No! A VPS is just a PC in a remote location closer to the broker's trade server. Nothing more. Usually a VPS just has higher protection against power outages and loss of network connectivity, but it still happens. The risk is still there, just slightly lower.

However, if you are using stops (T/P and S/L) on the trade server side (not on the terminal side), then those will remain valid and functional even if there is loss of power or network connectivity, irrespective of it being a VPS or your home PC.

No! A VPS is just a PC in a remote location closer to the broker's trade server. Nothing more. Usually a VPS just has higher protection against power outages and loss of network connectivity, but it still happens. The risk is still there, just slightly lower.

However, if you are using stops (T/P and S/L) on the trade server side (not on the terminal side), then those will remain valid and functional even if there is loss of power or network connectivity, irrespective of it being a VPS or your home PC.

That seems like a strange question. Don't you not know how your EA works?

Any active orders or open positions, and their respective real stops (not virtual stops) are visible from any desktop terminal, web-terminal or mobile terminal.

That seems like a strange question. Don't you not know how your EA works?

Any active orders or open positions, and their respective real stops (not virtual stops) are visible from any desktop terminal, web-terminal or mobile terminal.

That makes no sense. If you are placing OCO orders then you must be using some kind of EA, even if it is just a trading panel.

The terminal itself does not support them, unless you are referring to "Buy stop-limit" or "Sell stop-limit" orders.

If you are trading purely manually, with absolutely no EA managing orders and positions (nor terminal trailing stops) then a VPS will have no advantage at all, as pending orders and real stops are managed by the trader server.

That makes no sense. If you are placing OCO orders then you must be using some kind of EA, even if it is just a trading panel.

The terminal itself does not support them, unless you are referring to "Buy stop-limit" or "Sell stop-limit" orders.

If you are trading purely manually, with absolutely no EA managing orders and positions (nor terminal trailing stops) then a VPS will have no advantage at all.

I use the "New Order" panel for order placing, didn't know that was considered an EA too, as most definitions for it refer to automated trading bots.

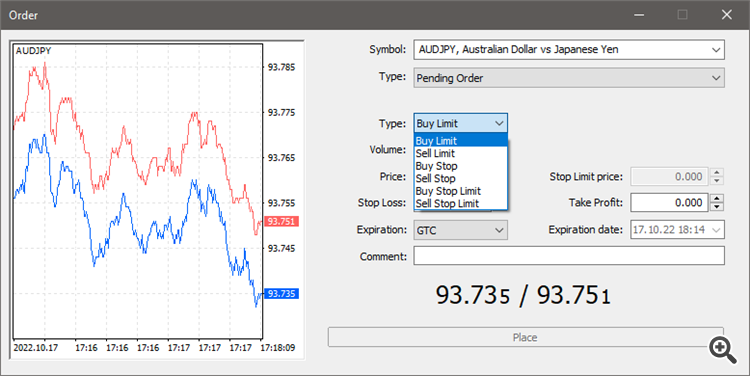

Then if you are using the normal terminal Order Panel, then that is not an EA and there are no OCO orders there. There are only market or pending orders, of which there are only 6 types of pending orders ...

- Buy Limit — a trade request to buy at the Ask price that is equal to or less than that specified in the order. The current price level is higher than the value specified in the order. Usually this order is placed in anticipation of that the security price will fall to a certain level and then will increase;

- Buy Stop — a trade order to buy at the "Ask" price equal to or greater than the one specified in the order. The current price level is lower than the value specified in the order. Usually this order is placed in the anticipation that the price will reach a certain level and will continue to grow;

- Sell Limit — a trade order to sell at the "Bid" price equal to or greater than the one specified in the order. The current price level is lower than the value specified in the order. Usually this order is placed in anticipation of that the security price will increase to a certain level and will fall then;

- Sell Stop — a trade order to sell at the "Bid" price equal to or less than the one specified in the order. The current price level is higher than the value in the order. Usually this order is placed in anticipation of that the security price will reach a certain level and will keep on falling.

- Buy Stop Limit — this type is the combination of the first two types, being a stop order to place a Buy Limit order. As soon as the future Ask price reaches the stop-level indicated in the order (the Price field), a Buy Limit order will be placed at the level, specified in Stop Limit price field. A stop level is set above the current Ask price, while Stop Limit price is set below the stop level.

- Sell Stop Limit — this order is a stop order to place a Sell Limit order. As soon as the future Bid price reaches the stop-level indicated in the order (the Price field), a Sell Limit order will be placed at the level, specified in Stop Limit price field. A stop level is set below the current Bid price, while Stop Limit price is set above the stop level.

Then if you are using the normal terminal Order Panel, then that is not an EA and there are no OCO orders there. There are only market or pending orders, of which there are only 6 types of pending orders ...

- Buy Limit — a trade request to buy at the Ask price that is equal to or less than that specified in the order. The current price level is higher than the value specified in the order. Usually this order is placed in anticipation of that the security price will fall to a certain level and then will increase;

- Buy Stop — a trade order to buy at the "Ask" price equal to or greater than the one specified in the order. The current price level is lower than the value specified in the order. Usually this order is placed in the anticipation that the price will reach a certain level and will continue to grow;

- Sell Limit — a trade order to sell at the "Bid" price equal to or greater than the one specified in the order. The current price level is lower than the value specified in the order. Usually this order is placed in anticipation of that the security price will increase to a certain level and will fall then;

- Sell Stop — a trade order to sell at the "Bid" price equal to or less than the one specified in the order. The current price level is higher than the value in the order. Usually this order is placed in anticipation of that the security price will reach a certain level and will keep on falling.

- Buy Stop Limit — this type is the combination of the first two types, being a stop order to place a Buy Limit order. As soon as the future Ask price reaches the stop-level indicated in the order (the Price field), a Buy Limit order will be placed at the level, specified in Stop Limit price field. A stop level is set above the current Ask price, while Stop Limit price is set below the stop level.

- Sell Stop Limit — this order is a stop order to place a Sell Limit order. As soon as the future Bid price reaches the stop-level indicated in the order (the Price field), a Sell Limit order will be placed at the level, specified in Stop Limit price field. A stop level is set below the current Bid price, while Stop Limit price is set above the stop level.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hi, as I understand it using MT5 in it's basic form (without VPS) means that my OCO orders are only hosted on my PC, in the platform, and if for example the power cuts out, the OCO orders will not get executed, leaving me with unlimited risk on the open position.

Will using the VPS mean the OCO orders are hosted in the server and even if the power cuts out, my positions still have take profit and stop loss orders active?