You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

You wouldn't believe it, but even randomness has a pattern. It's called the law of large numbers.

noooo.... that's old, the "new" is the "Principle of Computational Equivalence".

It feels like the forum is rapidly deteriorating.

On the one hand it is good - having meat in trading is essential. On the other hand, soon there will be no one to talk to

It feels like the forum is rapidly deteriorating.

On the one hand it is good - having meat in trading is essential. On the other hand there will soon be no one to chat with

The forum is rapidly degrading, because all the topics have been discussed for many years

... all topics have been covered over the years.

Nonsense) such an opinion may be an indication that you too are part of the degradation crowd.

denis.eremin:I'll explain for the last time - a random walk is a numerical series which, by definition, has no law and order in it. None at all.

Therefore, you can only make money on it by chance.

CHINGIZ MUSTAFAFAEV:

You will not believe it, but even chance has a pattern. It is called the law of large numbers.

Indeed, there is, and people say there is no such thing as a pattern.

"Law of large numbers.

The law of large numbers broadly

refers to the general principle that when

a large number of random variables, their average

outcome ceases to be random and can be

predicted with a high degree of certainty."

Or like this

" Law of large numbers.

The cumulative effect of a large number of random factors leads,

"under certain general conditions, a result which is almost independent of chance,

i.e. of a systemic nature."

Indeed there is, and people say there is no pattern.

"The Law of Large Numbers

The law of large numbers in the broad sense

refers to the general principle that when

a large number of random variables, their average

outcome ceases to be random and can be

predicted with a high degree of certainty."

Or like this

"The cumulative effect of a large number of random factors leads,

"under certain general conditions, a result which is almost independent of chance,

i.e. of a systemic nature."

noooo.... that's old, the "new" one is "The Principle of Computational Equivalence".

hmm, interesting, I'll have to read that.)

Specific implementation.

Once again, you have the perfect coin and you think that by betting on eagle you will make a profit because it is your genius trading strategy.

You flip a hundred times, 60/40 and you're in the money.

Another hundred times, 51/49, and you're in the money.

One more time, 72/18, and you're in the money.

You come to the form, throw out the results and write - "but what about these three histograms with the most obvious profit"?

Here's one for those completely in the BROWN TANK,

Betting not on the fact that you have a coin fall heads or tails, it's useless and really impossible to win, but that in a SERIES of a hundred shots, about 40-45% will be tails, and 50-100 of these SERIES, SERIES Which 40-45 shots will be tails tends to 90-95%.

Why do you think the nets work, they are the same throws, and the number of nets is SERIES of many throws =D

Here's one for those who are completely BORROWN TANK,

Betting not that you have a coin fall heads or tails, it is useless and really can not win, but that in a SERIES of a hundred shots, about 40-45% will be tails, and out of 50-100 of these SERIES, SERIES which 40-45 shots will be tails tends to 90-95%.

Why do you think nets work, it's the same throws, and the number of nets is SERIES of many throws =D

Again - bravo!!! No, even - bravissimo!!! It is the series I am talking about, which cannot be understood (due to sheer uneducation) by a certain Doctor.

The answer just came back.

decided to double-check on 3000 trajectories...Frankly, an unexpected result for me, but I'm inclined to sin that I'm doing something wrong. I'll have to double-check everything by taking the smart books)))

So, to the results:

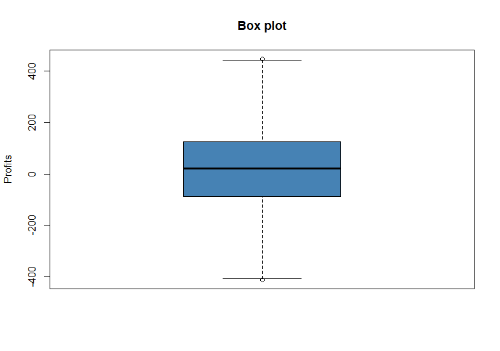

We start by evaluating the distribution of wins and losses for normality, looking visually

something resembling normal.

Tests:

Shapiro-Wilk normality test

W = 0.99894, p-value = 0.06206

Anderson-Darling normality test

A = 0.78803, p-value = 0.04098

at 5% significance level... well-oh-almost normal

at 1% - reject null hypothesis of normality

More interesting)

One sample t-test for the sample mean to be equal to zero:

One Sample t-test

t = 5.5464, df = 2999, p-value = 3.17e-08

alternative hypothesis: true mean is not equal to 0

95 % confidence interval:

10.74520 22.49687

sample estimates:

mean of x

16.62104

Thus, the hypothesis of the average profit being equal to zero can be easily rejected even at one percent confidence level.

Now the same after deleting outliers from the results.

Shapiro-Wilk normality test

W = 0.99781, p-value = 0.0003555

Anderson-Darling normality test

A = 0.70627, p-value = 0.06521

One Sample t-test

t = 6.1144, df = 2972, p-value = 1.096e-09

alternative hypothesis: true mean is not equal to 0

95 % confidence interval:

12.08241 23.48974

sample estimates:

mean of x

17.78607

As we can see, it is still not clear whether the distribution is normal, but the data on the mean are even more convincing.

What is the conclusion? I need to double-check and think hard)))