You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Sorento:

В чём другое? Ведь требуется строго больше. :)

Well, God forbid, strictly so! I agree.

Estimate by your method and give me the result.

With conditions { N=120, q(mo)=60.91%/12 Initial Capital=100 } I have given in the graph. and to fiddle with K is out of my hands. .

If someone will give me kOpt for these conditions - I'll tabulate postnumerand with roundings taken into account...

;)

So, now a question for Matemat and Sorento: above, both of you referred to the decision of the unique Mikhail Andreyevich in the sense of - So what now? everything is clear... like - what next?

It turns out that the esteemed Mikhail Andreyevich has nothing but a reduced formula for the time of doubling the score, nothing:-) In general, I suppose, we wait for approximate solution for kOpt from Alexey.

So, now a question for Matemat and Sorento: above, both of you referred to the decision of the unique Mikhail Andreyevich in the sense of - So what now? everything is clear... like - what next?

It turns out that the esteemed Mikhail Andreyevich has nothing but a reduced formula for the time of doubling the score, nothing:-) So, I suppose we wait for approximate solution for kOpt from Alexey.

Interesting conclusion.

The strategies that involve any (including proportional) withdrawal before the deadline Topt - are not optimal... Assuming that the depo is longer than the Topt - of course.

Please see the pictures (numerical)...

;)

It seems as if we are starting to solve a slightly different (more complicated) problem.

Let me remind you that by stipulation, I have a deposit in use for time t, on which a constant interest q of the current deposit amount is accrued monthly, and I MUST withdraw a fixed interest k every month, not more than q and not less than 0%. That's it.

I have to find such kOpt which maximizes withdrawal in period t without taking deposit into account. This solution must be presented in analytical form as function of two parameters q and t (numerical solutions, partial solutions in the form of all sorts of charts and dependencies are of no interest, because they have already been obtained). If the analytical solution is approximate, then the limits for q and t must be specified, in which the declared accuracy of the solution of the problem is achieved.

P.S. All contrivances like inflation, nonconstancy of accrued interest q, variations on parameter k, etc. I think there is no sense to consider until the solution for the simplest case is obtained.

"Recall that by convention, I have a deposit in use for time t, on which a constant percentage q of the current deposit amount is accrued monthly, and I MUST withdraw a fixed percentage k each month of no more than q and no less than 0%. That's it."

.

Sergey, and there is already an answer to the question, although the formula is not too simple, but it is quite understandable. The answer in such cases is usually given in reference books in the form of nomograms.

From the specification of the problem we can see: "q lies in the range 0.1<q<0.3".

Specify also the range "time t"

Oleg, for Forex t can be set to 50. Less makes no sense, because with the characteristic life of the deposit less than 5 years, it is correct to withdraw all profits, and the initial deposit size should provide "for life" on interest. If life time more than 5 years, then initial deposit size is not a problem and you can start with 1000 rubles, but there appears optimal withdrawal percentage. Moreover, if we take into account that characteristic life time is not obligatory for execution (because we are speaking about statistics), we can exclude this parameter from formula putting it equal to constant=50. Thus, we have (ideally) for kOpt an analytical approximation value from only one parameter - average proficiency of TC - q.

kOpt=q for t<50

kOpt=F(q) for t>50

The approximate form of the analytical dependence F(q) under the specified conditions is what we want to find out.

I don't yet know how to make the formula simple. Newton's method gives a more or less exact solution from at least the third or fourth iteration. It turns out to be a very cumbersome, multi-storey formula.

Clarification of q now further confirms that binomial expansion is useless here: even at q=0.1 and t=10 you have to keep too many terms of the binomial. And the larger t and q are, the worse it is. In other words, for reasonable t (probably not less than 20) it is almost always

(1+q-k)^t ~ exp((q-k)t)

Observations say that with large q and small t (say, 0.3 and 10, respectively) it is optimal to withdrawmost of what I earn in a month (70%).

With small q and small t there is no extremum within a reasonable range: it is necessary to withdraw all of your earnings.

At the same time, at medium q and medium t (0.2 and 20) it is reasonable to withdraw a substantial part of one half of one's earnings (44%).

Then, at medium q and large t (0.2 and 30), it is reasonable to withdraw a smaller fraction of your earnings (26%).

And so on and so forth. The problem behaves qualitatively differently under different parameters. There doesn't seem to be an optimistic, single answer. Maybe try to make some kind of estimate of k depending on q and t?

P.S. I see your comment, Sergey. OK, fix t=50. The problem has become easier: it is enough to withdraw a smaller part of the earnings(q=0.1, t=50-> k/q= 0.3, i.e. 30%). This is the maximum possible k/q.

..................

.................

................

The optimal value of alpha corresponds to the transition from the positive to the negative region.

.

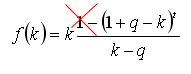

The formula was given above, I will repeat it here

You can reproduce it in Matcadet --- you can quickly adjust the parameters.

(and B does not play a role).

Maybe try to make some kind of estimate of k as a function of q and t?

Then the elegance of the analytical solution is lost. In this case, it is more correct to use a numerical solution. The problem seems to be out of reach for a simple expression...

I have tried to simplify the original expression for the sum of withdrawals .

.

In this case, the general form of the first derivative on parameter k is greatly simplified, down to a simple quadratic equation:

By solving it, one can get an approximate expression for

With acceptable accuracy in the range t>50, q>0.1

I wanted more...