Forum on trading, automated trading systems and testing trading strategies

newdigital, 2013.10.23 18:52

An Easy and Advanced Way to Set Stops

Talking Points:

- Stops are a necessity because no trading strategy wins 100% of the time

- Traders can use ATR to calculate stop distances based on recent price activity

- Price Action can be used to set stops in trending, or ranging market environments

But in the field of trading, risk management isn’t just a preference; it’s a necessity.

And the reason for this is simple: Because you cannot tell the future. And this means that no matter how hard you try, or how great a trader you become, you will simply never be able to avoid losing entirely. And as a natural extension of that fact, since you will lose on some trades, having sloppy risk management means that one or two losers can wipe away the gains of many small winners.

I know this may sound too simplistic; but this is exactly what was found to be The Number One Mistake that Forex Traders Make: They often win more frequently than they lose - but they lose so much when they are wrong that it wipes away all of the gains from their winners and then some.

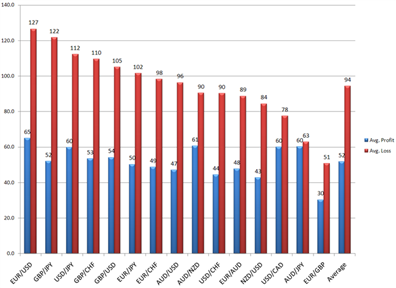

Average losses (in red) far outpace average wins (in blue) :

The first step to avoiding The Number One Mistake Forex Traders Make is

to set a stop. This allows you to cap the risk on any one trade, so that

if it doesn’t go in your direction, you can stem the bleeding before it

becomes too unbearable.

Below, we’re going to look at two popular, yet different ways of setting

stops. One easy way that is often employed by professional traders for

the sake of simplicity; and another more advanced method that may suit

certain trading styles more adequately.

The Easy Way

First off, just because this is an easier way of setting a stop does not

make it any less valid. This is classified as ‘the easy way’ simply

because most traders can pick this up right now, and begin using it

instantly with a minimum of instruction.

Average True Range is a favorite indicator of many professional

traders, and one of the great things about it is that it’s rather simple

in its design. While many indicators wear multiple hats and try to do a

few different things at once, ATR is just a measure of price movements

over a specific period of time.

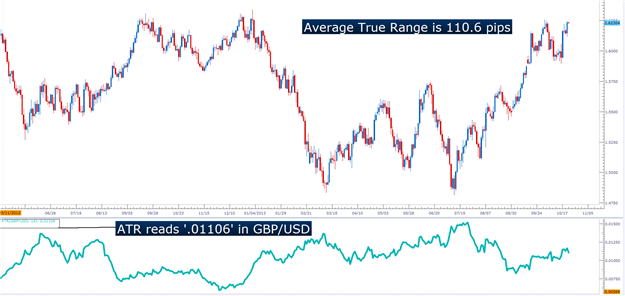

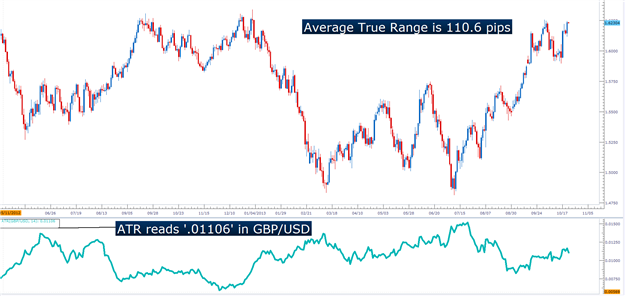

If those movements increase in value, ATR goes up. If those movements decrease, ATR goes down (see below).

ATR measures volatility, and this allows traders to set stops based actual market behavior :

There are a few nuances of ATR that traders need to know before

applying. We cover these, in depth in the article Managing Risk with

ATR. The first is the format with which the indicator displays values.

While it looks like an oscillator like RSI, and moves similar to an

indicator like ADX; the real value of ATR is in its value. It will

measure the ‘Average True Range’ of the last x periods, where x is the

input you choose. The default, and most common input for ATR is 14

periods. The value of ATR will read in the price format of the currency

pair being analyzed. So, for instance; if a value of .00760 is shown on

EURUSD, that means 76 pips (4th place to the right of the decimal is a

single pip in the quote).

ATR displays values in the format of the currency pair’s price :

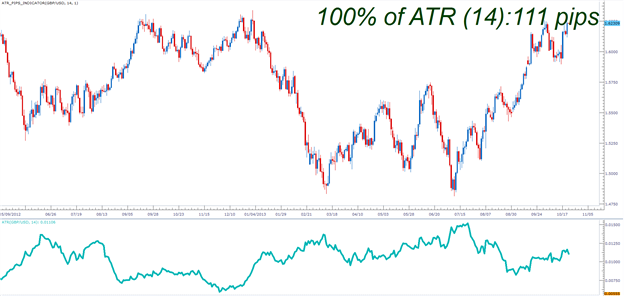

There is a slightly easier option, and for traders that are using

short-term techniques this can be extremely helpful. There is a custom

indicator available for Trading Station desktop that automatically

calculates, and displays ATR on the chart in a very easy-to-read format.

This is completely free, and can be downloaded from the FXCM App Store

at this link (link). As you can see below, not only does it display ATR,

but it even rounds the ‘.6’ fractional pip as appropriate.

The ‘ATR_Pips’ Indicator displays Average True Range in an easy-to-read format :

The Advanced Way

Price Action can have a huge impact on a trader’s performance.

Inclusion of price action into an approach will often take place

regardless of the trader or type of trading being done. Price action can

help traders read trends, find support and resistance, and perhaps most

importantly - manage risks.

Because, after all - if prices are trending higher, and we’re seeing

continuous higher-highs, and higher-lows, wouldn’t it be reasonable to

consider closing the trade if the trend reversed?

Remember, this is the number one mistake traders make, and this is the

reason stops are so important. If the trend reverses, the trader’s best

advice is often to close the trade and look for greener pasture

elsewhere... because if the reversal continues against the trader, one

loss can wipe away a lot of gains.

If traders are trading a trend, they can look to the previous

opposing-side swing for stop placement. So, if an up-trend is being

traded, we should be able to see higher-highs, and higher-lows. If we

are buying to take part in the up-trend, we can look to place our stop

below the prior swing-low (see picture).

During an up-trend, stops can be placed below the previous swing-low :

On the other hand, if we’re selling in a down-trend, we would want to look to place our stop above the prior swing-high.

During down-trend, stops can be placed above the previous swing-high

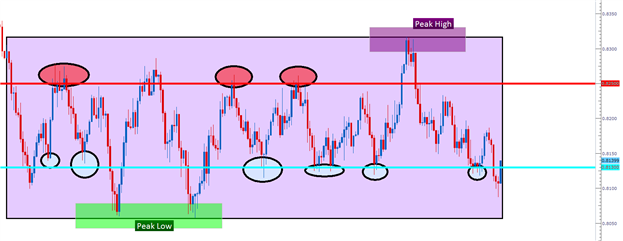

In How to Analyze and Trade Ranges with Price Action, we look at stop placement in

range-bound markets. If a range is being traded, the ‘peak-high’ and ‘peak-low’ should be identified (see below).

Traders can look to place their stop just outside of the peak of the

opposing side of their position. So, if buying, traders would look to

place their stop just below the peak-low; and if selling just above the

peak-high. This way, if the range turns into a breakout against the

trader, the bleeding can be stopped before one loser wipes away the

gains from a lot of winners.

If you’d like to become a better Price Action trader, we’ve put

together the basics into a Brainshark curriculum. The link below will

take you directly to the lesson, and after filling in a few pieces of

information into the guestbook the session will begin.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.20 07:54

Trading a Price Action Breakout (adapted from dailyfx article)

- Breakouts can determine market reversals and continuations

- Entry orders should be placed near support & resistance levels

- Stops and Limits can be entered using the ATR indicator

Previously the EURJPY had advanced as much as 756 pips from its February low to its current swing high at 136.22. However, looking at the chart below, it is important to notice that price action has moved below series of previous lows printed during the pair’s ascent. With the EURJPY breaking out towards lower lows for the first time in months, this makes the currency pair a prime candidate for breakout trading.

Today we will look at identifying a potential breakout and the opportunities that follow. So let’s get started!

Trading Breakouts

After finding the previous swing low or high in an uptrend, trading a price action breakout becomes a very straightforward process. Going back to our example on the EURJPY, the previous low for the pairs uptrend resided at 139.87. This point was acting as an area of price support for the pair as it was moving up towards higher highs. This support was acting like a floor for price and price action traders looking for a reversal have had to wait patiently for price to trade below this point. With the new creation of a lower low, traders began to sell this breakout with the expectation of price to develop a fresh downtrend.

Once a key line of support or resistance has been found, entry orders become an effective and easy way to prepare for a market breakout. An entry order is a pending order, and can be set through Metatrader. In the event that the market trades through a level or support or resistance, your order will be executed and your trade triggered into the market. Regardless if you are in front of your charts or not, by using an entry order your trade is scheduled to execute as soon as a breakout occurs!

Manage Risk

As with any active market strategy, trading carries risks. This holds true for breakout strategies as well. Because of this, after finding a breakout point to place an entry order, a trader’s next job should be considering how to manage their risk. Normally when trading a breakout in a new downtrend, traders will look to place stops above the broken line of previous support. Stop values can be placed 1ATR value above this level to account for current market volatility. In this example current ATR is 30 pips on the EURJPY. Once a stop is set using ATR (Average True Range), traders can then multiply that value to find a positive risk: reward ratio of their liking.

This is just one of many ways to start developing a price action strategy.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

ATR Channels:

ATR Channels create price movement channels considering ATR (Average True Range) technical indicator.

The indicator clearly shows trend acceleration and retardation moments and also overbought and oversold areas from the average true range perspective.

Author: Nikolay Kositsin