Please post only in English on this part of the forums. Or use the Italiano forum.

Use the automatic translation tool if needed. (2013)

Use simple language structure when using mechanical translation.

Forum rules and recommendations - General - MQL5 programming forum (2023)

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2014.02.15 06:58

Trader Styles and Flavors (based on dailyfx article)

Technical vs. Fundamental

Technical analysis is the art of studying past price behavior and attempting to anticipate price moves in the future. These are traders that focus solely on price charts and often times incorporate indicators and tools to assist them. They look at price action, support and resistance levels, and chart patterns to create trading strategies that hopefully will turn a profit.

Fundamental analysis looks at the underlying economic conditions of each currency. Traders will turn to the Economic Calendar and Central Bank Announcements. They attempt to predict where price might be headed based on interest rates, jobless claims, treasury yields and more. This can be done by looking at patterns in past economic news releases or by understanding a country’s economic situation.

Short-Term vs. Medium-Term vs. Long-Term

Deciding what time frame we should use is mostly decided by how much time you have to devote to the market on a day-to-day basis. The more time you have each day to trade, the smaller the time frame you could trade, but the choice is ultimately yours.

Short-Term trading generally means placing trades with the intention of closing out the position within the same day, also referred to as

“Day Trading” or “Scalping” if trades are opened and closed very rapidly. Due to the speed at which trades are opened and closed, short-term traders use small time-frame charts (Hourly, 30min, 15min, 5min, 1min).

Medium-Term trades or “Swing Trades” typically are left open for a few hours up to a few days. Common time frames used for this type of trading are Daily, 4-hour and hourly charts.

Long-Term trading involves keeping trades open for days, weeks, months and possibly years. Weekly and Daily charts are popular choices for long term traders. If you are a part-time trader, it might be suitable to begin by trading long term trades that require less of your time.

Discretionary vs. Automated

Discretionary trading means a trader is opening and closing trades by using their own discretion. They can use any of the trading styles listed above to create a strategy and then implement that strategy by placing each individual trade.

The first challenge is creating a winning strategy to follow, but the second (and possibly more difficult) challenge is diligently following the strategy through thick and thin. The psychology of trading can wreak havoc on an otherwise profitable strategy if you break your own rules during crunch time.

Automated trading or algorithmic trading requires the same time and dedication to create a trading strategy as a discretionary trader, but then the trader automates the actual trading process. In other words, computer software opens and closes the trades on its own without needing the trader’s assistance. This has three main benefits. First, it saves the trader quite a bit of time since they no longer have to monitor the market as closely to input trades. Second, it takes the emotions out of trading by letting a computer open and close trades on your behalf. This means you are following your strategy to the letter and are not able to deviate. And third, automated strategies can trade 24 hours a day, 5 days a week giving your account the ability to take advantage of any opportunity that comes its way no matter the time of day.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.04.18 13:02

News is different from forecast, and forecast is different from technical analysis.

This is how I understand it:

------

Forecasts. You are following some system which is 'black box' for you and can not be disclosed in public. You just believe in this unknown system/person/trader/coder which is making forecast for you. Forecasts are made with no any alternatives, for example: "buy EUR/USD at 1.2440 now/tomorrow at 10 am etc."

It is similar with weather forecast (no one is responsible for false signal for example). There are free forecasts and commercial forecasts.

Technical analysis. The person is using indicators or/and price action to make a technical analysis describing the market condition in the past together with price movement explanation to the future on alternative ways. For example: "if the price breaks this level to above so ...., alternative - if the price will cross this level to below so ...".

In this case - technical analysis is acting as the science which everybody can repeat in MT4/MT5, and you are always having the choice about what to do (to buy, or to sell, or to do nothing).

There are free technical analysis and commercial technical analysis.

There are some websites and sources which are publishing the articles with the word 'Forecast' (dailyfx.com and investing.com for example) but if you look at those articles so you will understand that it is the technical analysis only.

Analysts (the persons who are providing the technical analysis) consider the forecasts/forecasters as the forex scam (so, basicly they do not like each other).

We do not have forecasts on this part of the forum because it will be consider as an advertisement with commercial promotion anyway (technical analysis and forecasts can not be on the same subforums because of the differences between them: technical analysis is the science, and forecast is commercial or promotional service.

------

I mean - if someone will post some link to the website with the forex forecast/trading signals and so on (and if it will be real forecast without technical analysis) so this your thread will be deleted sorry.

Market Condition Evaluation

story/thread was started from here/different thread

================================

The beginning:

- Market condition indicators/tools thread

- MaksiGen Trading system (light Paramon): many variations of the system - the thread

- How to use Support and Resistance Effectively - educational thread

- Market condition and EAs thread

- Trend indicators thread

- Forex Market Conditions, a graphic depiction - the thread

- Evaluation of the market condition using six SMA indicators thread

- Multi-indics indicators thread

- Candle time tools thread

================================

Market condition

- the theory with examples (primary trend, secondary trend) - read staring from this post till this one

- Summary about market condition theory is on this post

- Practical examples about every market condition case by indicators: starting from this page till this one

- trendstrength_v2 indicator is here,

- AbsoluteStrength indicator new version is here

- AbsoluteStrength indicator old version is on this post

- AbsoluteStrengthMarket indicator is here to download.

- good feature in Metatrader 5: moving stop loss/take profit by mouse on the chart (video about howto)

- predictions are very different thing from technical/fundamental analytsis the post with explanation

- Technical vs. Fundamental; Short-Term vs. Medium-Term vs. Long-Term; Discretionary vs. Automated - the post

- Market condition setup (indicators and template) is here

================================

3 Stoch MaFibo trading system for M5 and M1 timeframe

- trading examples

- template to download

- explanation how to trade and more explanation here

- how to install

- 2stochm_v4 EA is on this post.

================================

PriceChannel ColorPar Ichi system.

================================

MaksiGen trading system

- indicator to download

- some explanation about the system in general how to use

- Trading examples with MT5 statement, more trading is here.

- Paramon trading system iis on this post; How to trade the system- manual trading with live examples - read this page.

================================

Forum on trading, automated trading systems and testing trading strategies

Market Condition Evaluation based on standard indicators in Metatrader 5

Sergey Golubev, 2023.04.19 13:39

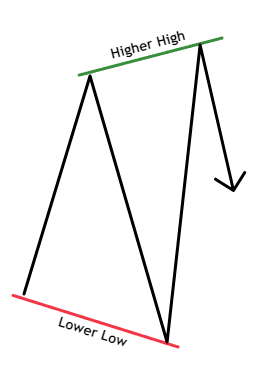

How to detect trends and chart patterns using MQL5

After reading this article, you will be able to detect highs and lows, identify trend types, double tops, and bottoms accordingly.

Forum on trading, automated trading systems and testing trading strategies

Forex Market Conditions, a graphic depiction

moneyline, 2008.11.09 07:18

Hi, since there's been questions about the varied Forex market conditions, here's a chart

that compares them.

moneyline

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hi everyone!

I have always been curious to know which analysis approaches traders find most effective in their daily trading strategies. Personally, I have explored both technical and fundamental analysis, but I would love to hear your opinions and experiences.

Technical Analysis : Do you use indicators such as MACD , RSI, moving averages, etc.? Do you find analyzing chart patterns and technical indicators more reliable for your short-term trades?

Fundamental Analysis : Do you prefer to analyze economic events, company financial reports, market news, etc.? Do you think this approach is more suitable for long-term investing or does it work for short-term trading too?

Combination of the Two : Or perhaps, you use a combination of both? How do you integrate these two approaches into your trading?

I'd love to hear your strategies, tips, and any success stories or lessons learned along the way. I hope this discussion can help all of us improve our trading strategies!

Thank you in advance for your responses and sharing your experiences!