Pair trading and multicurrency arbitrage. The showdown. - page 69

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

"walk the same" - it can be correlation (collinearity, if there are many of them) of increments, and for pair trading you need cointegration (which does not follow from correlation at all).

They walk the same way - at the same pace. That's not what everyone here is eating, green whistle and you can go to the canary :-)

If something is sold for $1000, then something else is bought with that $1000. General overvaluation/undervaluation, worldwide inflation, deflation do not lead to long term changes in mutual exchange rates.

Therefore, the Shatans can bake as many quid as they want and nothing will change as long as the printed volumes have time to be traded and coordinated in rates/price. The U.S. national debt will increase, but it will have no effect on exchange rates.

This economic paradox even has a name and a reputable author.

And the balance is also unaffected - as long as the volumes have time to be traded on the domestic/market, the overall effect on exchange rates is negligible.

It is similar as if all values A B C D multiplied by K, then this very K will mutually reduce in rates A/B C/D ; only the process is not instantaneous.

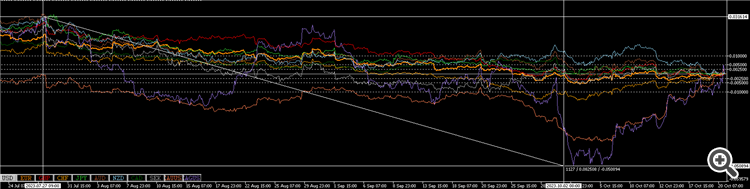

here's the USD H1:

gold and silver are the most spread out,

and all the currencies follow in a single bundle.

However, it is not surprising - the yield (profit% on operations for the time T) for all currencies is the same and very small.

If the crisis scatters them, then mutual revaluation and efforts of central banks will bring them down to a few per cent %/year anyway, minus inflation.

And currency risks are not so great as it seems looking at the exchange rate points, and no one invests in currencies for a long period of time (12% per annum, in a high jump and if you are lucky).

If the exchange rate difference is good, even private deposits will be closed by right and wrong, and this will start to move the exchange rates back.

and all the currencies follow a single bundle.

I wonder on what principle the Swedish krona is included?

Why not the Brazilian real, for example? Brazil's GDP is 6 times the GDP of Sweden.

I wonder on what principle the Swedish krona is included?

Why not the Brazilian real, for example? Brazil's GDP is 6 times the GDP of Sweden.

I wonder on what principle the Swedish krona is included?

Why not the Brazilian real, for example? Brazil's GDP is 6 times the GDP of Sweden.

The Swedish krona is the reserve currency of the EC and is part of the EURX euro index, a good reason to see it.

By the way about indices - scary fractional degrees that scare some people, on the presented graph is just a coeff.at the usual weighted average.

...

Meaning cumulativestop loss as a% of depo, not a specific price stop.

Tried it. Drains...

Now it is clear where the averaging comes from in this pond)))))

Although, to be fair, I checked superficially. It is possible to add a currency strength indicator filter: for example, when on the senior TF two currencies are at the very top, meaning the strength that will not allow either of them to quickly disperse (as an assumption).

If not by quality, then by quantity. And then optimise the divergence threshold. Anyway, I'll put it in the queue

Patriotic:

from this, by the way - you can look at ruble vs kiwi and other flatnesses based on this.

and I suspect that's a possibility from the yuan and gold weighing against the pound. Because I don't know of any direct strong links between the economies of Russia and New Zealand.

But the obvious links are China (both close to each other), Australian gold, and the pound and the ruble are two acrobat brothers with a very deep relationship:-).