EURUSD Technical Analysis 2015, 15.03 - 22.03: Breakdown Continuing or Market Rally Started? - page 2

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.03.18 19:10

2015-03-18 18:00 GMT (or 20:00 MQ MT5 time) | [USD - Federal Funds Rate]if actual > forecast (or previous data) = good for currency (for USD in our case)

[USD - Federal Funds Rate] = Interest rate at which depository institutions lend balances held at the Federal Reserve to other depository institutions overnight. Short term interest rates are the paramount factor in currency valuation - traders look at most other indicators merely to predict how rates will change in the future

==========Press Release

“Information received since the Federal Open Market Committee met in January suggests that economic growth has moderated somewhat. Labor market conditions have improved further, with strong job gains and a lower unemployment rate. A range of labor market indicators suggests that underutilization of labor resources continues to diminish. Household spending is rising moderately; declines in energy prices have boosted household purchasing power. Business fixed investment is advancing, while the recovery in the housing sector remains slow and export growth has weakened. Inflation has declined further below the Committee’s longer-run objective, largely reflecting declines in energy prices. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate policy accommodation, economic activity will expand at a moderate pace, with labor market indicators continuing to move toward levels the Committee judges consistent with its dual mandate. The Committee continues to see the risks to the outlook for economic activity and the labor market as nearly balanced. Inflation is anticipated to remain near its recent low level in the near term, but the Committee expects inflation to rise gradually toward 2 percent over the medium term as the labor market improves further and the transitory effects of energy price declines and other factors dissipate. The Committee continues to monitor inflation developments closely.

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. In determining how long to maintain this target range, the Committee will assess progress–both realized and expected–toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. Consistent with its previous statement, the Committee judges that an increase in the target range for the federal funds rate remains unlikely at the April FOMC meeting. The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term. This change in the forward guidance does not indicate that the Committee has decided on the timing of the initial increase in the target range.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. This policy, by keeping the Committee’s holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent. The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.”

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2015.03.18

MetaQuotes Software Corp., MetaTrader 5

EURUSD M5: 80 pips price movement by USD - Federal Funds Rate news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.03.19 12:05

EURUSD surges after the FOMC decision

EURUSD flew approximately 400 pips higher after the Fed, despite dropping “patient”, lowered its interest rate trajectory and downgraded its view on economic growth and inflation. EURUSD moved above the near-term downtrend line taken from back the peak of the 26th of February to hit resistance at 1.1045 (R2), close to the 61.8% retracement level of the 26th of February – 13th of March decline. Subsequently the pair retreated to trade below 1.08000. Although an astonishing rally, it is far from a trend reversal signal.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.03.19 15:39

2015-03-19 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Philly Fed Manufacturing Index]if actual > forecast (or previous data) = good for currency (for CHF in our case)

[USD - Philly Fed Manufacturing Index] = Level of a diffusion index based on surveyed manufacturers in Philadelphia. It's a leading indicator of economic health - businesses react quickly to market conditions, and changes in their sentiment can be an early signal of future economic activity such as spending, hiring, and investment.

==========

Philly Fed Index Unexpectedly Shows Modest Drop In March

Manufacturing activity in the Philadelphia region has increased at a modest pace in the month of March, according to a report released by the Federal Reserve Bank of Philadelphia on Thursday, although the index of regional manufacturing activity unexpectedly showed a slight decrease.

The Philly Fed said its diffusion index of current activity edged down to 5.0 in March from 5.2 in February. While a positive reading indicates continued growth in manufacturing activity, economists had expected the index to climb to 7.0.

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2015.03.19

MetaQuotes Software Corp., MetaTrader 5

EURUSD M5: 32 pips price movement by USD - Philly Fed Manufacturing Index news event

If D1 price will break 1.0494 support level on close D1 bar so the primary bearish breakdown will be continuing (good to open sell trade for example)

If D1 price will break 1.1217 resistance level so we may see the secondary market rally with the possibility to the reversal of the price movement from bearish to the bullish market condition

If not so it will be bearish ranging between 1.0494 and 1.1217 levels

D1 timeframe: the price is ranging between 1.0461 support and 1.1041 resistance levels:

W1 timeframe: support level for this timeframe is 1.0461 as well

Seems, 1.0461 is the key support level for the next week for this pair.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.03.19 20:10

Euro Correction Already Over? intraday volatility continues (based on dailyfx article)

The question on everybody’s mind after yesterday’s Fed inspired squeeze on USD long positons is whether that was it and the dollar can now resume higher or does the correction have more room to run? Judging by the action this morning it seems the market is scared of missing out on the next leg higher in the Greenbck as several pairs have already returned to pre-FOMC levels. Only time will tell whether this is the case, though it would be unusual to not see at least a period of minor consolidation first after such extreme volatility. In the euro, the 1.0550 area looks key with traction under this zone needed to confirm that a downside resumption is indeed underway. A move back over 1.0920 would warn that the correction has more room to run.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.03.20 06:47

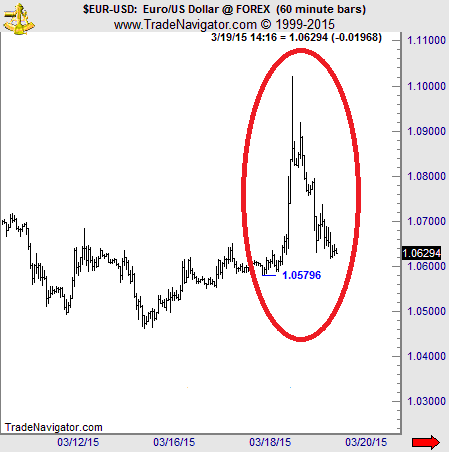

EURUSD: A Crazy 900-Pip "Roundtrip" (based on elliottwave article)

This week, we saw exactly what Jim had warned about: the craziest volatility in euro-dollar (EURUSD) we've seen in years. To be exact, last time EURUSD jumped 400-500 pips in one day was back in 2008. But the latest price action topped that: Not only did the euro rally almost 500 pips on Wednesday, but on Thursday it gave up almost all of those gains -- for an almost 900-pip "roundtrip":

In other words, bulls and bears got their clocks cleaned. All that's left now is confusion -- in both camps. While it may seem that the market "is out to get you" on days like these, the market doesn't have vendettas with anyone. It's simply doing what it should: taking money from the weak hands and handing it over to the strong. As Jim puts it, "The markets are doing what they are supposed to be doing: inflicting the most pain on the most number of people. The majority always gets caught on the wrong side at big reversals. Always.""At some point, everyone is in the same trade, like they are now in the euro short. Then it reaches the point of exhaustion: There is nobody left to sell the euro. Then somebody will start covering -- and before you know it, it's like Black Friday at your local Wal-Mart: Everyone is trying to squeeze through the same door at the same time. The coming EURUSD rally will be like that."

Jim Martens, Editor of Currency Pro Service

Forum on trading, automated trading systems and testing trading strategies

BRAINWASHING SYSTEM

newdigital, 2015.03.20 08:02

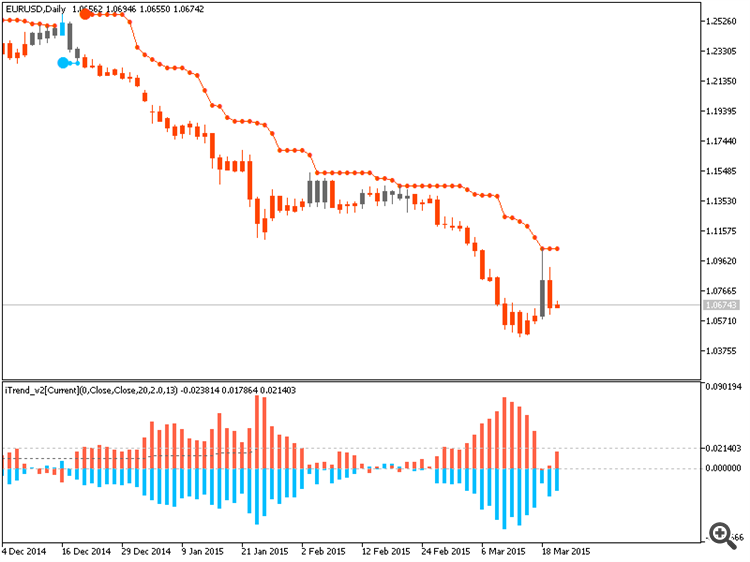

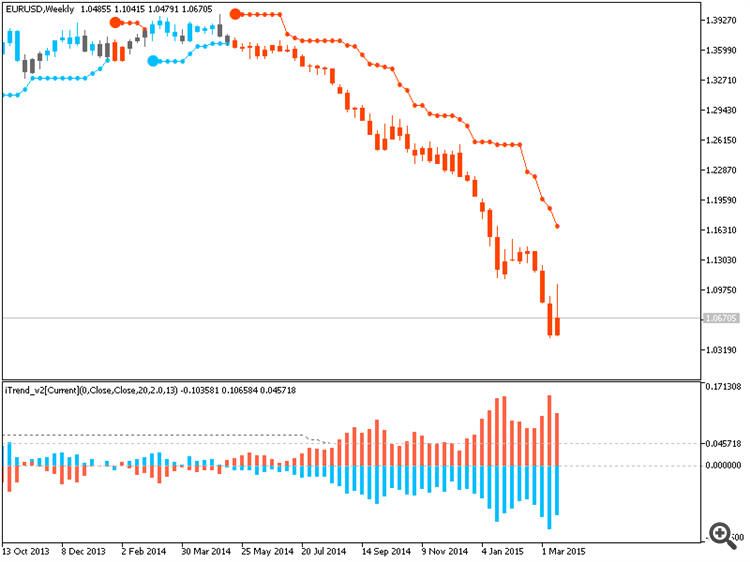

EURUSD movement for different timeframes according to this Brainwashing system

---

We know that this system was designed for trading and not for evaluation the market condition - there is no such a line which is dividing the chart onto bearish zone and bullish zone (this line exists only in Ichimoku systems and in SMA/EMA systems). But anyway, we can say something in general about the following:

So, let's evaluation EURUSD pair

---

H1 timeframe

As we see from H1 chart - it is just uptrend started on flat way. This buy signal is not a valid (value of iTrend indicator is below iTrend level) so we can understand this uptrend as a correcton within the bearish trend in general. This bearish trend was good and the system made

---

H4 timeframe

Same for H4 timeframe - uptrend just started with no valid signal to buy.

---

D1 timeframe

Downtrend is continuing with 1,550 pips in profit for now (4 digit pips).

---

W1 timeframe

Downtrend is continuing

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.03.20 19:22

The euro is going bananas (based on businessinsider article)

The euro is climbing against the dollar again on Friday, rising more than 1.7% to as high as $1.085 as of around 12:40 pm ET.

The euro spiked against the dollar when the Fed's latest decisions came out, as the US central bank looked less likely to hike rates in June (which would typically strengthen the dollar).

As it stands so far, the euro's depreciation bottomed out five days ago, below $1.05. A lot of people are still expecting parity by the end of 2015.

What will happen with euro in next week?

Regards

What will happen with euro in next week?

Regards

I will create the thread for the next week during this weekend so will see ...

As to EURUSD so it is bearish ranging for D1 timeframe: the price is ranging between 2 horizontal lines (support line and resistance line) - if the price crosses one of the line on close D1 bar so it will be buy or sell signal for us.

But I think that very trendable pairs (the pairs with good predicted movement for the next week) may be AUDUSD and NZDUSD (both for uptrend), and it is very interesting situation for XAUUSD (GOLD) and especially for XAGUSD (SILVER) so I am expecting good uptrend for those both pairs in some next coming weeks.