Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.14 12:32

Forex Weekly Outlook Feb. 16-20The US dollar was on the back foot against most currencies in the past week. Japanese GDP, German Economic Sentiment, UK employment data, the FOMC Meeting Minutes and the FOMC meeting minutes stand out. These are the main events on FX calendar for this week. Here is an outlook on the market movers coming our way:

U.S. retail sales unexpectedly declined 0.8% in January, following a 0.9% drop in December. The low oil prices did not boost sales as previously predicted and economists missed also on consumer confidence. However, analysts still believe sales will pick up in light of the ongoing improvement in the labor market and low prices. In the euro-zone, the hopes about a resolution for Greece, despite struggles, was joined by strong German growth numbers. In the UK, the hawkish approach from Carney helped sterling. The Aussie was pressured by weak employment data and the loonie was not boring as it moved sharply with oil prices.

- Japan GDP data: Sunday. 23:50. Gross domestic product contracted by an annualized 1.6% in the three months ended September, considerably lower than the 2.2% rise estimated by economists. On a quarterly basis, Japan’s GDP dropped 0.4%, amid lower business investment. Economies forecasted a 0.5% rise in the third quarter. Japan’s consumption tax increased to 8% in April but did not result in a major fiscal improvement. Policymakers consider another 10% rise to boost GDP growth. Economists expect GDP will rise 0.9% in the fourth quarter of 2014.

- Eurogroup meetings: Monday. The Eurogroup Finance Ministers will continue to search for a solution to the Greek debt crisis after failing to do so last week. The new Greek government is determined to change the rules of the game to relieve its staggering debt burden and loosen the tight austerity measures imposed by the previous Government. There is a better chance that this happens once Merkel passes the hurdle of state elections in Hamburg.

- UK inflation data: Tuesday, 9:30. The UK inflation rate declined sharply to 0.5% in December, from 1.0% in the previous month, reaching its lowest rate since May 2000. This decline was prompted by lower fuel prices. Analysts expected inflation to reach 0.7%. Bank of England governor Mark Carney still expects rate hikes in the next two years despite the sluggish inflation. Economists predict the ongoing inflation decline will continue while households are expected to benefit from these super low rates. UK CPI is expected to rise 0.3% this time.

- German ZEW Economic Sentiment: Tuesday, 10:00. German analyst and investor climate edged up in January amid low oil prices. Sentiment rose to 48.4 in January from 34.9 in December, reaching the highest level since February last 2014. The strong release beat forecast for a 40.1 reading. Economists warned that if the Greek situation deteriorates it will influence the German economy. German analyst and investor climate is expected to jump to 56.2.

- Japan rate decision: Wednesday. At its January monetary policy meeting, the Bank of Japan decided to maintain its monetary policy and continue to raise the monetary base at an annual pace of JPY 80 trillion. The decision was in line with market expectations. The bank noted a slight improvement in exports and a rise in industrial output and forecast a stronger expansion from lower oil prices. Inflation expectations also increased but expected to slow temporarily due to the oil price decline.

- UK employment data: Wednesday, 9:30. The number of people unemployed fell by 29,700 in December following a decline of 26,900 in November indicating UK’s labor market remains strong. Furthermore, average earnings have increased, a positive development to household spending. However, wage growth will be sustained only if production improves. The number of unemployed is predicted to decline by 25,200 in January. The unemployment rate for December is predicted to stand at 5.8% and wages at 1.7%.

- US Building Permits: Wednesday, 13:30. The number of US building permits declined 1.9% in December, reaching an annualized pace of 1.03 million units, while housing starts jumped 4.4% to 1.09 million units. Economists expected permits to reach 1.06 million. The main reason for the sluggish growth in the housing market is that wage growth is slow disqualifying many potential buyers from obtaining mortgages. The number of US building permits is estimated to reach1.08 million units.

- US PPI: Wednesday, 13:30. U.S. producer prices plunged 0.3% in December, the steepest decline in three years amid declining energy costs. The reading was in line with market forecast. Following this report the Fed reduced its inflation expectations, raising new doubts about future rate hikes. However policymakers regard the falling inflation is temporary. U.S. producer prices are expected to rise 0.4%.

- US FOMC Meeting Minutes: Wednesday, 19:00. In the last Fed decision back in late January, the Fed sounded optimism about the economy and about the “strong job market” to quote the statement. However, it continued urging patience regarding raising the rate and mentioned international developments. We will now learn how the members see the economy and how worried they are about events abroad.

- US Unemployment Claims: Thursday, 13:30. Initial claims for unemployment benefits edged up 25,000 to a seasonally adjusted 304,000 last week. However, the general trend still shows strength in the US labor market. Analysts expected a modest climb to 282,000 last week. The four-week moving average dropped 3,250 to 289,750. Economists expect jobless claims will remain subdued amid the massive job gain over the last three months. The number of jobless claims is expected to rise by 305,000.

- US Philly Fed Manufacturing Index: Thursday, 15:00. Manufacturing activity in the Philadelphia-region slipped into lower gear in January, reaching 6.3 points, following 24.5 in December. This was the largest fall in 11 months. Analysts expected a much higher figure of 20.3. The majority of responders reported that lower energy prices were having overall net positive effects on manufacturing business and the six-month outlook continued to be positive. Manufacturing activity is expected to climb to 8.8 points.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.16 05:45

GBP/USD Rallies Above 1.54 after BOE Comments (based on marketpulse article)

Sterling scaled a six-week peak early on Monday following recent hawkish-sounding comments from the Bank of England, while the other major currencies were subdued in a holiday-riddled week.

U.S. markets are shut on Monday for the Presidents’ Day holiday, while many centers in Asia will be closed later this week for the Lunar New Year holidays.

The pound climbed as far as $1.5435 in early trade, from around $1.5407 late on Friday in New York, reaching a high last seen on Jan. 2. It was last at $1.5415.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.14 13:10

GBPUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for British Pound: Neutral

- Pound Rally Extends for Third Week on Firming BOE Outlook

- Greek Debt Talks, UK CPI Data Threaten Rebound Continuity

The British Pound rose for a third consecutive week against the US Dollar after a hawkish-sounding Bank of England Quarterly Inflation Report rekindled interest rate hike speculation, as expected. Governor Mark Carney reminded investors that tightening is the next most likely direction for monetary policy, adding that the central bank intends to look past near-term downside inflation shocks from falling food and oil prices. Investors now price in at least one 25 basis point increase in the baseline lending rate over the coming 12 months, with futures markets reflecting bets on a move in the fourth quarter of this year.

Sterling can hardly expect to coast upward unmolested however. There is much that can happen between now and the end of the year that can upend the currency’s recovery. The revival of Eurozone redenomination risk stands out in the near-term as nervous markets prepare for another round of negotiations between Greek and EU officials over the country’s debt woes on Monday. A similar sit-down produced no results last week and the situation looks increasingly intractable: Greece’s government won a key confidence vote, confirming its mandate to scrap the existing EU/IMF bailout program. Meanwhile, German Finance Minister Wolfgang Schaeuble bluntly dismissed rumors of a 6-month extension on Greek debt repayments as “wrong”.

Both sides face negative fallout without an accord. Eurozone officials don’t want to endanger the bloc’s structural integrity by setting a precedent for a country to leave, an outcome with unknown consequences. Meanwhile, the newly-minted Greek administration surely understands its survival depends on ending economic hardship, which voters equated with EU-imposed austerity. Its fortunes might swiftly turn if a disorderly “Grexit” fails to end the malaise or compounds it.Political brinksmanship has been the status quo throughout the Eurozone debt crisis, so more of the same before a stay of execution is cobbled together is not surprising. If Monday’s meeting elevates hopes for a deal, the Pound is likely to face selling pressure as capital inflows seeking refuge from Euro-linked instability reverse course.

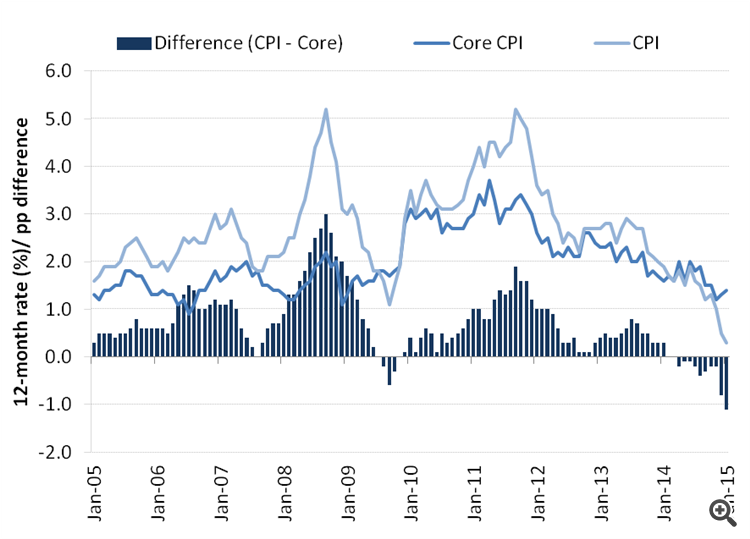

Furthermore, the markets’ policy bets will continue to evolve with incoming economic news-flow. The coming week features a potentially formative bit of event risk as January’s CPI figures cross the wires. The headline year-on-year inflation rate is expected to drop to 0.4 percent, the lowest since at least 1989, but Mr Carney’s sanguine posture on this front will likely dilute the figures’ potency. Instead, all eyes will be focused on the core CPI print – a reading that excludes the influence of volatile items the BOE has opted to dismiss – which is expected to rise for a second month to 1.4 percent. UK price growth data has broadly tended to underperform relative to consensus forecasts over the past two years. If that trend continues and a soft core reading emerges, Sterling may retreat as rate hike expectations cool anew.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.14 17:51

GBP/USD forecast for the week of February 16, 2015, Technical Analysis

The GBP/USD pair broke higher during the course of the week, and as a result the market looks as if it’s reaching for the 1.55 handle. That is an area that has a significant amount of resistance, and as a result we are actually looking for a selling opportunity in that general vicinity. In fact, we can’t buy this market until we get above the 1.58 level, which is something that we do not anticipate seeing anytime soon. With that, we are bearish and ignoring the bullish pressure that we’ve seen recently.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.17 12:00

2015-02-17 09:30 GMT (or 11:30 MQ MT5 time) | [GBP - CPI]- past data is 0.5%

- forecast data is 0.3%

- actual data is 0.3% according to the latest press release

if actual > forecast (or previous data) = good for currency (for GBP in our case)

[GBP - CPI] = Change in the price of goods and services purchased by consumers. Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate.

==========

"The rate of inflation faced by households has fallen to its lowest level on record. The Consumer Prices Index, which measures changes in the prices of the goods and services bought by households, increased by 0.3% in the year to January 2015, down from 0.5% in December 2014.

With the rate of inflation slowing, commentators are considering the possibility of deflation – where prices, overall, become cheaper than they were previously. While some prices (such as motor fuels and food) are lower than they were a year ago, others (such as clothing and furniture) are rising."

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

GBPUSD M5: 63 pips price movement by GBP - CPI news event

newdigital:

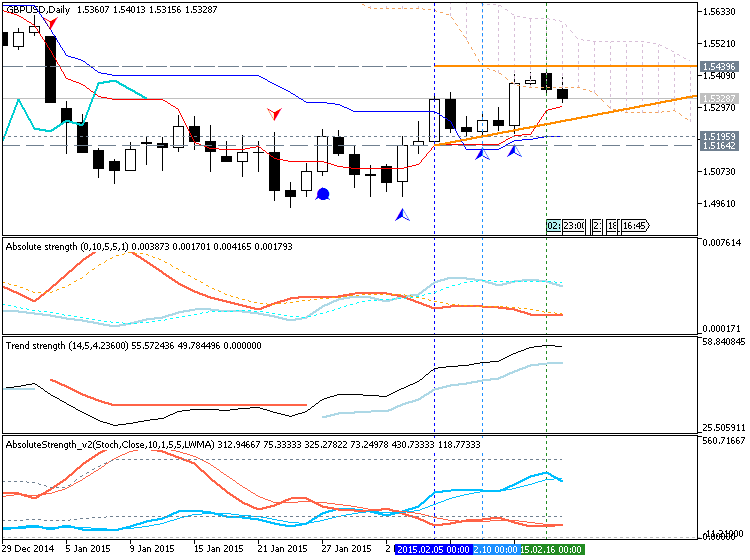

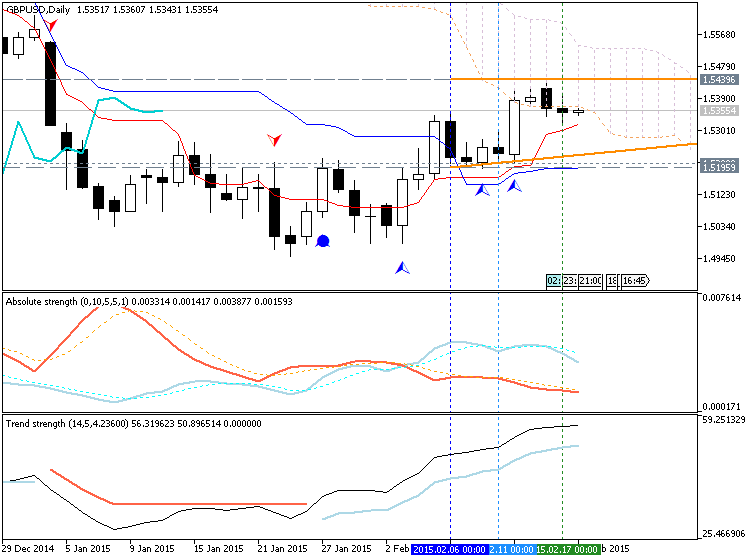

If D1 price will break 1.4988 support level on close bar so the bearish trend will be continuing for whole the week

If D1 price will break 1.5412 resistance level - we may see the reversal of the price movement from bearish to the bullish with ranging as a secondary trend

If not so it will be bearish ranging between 1.4988 and 1.5412 levels

- Recommendation for long: watch D1 price to break 1.5412 resistance for possible buy trade

- Recommendation to go short: watch D1 price to break 1.4988 support level for possible sell trade

- Trading Summary: ranging

Next resistance level is 1.5439:

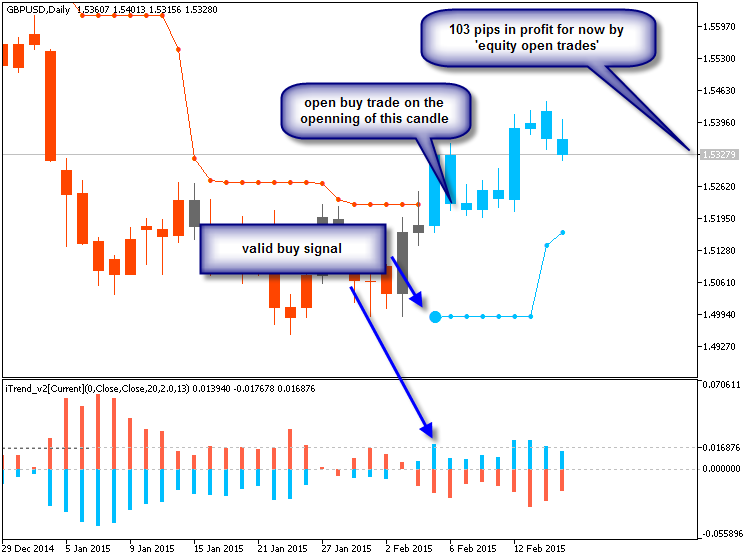

But according to Brainwashing system (D1 timeframe) - the uptrade was already started and buy trade should be opened in the beginning of 6th of February with +103 pips in profit for now (4 digit pips):

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.17 17:08

GBP/USD’s February Uptrend Holding Even After Weak CPI - Here’s Why (based on dailyfx article)

- Headline UK CPI sinks to an 'all-time low' of +0.3% - misleading.

- Yearly core CPI rose for second month - BoE looks prescient.

A quick scan of GBP-related headlines this morning will reveal the dire warning: 'UK Inflation Slows More Than Forecast to Record-Low 0.3%' (Bloomberg). But a look beyond the headline data shows that price pressures are actually building in the UK economy, which may be contributing to seemingly quizzical response by the British Pound in the wake of the data.

The core inflation figure - stripped of the fuel component - actually shows the second consecutive month of increasing price pressures. So while the headline yearly figure dipped to a record low +0.3%, the core yearly figure increased to +1.4% in January from +1.3% in December and +1.2% in November. The data fits in neatly with the Bank of England's diagnosis last week in its Quarterly Inflation Report that, but for dampened exogenous conditions, the domestic environment is perking up and a rate hike shouldn't be dismissed over the coming months.

Sure enough, rate hike expectations are intact after today's CPI data, despite the misnomer that is the 'all-time low' headline figure. The Credit Suisse Overnight Index Swaps and forward rates, which at a point in January were suggesting a late-Q3' or early-Q4'2016 rate rike, are now pricing in 25-bps into the British Pound over the next 12-months - suggesting the market should be looking for the Bank of England to raise rates in February 2016.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.18 08:13

Trading the News: U.K. Jobless Claims Change (based on dailyfx article)

Another 25.0K contraction in U.K. Jobless Claims may encourage an

improved outlook for the real economy, but the lack of stronger wage

growth may generate a limited market reaction in GBP/USD as the Bank of

England (BoE) remains in no rush to normalize monetary policy.

What’s Expected:

Why Is This Event Important:

As a result, the BoE may retain a wait-and-see approach throughout the

first-half of 2015, and we may continue to see a unanimous vote to

preserve the current policy until there’s a sharp rise in household

earnings.

However, waning business outputs along with the slowdown in building

activity may drag on hiring, and a dismal employment report may trigger a

near-term pullback in the British Pound as it raises the BoE’s scope to

retain the highly accommodative policy stance for an extended period of

time.

How To Trade This Event Risk

Bullish GBP Trade: Claims Decline 25.0K or Greater Accompanied by Stronger Wages

- Need green, five-minute candle following the print to consider a long GBP/USD trade

- If market reaction favors buying sterling, long GBP/USD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

- Need red, five-minute candle to favor a short GBP/USD trade

- Implement same setup as the bullish British Pound trade, just in opposite direction

GBP/USD Daily Chart

- GBP/USD looks poised for a larger recover as it breaks out of the bearish trend/momentum carried over from back in July.

- Interim Resistance: 1.5500 pivot to 1.5520 (38.2% expansion)

- Interim Support: 1.5250 (100% expansion) to 1.5270 (38.2% retracement)

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| DEC 2014 |

01/21/2014 9:30 GMT | -25.0K | -29.7K | -136 |

U.K. Jobless Claims fell more-than-expected as the figure shrank another 29.7K in December, while the ILO Unemployment Rate declined to a 6-year low of 5.8% during the three-months through November. Wage growth outpaced the headline reading for inflation, with Average Weekly Earnings expanding an annualized 1.7% during the same period. Despite the ongoing improvement in the labor market, it seems as though the Bank of England (BoE) will preserve its neutral stance as the central bank curbs its near-term outlook for inflation. Nevertheless, the better-than-expected print failed to spur a meaningful reaction in GBP/USD, with the pair largely advancing during the North American trade to end the day at 1.6480.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

GBPUSD M5: 60 pips price movement by GBP - Unemployment Rate news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.02.19 05:50

2015-02-18 19:00 GMT (or 21:00 MQ MT5 time) | [USD - FOMC Meeting Minutes]- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[USD - FOMC Meeting Minutes] = It's a detailed record of the FOMC's most recent meeting, providing in-depth insights into the economic and financial conditions that influenced their vote on where to set interest rates.

==========

FOMC Minutes - Reactions From 10 Major Banks

BofA Merrill: The recent steady stream of Fed speakers advocating for a potential June rate hike led to expectations for relatively hawkish FOMC minutes. The headlines for the minutes surprised to the dovish side, and led to a decline in Treasury yields and the US dollar. However, a closer reading suggested a more modest dovish bent with a lot of disagreement among participants. Thus, attention now shifts to Chair Yellen's Congressional testimony next week, which in our view should elaborate and update the assessment of risks while still leaving a June liftoff in play. We expect persistently below-target inflation delays the Fed until September, but the minutes confirm a fair degree of uncertainty about the timing of the first rate hike.

Credit Agricole: The minutes of the January FOMC meeting were relatively dovish and spelled more caution over the inflation outlook and timing of the rate liftoff. On balance, we continue to expect rate normalization to begin in the Q3 2015.

UBS: The minutes of this FOMC meeting are quite ambiguous. There was no definitive view on the impact of foreign developments. Also, there was no clear view on the outlook or the timing of the first rate hike. This was due, likely in part, to the fact that there was uncertainty about the right inflation measures to look at and what other measures might influence them. Even the phrase "patient" was debated: Would removing it cause markets to adjust the timing of the first rate hike too aggressively?...Unfortunately, all the cross currents give us little direction. Prior to the re-acceleration in wages and the continued strong labor market readings and the rebound in oil prices, it would appear that fading a June hike would have made sense given these minutes. Post these realities, it is not clear. The testimony next week is unlikely to prove too instructive as Yellen testifies on behalf of the committee, which last met on January 28th. For now we will keep our forecast of a June rate hike counting on the still-strong labor market and rebound in energy prices to win the day. We will have to be "patient" to see how this wind blows.

Deutsche Bank: The minutes from the January 27 - 28 FOMC meeting did not indicate any substantive changes to the growth outlook compared to the Fed's most recent projections released last December. The near-term inflation outlook was revised down slightly due to further declines in oil prices. However the staff's inflation forecast for 2016 and 2017 was "essentially unchanged." There was considerable debate over the interpretation of market-based measures of inflation compensation but there were no firm conclusions with respect to the longer-term inflation outlook, which the FOMC still sees as gradually rising toward its 2% target. Moreover, the Fed reiterated the view that low energy prices were a net positive for the economy. In short, there were no material changes with respect to the economic and financial outlook.

ANZ: The minutes from the January FOMC meeting were more dovish than expected although we do not expect there has been a wholesale change in view. The FOMC appears more concerned about risks from offshore and the higher USD and many FOMC members would prefer to keep the fed funds rate at near zero bound for a longer time. In our view, we would not read too much into the term 'longer'. In addition, given many of the offshore risks - such as the Greek and Ukraine situations - now look more likely to be resolved, this should allay a lot of the stated reasons for hesitancy. We continue to look for the first hike around mid-year although we acknowledge the risks of the Fed waiting have increased. Yellen's speeches next week will be important

NAB: The killer paragraph in the minutes of the Fed's January meeting reads as follows: "Many participants indicated that their assessment of the balance of risks associated with the timing of the beginning of policy normalization had inclined them toward keeping the federal funds rate at its effective lower bound for a longer time". In FOMC speak, many is taken to mean a majority, and these words have had the effect of pushing implied money market yields in the fourth quarter of 2015 down by about 5bps on average, and by as much as 10bps further out along the shorter end of the yield curve. It's worth remembering here that the mood music coming from Fed officials ahead of the minutes - but since the meeting itself - had been consistent in suggesting that a June Fed 'lift-off' is still a very live risk. Janet Yellen's testimonies next week now loom large. Trading will be thinner than normal given today is the Lunar New Year holiday and so Greater China is shut.

SEB: It is our understanding that the Fed minutes did not suggest that the FOMC is paving the way for a June rate hike as "many officials were inclined to stay at zero for longer". Moreover, the drop in inflation expectations was apparently worrying since a number of participants emphasized that they would need to see either an increase in market-based measures of inflation compensation or evidence that continued low readings on these measures did not constitute grounds for concern. While we may have a different view after Chair Yellen's semi-annual testimony before congress next week, the minutes are not suggesting to us that "patience" will be dropped as early as in the March statement. Our forecast still is for liftoff a few meetings later, in September.

Barclays: Our main takeaway from the January FOMC minutes is that concern about downside risk to inflation has risen and, consequently, the bar for raising rates by June is higher than it was in December. We maintain our baseline forecast for a June rate hike at this juncture, but the risk of a later takeoff has risen, particularly if downside surprises on core inflation continue. We look to Chair Yellen's comments in front of the US Senate and House of Representatives next week for further clarification on the committee's thinking.

Danske: The minutes from the January FOMC meeting strongly suggest that the FOMC's fed funds rate projections will be lowered at the upcoming 18 March meeting and the minutes were in general more dovish than recent Fed speeches. Data received since the FOMC meeting on 28 January includes the January employment report, which was very strong. However, we doubt that one data point is enough to turn the Committee's sentiment, in particular when inflation indicators continue to be soft. This challenges our call that the Fed will remove 'patient' from the statement in March and raise the fed funds rate this summer If February data on employment continue to show solid improvement and inflation indicators stabilise, we continue to believe the Fed would like to have the flexibility to raise rates in June. Hence, 'patient' should be dropped in March but will be combined with soft comments from Janet Yellen and lower economic projections in order to keep the market reaction moderate.

CIBC: The latest minutes show that many officials felt dropping patient could lead markets to price in too early a move to tighten policy, putting upwards pressure on rates when some sectors like housing are still showing uneven signs of recovery. Notwithstanding that, several members suggested that a "late departure" could result in monetary policy becoming excessively accommodative. Not inconsistent with that view, there was general agreement that the minutes should "acknowledge solid growth over the second half of 2014, as well as the further improvement in the labour market." The minutes overall show that opinion within the FOMC remains deeply split on when the Fed should take the next step on the road to policy normalization. Although inflation has moved down, the minutes also affirm the statement in suggesting that most members continue to see the drop as a transitory consequence of lower oil prices, and therefore not sufficient at this point to warrant a notable delay in moving interest rates up from the lower bound. Today's release does not change our view that June still remains the most likely date for policy lift off. A slight positive for bonds given further signs of the Committee's reluctance to dispense with the key word "patience". The focus now shifts to Yellen's testimony next week for further information on the policy outlook.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

GBPUSD M5: 60 pips price movement by USD - FOMC Meeting Minutes news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

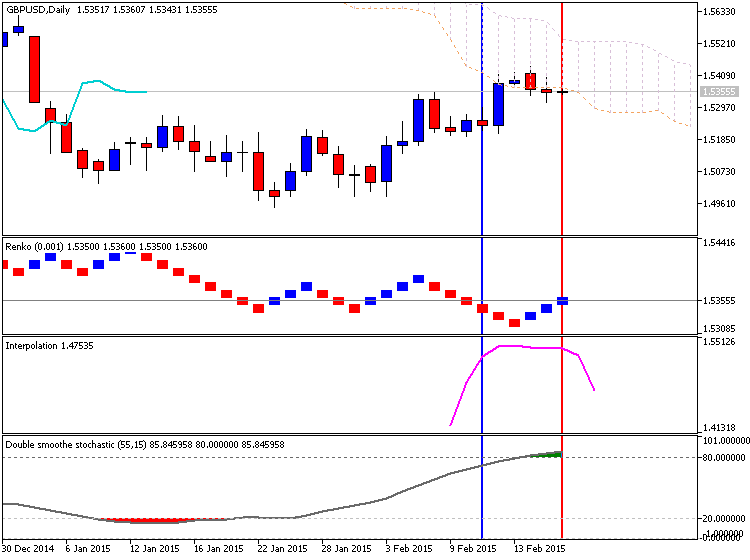

D1 price is on reversal of from bearish to the bullish market condition:

W1 price is on bearish market condition with market rally started on Friday on close W1 bar with 1.4950 support level

MN price is on bearish breakdown with 1.4950 support level; just market rally was started as secondary trend on open monthly candle

If D1 price will break 1.4988 support level on close bar so the bearish trend will be continuing for whole the week

If D1 price will break 1.5412 resistance level - we may see the reversal of the price movement from bearish to the bullish with ranging as a secondary trend

If not so it will be bearish ranging between 1.4988 and 1.5412 levels

UPCOMING EVENTS (high/medium impacted news events which may be affected on GBPUSD price movement for this coming week)

2015-02-16 00:01 GMT (or 02:01 MQ MT5 time) | [GBP - Rightmove HPI]

2015-02-17 09:30 GMT (or 11:30 MQ MT5 time) | [GBP - CPI]

2015-02-18 09:30 GMT (or 11:30 MQ MT5 time) | [GBP - Claimant Count Change]

2015-02-18 09:30 GMT (or 11:30 MQ MT5 time) | [GBP - Unemployment Rate]

2015-02-18 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Building Permits]

2015-02-18 13:30 GMT (or 15:30 MQ MT5 time) | [USD - PPI]

2015-02-18 19:00 GMT (or 21:00 MQ MT5 time) | [USD - FOMC Meeting Minutes]

2015-02-19 11:00 GMT (or 13:00 MQ MT5 time) | [GBP - CBI Industrial Order Expectations]

2015-02-19 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Unemployment Claims]

2015-02-19 15:00 GMT (or 17:00 MQ MT5 time) | [USD - Philly Fed Manufacturing Index]

2015-02-20 09:30 GMT (or 11:30 MQ MT5 time) | [GBP - Retail Sales]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on GBPUSD price movementSUMMARY : bearish

TREND : ranging