EURUSD Technical Analysis 2015, 19.04 - 26.04: Bear Market Rally with good reversal possibilities to primary bullish with 1.0461/1.0954 levels

In monday 100+ PIPS UP

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.17 15:51

Forex Weekly Outlook April 20-24 (based on forexcrunch article)

Inflation data in New Zealand and Australia, Poloz and Stevens’ speeches, German ZEW Economic Sentiment and German Ifo Business Climate, US Unemployment Claims and Durable Goods Orders are the highlights of this week. Here is an outlook on the top events on Forex calendar.

Last week, US data disappointed with weaker than expected housing and employment data as well as soft retail sales. Jobless claims rose 12,000 to 294K, building permits came reached 1.04 million while forecasted 1.08 million and housing starts hardly recovered with 0.93 million. Retail sales registered a 0.9% increase, below the 1.1% rise predicted and Core sales gained 0.4% far below the0.7% expected. However, the Philadelphia Fed Manufacturing Index surprised with 7.5 points vs. 5 in the previous months exceeding forecasts for a 6.5 points reading. Will the US data stabilize this week?

- New Zealand Inflation data: Sunday, 23:45. Consumer prices in New Zealand declined by 0.2% in the fourth quarter of 2014, amid lower oil and vegetables prices. This was the first decline since the fourth quarter of 2012. Analysts expected rates to remain unchanged and expected an annual growth of 0.9% rather than the 0.8% reported. However, international air fares edged up 7.3%, while domestic air fares expanded 8.3%. Housing costs were also a positive contributor to inflation in the December quarter. Consumer prices are expected to decline once more by 0.2%.

- Stephen Poloz speaks: Monday, 15:05. BOC Governor Stephen Poloz is scheduled to speak in New York. Poloz may talk about the central bank’s decision to keep its key overnight lending rate unchanged and about his bright forecast for Canadian growth despite the current slowdown forced by the oil price collapse.

- Glenn Stevens speaks: Monday, 17:30. RBA Governor Glenn Stevens is expected to speak in New York. He may refer to The RBA’s decision to leave the cash rate unchanged at 2.25%, despite talks of a rate cut.

- Eurozone German ZEW Economic Sentiment: Tuesday, 10:00. German investors’ sentiment remained positive in March, climbing for the fifth time to 54.8 from 53 in February amid rising domestic demand. However concerns about Greece and Ukraine clouded future outlook. Analysts expected a higher figure but predict optimism will grow in the coming months after the fog, surrounding Greece and Ukraine, clears. Investors sentiment is expected to rise to 56.

- Australian inflation data: Wednesday, 2:30. Australian inflation in the last quarter of 2014, rose 0.2% following 0.5% rise reported in Q3. The reading was below expectations reflecting lower prices for transport, due to the ongoing decline in oil prices, as well as for healthcare. Falling fuel prices are the main cause for the tame inflation in the fourth quarter. But Core inflation a more precise measure posted a 0.7% gain reaching an annual 2.3% just above the bottom of the RBA’s 2-3% target range. CPI is forecasted to gain 0.1%.

- US Unemployment Claims: Thursday, 13:30. The number of Americans filing initial claims for unemployment aid increased by 12,000 to 294,000, rising for the second straight week. However, the number of jobless workers is still low. The four-week average, edged up by 250 to 282,750, nearly the same as in the prior week. The total number of Americans seeking aid declined to 2.27 million, the lowest in more than 14 years. The number of claims is expected to reach 90,000 this week.

- Eurogroup Meetings: Friday. The Eurogroup meetings attended by Finance Ministers from the euro area will be crucial for Greece. Unless a funding agreement is reached, Greece will not get the third aid program from the ECB, resulting in a default. Athens has not received bailout aid since August last year and has been hard pressed to cover payments amid a cash crunch, resorting to measures such as borrowing from state entities to tide it over.

- Eurozone German Ifo Business Climate: Friday, 9:00. German Ifo business climate edged up to 107.9 in March from 106.8 in February, beating forecast for 107.3. Optimism about current conditions rose as well as six months outlook. Strong growth and low oil prices boosted domestic demand. Ifo economists believe expansion will continue in the coming months.

- US Core Durable Goods Orders: Friday, 13:30. Orders for long lasting goods declined in February by 1.4% contrary to forecast of 0.3% gain. Meanwhile, core orders fell 0.4% posting the fifth straight monthly decline. The weak figures suggest softening in domestic demand despite growth in employment. However, economists expect growth will increase in the coming months.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.17 18:54

EURUSD tests resistance again (based on forexlive article)

The EURUSD - like the AUDUSD (and also the USDCAD) - has seen the price action complete a full lap in trading today. The price moved higher in London morning session, but subsequently fell all the way down to the days lows when NY traders entered.

The weekend flows can wreck havoc. Greece will be in play over weekend

(and going forward). As a result geo-political risk have the potential

to lead to more squaring up and choppy trading action -especially in the

next hour.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.18 07:23

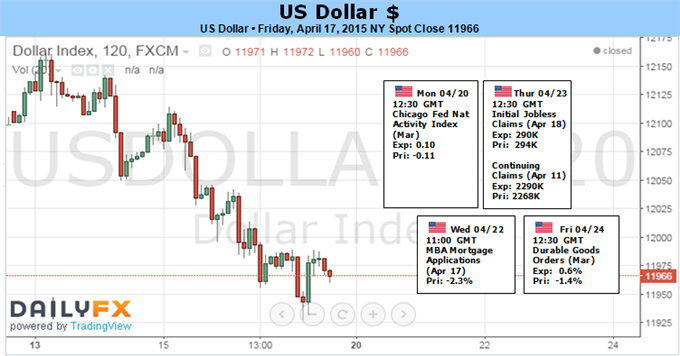

US Dollar Fundamentals (based on dailyfx article)

Fundamental Forecast for Dollar: Bearish

- The USDollar suffered its second largest weekly decline in a year this past week, but conviction was uneven

- Inflation and Fed talk offered a little more traction for USD selling, but key risk in 1Q GDP and FOMC is further out

The Dow Jones FXCM Dollar Index (ticker = USDollar) dropped 1.1 percent this past week while the ICE Dollar Index tumbled 1.8 percent. That represents the second worst week for the even-weighted measure (USDollar) in 12 months and the second worst performance for the EURUSD-heavy gauge in 22 months. Have speculators over-reached on this advantaged currency? The recent stumble after two months of consolidation alongside speculative positioning suggests that may be the case. However, as market participants weigh the impetus for correction against the tangible fundamental appeal the currency holds over the longer-term; progress will lean heavily on meaningful catalysts to motivate a counter-trend move. And, this week’s docket will struggle for the high profile drivers while the period after is overstocked with redefining updates.

From a fundamental perspective, it is important to establish the longer-term position for the Greenback. Treasury Secretary Jack Lew at the G-20 noted the United States’ economic dominance when he remarked that it was not ‘sufficient’ that the US be the lone driver of global growth. That bodes well for investor returns (and thereby capital inflow) alongside the first-mover advantage the Fed seems to be taking with its relatively hawkish monetary policy standing. Furthermore, in the event of a global financial slump; the Dollar will likely revert back to its ‘haven’ status – after a certain intensity is reached. Medium to long-term, the currency looks well positioned to advance further. Yet, that doesn’t preclude it to interim corrections.

A ‘correction’ is what lurks for the Greenback. Nine-months of steady climb in the most rapid move since the early 1980’s mixes both fundamental reasoning and speculative exuberance. It is the faction that participated to take advantage of momemtum rather than hold positions to realize long-term developments that pose the currency short-term risk. It is difficult to establish exactly how much excess could be worked off, but positioning measures can act as a proxy. The CFTC’s Commitment of Traders (COT) report this past week showed a continued reversal from the record net-long exposure set in January. Now at its lowest level since the end of December, there is still plenty of room for moderation as we’ve only seen a 13 percent retreat from the bullish shift that began in 2012.

The most capable driver for the Dollar in its long and short-term course is monetary policy. This past Friday, a range of inflation measures bolstered the persistent doubt of near-term FOMC rate hikes. The headline CPI reading for March slipped back into negative territory (-0.1 percent), a real average weekly earnings figure retreated from its series high to a 2.2 percent clip and price forecasts from the University of Michigan confidence survey posted sharp declines. Caveats of robust core measures and the general trend of the wage numbers factor in, but viability of a near-term hike is certainly diminished. According to Fed Fund futures, the first hike is once again not fully priced in until January 2016.

Moderated rate expectations reinforced by tepid data, but it’s capability as a fundamental driver is diminished considering the time frame yields imply and the persistent buoyancy of the Dollar – a rate hike may come later but it is still a hike among QE programs. Sentiment may simply tip out of favor for the Greenback and pull it lower, but the most effective means would by through key event risk to focus the selling effort. For the coming week’s docket, there is limited high-profile event risk to hit all traders’ radars. And, marking a meaningful distraction, there are very high profile events in the following week (FOMC decision and GDP amongst others).

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.21 07:08

Forex technical analysis (VIDEO): EURUSD starts the week more bearish. Can it continue? (based on forexlive article)

The EURUSD started the day at the highs and wandered lower in trading as

the week got started. Will the bearishness continue this week? What

levels will keep the bears in control.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.21 16:00

EUR/JPY, EUR/USD Triangles Continue to Develop Downside Potential (based on dailyfx article)

- EURJPY, EURUSD triangles begin to favor more downside.

- EURGBP double top remains valid towards 0.7063.

Short-term technical indicators are close to turning outright negative for various EUR-crosses. For EURJPY and EURUSD, this potentially means continuation outside of their recent triangls after breaking the uptrends from last week's lows (although in EURUSD, a longer-term triangle may be in the works). For EURGBP, we've seen the key topside resistance level respected throughout the consolidation, keeping the double top intact.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.21 17:10

ECB Mulls Tightening Noose Around Greek Banks (based on rttnews article)

The European Central Bank is exploring measures to reduce the Emergency Liquidity Assistance to Greek banks, reports said Tuesday, citing people with knowledge of the discussions. ECB Staff have suggested an increase in the haircuts banks take on the collateral they offer for emergency funding from the Bank of Greece, both Bloomberg and CNBC said.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.22 06:25

As DXY Consolidates, GBP/USD, EUR/USD Start To Rally - BofA Merrill (based on efxnews article)

While Bank of America Merrill Lynch didn't expect the USD Index DXY to remain within its recent corrective range trade (currently consolidating between 99.92 & 96.58), BofA now thinks that this longer than anticipated consolidation has done no damage to the larger bull trend.

"Absent a sustained break off 96.58/95.94 we look for a bullish resolution towards 103.85 (Triangle objective) ahead of 106.00 (long term upside target)," BofA argues.

It is a slightly different story for GBP/USD, according to BofA, as the setup here is for a more directional correction higher.

"In the sessions ahead we look for a push to 7m channel resistance at 1.5232 ahead of swing targets at 1.5350 and potentially beyond before the long term downtrend resumes for a push towards 1.35/1.40 (secular range lows), BofA projects.

Turning to EUR/USD, BofA advises bulls to watch the 55d average around 1.0992.

"While we remain long term EUR/USD bears, targeting 1.0283/1.000, in the near term the pair is stuck in a choppy corrective range between 1.0462 (Mar-16 low) and the 55d avg (now 1.0992)," BofA notes.

"Bulls need a sustained break of the 55d to point to a greater correction than anticipated, exposing the 1.1261/1.1534 February congestion zone," BofA advises

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.22 09:21

EURUSD Technical Analysis: Digesting Gains Above 1.07 (based on dailyfx article)

The Euro is digesting gains against the US Dollar after rising as expected

after showing a bullish Morning Star candlestick pattern. Near-term

resistance is at 1.1040, the March 18 high, with a break above that on a

daily closing basis exposing the 38.2% Fibonacci retracement at 1.1266.

Alternatively, a move back below the March 31 low at 1.0712 clears the

way for a test of the 1.0461-1.0554 area (March 13 low, 23.6% Fibonacci

expansion).

We see the Euro trend as broadly bearish, in line with our long-term outlook. As such, we will approach on-coming gains as corrective in the context of a larger structural decline and position for opportunities to enter short after the move higher is exhausted. In the meantime, we remain flat.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.23 05:57

EUR/GBP: Breaks Down; EUR/USD: Excellent Selling Pattern - BofA Merrill (based on efxnews article)

EUR/GBP is resuming its larger downtrend, following the break of 0.7174/0.7166, notes Bank of America Merrill Lynch.

"We look for a test and break of the Mar-11 low at 0.7014, ahead of the 0.6900/0.6800 region. Bounces should not exceed the Apr-19 high at 0.7245," BofA projects.

Turning to EUR/USD, BofA notes that while the 1.0500-1.1000 range is still intact, its correction is turning increasingly in a 'Triangular' pattern.

A Triangular Correction, according to BofA, is a range defined by two contracting trendlines.

"This is one of our favorite patterns and should provide an excellent opportunity to go short for a move toward 1.0000 once the pattern completes," BofA argues.

"For

now, stay patient. Gains should not exceed the 55d at 1.0967, while a

break of 1.1053 points to a larger correction than anticipated," BofA advises.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

W1 price is on bearish market condition with secondary ranging between 1.0461 (W1) support and 1.1051 & 1.1449 (W1) resistance levels

MN price is on bearish breakdown with 1.0461 support level

If D1 price will break 1.0520 support level on close D1 bar so the primary bearish will be continuing

If D1 price will break 1.0817 and 1.0954 resistance levels so we may see the reversal to the primary bullish condition

If not so the price will be ranging between 1.0520 and 1.0954 levels

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2015-04-20 07:00 GMT (or 09:00 MQ MT5 time) | [EUR - German PPI]

2015-04-21 10:00 GMT (or 12:00 MQ MT5 time) | [EUR - German ZEW Economic Sentiment]

2015-04-23 08:00 GMT (or 10:00 MQ MT5 time) | [EUR - French Manufacturing PMI]

2015-04-23 08:30 GMT (or 10:30 MQ MT5 time) | [EUR - German Manufacturing PMI]

2015-04-23 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - Manufacturing PMI]

2015-04-23 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Unemployment Claims]

2015-04-24 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - German Ifo Business Climate]

2015-04-24 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Durable Goods Orders]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movementSUMMARY : bearish

TREND : bear market rally