You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

I was studying options not for a long time, I was confused by statistics that small speculators are not getting very rich on options.

It is possible to earn without hemorrhoids on options starting from 30K Dollars SELLING options as a market maker, if you have money look for Andrey on speculator webinar - listen, think about it. Buying options is harder to earn, it's the same as trading but in profile)

www.thinkorswim.com or any broker that has a ninja trader. And look at the volumes of transactions in the current period, not the option contracts. Options are a bit different.

Igor - that's your advice, the easiest way to check if you need it, don't bother with pars, just check. I've checked it, but I can't get the data from the suite right away, there's something wrong there, so I don't want to go deeper.

And on the subject: the only thing worse than mental masturbation is collective brain masturbation.

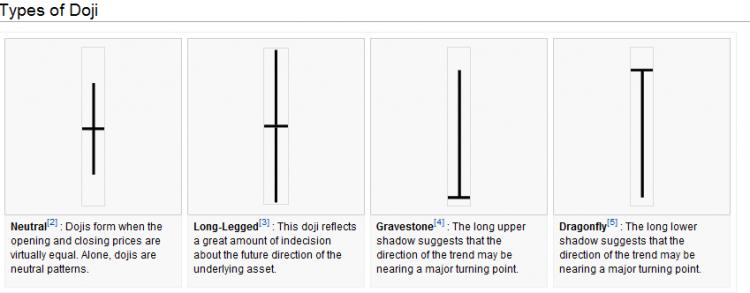

If you look at the definition of dojas, you will see that they are universal, but they are meaningless for trading, they can only be considered in combination with the background and volume and in the case of this definition (http://web.streetauthority.com/terms/doji.asp) you are guaranteed dull evenings in the maze of your own thoughts.

Igor - this is you, the case is advised, the easiest way to check whether you need it, do not bother with parsing, just check it out.

i'm already familiar with ninsey, it's hard to find a russian forum for programmers and programming documentation, and a 30-day demo account is also stressful, and parsing - it's easy, the only problem is how long the site structure for parsing will be unchanged

for the sake of argument: why a dodge? how many times has the price moved from Open to Close within a dodge-bar?

imho - dodge is the same "lure" for inquisitive minds, like a new one-hour bar that has begun to move intensively in the expected direction - try to enter the market on such a candle in the direction of movement, and count the statistics of successful trades - I've tried it and verified it, that market entries on such candlesticks give an expectation of winning not even 50 to 50, but much less, who draws these doji and candlesticks, I do not know, but I think that small speculators are always hunting and all these wonders and regularities of charts is just a game with small fish

I'm already familiar with ninsey, it's hard to find a russian-language programming forum and programming documentation, and the 30-day demo account is also stressful, but parsing is easy, the only problem is how long the structure of the site for parsing will remain unchanged

I don't use ninze, I can't advise anything good, learning English is not good advice.....

I'm already familiar with ninsey, it's hard to find a russian programming forum and programming documentation, and the 30-day demo account is also stressful, and parsing is easy, the only problem is how long the structure of the site for parsing will remain unchanged

for the sake of argument: why dodge? how many times has the price moved from Open to Close within a dodge-bar? how is it better/worse than studs or candlesticks without shadows?

imho - dodge is the same "lure" for inquisitive minds, like a new one-hour bar that has begun to move intensively in the expected direction - try to enter the market on such a candle in the direction of movement, and count the statistics of successful trades - I've tried it and verified it, that market entries on such candlesticks give an expectation of winning not even 50 to 50, but much less, who draws these doji and candlesticks, I do not know, but I think that small speculators are always hunting and all these wonders and regularities of charts is just a game with small fish

All these candlestick combinations were invented before there were computers. This is a maximum simplification of the price series for visual analysis

all these candlestick combinations were invented before there were computers. It's a maximum simplification of the price series for visual analysis

imho - this dodge is the same "lure" for inquisitive minds like a new one-hour bar that has started to move intensively in the expected direction - try to enter the market on such a candle in the direction of movement, and count the statistics of successful trades - I checked and verified it, that market entries on such candlesticks give an expectation of winning not even 50 to 50, but much less, who draws these doji and candlesticks, I do not know, but I think that small speculators are always hunting and all these wonders and regularities of charts is just a game with small fish

Just for fun I decided to check too, entry in the direction of the move, stop on the high/low of the given bar, s.l.=t.p. (I.e. 50/50 or stop or profit) from 2008 till today on eurobucks:

The result is shitty, but to argue

that market entries on such candlesticks give an expectation of winning not even 50/50, but much less

I would not)))

For fun, I also decided to check, entry in the direction of the move, stop on the high/low of the given bar, s.l.=t.p. (i.e. 50/50 either stop or profit) from 2008 till today on Eurobucks:

The result is shitty, but to argue

that market entries on such candlesticks give an expectation of winning not even 50/50, but much less

I would not)))

It's a reference point test.

No problem....

paukas:

I can draw you a straight line at 45 degrees to the horizon on one of these in a couple of minutes.

Wait for it... I can even wait a couple of hours or even more, just tell me how much, by the way 45 degrees is cool, even 30 will do ;)

No problem....

Waiting... I can even wait a couple of hours or even more, just tell me how much, by the way 45 degrees is cool, even 30 will do ;)

Can I ask about two parameters in the report, namely Average Profit/Loss trades and Profit trades (% of all) Loss trades (% of all)

I just don't think you're in the know... it's about

IgorM:

попробуйте войти в рынок на такой свече в сторону движения, и посчитайте статистику удачных трейдов - было дело я проверял и убедился, что входы в рынок на таких свечах дают ожидание выигрыша даже не 50 на 50, а намного меньше

Did you stick to this particular strategy? Or did you just decide to get your "dicks in a twist"?

If it's this strategy, then my hat's off to you...