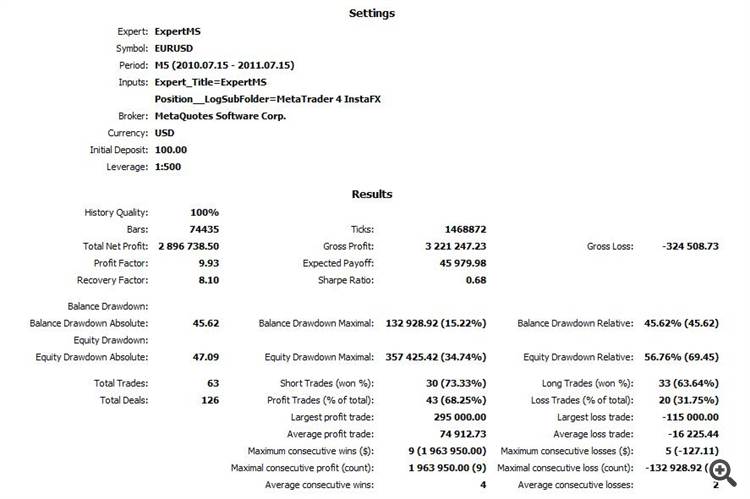

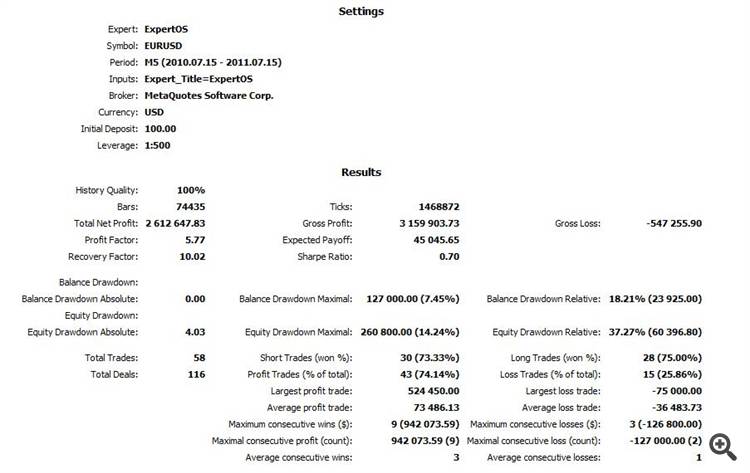

The one with profit factor 5.77 because it's Drawdown is smaller and it will be more important than PF when you will do (live/competition)forward testing. It's nice to have good PF but you not going to be happy about big drawdowns, so, I vote for second one. But it would be good if you would show picture of equity graph. And when you test, don't increase lot size when balance increases (you can do it once you have found the best setup) - it will just give you misleading results - PF, RF, DD and you will not be able to relay on Strategy Test Results - it's common mistake for newbies (can't tell about you, since you didn't attached balance graph).

The one with profit factor 5.77 because it's Drawdown is smaller and it will be more important than PF when you will do (live/competition)forward testing. It's nice to have good PF but you not going to be happy about big drawdowns, so, I vote for second one. But it would be good if you would show picture of equity graph. And when you test, don't increase lot size when balance increases (you can do it once you have found the best setup) - it will just give you misleading results - PF, RF, DD and you will not be able to relay on Strategy Test Results - it's common mistake for newbies (can't tell about you, since you didn't attached balance graph).

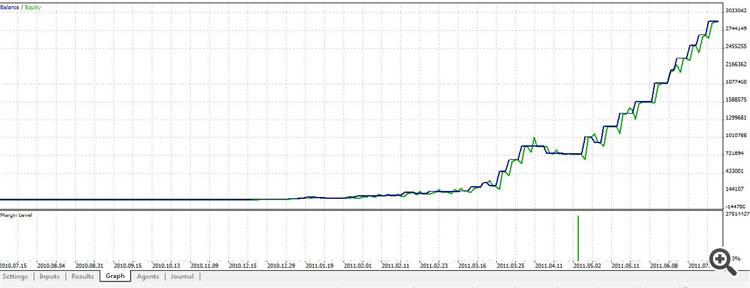

Thank reply Curve expertMS

curve OS

beware with over optimizing ea, you should try in a demo first before the real one..

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use