a dismal CPI print may generate a further near-term advance in EUR/USD as market participants push back for the Fed liftoff.

How To Trade This Event Risk

Bullish USD Trade: U.S. CPI Rebounds 0.1% or Greater

- Need to see red, five-minute candle following the release to consider a short trade on EUR/USD.

- If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

Bearish USD Trade: Consumer Price Growth Disappoints- Need green, five-minute candle to favor a long EUR/USD trade.

- Implement same setup as the bullish dollar trade, just in reverse.

Potential Price Targets For The ReleaseEURUSD Daily

- Despite the more cautious tone coming out of the

Federal Reserve, EUR/USD may continue to face range-bound prices over

the near-term as it fails to break out of the monthly opening range.

- Interim Resistance: 1.1510 (61.8% expansion) to 1.1532 (February high)

- Interim Support: 1.0970 (38.2% expansion) to 1.1000 (50% retracement)

Impact that US CPI has had on EUR/USD during the last release(1 Hour post event )

(End of Day post event)

2015

12:30 GMT

March 2015 U.S. Consumer Price Index

EURUSD M5: 140 pips price movement by USD - Consumer Price Index news event:

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2015.06.18

MetaQuotes Software Corp., MetaTrader 5

EURUSD M5: 38 pips price range movement by USD - CPI news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.06.19 11:10

Did it BREAK higher and fail, or are we going back above the old ceiling (based on forexlive article)

The EURUSD broke above the ceiling at the 1.1379-86 area. The move above spent 8 hours above. Over the last two hours the price has moved back below that ceiling. The pair has been consolidating over 7 or so days until the extension higher today. The move back below the ceiling is a disappointment. Is that it? IS that all the market could do? Was that your best shot?

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.06.19 17:19

Forex Weekly Outlook June 22-26 (based on forexcrunch article)

US Existing Home Sales, Jerome Powell’s speech, US Durable Goods Orders, German Ifo Business Climate, US Final GDP, US Unemployment Claims are the highlights of this week. Here is an outlook on the main market movers coming our way.

Last week U.S. Federal Reserve two-day policy meeting concluded with a decision to maintain current monetary policy. However, Fed Chair Yellen stated the Federal Reserve may increase rates by as much as 2% until the end of next year, with gradual hikes in between, if “more decisive evidence” arrives from the US labor market. At the same time, the Fed lowered their projections of growth this year, to a range between 1.8% and 2.0%, from the 2.3% to 2.7% rise they predicted in March. Will we see stronger US data in the coming months?

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.06.20 07:34

US Week Ahead: GDP, PCE, Durable Goods, UMich Sent, Housing (based on efxnews article)

Existing home sales likely rose a solid 4.4% to 5.26 million units in May. May existing (previously-owned) home sales are expected to post a solid 4.4% gain to 5.26 million units, more than reversing the April dip. Pending sales of existing homes, a leading indicator, have seen a steep upward trajectory since January and touched a post-recession high in April.

Durable goods orders likely slipped 0.2% in May while ex-transportation orders likely rose 0.6%. We expect durable goods orders to fall 0.2% while ex-transportation orders likely bounced back with a 0.6% increase. Non-defense aircraft orders likely weighed in May as Boeing reported only 11 new aircraft orders, down from 37 in April.

May new home sales are expected to rise 1.1% to a 523K unit annual rate. New home sales likely saw continued growth in May, rising 1.1% to 523K units. Sales in April jumped 6.8% led by a surge in the Midwest. We look for sales to increase on balance in May, albeit at a softer pace as the Midwest region likely retracted a touch.

In its third and final release, Q1 GDP growth likely saw an upward revision to -0.1% from -0.7%. We look for an upward revision to Q1 real GDP growth (-0.1% vs. -0.7%), reflecting revisions to March trade data that imply less of a decline in net exports.

The May headline PCE price index likely rose 0.4% on the month with the core index rising 0.1%. As a result, annual PCE inflation likely firmed to 0.2% YoY while core inflation was stable at 1.2% YoY. The May headline PCE price index likely rose 0.4% on the month while the core index is expected to rise 0.1%. Both match the monthly increases in the May CPI. In the May CPI report, energy prices boosted consumer prices with the gasoline index rising 10%, while food prices remained weak with a flat print.

Personal nominal income likely rose 0.5% in May while spending likely picked up with a 0.6% increase. May nominal income likely rose 0.5%, slightly firmer than the 0.4% increase in April. Earnings and hours posted strong gains in May, with average hourly earnings and the aggregate workweek both rising 0.3%.

The final University of Michigan (UofM) consumer sentiment index likely confirmed a rebound in June to 94.6 from 90.7 in May. June UofM consumer sentiment likely confirmed its preliminary print of 94.6, up from 90.7 in May. A June rebound in sentiment will be most welcome as the weak May reading marked the lowest level since November 2014. Gas prices hardly moved since the preliminary survey release, standing at $2.80/gal on average at the time of writing. After a volatile few weeks, stock prices also have rebounded from their June lows.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video February 2014

Sergey Golubev, 2014.02.10 11:15

06: DURABLE GOODS

This is the 6th video in a series on economic reports created for all markets, or for those who simply have an interest in economics. In this lesson we cover the Durable Goods report.

============

Previous parts:

============

Durable Goods OrdersDurable Goods Orders (DGO) is an indicator of orders placed for relatively long lasting goods. Durable goods are expected to last more than three years, e.g.: cars, furniture, appliances, etc.

This indicator is important for the market because it gives an idea of the consumers' confidence in the current economic situation. Since durable goods are expensive, the increase in the number of orders for them shows the willingness of consumers to spend their money on them. Thus, the growth of this indicator is a positive factor for economic development and leads to growth of the national currency.

============

USDJPY M5 : 47 pips price movement by USD - Durable Goods Orders news event

EURUSD M5 : 32 pips price movement by USD - Durable Goods Orders news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2015.06.20 18:18

BNP Paribas - 'We remain USD bulls', or 'fade EUR/USD rally on any Greek resolution' (based on efxnews article)

"Despite a dovish market reaction to this week’s FOMC statement, the Fed’s message remains focused on data dependency, and our economists continue to believe that conditions will be met for policy tightening to start in September. Accordingly, markets should remain focused on upcoming US economic releases.

In the week ahead, a rebound in May core durable goods orders would be encouraging after a downward revision to April data, while the personal income and spending report should echo the improvement in retail sales data. We remain USD bulls but recommend positioning through option structures with limited upside potential given the Fed’s sensitivity to dollar strength.

The coming days may be the final opportunity for some sort of Greek deal to be agreed ahead of the end-June deadline. Reading EUR moves around Greek headlines remains complicated by the EUR’s funding currency status. Our preference is still to fade any rallies on a Greek ‘resolution’ as we believe it would ultimately lead to investors regaining appetite for shorting the EUR against pro-risk currencies."