You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

There is no point looking for a black cat in a dark room if it is not there at all...

The quantum frequency approach gives better results than the most advanced indicator. By using quantum frequencies you can sift out unprofitable trades made by the TS. (i.e. reduce the number of losing trades, leaving more profitable ones) Now I'm not looking for anything in quantum, everything is already found! The "black cat" is searched for 7 hours by the optimizer.

To believe or not to believe in quantum analysis is an individual matter. I am not going to convince anyone.

Tell me what works better for you? Waves? Stochastic on M5? Or UltraTrendIndicatorSuperPuperBest_2011.ex4?

It is useless to argue if this analysis method is good or bad. This is a matter of taste. To discuss the strategies and new trends in analysis, to complicate existing indicators and to develop new ones, is an endless debate. But all this is meaningless if it does not bring money.

We are still discussing and searching for the "best", "optimal", "stable", "reliable", "highly profitable" trading strategy on forex forums. Some people who are present here have more than once doubled their deposits stupidly trading on two crossings of muwings 8 and 55, on the euro on H1, and the capital loss on M15. (this is for the last year and a half!)

You can find enough literature about it (quantum consciousness) on the internet. It's not that simple.

There is indeed a lot of information on the Internet about quanta and the author's branch will also help to understand everything. It took me 2 weeks to digest the material. Before that I knew nothing about quanta and frequencies.

If you don't want to bother with quantum frequencies, you can work in the direction of divergences. Makdi with parameters 12, 26, 1 suits well for this. It works on Н4 on the eurik and Н1 on the pound, the Aussie and the NZ. Divergences are better watched on the troughs of the mcdis, then these signals are trending.

I have ideas how to trade by Fibonacci. I cannot program them, though. The problem is in optimal finding tops and bottoms on the chart, between which the grid is plotted. (If someone wants to implement it, write to me in a message box, I will tell you the details.)

There are some ideas with locking. The famous Gelantrauler works on the principle of locking, money management and hedging. (I do not know if I may post the link to this Expert Advisor here or not) We can discuss his trading algorithm, there is nothing complicated about it. If someone wants to implement his gelantravler, I can tell you his trading algorithm. I have a stable yield, but it is about 1% per month. For a 100K deposit the trader trades with 0.03 lots, but in 10 currencies, and in two directions.

There are ideas with locking. The famous Gelantrauler works on the principle of locking, money management and hedging. (I don't know if I can post the link to the EA here or not.) We can discuss its trading algorithm, there is nothing complicated about it. If someone wants to implement his gelantravler, I can tell you his trading algorithm. I have a stable yield, but it is about 1% per month. For a 100K deposit the trader trades with 0.03 lots, but in 10 currencies, and in both directions.

Thank you. (there's actually something selling the algorithm in secret as I understand it)

They' re selling an EA there. Under the guise of a unique trading strategy, they offer a hedging algorithm with money management and counter trades. We can discuss it, but probably in another forum. Galen is not a new trend in technical analysis.

In the first second of the hour the frequency may be one, and in a minute another, and in 10 minutes another. And for example, if by the classic TS I need to enter at the opening of a candle, then in the case of frequency analysis, the transaction will have to open at 7 minutes of the hour, for example.

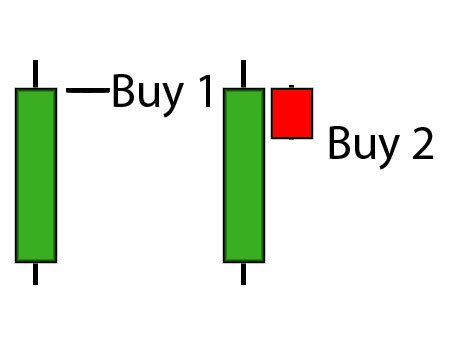

For example, for a buy deal to enter a little lower than the opening candle (2), a little more profitable than at the opening of the candle (1). In this case the TP is bigger and the SL is smaller.

Tell me, how much is "slightly lower"?

And can you compare the results of TS with and without this functionality (i.e. opening positions strictly by Open candlestick) for example?

--------

I am amazed by the picture that visually reflects the work of the module developed about 1.5 years ago. Its application improves the TS characteristics.

But the funny thing is that methods based on quantum frequencies are not even close to being applied.

And if similar results are obtained by applying different methods, it means that there is something in it....

It would be interesting to compare them.

-------

And one more question: is there a methodology for obtaining quantum frequencies for price series described anywhere? How to code this case?

They are selling an advisor there. Under the guise of a unique trading strategy, they offer a hedging algorithm with money management and counter trades. We can discuss it, but probably in another thread. Galen is not a new trend in technical analysis.

What other branch (the Sultonov branch?) this is technical analysis.

Any links to read? (yields are really understated)

You've written that you know the algorithm, it's simple, can you share in two words?

In what other thread (the Sultonov thread?) this is technical analysis.

You could start a whole thread discussing gelan.

The principle is simple.

Very briefly and without pictures: Two differently directed trades are opened. Buy and sell with 0.1 lot. Conditionally, after 100 points of price movement upwards the profitable buy trade is closed. Then the Buy trade opens upwards again with 0.1 lot, and the Sell trade opens with 0.2 lot. If the price goes upwards, we close the profitable trade. If down, then close 2 sell trades, when total profit on them will be 0.

This system can have a good drawdown, in strong trends.

So we should use it to avoid drawdowns:

1) on sideways trends.

2) for diversification of risks - in different currencies (to hedge), you drawdown on one currency pair, and gain on the other. Cross rates are perfect for that. For example, trade USD/JPY GBP/USD GBP/JPY. You may complicate the scheme by using 10-15 currency pairs at a time, as we have done in Galan.

Tell me, how much is "a little lower"?

And can you give me an example of how the TS works with and without this feature (i.e. opening positions strictly by Open candles)?

--------

I am amazed by the picture that visually reflects the work of the module developed about 1.5 years ago. Its application improves the TS characteristics.

But the funny thing is that methods based on quantum frequencies are not even close to being applied.

And if similar results are obtained by applying different methods, it means that there is something in it....

It would be interesting to compare them.

-------

And one more question: is there a methodology for obtaining quantum frequencies for price series described anywhere? How to code it?

Suppose I know that I need to trade at the 10th, 12th and 15th frequencies.

Suppose the frequency is 8 at the opening of a candle. I do not open a trade. Time passes, the price changes inside the candle, the frequency is read every tick. (Frequency changes due to the formation of new High and Low) At some point, the frequency becomes = 10. And I open a deal!

Put an advisor, preferably a simple and preferably does not plummet and with a simple, understandable source code . (ie, that he had a profitable trade) I'll filter it out and post the results here.

You could start a whole thread to discuss gelan.

The principle is simple.

Very briefly and without pictures: Two differently directed trades are opened. Buy and sell with 0.1 lot. Conditionally, after 100 points of price movement upwards the profitable buy trade is closed. Then the Buy trade opens up again with 0.1 lot, and the Sell trade opens with 0.2 lot. If the price goes upwards, we close the profitable trade. If down, then close 2 sell trades, when total profit on them will be 0.

This system can have a good drawdown, in strong trends.

So we should use it to avoid drawdowns:

1) on sideways trends.

2) for diversification of risks - in different currencies (to hedge), you drawdown on one currency pair, and gain on the other. Cross rates are perfect for that. For example, trade USD/JPY GBP/USD GBP/JPY. You can make it more complicated by using 10-15 currency pairs, like we did in Gelan.

Thanks! Actually I traded (tested the demo) the same, but not - I increased the sell by 0.2 - I often opened more sells by false signals - baiys also opened and closed with profits +30 50 pips. - the pair was going in the plus when the trend reversed (significant decrease of losses on long-distance sells).

on the general pluses of the account - all trading was fixed and started again. (you could call it cyclical trading).

The most important is that it has fallen in the trends (Gold, Silver, Aussie) - because of this testing is suspended (large stop - the same will not help).

Conclusion in this form it is not suitable. The choice of pairs does not guarantee anything - it may start a reverse trend there, (I traded over 20 pairs at once).

Thanks again!

Thanks! Actually traded (tested demo) all the same only not - increased the sell 0,2 - often by false signals opened more sells - bai also opened and closed with profits +30 50 pps. - the pair was getting profit when the trend reversed (significant decrease of losses on distant sells).

The conclusion is not suitable for this kind of TS. The choice of pairs does not guarantee anything - maybe there will start a no-trend, (there were more than 20 pairs in trade at once).

Thanks again!

When the situation in Japan started, gelantrauler was stopped. Just because of the strong movements.

There are no strong movements on crosses and they are almost all sideways. That is where you need to trade. Small lots, large margin...