I checked the order book is the same on all platforms, so the difference must be in the orders cross, that is, the MT5 broker would be acting as Market Maker. What we see, is the broker book, not the CME one.

Can anyone confirm these suspicions?

If they are a licensed, regulated and reputable broker, then they will disclose that information publicly.

Thanks for your response.

The broker is authorized as a Futures Clearing Merchant “FCM” regulated by the National Futures Association and the Commodity Futures Trading Commission, with license no. 0412490. Headquarters: 221 N. LaSalle Street, 25th Floor, Chicago, IL 60601 US.

Due to forum rules, I can't put his name here, but you can see who is.

The "FINRA Rule 4019" or "Order Crossing Rule", allows a brokerage firm to cross orders from its clients, that is, to execute a simultaneous purchase and sale of securities at fair and equitable prices. Rule 4019 also requires brokerage firms to inform their clients about the order crossing and provide information on the prices and quantities involved. Rule 4019 applies to all brokers registered with the Financial Industry Regulatory Authority (FINRA).

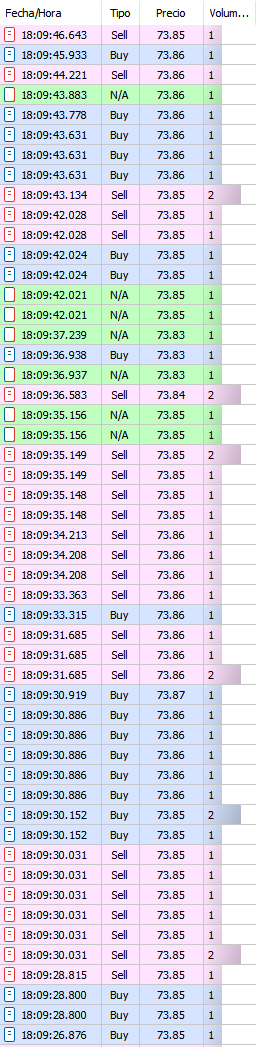

In MT5 we can see this cross orders with no type in green color:

The point is that the same broker offers different platforms, with different data. Even contracting the same CQG data provider, the results are different. So, the execution seems to be different between MT5 and the other platforms.

Regards,

Indicators are not conclusive, as it is not known which one takes these buy+sell/NA ticks into consideration. Perhaps the MT5 delta does.

Here is a post from a thread also about these ticks. Different exchange, but it is the same principle.

Forum on trading, automated trading systems and testing trading strategies

TICK_FLAG_BUY and TICK_FLAG_SELL simultaneously set in MqlTick structure

Heraldo Almeida, 2017.08.04 21:32

I talked to a person who does not know Metatrader but knows very well the BMF market and he gave me an explanation that i would like to share with you.

He said that there are 3 kinds of trades at BMF:

- BUY trades - a buyer sends a buy market order that closes someone's sell limit order

- SELL trades - a seller sends a sell market order that closes someone's buy limit order

- DIRECT trades - a buyer and a seller send buy and sell market orders simultaneously through the same broker and that broker deals the trade directly between them, without closing any limit order at the market.

He explained me that the broker is authorized to make direct deals between its own customers, as long as the transaction price is inside the market spread range (higher than the current bid price and lower than the current ask price) and the trade information is sent to the market. He told me direct deals are regularly recorded as any other trade (so they must generate tick data records as well).

I told him that the "Buy/Sell" records are around 1% of the total market volume and he thinks it looks a plausible figure for the volume share of direct deals at BMF.

So, it seems that the mistery of the "Buy/Sell" ticks at BMF is solved.

I am curious to know if the markets in other countries also have that kind of direct trade, or if it is just a "Brazilian weirdness".

Regards!

Not sure how this information is send back to the market (ie the central exchange), and what flags are set for those receiving this information from the central exchange.

Edit for the Red highlight. Considering this very aspect, i would not include local N/A ticks in any statistical model or indicator as there is zero impact on the exchange.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

If you compare the data on other platforms such as NinjaTrader or Quantower, you will be able to verify that the CME data is the same for all this platforms. However, they are different in MT5.

I checked the order book is the same on all platforms, so the difference must be in the orders cross, that is, the MT5 broker would be acting as Market Maker. What we see, is the broker book, not the CME one.

Can anyone confirm these suspicions?

Regards,