Pair trading and multicurrency arbitrage. The showdown. - page 92

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Thank you, interesting...

for everyone's convenience, here is a link to the primary source mentioned in CCFp's post https://www.mql5.com/ru/articles/1464

message

haven't had the right ones yet

more or less

but it's still not right.

overdone

Renat, I proceed solely from what you wrote.

Let's start from the beginning, you gave a kind of hint that we should build everything by profitability.

Although I already know that the data should be scaled. And they can be scaled in different ways.

But you're writing for yield.

Forum on trading, automated trading systems and testing trading strategies.

Pair trading and multicurrency arbitrage. Disputes.

Renat Akhtyamov, 2023.08.01 02:03

Okay, don't argue.

Your main mistake is not understanding the essence of the question.

I always like to prompt with leading questions.

Whoever can answer will understand what I mean.

---

let's say all goods went up the same percentage, 100 per cent.

matches from 1 to 2.

bread from 30 to 60.

Now calculate the correct spread.

and it's obvious to anyone that they're not going to go back together.

Well, okay.

Then Eugene shows his screen, what he got in the end, but already with the formula.

Forum on trading, automated trading systems and testing trading strategies.

Pair trading and multicurrency arbitrage. Showdown.

Yevgeniy, 2023.10.25 20:16

Renat, trying to identify, help. Behind the reference point, the balance is still zero.

You answer him that everything is correct

Forum on trading, automated trading systems and testing trading strategies

Pair trading and multicurrency arbitrage. Disputes.

Renat Akhtyamov, 2023.10.25 20:32

mda, norm, beautiful, very heartfelt and correct

the beginning of the countdown time on a drum, it should be so and should be

It's right here.

Now switch the TF to MN1 and send me a screenshot.

//if you see what's going to happen there, you don't need to show it here.OK, based on the fact that everything is correct, I take Eugene's screen as an example. Isn't that logical?

You never bothered to show your own screen.

I am building everything by profitability without formula and showing it.

Forum on trading, automated trading systems and testing trading strategies.

Pair trading and multicurrency arbitrage. Showdown.

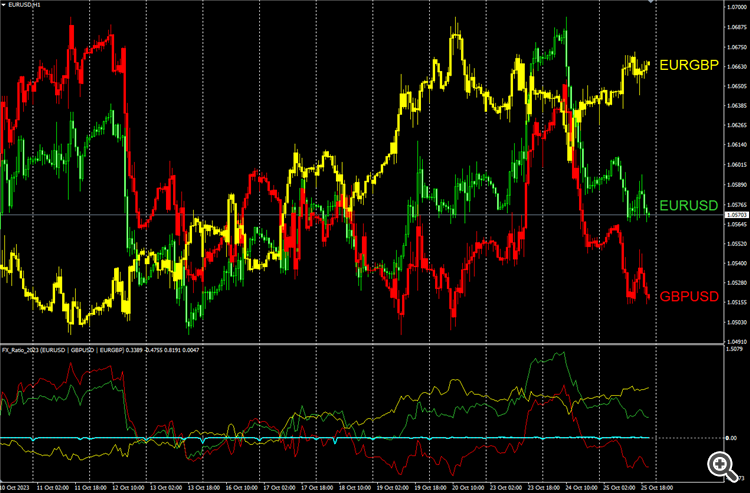

Roman, 2023.11.03 16:37

Well, what he shows on the screens does not look like what I get on the hourly chart, if we are talking about Renat's approach.

So he has his own bicycle of construction.

On this screen without the formula, I still can't get to write it.

At the moment on a simple yield on the hourly chart, there is such a sliding.

Which is quite similar to Eugene's screen, but here without the formula, and as if there is hope that the formula should solve the problem finally.

And now you start to say that, again, everything is wrong.

But at the same time someone mentioned that you send everyone to the bablokos branch, that it's kind of basic there.

But Alexander has a completely different system, and he has a completely different approach to graph construction, you know it yourself.

I conclude that from what you have spelled out here, not a single person will not build what you wanted to supposedly see, like right.

Because your statement is confused to such an extent that some people have supposedly correct, and others the same construction is wrong.

Here and understand you, what you wanted to say in the end. Maybe you think about Alexander's approach at all, but you write about triangle and formula.

Yes, this is another part of the strategy, but it does not refer to the construction by formula.

What do you think is right? Let's start with this. Yield, equity, pips? There's a lot of options to build on.

Where's your truth? What's overdone? I only showed the yield chart.)

Experiments continue )

Experiments continue )

It doesn't look very informative...(

It doesn't look very informative.(

We look for the maximum and minimum of currency pairs. Which is on the top we sell and which is on the bottom we buy. I also think it is necessary to flip pairs with USD in front or not? Entry by sliding in pips, exit closing in parts to a certain profit. There is 1 signal in processing so far.

Experiments continue )

Nostril to nostril... :-)

from slightly different angles.

the screenshot shows the same time.

nostril to nostril. :-)

from slightly different angles

the screenshot shows the same time.

And I think that taking any max/min from the bundle is not the right approach. Even if they are historically repeated.

It is necessary to take only instruments of the triangle in a position, so that it does not happen that on some news your position was torn to pieces.

What is the starting point?

Linear regression and other statistical methods give bias of estimates, curves start to float with time, not corresponding to reality.

Even those methods that position themselves as suitable for real time, still either lag or give bias of estimates.