Risk depends on your initial stop loss, lot size, and the value of the symbol. It does not depend on margin or leverage. No SL means you have infinite risk (on leveraged symbols). Never risk more than a small percentage of your trading funds, certainly less than 2% per trade, 6% account total.

-

You place the stop where it needs to be — where the reason for the trade is no longer valid. E.g. trading a support bounce, the stop goes below the support. Then you compute your lot size.

-

AccountBalance * percent/100 = RISK = OrderLots * (|OrderOpenPrice - OrderStopLoss| * DeltaPerLot + CommissionPerLot) (Note OOP-OSL includes the spread, and DeltaPerLot is usually around $10/PIP, but it takes account of the exchange rates of the pair vs. your account currency.)

-

Do NOT use TickValue by itself - DeltaPerLot and verify that MODE_TICKVALUE is returning a value in your deposit currency, as promised by the documentation, or whether it is returning a value in the instrument's base currency.

MODE_TICKVALUE is not reliable on non-fx instruments with many brokers - MQL4 programming forum (2017)

Is there an universal solution for Tick value? - Currency Pairs - General - MQL5 programming forum (2018)

Lot value calculation off by a factor of 100 - MQL5 programming forum (2019) -

You must normalize lots properly and check against min and max.

-

You must also check Free Margin to avoid stop out

-

For MT5, see 'Money Fixed Risk' - MQL5 Code Base (2017)

Most pairs are worth about $10 per PIP. A $5 risk with a (very small) 5 PIP SL is $5/$10/5 or 0.1 Lots maximum.

Yes! You could have easily tested this on a demo account!

Then you are losing money, because you end up paying double the spread and double the commission. Use a stop-loss instead. Do the maths.

Yes! You could have easily tested this on a demo account!

Then you are losing money, because you end up paying double the spread and double the commission. Use a stop-loss instead. Do the maths.

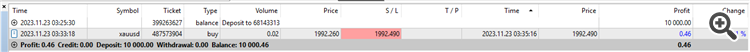

Can anyone analyze this?

I bought XAUUSD at 1992.26 and when I got in profit, i set trailing stop 10 points without set initital stop loss

Then it closed at 1992.49

How this worked?

What do you mean?

It worked as expected — a trailing stop of 10 points was applied and when the price reversed it hit the stop-loss that was set by the trailing stop.

Do you know how a trailing stop-loss works?

Also, you don't need to wait until it is in profit. You can set the trailing-stop right after the position is opened.

What do you mean?

It worked as expected — a trailing stop of 10 points was applied and when the price reversed it hit the stop-loss that was set by the trailing stop.

Do you know how a trailing stop-loss works?

Also, you don't need to wait until it is in profit. You can set the trailing-stop right after the position is opened.

Trailing stop is a way to move the SL point a certain number of points every time the profit increase, and sure there are many types of trailing stops

Yes it worked, but I mean the math analysis of the numbers, entry and why it hit stop loss at this level?

The position opened 1992.26 , so if 10 points trailing, it should stop at 1992.36? why it stopped at 1992.46?

this means if price went 1992.70 directly, and back, it will close at 1992.65? so it add 10 points every step right?

Trailing stop is a way to move the SL point a certain number of points every time the profit increase, and sure there are many types of trailing stops

Yes it worked, but I mean the math analysis of the numbers, entry and why it hit stop loss at this level?

The position opened 1992.26 , so if 10 points trailing, it should stop at 1992.36? why it stopped at 1992.46?

this means if price went 1992.70 directly, and back, it will close at 1992.65? so it add 10 points every step right?

No! A trailing stop price is calculated from the Maximum Favourable Excursion price, not from the Opening Price.

In other words, the price moved favourably up to 1992.500 (before reversing), setting the stop-loss at 1992.490 (1992.500 - 10 points).

So I ask again, do you know how a trailing stop works?

PS! 1992.360 - 1992.260 is 100 points, not 10 points.

Maximum Favourable Excursion price

If I know i was not going to ask

So it calculate based on Maximum Favourable Excursion price

So lets say when price went to 1992.500 and I set trailing at 100 points, price continue up without being back until 1993.50 and started to go down from there, so it will close at 1993.40 right?

Another question, you said we can set trailing stop when the trade is opened, in this case what will be the Maximum Favourable Excursion price?

Yes!

Right after opening, the MFE would be the Bid price, which would be ( Ask - spread ), or [opening price] - [spread].

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hello everyone

Generally I dont use stop loss while trading, but I prefer to create hedge position to limit losses until market move to my favorite direction

So I was thinking to use trailing stop feature to lock profits at a point and let the position open for more profits

My question is, I can use the trailing stop feautre without setting initial stop loss?