It depends very much on the strategy you are following. If you trade a trend you may exit when the trend changes (no TP), for channel trading it could be the channel, a scalper could have fix exit of a couple of points ...

So set up several ways to exit a position and the the optimizer tell you what might(!) work.

hi

internet is full of best entry strategies , but no one talks about setting TP points , what is best way to set take profit point ? latest swing points ? R/R ? pivots ? how you identify the retest so u dont break even fast ? do you use higher time frames for exit points ?

but the problem is : i always exit very quick , focusing so much on entry points and quick exits don't let me focus on exit points , can you help me ?

please lets not talk about entry point strategies and money managment , they are fine , 500+ pips with a 90% daily win rate in 1m TF @ XAUUSD

just looking for a proper TP targeting , and also when to break even (for example you break even in 50% of target reached or what ? )

is there any indicator that can help me in this one?

i looked ATR ADX but could not find it useful in 1m TF since they calculate previous data and can be false with a long reversal candle with high volume , or maybe i am wrong

any recommandations ?

thanks

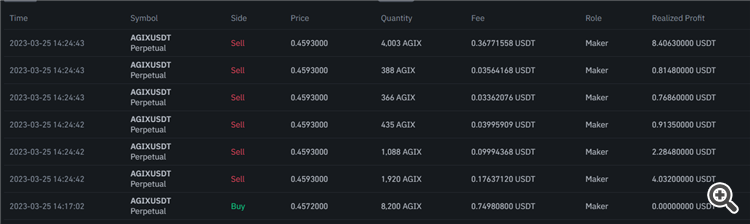

I am a scalper so I exit immediately in few points I will explain in detail my recent trade on $AGIXUSDT

I traded Swing AX's 200% and exited above 1.618, this is all in 1 min chart

A good exit point means it is also a good entry point. if you have a good exit method, generally, you can use this method to deal opposite to earn.

to test my entry method work, i use fixed time exit. But i also have a MA group to follow the trend until the MA group are not the same direction.

so it is: fixed_time_up && MA_Direction != trade_direction

hi

internet is full of best entry strategies , but no one talks about setting TP points , what is best way to set take profit point ? latest swing points ? R/R ? pivots ? how you identify the retest so u dont break even fast ? do you use higher time frames for exit points ?

but the problem is : i always exit very quick , focusing so much on entry points and quick exits don't let me focus on exit points , can you help me ?

please lets not talk about entry point strategies and money managment , they are fine , 500+ pips with a 90% daily win rate in 1m TF @ XAUUSD

just looking for a proper TP targeting , and also when to break even (for example you break even in 50% of target reached or what ? )

is there any indicator that can help me in this one?

i looked ATR ADX but could not find it useful in 1m TF since they calculate previous data and can be false with a long reversal candle with high volume , or maybe i am wrong

any recommandations ?

thanks

You can choose Reward/Risk ratio as an input parameter to be optimized via strategy tester.

Take profit strategy is a predetermined price level at which a trader decides to close out a profitable trade. The goal of this strategy is to lock in gains before the market moves against the trader's position.

Take profit strategies can vary widely depending on a trader's individual goals, risk tolerance, and trading style. Some traders may choose to set a fixed profit target based on a specific price level or percentage gain, while others may use technical analysis tools to identify potential resistance levels where price movements could stall.

Since I'm a intraday trader/scalper I can only comment as such.

For me personally I look for 1H and 4H clean candles and use their top or bottoms as possible TP levels. Also good idea to close only a portion of trades during trending conditions and let some trades run while you SL is at BE.

This should also compliment your money management from a risk/reward point of view.

At some point though you have to decide how much money you want to make from a trade, otherwise you might end up with a lot of BE trades...

Trade safe.

with a 60% of right trades.

Trading is about consistency and growing account slowly.

If you try to chew it all at once you will drown with the food.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

hi

internet is full of best entry strategies , but no one talks about setting TP points , what is best way to set take profit point ? latest swing points ? R/R ? pivots ? how you identify the retest so u dont break even fast ? do you use higher time frames for exit points ?

but the problem is : i always exit very quick , focusing so much on entry points and quick exits don't let me focus on exit points , can you help me ?

please lets not talk about entry point strategies and money managment , they are fine , 500+ pips with a 90% daily win rate in 1m TF @ XAUUSD

just looking for a proper TP targeting , and also when to break even (for example you break even in 50% of target reached or what ? )

is there any indicator that can help me in this one?

i looked ATR ADX but could not find it useful in 1m TF since they calculate previous data and can be false with a long reversal candle with high volume , or maybe i am wrong

any recommandations ?

thanks