EURUSD Technical Analysis 2015, 24.05 - 31.05: breakdown to the ranging zone of the correction with good reversal possibility to the bearish

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.24 15:25

EUR/USD Weekly Outlook (based on actionforex article)

EUR/USD's fall last week and suggests that rebound from 1.0461 could have completed at 1.1466 already, well below. 38.2% retracement of 1.3993 to 1.0461 at 1.1810. Initial bias remains on the downside this week for retesting 1.0461/0520 support zone. Meanwhile, above 1.1207 minor resistance will dampen this bearish view and turn focus back to 1.1466.

In the bigger picture, overall price actions from 1.6039 long term top is viewed as a corrective pattern. Fall from 1.3993 is the third leg of such pattern. A medium term bottom is in place at 1.0461, ahead of 100% projection of 1.6039 to 1.2329 from 1.3993 at 1.0283. Some consolidations could be seen. But after all, break of 1.2042 support turned resistance is needed to indicate medium term reversal. Otherwise, outlook will stay bearish. We'd still favor another fall to extend the down trend.

In the long term picture, price actions from 1.6039 (2008 high) is viewed as a corrective move with fall from 1.3993 as the first leg. We'll start to look for bottoming signal below 100% projection of 1.6039 to 1.2329 from 1.3993 at 1.0283. However, sustained trading below 1.0283 will open up the case for a new low below 0.8223.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.23 12:35

Forex Weekly Outlook May 25-29 (based on forexcrunch article)

The US dollar made a comeback and the greenback was a big loser in a

week that saw trends change. And now, US Durable Goods Orders, Consumer

Confidence as well as UK, Canadian and US GDP data stand out. These are

the highlight events in Forex calendar. Here is an outlook on the main

market-movers for this week.

The Federal Reserve released minutes from its April 28-29 policy

meeting, revealing the planned rate hike will not take place in June.

Despite growing confidence in the US economic recovery, the recent data

suggest a temporary slowdown. Weaker consumer spending, slow growth and

employment data led policy makers to postpone their decision on raising

rates. Fed officials were also disappointed that falling oil prices did

not spur growth as anticipated and that the recent dollar softness muted

inflation. The Fed has reiterated it will not raise rates until it is

“reasonably confident” that prices are moving toward its 2% target. Will

the US economy rebound from its recent soft patch? In the euro-zone,

talk about front-loading QE hit the euro in particular. The common

currency reversed its previous gains. In the UK, inflation dipped below

0% and in Japan GDP came out better than expected.

- US Durable Goods Orders: Tuesday, 12:30. The U.S. manufacturing sector rebounded in March amid expansion in the transportation industry. New orders for long-lasting manufactured goods increased by 4.0%, to $240.2 billion, following a 1.4% decline in February. However, core durable goods orders, excluding the volatile transportation sector, declined 0.2% to $159.9 billion. The weak core figure followed seven months of negative readings, indicating the second quarter may not be as strong as forecast. A drop of 0.4% in orders and a gain of 0.5% in core orders is on the cards.

- US CB Consumer Confidence: Tuesday, 14:00. Consumer confidence fell unexpectedly in April to 95.2 from 101.4 in March amid weak job growth. While economists expected sentiment to rise to 102.5, sentiment plunged to the lowest level in 2015. Fuel prices continue to remain below last year’s prices contributing to growth but the soft patch in the US labor market overshadowed this positive development. 95.3 is expected now.

- Canadian rate decision: Wednesday, 14:00. The Bank of Canada kept its overnight rate unchanged at 0.75%. Governor Stephen Poloz forecast a positive outlook for the Canadian economy, despite the current weakness related to the collapse in oil prices. The central bank cut its original 1.5% growth forecast for the first quarter of 2015, to non- growth. However, Poloz insisted the economy would rebound in the second half of the year. Nonetheless, many economists believe the oil prices collapse will have a longer effect on Canadian growth.

- US Unemployment Claims: Thursday, 12:30. The number of Americans filing initial claims for unemployment benefits increased by 10,000 claims last week, reaching 274,000. Analysts expected a smaller rise to 271,000. Despite last week’s increase, the number of claims remained below 300,000 indicating the labor market continues to strengthen for the 11th week. The four-week moving average fell 5,500 last week to 266,250, reaching the lowest level since April 2000. A similar level of 272K is estimated now.

- UK GDP: Thursday, 8:30. According to the preliminary release for Q1 2015, the economy expanded by only 0.3%. The figure will likely be upgraded to 0.4% this time. It’s important to note that this growth rate is lower than seen beforehand.

- Canadian GDP: Friday, 12:30. Canada’s economy stalled in February showing no-growth, after contracting 0.2% in January. The mild improvement in the service sector was offset by contraction in goods-producing industries. Both manufacturing and energy sectors shrank in February suggesting the energy sector is not the sole cause for Canada’s economic weakness, as implied by the Central Bank. Economists believe the BOC will have to cut rates later this year to spur growth. An advance of 0.2% is on the cards now.

- US GDP: Friday, 12:30. According to the first release for Q1, the economy grew at an annual rate of only 0.2%, below expectations. Things are expected to turn even lower, with a downgrade to contraction of around 0.9% this time . Fed Reserve chair, Janet Yellen also discussed the possibility of raising rates if the employment market will show substantial signs of growth.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.23 12:56

EUR/USD forecast for the week of May 25, 2015, Technical Analysis (based on fxempire article)

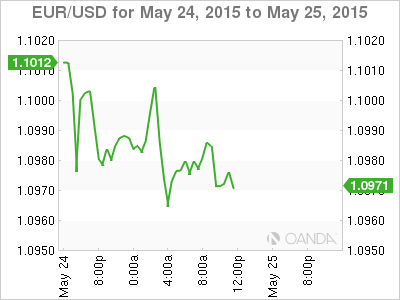

The EUR/USD pair broke down during the course of the week, testing the 1.10 level for support. That’s basically where we close for the week, and this is an area that we should see support at. However, we are closing at the very bottom of the range, and that of course is a very bearish sign. This is a simple set up for us: we believe that if we get a daily close below the 1.10 handle, that the market should continue down to roughly 1.05 or so. On the other hand, if we get a supportive daily candle near the 1.10 level, we believe that the market will then bounce towards the 1.15 handle. With that being said, daily charts will probably be where you need to look for setups.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.25 18:34

Yellen's Words Fuels The Greenback's Rise (based on forbes article)

"The U.S. dollar hit a two-month high against the yen and is holding firm against other Group of 10 currencies on Monday after Federal Reserve Chair Janet Yellen suggested late last week the central bank will raise interest rates in 2015."

"With U.S. markets and most of Europe on holiday today, the thinned trading conditions will have most investors looking ahead to tomorrow’s forward-looking U.S. durables data, and Friday’s release of second estimate of U.S. gross domestic product (GDP) as key fundamental touch points for the dollar’s direction. Obviously, any news on Greece or of a potential Grexit will have an immediate impact on the EUR, similar to what happened in the overnight session in Asia."

"Yellen argued that the slowdown in first-quarter GDP growth was “largely” due to temporary factors, such as the record cold weather and a port dispute. The market took “largely” as being more important or convincing than Yellen’s “in part” verbiage that was used in the most recent FOMC statement (there will be a rebound in growth in the second quarter)."

"Yellen repeated her assessment that “it will be appropriate at some point this year to take the initial step to raise the federal funds target.” Not a very transparent statement on timing, but if you include rebounding economic growth, plus a pickup in consumer prices that’s supported by wage growth, you have a fixed-income market now pricing in a rate hike no later than September."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.26 06:12

Sell AUD/USD At S/T Resistance; Sell EUR/USD At Breakout Zone - Credit Suisse (based on efxnews article)

Credit Suisse looked at the technical setups for AUD/USD, and

EUR/USD where CS is bearish near-term, and recommends selling

limit-orders on approaching specific technical levels.

AUDUSD

Starting with AUD/USD, CS notes that the immediate focus turns towards a cluster of supports at .7790/74.

"AUDUSD has reversed its early gains, completing a bearish “outside” session to weigh on a cluster of supports at .7790/74 - the early May low, 61.8% retracement and 55-day average support – where we would expect fresh buying to show here". "A direct break lower though can trigger further selling for .7683 initially, followed by a stronger support from the range lows at .7555/33. Near-term resistance moves lower to .7861/67, followed by .7936. Above can target .7976/86 and then .8030/63 which we look to ideally cap".

CS runs a limit order to sell AUD/USD at 0.7855, targeting a move to 0.7605.

EURUSD

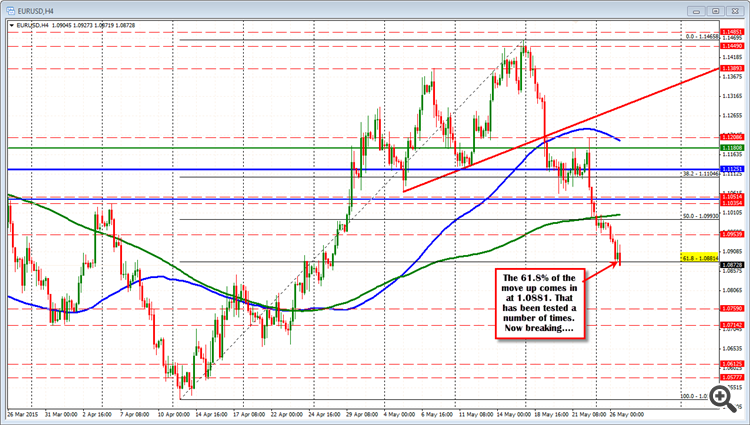

"We look for further weakness here to test the 55-day average at 1.0918 at first, through which can aim at the 61.8% retracement level at 1.0849/43, followed by the low end of the former range at 1.0660/14". "Near-term resistance moves to 1.1062, then 1.1101 with

price and “neckline” resistance at 1.1208/48 expected to cap to keep

the trend lower. Strategy: Flat. Sell at 1.1060, stop above 1.1248 for

1.0525".

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.26 09:26

EUR/USD Technical Analysis: Sellers Overcome 1.10 Figure (based on dailyfx article)

- Support: 1.0934, 1.0808, 1.0653

- Resistance:1.1059, 1.1214, 1.1310

The Euro turned lower against the US Dollar as expected after negative RSI divergence pointed to fading upside momentum. Near-term support is at 1.0934, the 50% Fibonacci expansion, with a break below that exposing the 61.8% level at 1.0808. Alternatively, a reversal above the 38.2% Fib at 1.1059 clears the way for a test of the 23.6% expansion at 1.1214.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.26 20:00

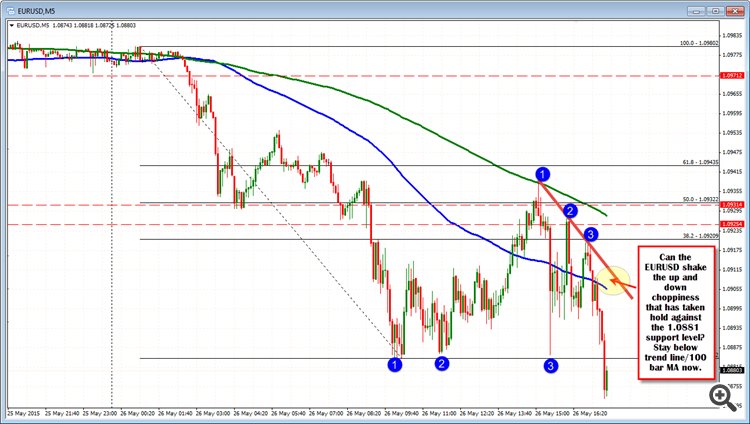

Forex technical analysis; EURUSD takes another run at support (based on forexlive article)

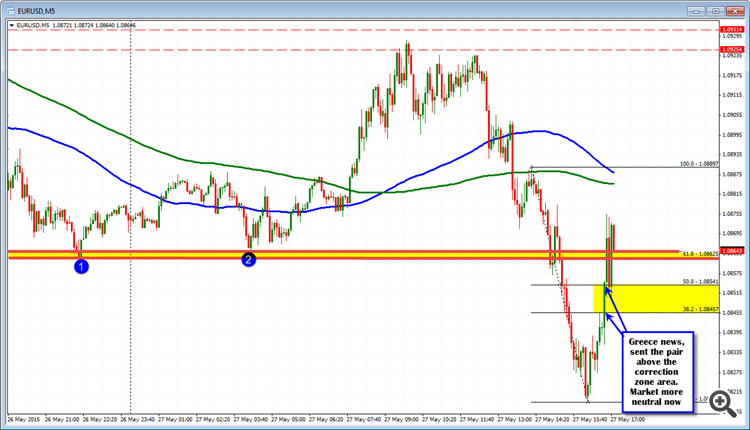

The 61.8% of the move up from the April low is being tested for the 4th time and has been broken. The level came at the 1.08814. Prior to the break, the line was test on 3 separate occasions. Better US data (durable goods, S&P Case Schiller, new home sales, consumer confidence, Richmond Fed) has helped contribute. The pair has a 113 pip trading range. The average is 141. So if the momentum can continue, there is room to roam.

The 5 minute intraday activity in the NY session has not been a thing of beauty to be honest. Apart from the last push lower, traders seemed more intent on buying dips. Three successful test of the support target can do that to you. This break is a chance for the market to shake the choppy cobwebs away. The best case scenario would be to stay around the 1.0881-84 area, but already that is not happening (the price is back above that area). The next best thing for the shorts is to put up with a correction toward the 100 bar MA (blue line at 1.0905)/trend line (at 1.0911 currently). Both are moving lower.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.27 07:40

EURUSD: Traders Sell First And Ask Questions Later (based on actionforex article)

The strong selloff in EURUSD since the start of last week suggests that the long-term downtrend may be resuming after a sub-50% retracement in April and early May. Friday's big Bearish Engulfing Candle, along with the break back below key previous-resistance-turned-support at 1.1050, set the bearish tone heading into this week, and with rates peeking below the 61.8% Fibonacci retracement of the previous rally, more downside is possible this week. As for the secondary indicators, the MACD is about to cross below its '0' level, signaling a shift to outright bearish momentum, though the oversold Slow Stochastics hint at a pause or near-term bounce over the next few days.

Bringing all of the above together, it would not be surprising to see some near-term consolidation or a brief counter-trend rally in EURUSD this week, but as long as the pair remains below the 1.1000-50 zone and Greece's debt situation remains unresolved, traders will continue to sell first and ask questions later.

A Bearish Engulfing candle is formed when the candle breaks above the high of the previous time period before sellers step in and push rates down to close below the low of the previous time period. It indicates that the sellers have wrested control of the market from the buyers.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.27 17:39

Greek headlines lead to snap back in EURUSD (based on forexlive article)

The news headlines on Greece led to a snap back move higher in the EURUSD (they can come at any time unfortunately).

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.05.28 08:47

Goldman Sachs downside targets on EUR/USD (based on forexlive article)

Phase I

"Following the

ECB QE announcement on Jan. 22, EUR/USD settled around 1.14 for 5

weeks. On Feb. 26, higher-than-expected core CPI (for Jan.) caused EUR/$

to fall two big figures to 1.12. Subsequent days brought data that

showed decent activity, ending with better-than-expected February

payrolls on Mar. 6 and EUR/$ near 1.08. The start of ECB QE on Mar. 9

and associated curve flattening in the Euro zone took EUR/$ to 1.05 in

the run-up to the March FOMC".

Phase II

"The March FOMC

had all the makings of a Dollar-positive catalyst. In the wake of this

meeting, USD appreciation ground to a halt, with EUR/$ cycling in a

range from 1.05 - 1.10. An upbeat ECB press conference on Apr. 15,

during which President Draghi emphasized the positive growth effects of

QE, helped push EUR/$ to the top of this range by end-April".

Phase III

"The weak

first quarter GDP reading for the US on Apr. 29 began the unwind of the

ECB QE trade, with EUR/$ and German Bund yields rising and the DAX

falling on the day. Weak retail sales for April (May 13) raised fears

that the Q2 growth rebound might be slow in coming, which were

exacerbated by the surprise drop in consumer confidence for May (May

15). EUR/$ broke out of its 1.05 - 1.10 range and returned to its

post-ECB QE level of 1.14, with broad Dollar weakness taking over

against the majors".

"As a result, we are inclined to see the recent sell-off in the ECB QE trade as a temporary squeeze, albeit a painful one. It remains our expectation that fundamentals will pull EUR/$ lower, in line with our 12-month forecast of 0.95. We expect the market to refocus on the European "growth crisis" in coming weeks, continuing to pull EUR/$ down".

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

The price was ranging between 1.1466 resistance and 1.1061 support since the beginning of May this year. The daily price is on primary bullish market condition for now with secondary correction which was started on the beginning of last week on daily close bar. The price is continuing with this local downtrend/correction trying to break 2 support levels:

If those 2 support levels is broken so the price will be inside Ichimoku cloud for ranging market condition within the primary bullish with very good possibility to be reversed to the bearish on daily timeframe for this week.

D1 price is on primary bullish with secondary correction:

W1 price is on bearish market condition with secondary ranging between 1.0520 (W1) support level and 1.1466 (W1) resistance level

MN price is on ranging bearish with 1.0461 support level

If D1 price will break 1.1061 support level on close D1 bar so we may see the correctional ranging market condition within the primary bullish with good possibility for the daily price to be reversed to the bearish in the near future

If D1 price will break 1.1466 resistance level so the bullish trend will be continuing

If not so the price will be ranging between 1.1061 and 1.1466 levels

SUMMARY : correction within the bullish market condition

TREND : ranging